Property Investment

How are interest rates changing right now? February 2026

See how interest rates are shifting, the lowest rates available, and how much you could negotiate right now.

Property Investment

2 min read

Here is your monthly interest rate report.

This gives you a quick, plain English update on how much your mortgage costs.

Mortgage interest rates are falling, again.

Last month the average banks’ 1-year rate was 4.72%. Today it is 4.49%.

That’s another 0.23% lopped off in the last month.

And 0.39% down over the last 3 months.

If you’ve got a $500k mortgage, that small 0.23% drop saves you about $16 a week – every week.

That’s if you’re paying your mortgage off over 30 years.

These changes are … big.

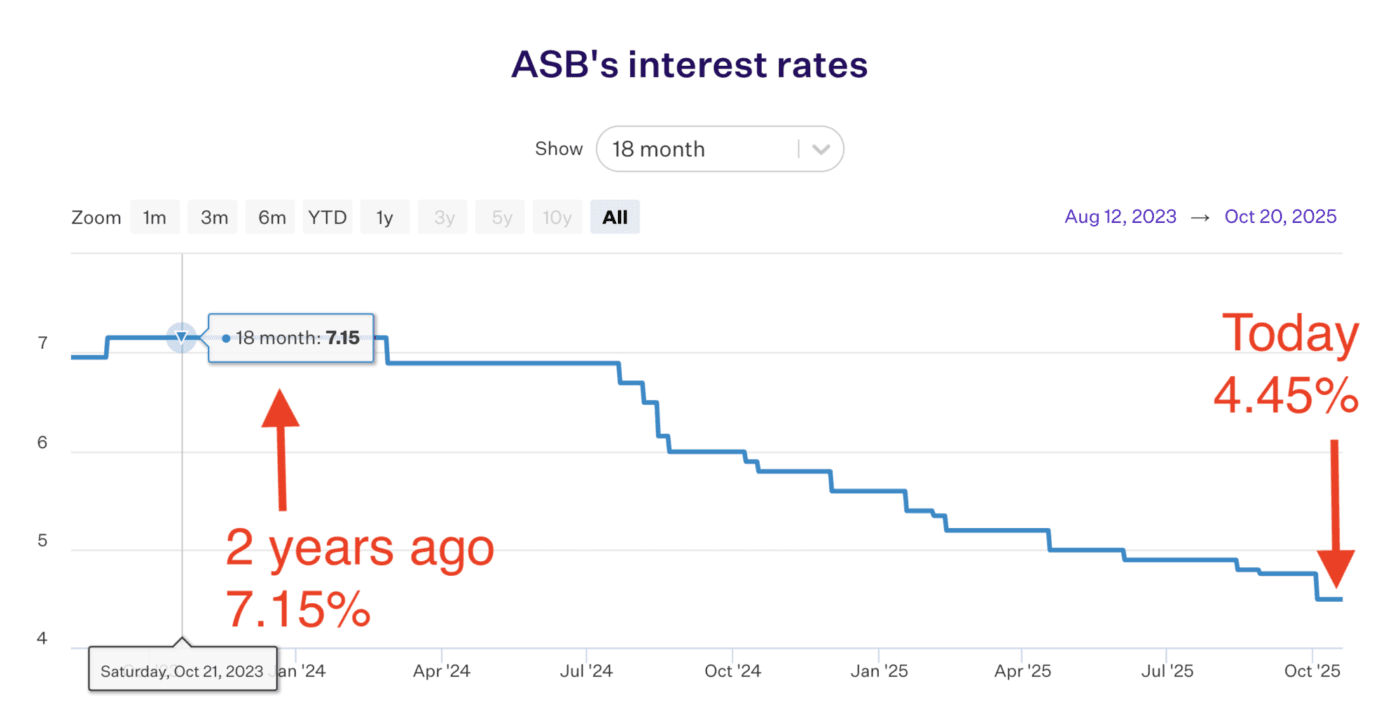

The lowest rate in the market is now 4.45%. ASB is offering that for 18-months.

2 years ago their 18-month rate was 7.15%!

So in the last year ASB cut 2.7% of their 18-month rate.

That saves $198 a week on a $500k mortgage (if paying off over 30 years)

But, every time I think rates won’t fall more … they do. Here’s why 👇

The reason rates keep falling is simple, but sad.

The economy is not doing so good. GDP fell 0.9% in the June quarter.

That’s a bigger drop than most people expected.

What’s the Reserve Bank to do? They cut The Official Cash Rate (OCR). And they cut hard.

Just two weeks ago we got a double decker 0.5% cut. The Reserve Bank’s interest rate (OCR) fell from 3% to 2.5%.

That flows through into the market and makes it cheaper for banks to lend money to you and me for our mortgages.

Why does the Reserve Bank do that?

Exactly what the Reserve Bank wants.

But, will interest rates keep falling? Here’s what it’d take to get more cuts.

Could mortgage interest rates fall even lower?

Yes, and they probably will, a bit. Most commentators expect another OCR cut in November.

As that gets closer banks will likely get their scissors out.

What would it take to get some more big drops?

We’d need to see more OCR cuts beyond what’s expected in November.

And for that to happen, we’d need some unexpectedly bad economic news.

Something that will make the banks think that the Reserve Bank will need to cut even more to get the economy going.

Will we get more bad economic news? Time will tell.

Even though mortgage rates are falling … the banks are still competing with each other.

So, they are handing out cash.

If you take out a new mortgage (or switch banks) they will often give you a cashback.

They put money in your bank account. And you can spend that on whatever you want.

It’s typically 0.8-0.9% of the loan.

So if you have a $500k loan that’s $4,000 - $4,500.

There are some t’s and c’s. Not everyone can get it. Like:

On top of that, you have to pay a lawyer to move the mortgage from one bank to another.

But all up it could make you a couple of grand … just switching banks.

So if you’ve got an interest rate coming up for re-fix … and want to make some mortgage moves …

Let me know your situation.

I’ll come right back to you to see if my team can help.

Cheers,

Pete

Mortgage broker for over 10 years, property investor and Managing Director at Opes Mortgages

Peter Norris, a certified mortgage adviser with 10+ years of experience, serves as the Managing Director at Opes Mortgages. Having facilitated over $1.2 billion in lending for 2000+ clients, Peter is a respected authority in property financing. He's a frequent writer for Informed Investor Magazine and Property Investor Magazine, while also being recognized as BNZ Mortgage Adviser of the Year in 2018 and listed among NZ Adviser's top advisers in 2022, showcasing his expertise.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser