Property Investment

What’s a good gross yield?

Property investors always chase the best rental returns. But what’s good in one city can be disappointing in another. Here’s the data.👇

Property Investment

4 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Private Property – our weekly newsletter that gives you insights into what's happening in the NZ property market. Written by managing director Andrew Nicol. Sign up to receive this in your inbox every Thursday.

It’s the time we've been waiting for. The interest deductibility rules have been finalised … and have passed into law.

The IRD released a special 216-page report outlining all the new rules.

And in today’s newsletter, you’ll learn what’s in and what’s out.

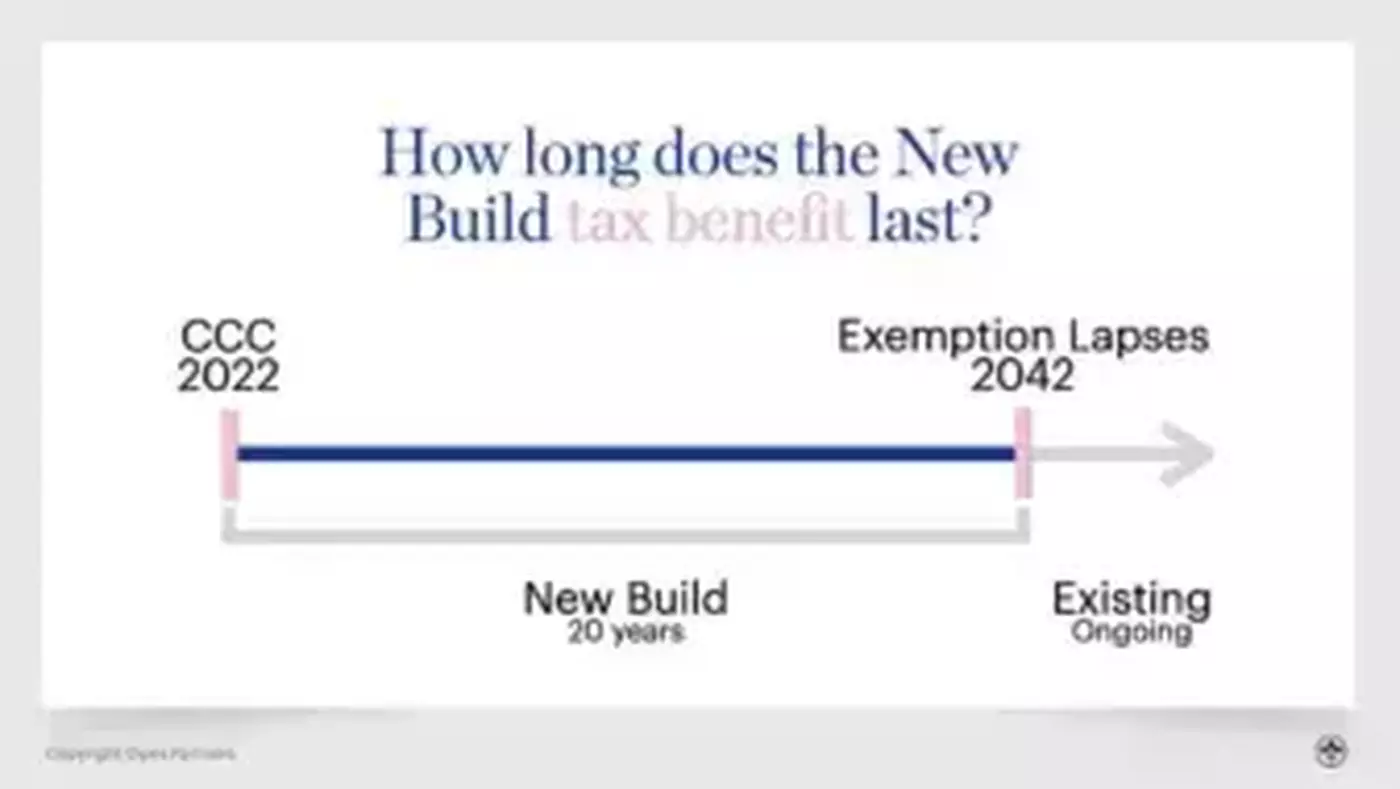

New builds receive significant tax advantages under the new law.

These properties can continue to claim their interest for 20 years after the council issues the code compliance certificate.

A new build with a $1 million mortgage receives $13,200 of tax benefits per year compared to the equivalent existing property (assuming a 4% interest rate and 33% marginal tax rate).

No surprises here.

Effectively, you will be taxed as if you don’t have a mortgage … even though you still have a mortgage to pay.

This could mean that even though your property is negatively geared, you still have to pay significant tax.

However, there are opportunities to renovate these properties and convert them so they'll be counted as new builds (to get the new build tax exemption).

The emergency housing waitlist is a national embarrassment. There are now over 5x more people waiting for state-subsidised homes than 5 years ago.

But, under these new rules, there are significant incentives to rent your properties as social housing.

It’s now confirmed that you can continue to deduct your interest costs if you rent your property out to Kainga Ora (part of Housing New Zealand) or a Registered Community Housing Provider.

Here’s where to find every registered community housing provider in the country. They’ll be happy to hear from you.

Let’s say your own home has two dwellings on the site – the main house and a minor dwelling out back.

In the initial discussion documents (released over a year ago), it looked like you could still claim part of the interest as a tax deduction.

That’s not the case for the final tax rules … unless you can come under the new build exemption above.

If you can convert one dwelling into two dwellings, both are considered “new builds” and can claim the tax benefits.

The most common case is converting a two-story building into two separate dwellings. One on each floor. There is a fantastic article below by Ilse Wolfe showing you the practical steps to undertake this type of conversion.

The new tax rules create a new type of property – a “boarding establishment.”

If your property has 10 or more rooms rented out individually to separate tenants … AND the rooms are not self-contained … you can claim the tax benefits.

Note that this is a different definition from what’s contained in the Residential Tenancies Act (RTA) and many council bylaws.

Under the RTA, a boarding house has 6 or more rooms with separate agreements. So, you may own a property that is a boarding house for tenancy purposes but isn’t a boarding establishment for tax purposes.

(Weird, I know … but I didn’t make the rules).

If you move a house from down the street and onto your piece of land, it can be considered a new build and claim the tax advantages – as long as it gets a fresh Code Compliance Certificate (CCC) from the Council.

In fact, you don't even have to move a property onto your land to get in on this one. If you move your already-existing house to another part of your land and get a new CCC, it becomes a new build.

But, you need to have a valid reason for this. You can’t just do it to get the tax deduction. Otherwise, you might find an IRD investigator on your doorstep.

A valid reason would be:

"I relocated the house further forward on the section to make room to build a minor dwelling on the back.”

In that case, both are considered new builds and receive tax incentives.

Two long-term property investment strategies still work

1) Use the passive buy-and-hold strategy. This is where you buy a new build and hold onto it long-term. This way, you get access to the tax incentives for the next 20 years.

2) Renovate your properties to either fit the definition of a new build or to increase the rent substantially. This will compensate for the extra tax.

Looking for more detail? We released this podcast video a few days ago, which goes through all the changes. Find this in the articles below.

And if you want to dive right into the details, here is where you can access the entire special report from the IRD.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser