Property Investment

Property Investment

2 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

How do you make money through property? Yes, buying the right investment property matters. Just it’s not the only thing.

When you buy matters much more.

Let’s say you’re 50 right now.

If you bought the median house 5 years ago (when you were 45), you could have made roughly $125k by now.

That’s based on data from the Real Estate Institute of NZ (2020 - 2025). And assumes your property followed the market perfectly.

$125k is a lot of money.

But what if you invested at 40 years old instead?

You could have made $315k just buying the average property.

What about 5 years before that, when you were aged 35?

You could have made $430k just by buying the average house in NZ.

And if you invested 20 years ago when you were 30, you’d have made just over half a million dollars.

Is there a bit more to it than just buying a house and waiting? Of course.

That’s why there are over 2,000 episodes of the Property Academy Podcast.

But, I also know that sometimes we can get lost in the weeds.

So this is a simple way of getting across that age-old idea:

“The earlier you invest. The more money you generally make.”

The numbers I just showed you are based on if you’re aged 50 today.

And over 20,000 people get Private Property (this newsletter) every week.

So there’s a good chance that you’re not 50 right now.

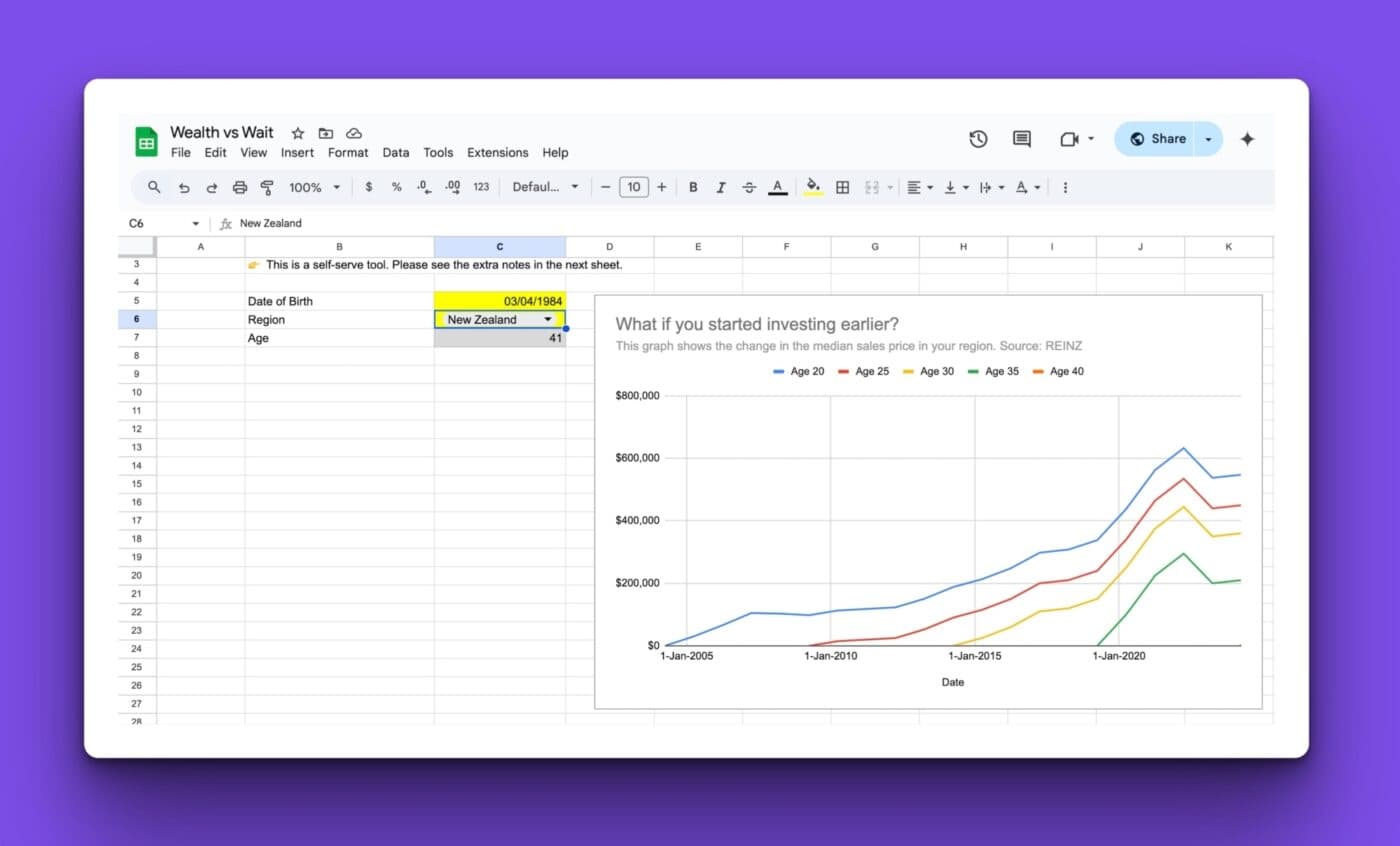

So I created this spreadsheet so you can run the numbers yourself.

You put in your birthday, and it shows you what could have happened if you bought at different ages.

You can even choose your home region.

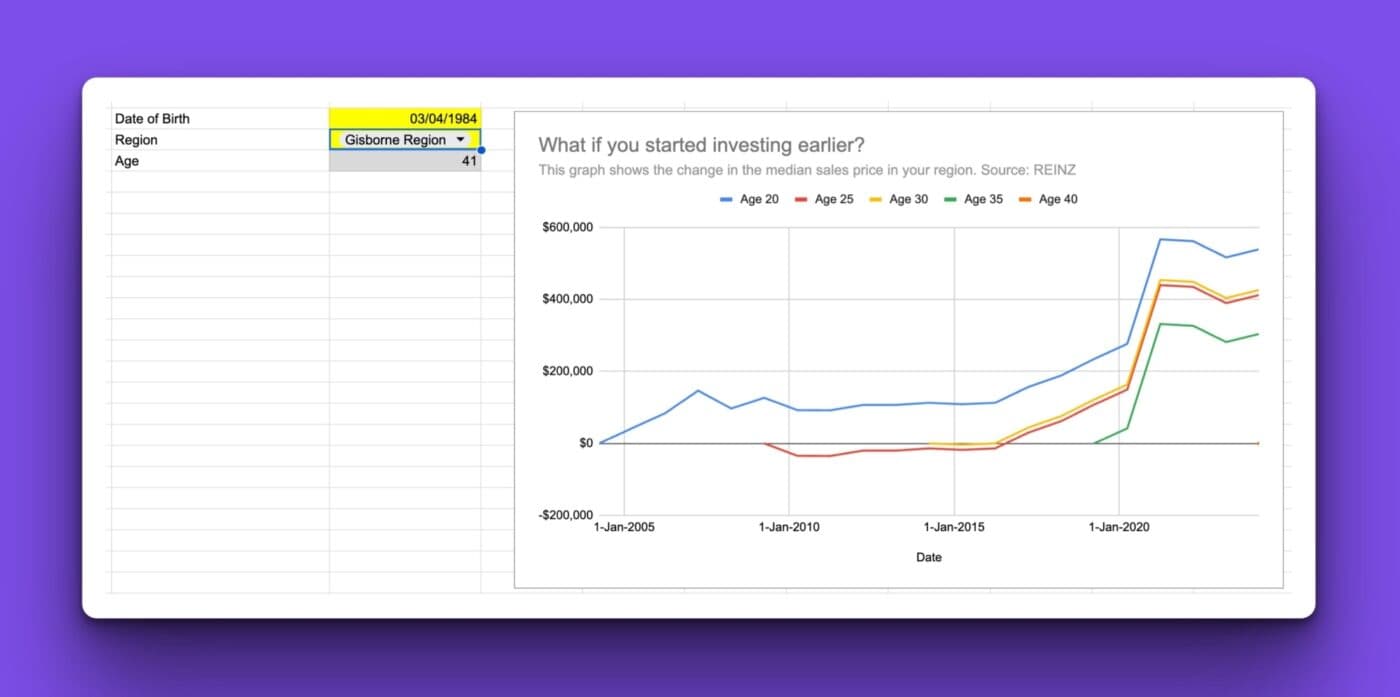

And depending on which region you choose … you’ll see that buying at younger and younger ages doesn’t always pay off.

For instance, if you’re 40 now and live in Gisborne. Buying at 30 would have made slightly more money than if you bought at 25.

So buying early doesn’t make more money 100% of the time.

But it does most of the time.

Just keep in mind that this is backward-looking. This doesn’t show you the future. You need a crystal ball for that.

But I also know how this newsletter might make you think:

We all get that house prices have gone up.

And if we had bought it a long time ago … we would have made more money.

So I’m not berating you for being a lazy 5-year-old and not buying property back then.

It wasn’t an option.

But you’re also not 5 anymore.

So the message isn’t “Why didn’t you buy 20 years ago?”

The purpose is to give you another way of thinking … and prove some of those old investment sayings like:

“Don’t wait to buy property. Buy property and wait.”

Do the maths. Then decide: are you going to wait again?

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser