Private Property – our weekly newsletter that gives you insights into what's happening in the NZ property market. Written by managing director Andrew Nicol. Sign up to receive this in your inbox every Thursday.

I’ve just returned from the NZ Property Investors Conference in Palmerston North, where I was a guest speaker.

A hot topic around the conference was ...

“Is Interest Deductibility going to be repealed if National get in at next year’s election?”

So here are two lists.

One contains reasons that interest deductibility will be repealed.

The second is a list of reasons interest deductibility won’t be repealed.

Reasons why interest deductibility will be repealed

1. National has committed to repealing interest deductibility

Chris Bishop – National’s housing spokesman – spoke at the conference.

The crowd cheered when he said National wanted to “stop the war on landlords”.

He confirmed that if National secures the top spot, the interest deductibility rules will go.

2. National wants to repeal the legislation quickly

While coy when asked when the rules would be changed back, Bishop said he wants

to move quickly.

One idea is to create one “big repeal bill”. This will overturn a lot of current legislation at the same time. If he can pull it off, interest deductibility would be included.

If National wins the election, these tax rules could be repealed before Christmas next year, depending on when the current prime minister calls the election.

If the PM calls the election for September (and National gets in) – Bishop reckons the new tax laws could be gone before the holidays.

However, if the PM calls the election in November, then parliament will only sit for a few weeks before the end of 2023.

In that case, interest deductibility wouldn’t be repealed until February 2024 at the earliest.

3. National has a shot at winning

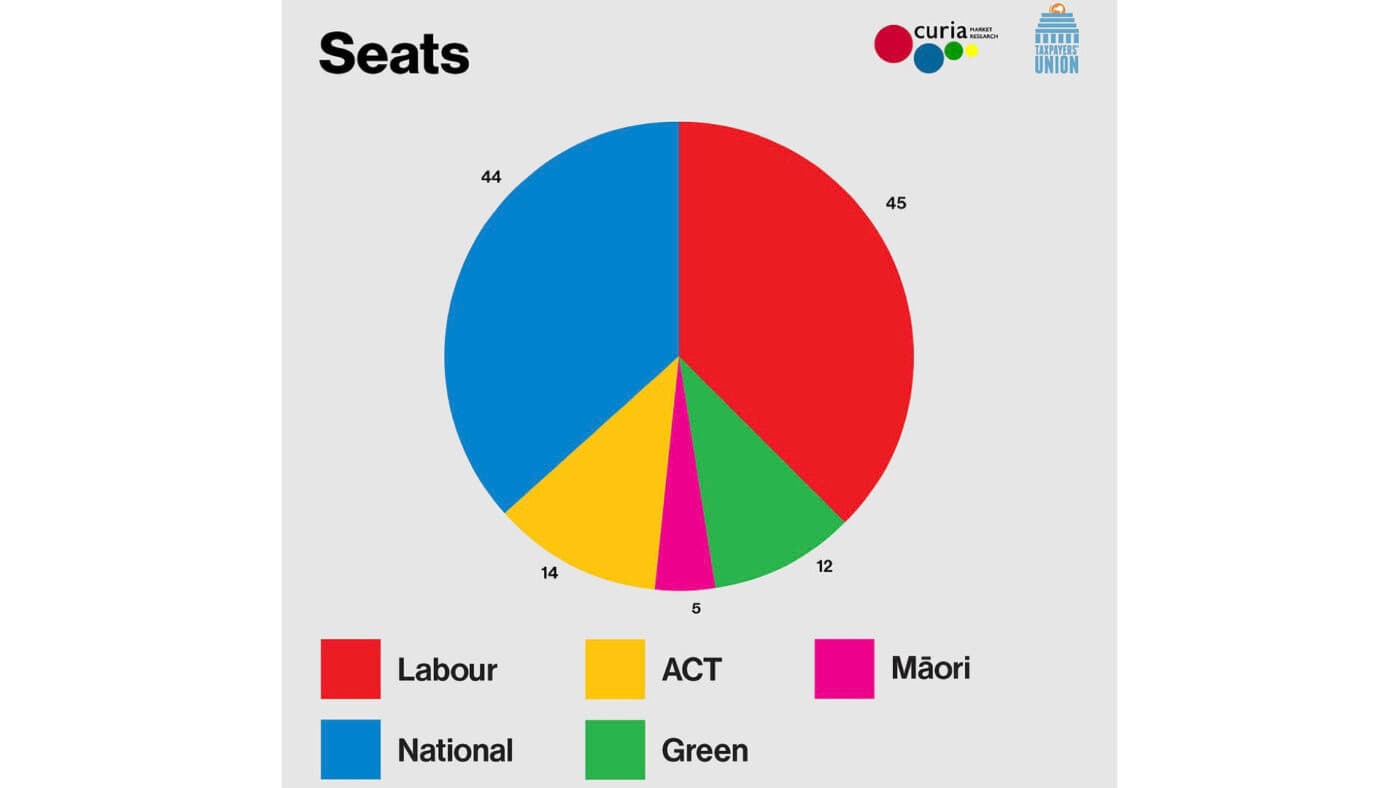

According to the Taxpayers Union Curia Poll, National and Labour are neck-and-neck.

This poll had the National/Act block on 58 seats and Labour/Greens on 57.