Property Investment

Opes' FMA monitoring review outcome

Earlier this year, the Financial Markets Authority (FMA) carried out a routine monitoring review of Opes. Here are the findings 👇

Property Investment

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

After last week’s Private Property (about how much income you need to invest), Caitlin emailed me saying:

“Ok, I’ve got the money to invest … but is it a good time to buy?”

So this week, here are the 6 reasons why house prices will turn around in 2023.

And to keep things balanced … in next week’s Private Property, I’ll release why the prices won’t turn around this year.

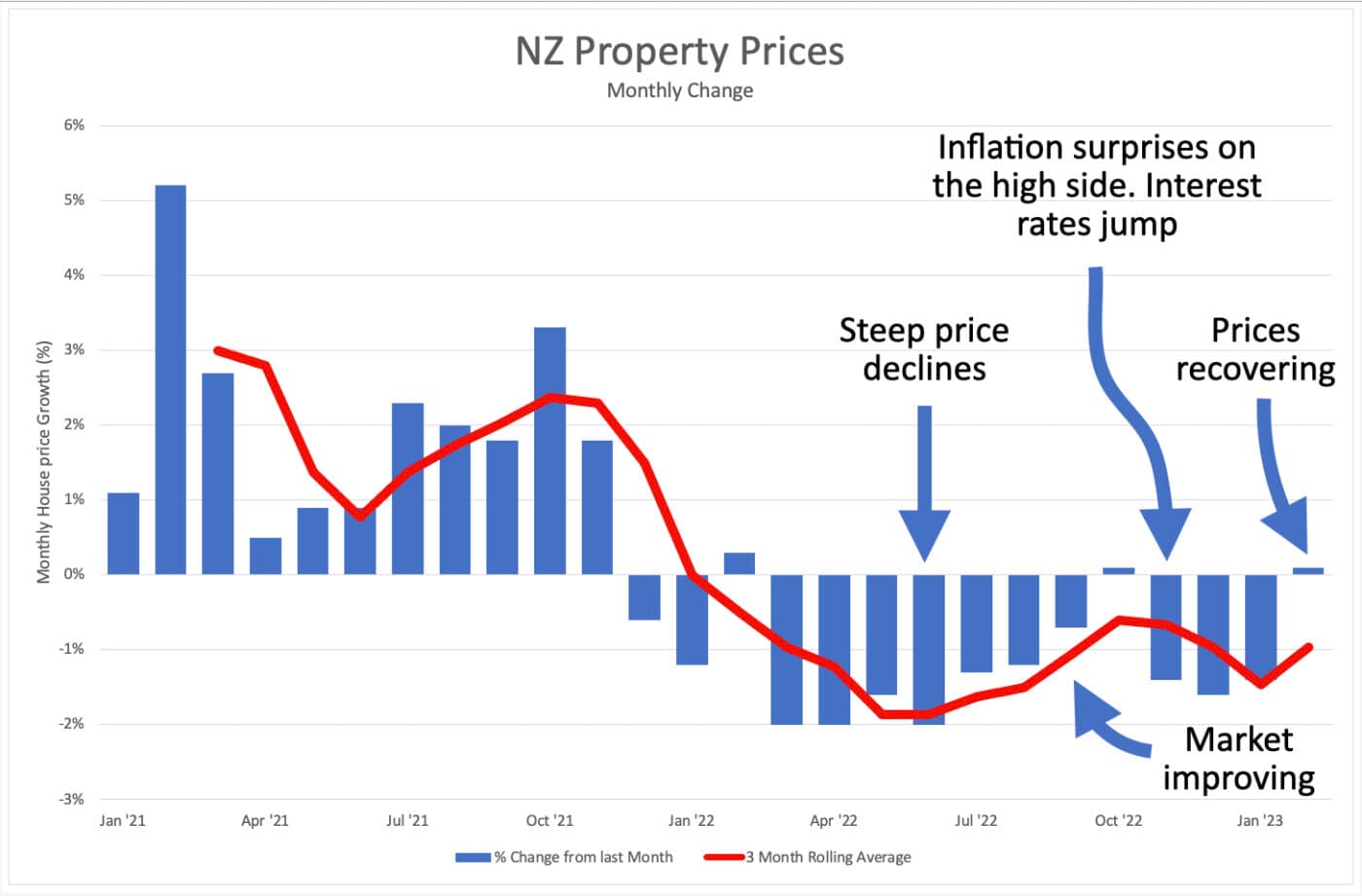

NZ house prices increased by (a measly) 0.1% between January and February.

Nothing to write home about. But what’s important is the change of pace.

Between June 2022 and October, house prices were falling … but at a slower and slower rate. The momentum of the market was improving.

But in November, inflation came out way higher than anyone expected, which caused a new round of interest rate hikes.

This gave house prices a kick in the guts.

This most recent data is the first sign that the market is recovering from that blow and suggests that house prices may stop falling soon.

More people are coming to live in New Zealand than those leaving.

In June last year, when house prices were falling quickly, a net 16,000+ people were leaving NZ per year.

Today the numbers have reversed. 33,000 more people moved to NZ than those who moved away.

Migration is adding to population growth. In a small country, that matters. Even a tiny change in net migration has a significant impact.

This will cause pressure both in rents and house prices as these people need somewhere to live.

As Ed shares in this video, interest rates are likely at or near their peaks.

Two weeks ago, the 1-year fixed interest rate was the highest since 2009.

The longer-term rates have already come down a bit from their peak this cycle.

As more New Zealanders feel that interest rates have stabilised and will slowly come down, this will change the sentiment in the housing market.

(Watch the video for more info).

Banks are competing for your mortgage.

Fewer people are buying houses, which means fewer people are taking out new lending.

Will the banks drop their profit and revenue targets in response? Unlikely.

Although the advertised rates haven’t moved much … our mortgage team sees banks offer steep discounts.

One bank an investor a 6% 1-year rate, down from the 6.5% advertised rate. The investor also got a 1% cashback.

Another bank recently offered new borrowers a 4.99% 1-year fixed rate.

You might not see the war for your mortgage on billboards, but behind-the-scenes mortgage advisers are getting investors steep discounts.

Covid made house prices go crazy, and house prices got out of whack with wages. Today things have changed.

Yup, house prices are up 20% since March 2020. But wages are also up 17%.

The labour shortage is driving incomes up, while house prices are still coming down (February excluded).

The house price to income ratio is only a whisker above where it was pre-pandemic.

KiwiBank, ANZ and the Treasury all predict that house prices will bottom out this year.

Not everyone agrees with them. But, there is a consensus building that interest rates are peaking, and the house price turnaround isn’t too far off.

House prices will likely still fall a wee bit this year. But we are very close to the end.

No one can predict the bottom of the market perfectly. But savvy investors are looking at deals.

I was texting one this morning who had flown to Christchurch from Auckland. She’s been scouting around for deals over the last few days.

But to keep a balanced perspective … next week’s private property will be a list of reasons why the market may take longer to turn around.

If you think I’m totally wrong about the market turning around. Good. Send me your thoughts. This will give me more ideas when I write Private Property next week.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser