Another restriction on lending?!

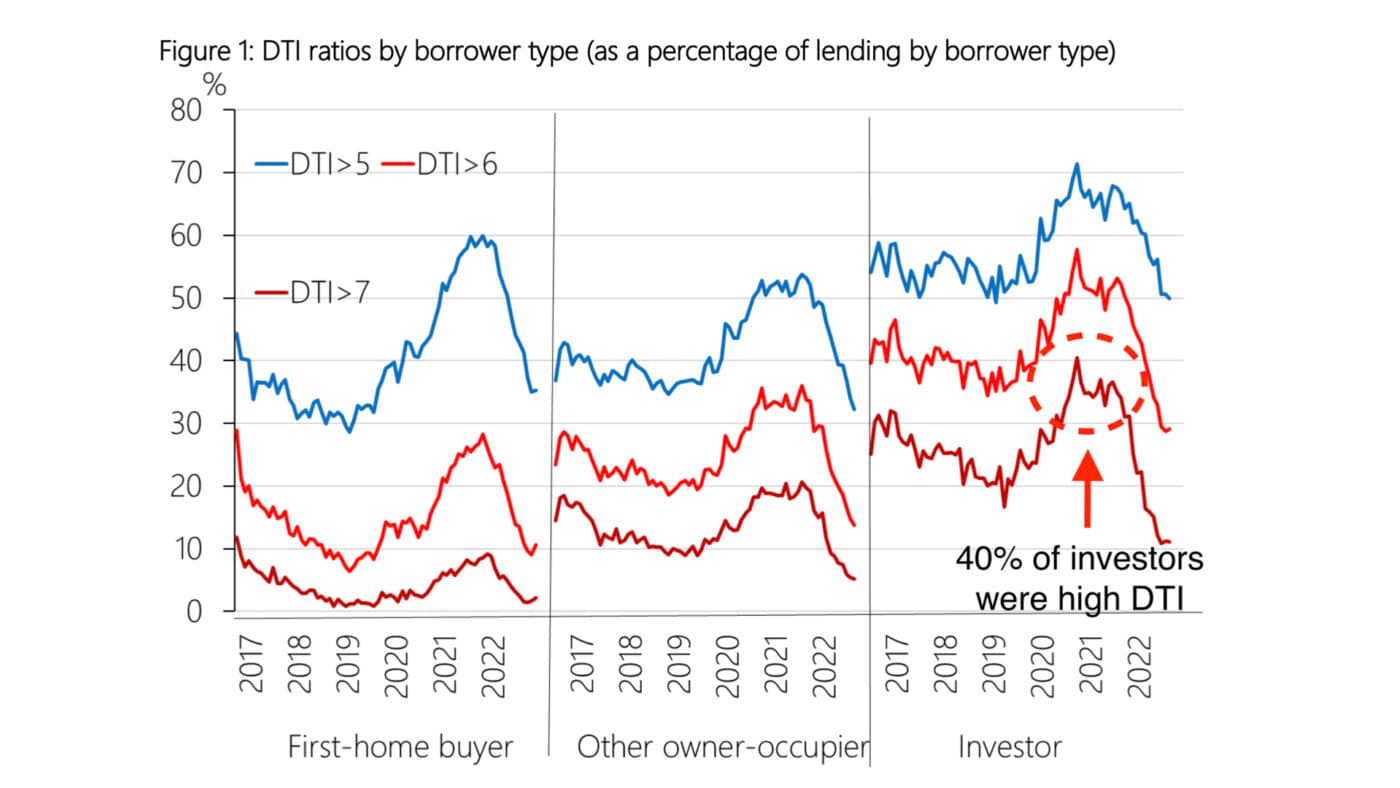

A debt-to-income ratio will decrease how much Kiwis can borrow, which the Reserve Bank hopes will slow down house prices.

Here’s how they work. A DTI limits how much you can borrow based on your income.

To work out how much you can borrow:

Income x DTI = max borrowing

For instance, let’s say you and your partner earn $100,000 (together) a year.

If the debt-to-income ratio is 7, you can only borrow $700,000.

$100,000 x 7 = $700,000

So, is the maximum debt-to-income ratio going to be 7x?

We don’t know … the Reserve Bank won’t announce the exact DTI until they bring it in. But it will likely be 6x or 7x.