Property Investment

Opes' FMA monitoring review outcome

Earlier this year, the Financial Markets Authority (FMA) carried out a routine monitoring review of Opes. Here are the findings 👇

Property Investment

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Private Property – our weekly newsletter that gives you insights into what's happening in the NZ property market. Written by managing director Andrew Nicol. Sign up to receive this in your inbox every Thursday.

How do you find a tenant when your property’s been empty for 3 months?

At last week’s webinar, one investor asked:

“What tactics can we use to find a tenant in this challenging market? It’s a studio unit, so no real scope for renos. The bathroom/kitchen are only 6-7yrs old and in good nick but it’s been on the market for 3mths…”

Let’s look at this investor’s property to see what she could do.

What’s the property?

The investor owns a small studio apartment in Mt Eden, located on the 4th floor of the building.

It was advertised on TradeMe (with stunning photos) for $470 a week – and the investor was using a property manager.

To buy an(other) investment property, you need to know what your current properties are worth.

That’s because most investors use the equity in their home to buy the next one.

But, how do you figure out what your property is actually worth?

You can use these three steps, and we’ll use one of my properties as a case study – 12 Maple Place, Rangiora.

First, type your address into an online valuation site like Homes.co.nz, TradeMe or QV.

This will give you a ballpark [and it is only a ballpark] straight away.

Personally, I always use QV because we found it to be the most accurate in episode 928 of the Property Academy Podcast.

QV says my Maple Place property is worth: $800,000.

But, while free, this is not very accurate.

Homes data shows that, on average, their “HomesEstimate” are 10% off.

So if Homes agreed with QV and said my property is worth $800k, that means the property will sell between $720k – $880k.

It’s safe to assume this margin of error applies to the other websites too.

Here’s a nationwide map of how accurate Homes.co.nz is in your area.

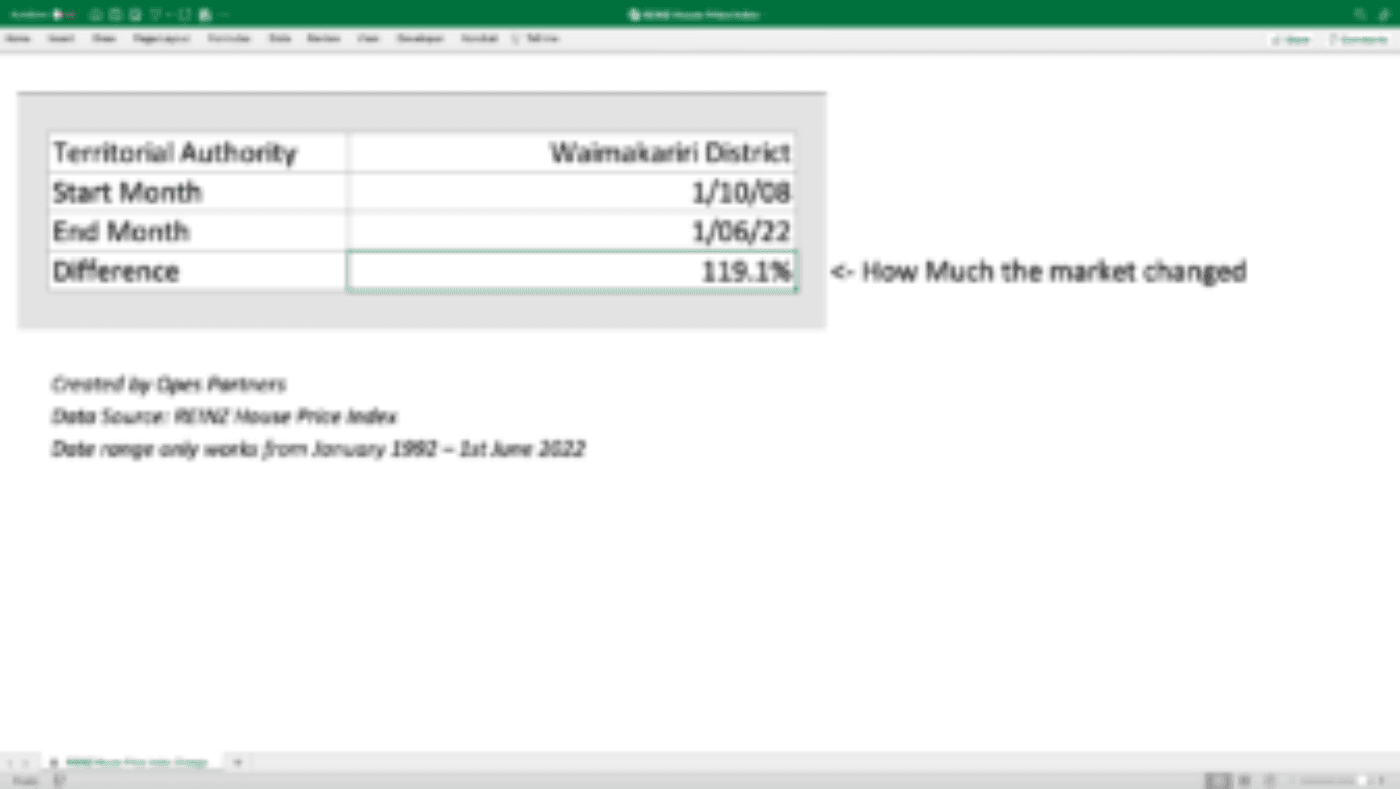

The second step is to take the purchase price (or your last valuation) and adjust it for how the market has changed.

And the REINZ house price index is the most accurate way of tracking market changes.

For example, the registered valuation for my Maple Place property was $375k when I bought it in October 2008.

Since then, house prices in the Waimakariri district have increased by 119.1%.

So, if my property followed the market perfectly, it would be worth $821,625.

But there’s one big drawback with the House Price Index – it’s not public.

It’s only available to real estate agents and people like me who pay thousands for access.

So, I created this excel spreadsheet so you can see how the market has changed (without breaking any fair use rules). Download here.

And I’ve got my team to turn this into an online calculator to make it easier (it’s coming).

When a registered valuer comes to your house, they’ll look at similar properties sold in the area and judge whether yours is better or worse than those properties.

This means they can create a price range. The third step is to do the same.

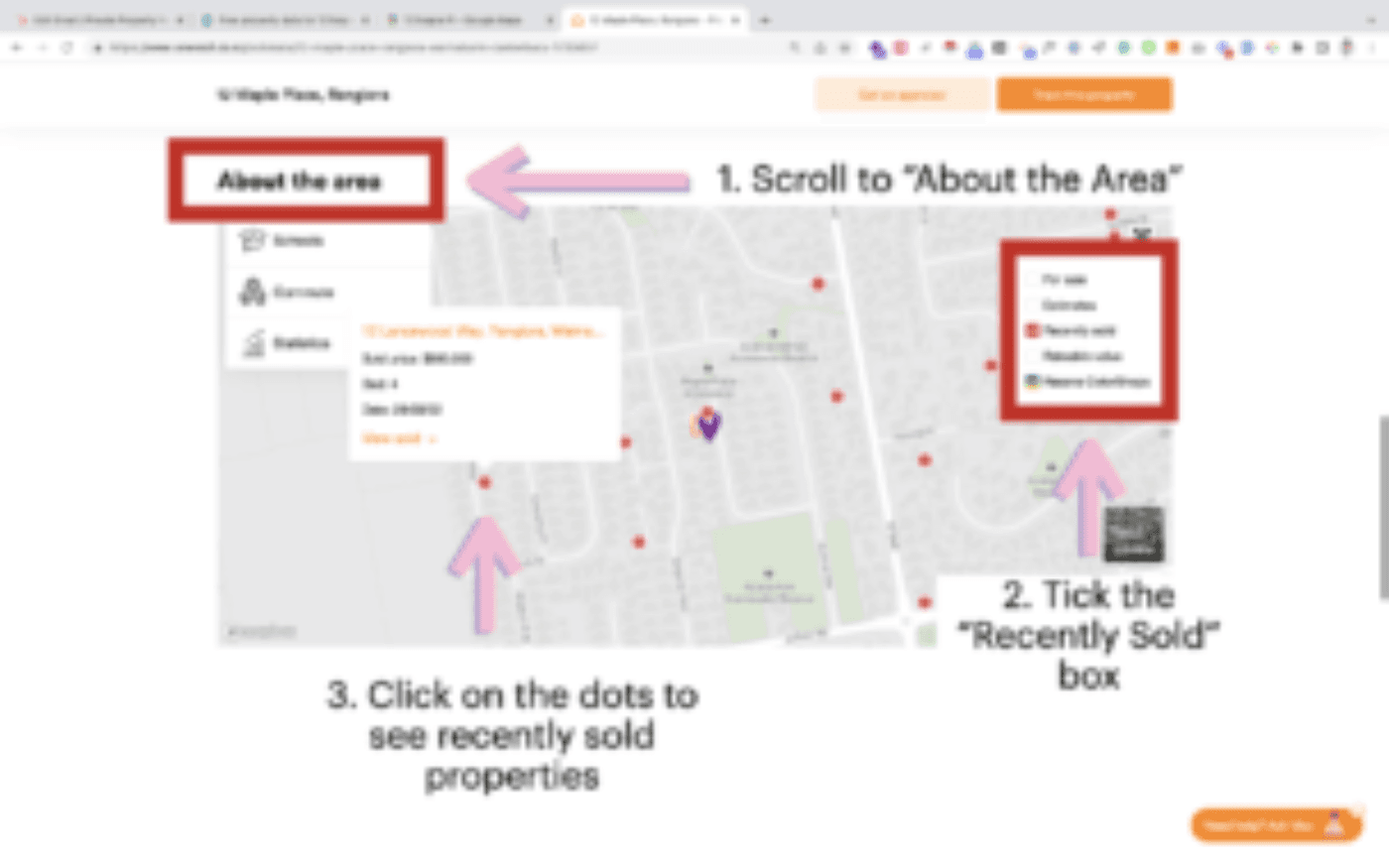

Head to OneRoof and use the "About the area" section to find nearby properties that have sold recently.

Then make a table and rank them (inferior/similar/superior).

Look at this table I made for my property. These properties are within 1 kilometre of my property and have sold within the past 12 months.

Creating a table takes the emotion out of it.

This shows me that my property is worth less than $835k, but it is worth more than $760k. And it’s probably closer to $815k since that’s what a very similar property across the road sold for 5 months ago.

All things considered:

After looking at how some of these properties were marketed, I’d say the property is worth $820,000.

And I know this is a good way to figure out the value. Because I recently paid for a valuation, which came back at $825,000.

Pretty close.

So when you need to figure out the value of a property, these are three steps to do it.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser