Property Investment

What should my retirement plan look like?

Thinking about retirement? The Epic Guide to Retirement Planning is the guide that will give you the knowledge so you can plan for your retirement in 2023

Property Investment

11 min read

Author: Laine Moger

Journalist and Property Educator with six years of experience, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Our Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

40% of Kiwi investors choose to buy property to build a passive income. And a further 25% invest to sort themselves out for retirement.

But, after buying a few properties, they often wonder “so how am I going to use these properties to sort my retirement? … what’s the end game?”

There are two strategies you can use:

a) The Golden Goose strategy. This is where you buy high yielding properties that generate a passive income

b) The Nest-Egg strategy. This is where you sell your properties and live off money you get from selling.

Both are valid retirement strategies. But which one is right for you?

In this article, you’ll learn what the Golden Goose strategy is and whether it’s the right strategy for your retirement.

If you have any questions or thoughts, please leave them in the comments section below.

The Golden Goose strategy is not as common as its alternative (the Nest Egg) but it is arguably more desirable.

Why?

Because under this strategy you can live forever and you won’t run out of money. There’s no having to budget according to how many years you are going to live.

How the Golden Goose works:

The rental income you then receive from the high yielding properties then funds your lifestyle forever.

As long as you hold those properties, you’ll receive your permanent passive income.

For example, let’s say you have $1 million invested and get a 4% net return. Your passive income is $40,000 per year.

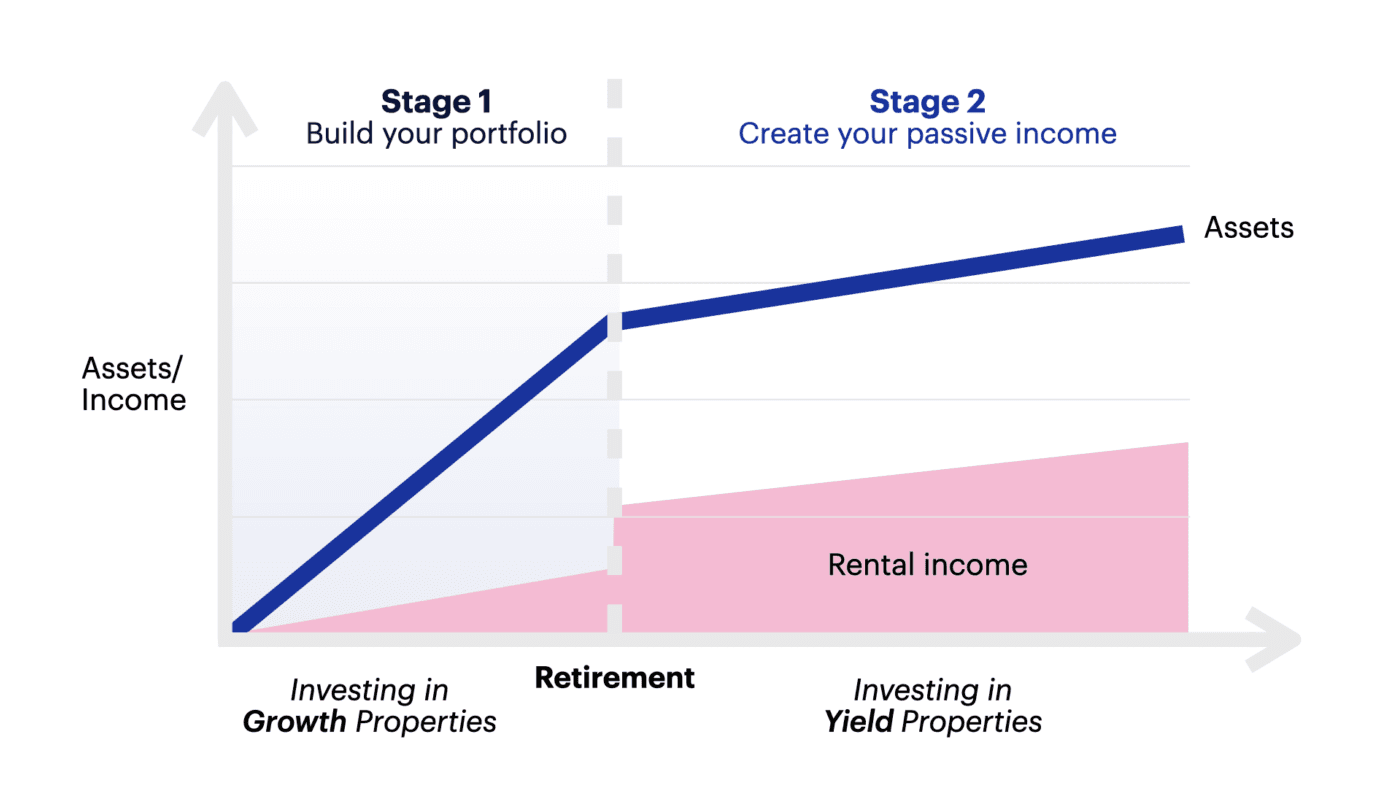

In the Golden Goose, there are two key stages:

Secure a comfortable retirement with 3 easy steps

Book your free sessionIn the first stage you need to build an asset base and grow your wealth.

This is when you actively buy property and build a portfolio that grows this wealth.

You’ll primarily focus on investing in growth properties. These are properties that do a better job at increasing your wealth, even though the cashflow isn’t as strong immediately.

So that likely means investing in townhouses and standalone houses in the major centres.

Having said that, it’s not unusual for these types of investors to purchase the occasional yield property to support their portfolio’s cashflow.

Once you’ve built your portfolio, you’ll hold these properties for the long term to achieve capital growth.

The second stage of life is where you live off the proceeds of the assets you’ve built in the first stage.

As you approach retirement – whatever age this may be – you’ll sell your growth properties and reinvest in yield properties.

These properties earn better cashflow and will maximise the passive income you get from your assets. More on the types of properties you’ll invest in below.

Typically, you’ll purchase these yield properties without a mortgage (or a very low mortgage). This allows you to live off rent received.

Let’s say you want to live on $100k (pre-tax) income per year. How many assets will you need to create this income?

A good assumption is that you can earn a 4% net yield on your assets, once the Golden Goose strategy is fully implemented and you’ve invest in high-yield properties.

That means if you have $1 million of net assets, you can earn a $40,000 pre-tax passive income. $1 million x 4% = $40,000.

So if you want to earn $100k a year in passive income, you need $2.5 million in net assets.

Since $2.5 million x 4% = $100,000.

Net assets is the value of your portfolio, minus your debt. For instance, if you have $5 million of assets and $2.5 million of mortgage debt, you have $2.5 million in net assets.

Even though many investors aim for the Golden Goose strategy, there are still pros and cons

When you use the Golden Goose strategy, you don’t have to guess when you’ll cark it.

That’s because your passive income goes on forever. If you hold the properties the income continues.

So, there isn’t any guesswork required to figure out how many years your money will last.

This is great if you are planning to retire earlier than 65 or have a longer-than-normal retirement.

Historically, inflation is around 2% per year. But rents increase by about 4.7% annually.

So, as you continue to hold your assets, your passive income will likely grow faster than your cost of living. This means your lifestyle continues to get better over time.

One reason investors like the Golden Goose strategy is it creates inter-generational wealth. You can pass your assets on to your children.

That’s because under the Golden Goose you’re not selling your assets and living off them. You’re just living off the income.

This preserves your assets and leaves an asset base you can pass on to your family as inheritance.

Even though you're not trading time for your money, you still pay tax on the passive income your assets generate.

This means, if you want to spend $75,000 (in your hand) per year, you’ll need to earn about $100,000 in passive income.

This is the trade-off between the Golden Goose and the Nest Egg strategies.

Because under the Nest Egg strategy, you don’t have to pay tax. You’re not earning an income; you’re spending the money you already have.

Because you need to make more money under the Golden Goose (so you can pay the tax man), you therefore need more assets to achieve your goal.

And the difference can be substantial. Here’s an example of the different level of assets you will need.

Let’s say you want to spend $75k a year in retirement. You’re planning to start your retirement at 65 and hoping you’re going to live till 82 (the average age of death in NZ).

How many assets would you need if you’re following the Golden Goose strategy vs the Nest Egg strategy?

When you compare the two strategies, depending on the numbers you use, you might require 30–50 per cent more assets if you take the Golden Goose approach as opposed to the Nest Egg approach.

However, this is all dependent on how long you expect to live. If you think you’ll live past 90, the number of assets needed starts to become comparable.

The critical part of the Golden Goose is finding properties that earn a 4% net yield.

That means that after paying your rates, insurance, and maintenance (but not your mortgage), you are left with a 4% return on your net assets.

Generally, houses and townhouses (growth properties) will not provide this sort of yield.

Instead, the properties capable of delivering this sort of yield are multi-income properties, such as room-by-room rentals or dual-key apartments (yield properties).

For example, a dual-key apartment is where two separate units are held under one legal title.

These properties don’t grow in value as quickly, but they do provide higher rental income.

You might ask, why not just keep my growth properties? This is a good question, since growth properties increase in value more quickly.

However, if you attempt to earn a passive income from growth properties, you’ll need significantly more assets.

The $2.5m worth of net assets you need to fund your $100,000 income is based on you getting a 4% net return.

Let’s say you keep your growth properties and get a 3% net yield.

Now you need $3.33 million in net assets for your portfolio to generate that same $100k of income.

That’s over $800k in assets you’d need to create the same income.

The Golden Goose is a great fit for people who plan to retire for a long time.

If you want to retire earlier than 65, or plan to live to 100, the Golden Goose is probably for you.

That’s not just because your passive income goes on forever, but if you want to retire early you won’t have access to KiwiSaver of Govt superannuation.

It’s also well-suited to people who want to pass on their assets to the next generation, or for people in relationships with age gaps.

That’s because one partner will likely pass on before the other. And if you’re reliant on NZ superannuation that income will drop once only one partner is left.

However, because you need more assets to make the Golden Goose work, you need to have enough time to build your asset base.

So, if you have a shorter runway into retirement – 7-15 years – you might find that the Nest Egg strategy is a better fit.

Because you need more assets to use the Golden Goose, you often need to buy more properties. If your budget (or your bank) stops you from building a large enough portfolio, you might decide to go for the Nest Egg strategy as well.

If at the end of this article you feel Golden Goose is the right strategy and the right fit for your situation, your next step is to book a Portfolio Planning Session with a property partner from our team at Opes.

Journalist and Property Educator with six years of experience, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator with six years of experience, holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for two years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.