Mortgages

How are interest rates changing right now? January 2026

See how interest rates are shifting, the lowest rates available, and how much you could negotiate right now.

Mortgages

2 min read

Here is your monthly interest rate report.

This gives you a quick, plain English update on how much your mortgage costs.

TL;DR

The banks are getting their scissors out.

That’s because most commentators expect the Reserve Bank to trim the OCR by another 0.25% next week.

That would take the Official Cash Rate from 3.25% to 3%.

That’s why ANZ just cut their rates on Monday. Their 1-year rate went from 4.95% down to 4.79%.

Expect all major banks to follow in the next 7 days.

These cuts on their own don’t make a huge difference. It saves about $15 a week on a $500k mortgage. That’s if it’s interest only.

But if you add them to the flurry of cuts over the last year … they really start to add up. More on that below.

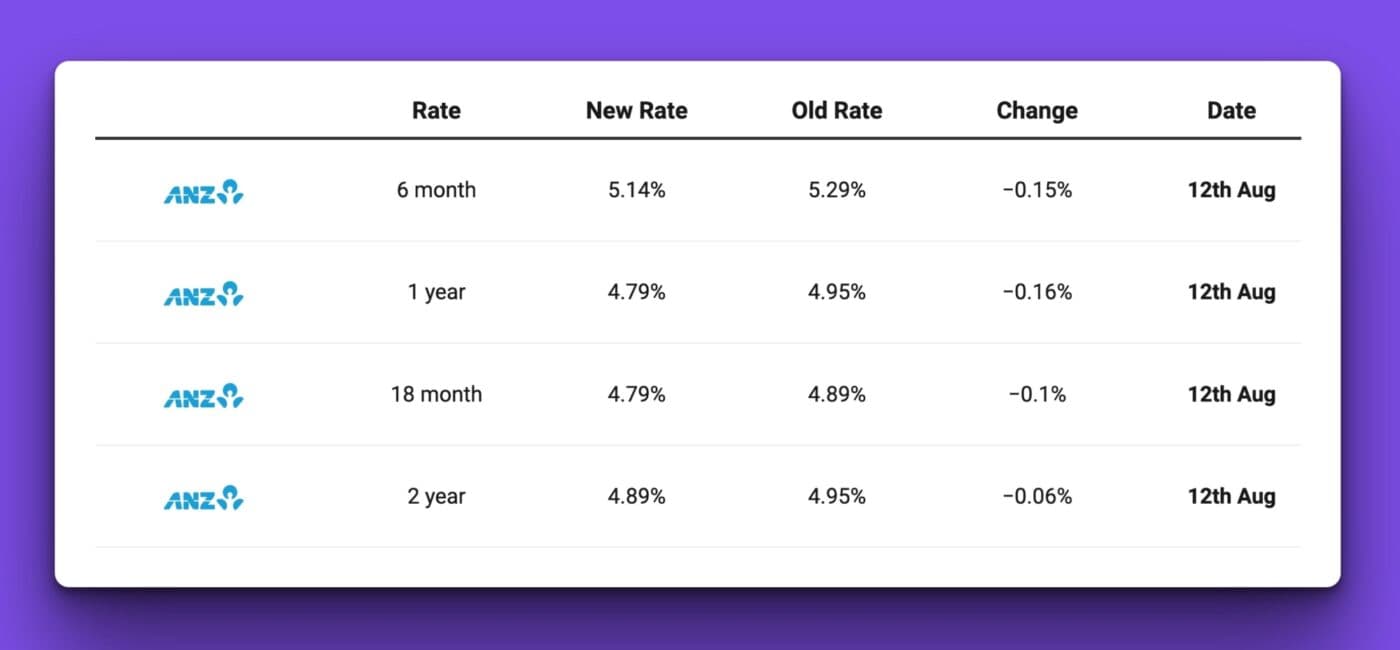

In the meantime, here are ANZ’s cuts from this week:

Interest rates have crashed over the last year.

ANZ’s 1-year rate fell from 6.85% to 4.79%.

That’s a massive 2.06% cut.

Let’s say you have a $500k mortgage. If you fixed at 6.85% a year ago, you would have paid $756 a week to the bank.

But at today’s rate, you’d pay $605 a week.

So you might find an extra $151 in your account each week.

That’s big.

And while I’m talking about ANZ, it’s a similar story for all the major banks.

I’m just using ANZ’s numbers since they’re the largest.

Most Kiwis I meet tend to lock in for a year.

And about 41% of mortgage debt will get a new interest rate over the next 6 months.

So a lot of Kiwis will soon be paying less money to the bank.

You might have seen interest rates falling over the last year and thought, “That’s great for everyone else getting those lower rates. But I’m still paying a higher rate.”

If that’s you, it’s time to get ready to refix because it’s time to benefit from those lower rates.

Right now, I’m seeing investors and homeowners make money moves to get a better deal.

Over the last week:

So if you are one of those 41% of people with an interest rate coming up … and want to make some mortgage moves …

Hit reply and let me know your situation.

I’ll come right back to you to see if my team can help.

Mortgage broker for over 10 years, property investor and Managing Director at Opes Mortgages

Peter Norris, a certified mortgage adviser with 10+ years of experience, serves as the Managing Director at Opes Mortgages. Having facilitated over $1.2 billion in lending for 2000+ clients, Peter is a respected authority in property financing. He's a frequent writer for Informed Investor Magazine and Property Investor Magazine, while also being recognized as BNZ Mortgage Adviser of the Year in 2018 and listed among NZ Adviser's top advisers in 2022, showcasing his expertise.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser