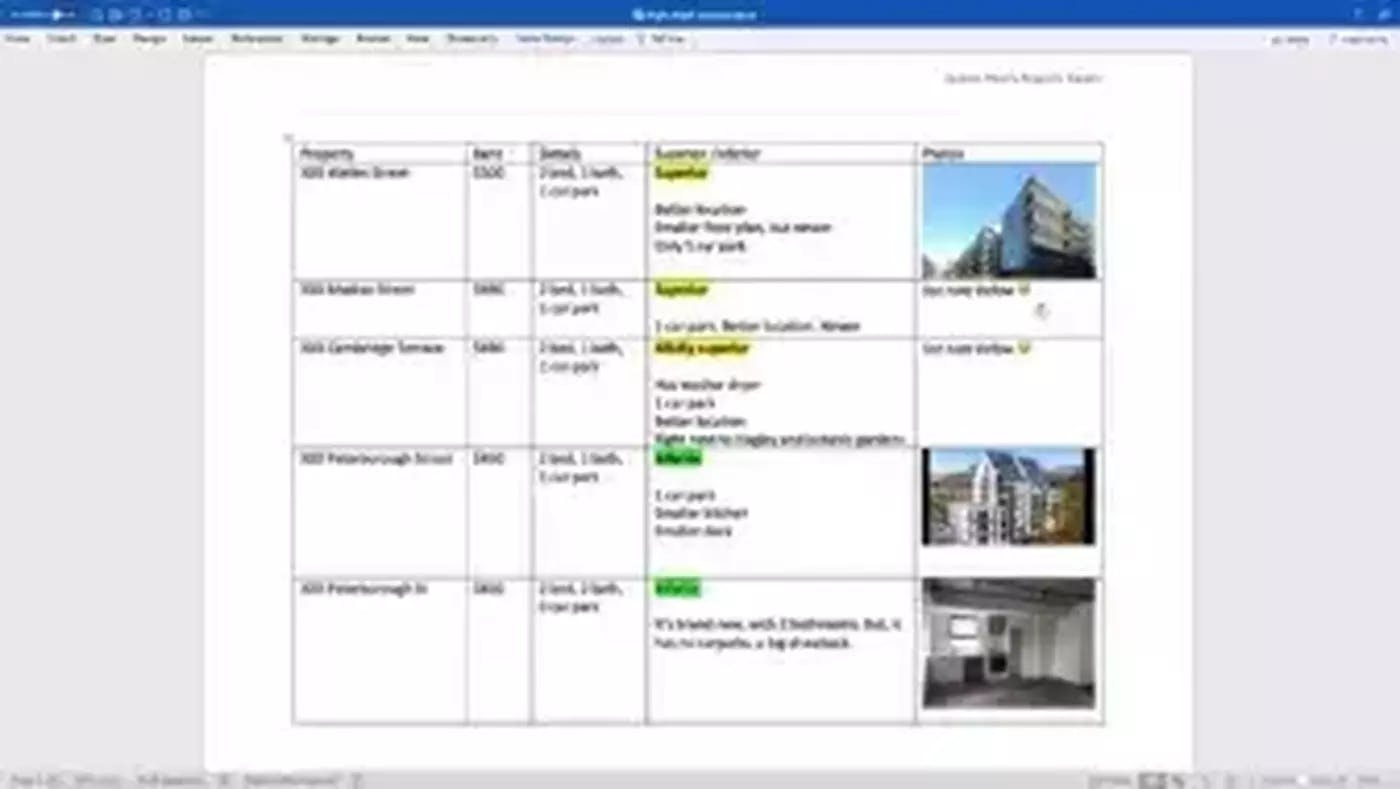

Here’s a case study. I was trying to set the rent for one of my properties. It’s a 2-bed, 1 bath, 2 car park apartment located in Central Christchurch.

It’s currently renting for $405 – well below the market rate.

So first, I went to TradeMe to see what similar properties were being advertised for.

I found this one – a 2-bed, 1-bath, 1 car park apartment advertised for $490 per week.

This is where you now need to switch your mindset and think like a tenant. Ask yourself, “if I was a tenant, and both these properties were advertised at the same rent, which one would I choose?”

If I was a tenant, I’d pick the other property. Even though my apartment has an extra car park, this other one is in a better location, is newer and has a slightly larger floor plan.

So the other property is superior to mine. So now you put that in the table with the justification (that is very important).