Case Studies

Case Study: Investor makes $225k in 8 years.

Here’s an example of a standalone house that made an investor $225,000 in just 8 years.

Case Studies

1 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Thinking about working with Opes? You're probably wondering: “How much money have your investors made?”

That's a fair question. And an important one, too.

After all, a good property investment company should be able to pick a good investment.

Here’s an example of a 4-bed house an investor sold for 49% more than he bought it for. That happened after just 4 years.

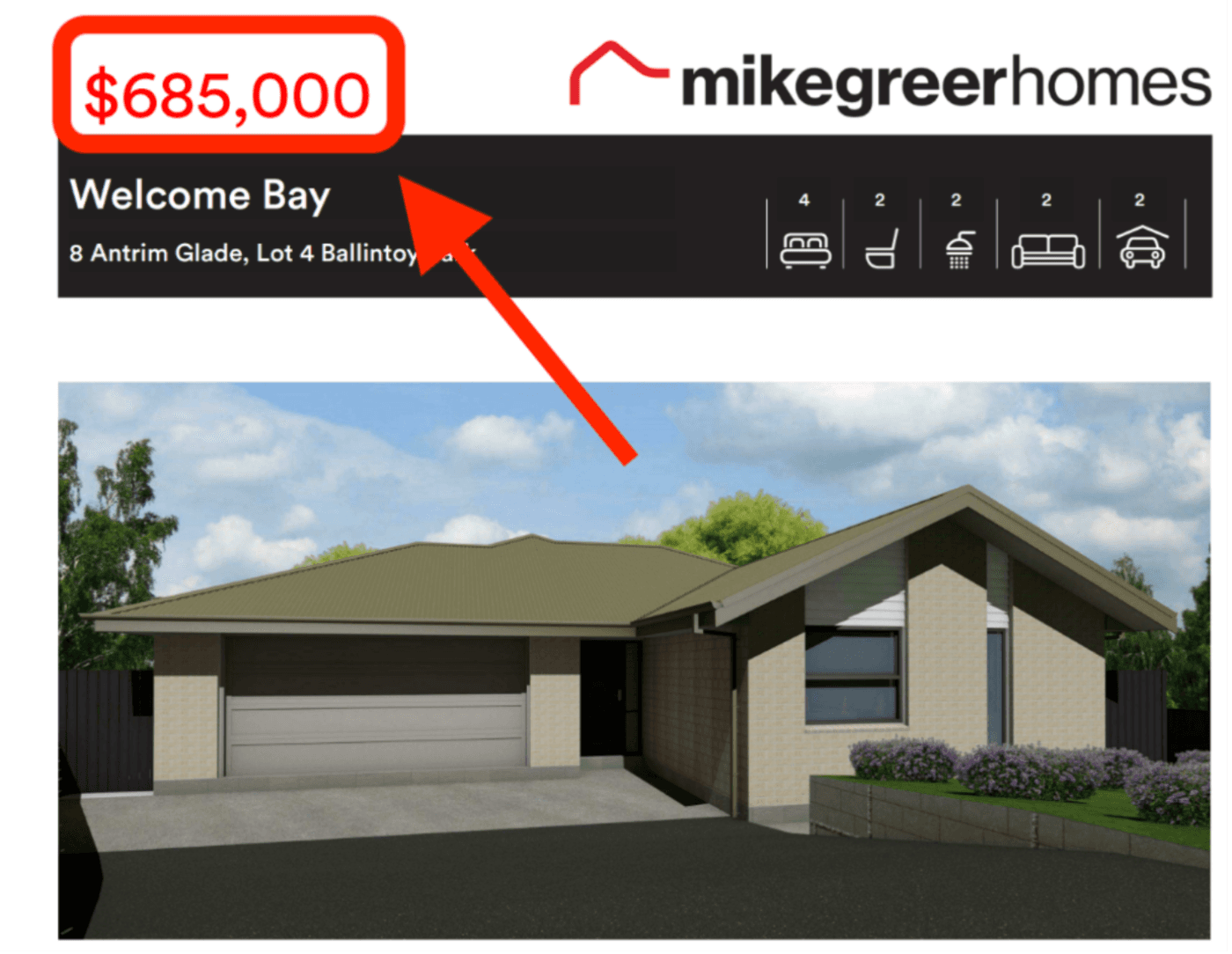

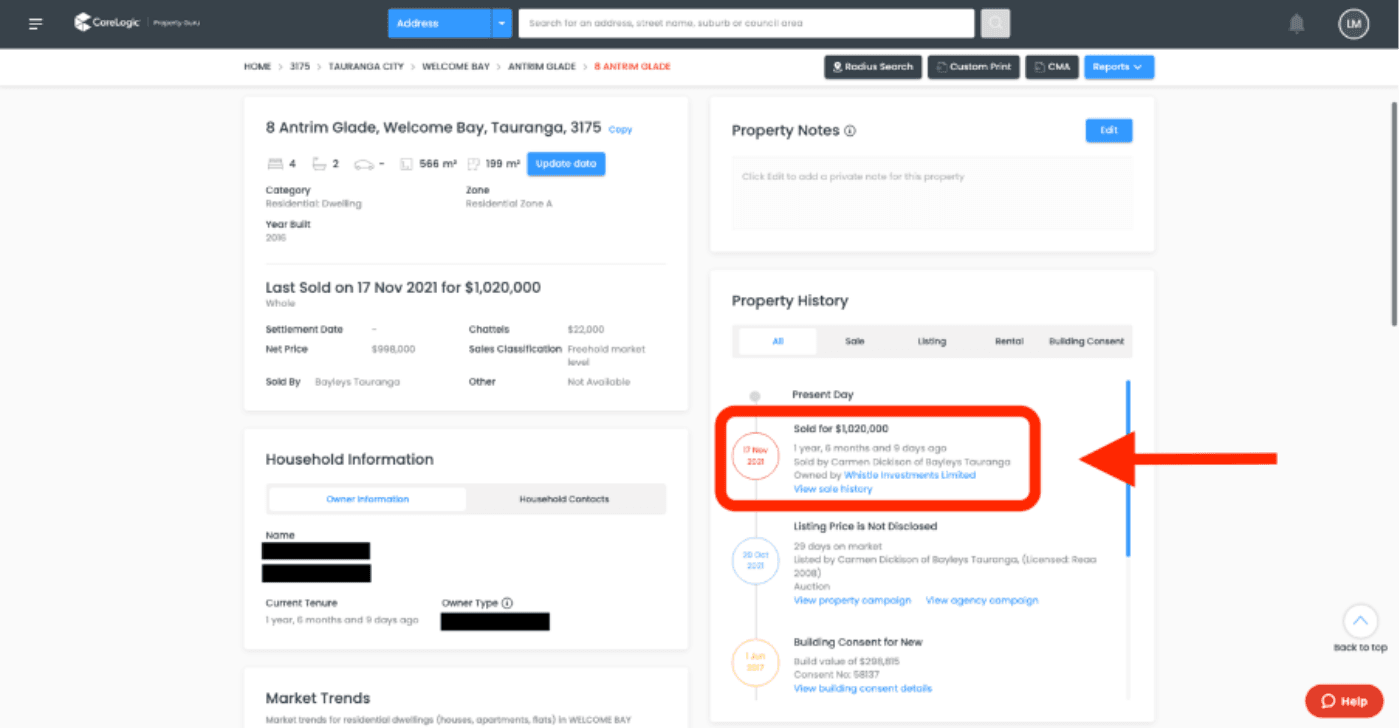

This property was 8 Antrim Glade, Welcome Bay, Tauranga.

This 4-bed, 2-bath standalone home was bought for $685k in April 2017.

It was a New Build.

The property took 10 months to build and was completed in February 2018.

This investor had a change of circumstance and sold the property. They got the timing right and sold at the peak of the market – November 2021.

They sold for $1,020,000. That’s right, they made $335,000 from the property going up in value. That happened less than 4 years after paying for the property.

That means they sold the property for 49% more than they bought it for.

That works out at 9.1% per year; faster than the 5% we use when forecasting how fast house prices grow in Tauranga.

Over the same period, the average value of a property in Welcome Bay increased 52.8%. So this property increased at roughly the same rate as the rest of the suburb.

After reading this article, you might wonder ... “Do Opes investors always make more money than the rest of the market?”

The answer is “not always”.

(Sadly), we are not property investment oracles. We don’t have any special magic power to predict the market. Every. Single. Time.

But we do our best to try to get it right more often than not. That’s why we use data and number-crunching to inform our investment recommendations.

We aim to help you be a more successful property investor than if you found a property on your own.

But even after that number-crunching, high investment returns aren’t 100% guaranteed. They’re not locked in.

Investing comes with risk. The question is then how you manage it.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser