BRRRR

The ultimate guide to the BRRRR strategy

The BRRRR strategy is game plan for how to quite literally, build equity and value into a property through renovation improvement.

New Builds

8 min read

Author: Laine Moger

Journalist and Property Educator with six years of experience, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Our Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

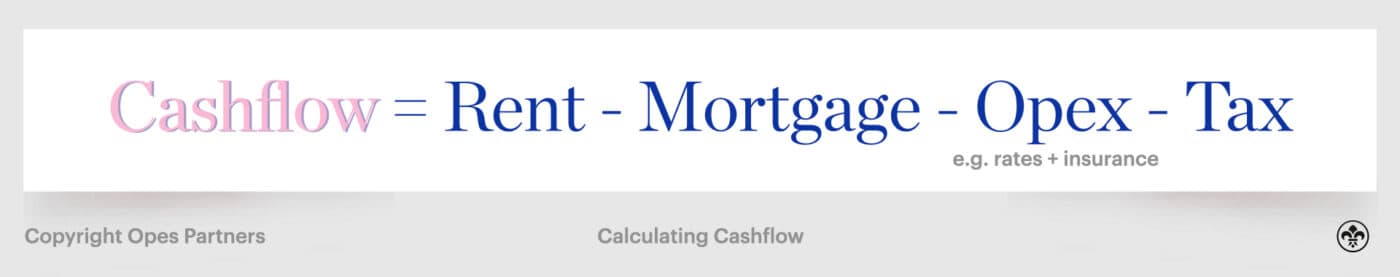

Cashflow is the money that goes in and comes out of your investment property’s bank account.

How much flow you have on your property investment’s cash depends on a whole bunch of things, and it’s mainly to do with your investment strategy.

For instance, what’s an acceptable cashflow to a passive buy-and-hold investor dealing in New Builds is going to be different to an active investor who is using the BRRRR strategy to renovate properties.

In this article you’ll learn what an acceptable cashflow could be for each of these strategies, paying particular attention to how they differ for growth and yield properties.

Disclaimer: This is an article on the internet, designed to give investors an idea of what sorts of cashflow possibilities exist. For more specific numbers you can play with our ROI spreadsheet, or speak to your financial advisor for more detailed advice.

To answer this question, New Build properties must be split into two types: growth and yield.

A growth property tends to increase in value more substantially, but has less cashflow.

Conversely, a yield property tends to go up in value slower, but has greater cashflow.

With this is mind here are the examples of what an acceptable cashflow might look like for each:

A growth investment property might look like a 2-bed, 1 bath townhouse in Addington, Christchurch.

The price of the house is $620,000 and is currently being rented for $525 a week.

To see how this property’s cashflow fares over the long term we have the Return-On-Investment (ROI) calculator

Having entered the figures our spreadsheet tells us that for the first 9 years of owning this property it is going to be negatively geared.

This means that you have a cashflow shortfall between what the property makes in rent and what the property costs in expenses.

For instance, let’s say your rental property makes $25,000 in rent each year, but your expenses tally $30,000.

This means your property is negatively geared by $5000, so you will have to contribute the shortfall out of your own pocket. This is known as “topping up”.

Negative-gearing is common with growth properties, because yields are often lower. With this example you can see the interest rates are expected to increase and mortgage repayments will get higher, which will impact cashflow.

The top-up for this property is expected to be an average of $106 per week.

We hear you – how do you make money off a property with a negative cashflow?

It’s simple: Property is a long game. It’s not about what sort of returns you get tomorrow or even in 5 years from now; it’s about what returns you will get in 10, 15, 20 years’ time.

Here’s an example of the projected capital growth on this property per week, compared with the top-up put in by the investor:

See how the investor stops putting in the top-up from years 8-9 onwards, but still gets the benefit of capital growth.

By these calculations the future cashflow and capital growth far outweigh the amount of top-up the investor initially put in.

A yield property might look like a dual-key townhouse in central Christchurch.

Dual-keys are a slightly newer concept in New Zealand, but they are extremely popular in Asia.

Essentially, a dual-key townhouse (or apartment) is two separate but adjoining units, under one title.

These two units are often rented separately, so you have two sources of income which maximises your rental yield.

This property was bought for $799,000, but it rents for a collective $920 per week.

When we run this property through our ROI spreadsheet we are told the property will be negatively geared for 3 years. This is because of construction and projected high interest rates.

So, for those first few years the investor has to top up the property by $65 a week.

However, the combination of capital growth and future cashflow far outweighs this $65 a week the investor must initially add.

Investors who choose an active strategy and invest in existing properties are more likely to avoid a negatively-geared property.

This is because at the heart of this strategy is renovating a property to ratchet up the rent and maximise cashflow.

For instance, let’s take a look at an existing property BEFORE it is renovated.

In this case we’ve used a $620,000 standalone house in Christchurch that rents for $620.

Note how that even though this property earns more rent, the cashflow is worse than the New Build. This is because with the existing property the investor has to pay more tax.

Here are the cashflows side-by-side:

Over the 15 years the New Build has negative cashflow of $48.5k; the existing property has negative cashflow of $64.5k.

So the existing property has worse cashflow than a New Build.

Now let’s take a look at what the cashflow is projected to be after the renovations.

In this example we have accounted for a $50,000 renovation, which has increased the rent to $1,000 per week.

These figures are realistic based on our experience where we help investors undertake these renovations through the Opes Accelerate programme.

So, the cashflow is significantly improved after renovating the property. In this case the renovated property has better cashflow than the New Build.

But if you didn’t renovate the property, the New Build would have a better cashflow.

So if you want to get the highest cashflow, you’ll need to:

If you invest in a New Build you’ll often need to top up your investment in the short term. But you’ll have a brand new, low hassles investment.

And you’ll make money over time as the property increases in value. This can be attractive for investors with busy lives who don’t have the time or inclination to renovate.

On the other hand, if you are eager and willing to swing a hammer, then renovating existing properties can generate better cashflow.

But, just be warned, if you buy an existing property and don’t renovate (or don’t do the right renovations), the property’s cashflow will often be worse than a New Build.

Use the No.1 Return On Investment Calculator by Opes. This spreadsheet has helped over 4,000 Kiwis run their OWN numbers on potential investment properties.

Journalist and Property Educator with six years of experience, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator with six years of experience, holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for two years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.