Property Market

Property Investment

2 min read

The market downturn is over. Been and gone according to the Reserve Bank (RBNZ).

At their press conference yesterday, the Reserve Bank announced it would be leaving the OCR at 5.5%.

But the most important changes were in their forecasts.

But there’s both good and bad news. Here’s what you need to know.

Property prices have turned a corner and the Reserve Bank expects them to continue.

The Reserve Bank says the bottom of the market hit in June 2023.

Now they say, house prices should rise by 3.2% over the next year (September ‘23 - 24).

They expect house prices to increase:

Their forecasts suggest house prices have bottomed out sooner than they expected.

That lines up with other data that came out this week. On Tuesday new REINZ data showed the house prices increased in July.

Property prices rose 0.9% across NZ (in a single month). In Auckland prices were up 1.1%. Canterbury was up 1.3% and Otago 1.4%.

Prices are bouncing back.

But of course, that’s not the case for every region. And you’ve got to put that monthly change into context.

To help you do that for your region, this table shows the house price changes over the last month and year.

Just remember, if you find good news in this table … make sure you balance it out and keep reading the bad news below.

Yes, the Reserve Bank decided to hold the OCR at 5.5% … for now.

But the bank did say they may increase it one last time later in the year. Here is their forecast for the OCR.

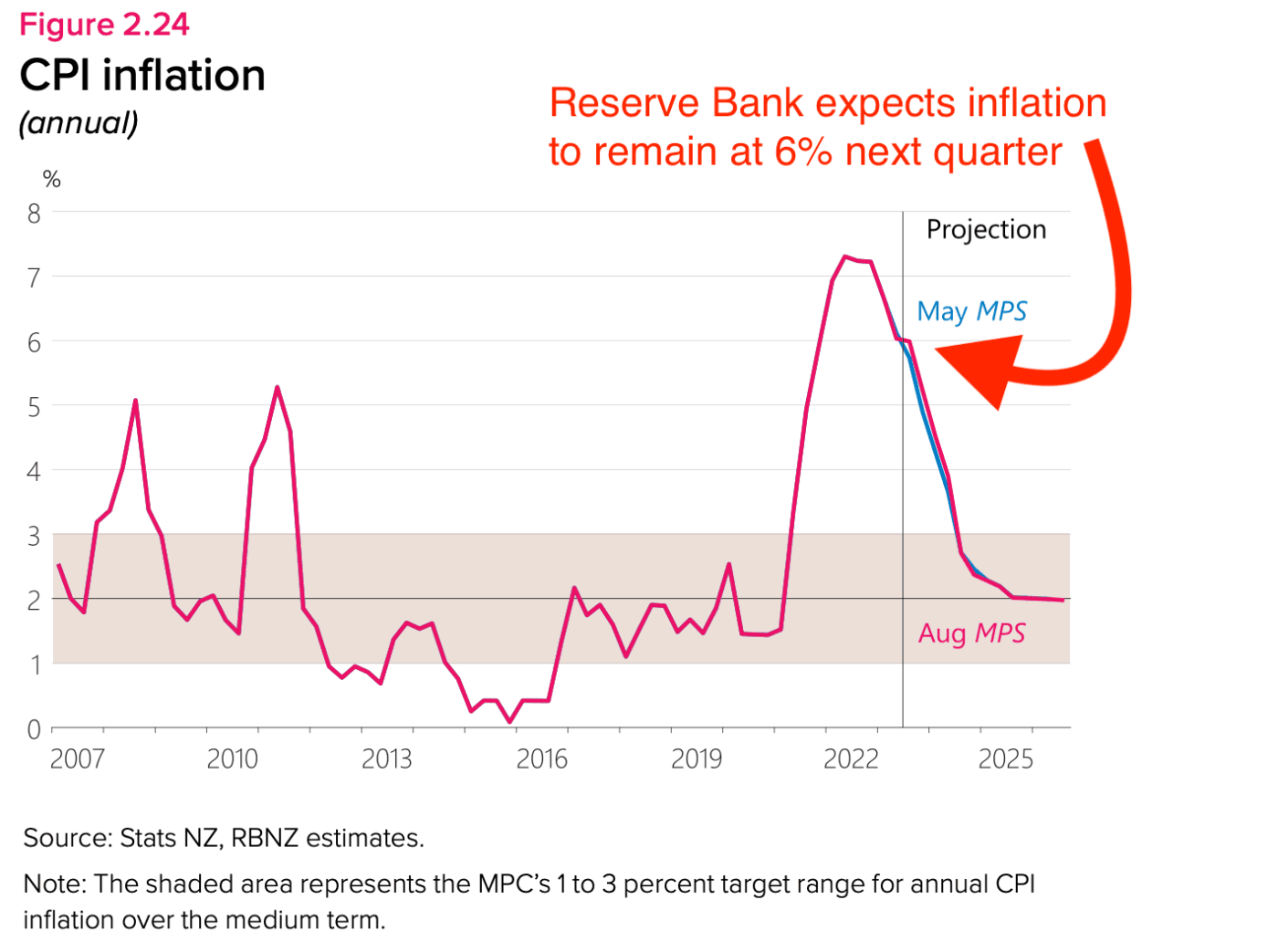

They still expect inflation to fall over the next few years. But, they expect a strong quarter the next time inflation data comes out in October.

The knock-on effect is that interest rates may go up a smidge more at the end of 2023.

Though some interest rates are still creeping up, many economists say they're within cooee of the peak.

Why?

The 1-year rate has already risen 4.8 percentage points. Another 0.1-0.4% isn’t a lot more considering how far we’ve come.

We may have to wait a bit longer for interest rates and inflation to come down.

But, when it comes to house prices – the bottom of the market has already happened. It's been. It's gone.

The house price recovery has started.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.