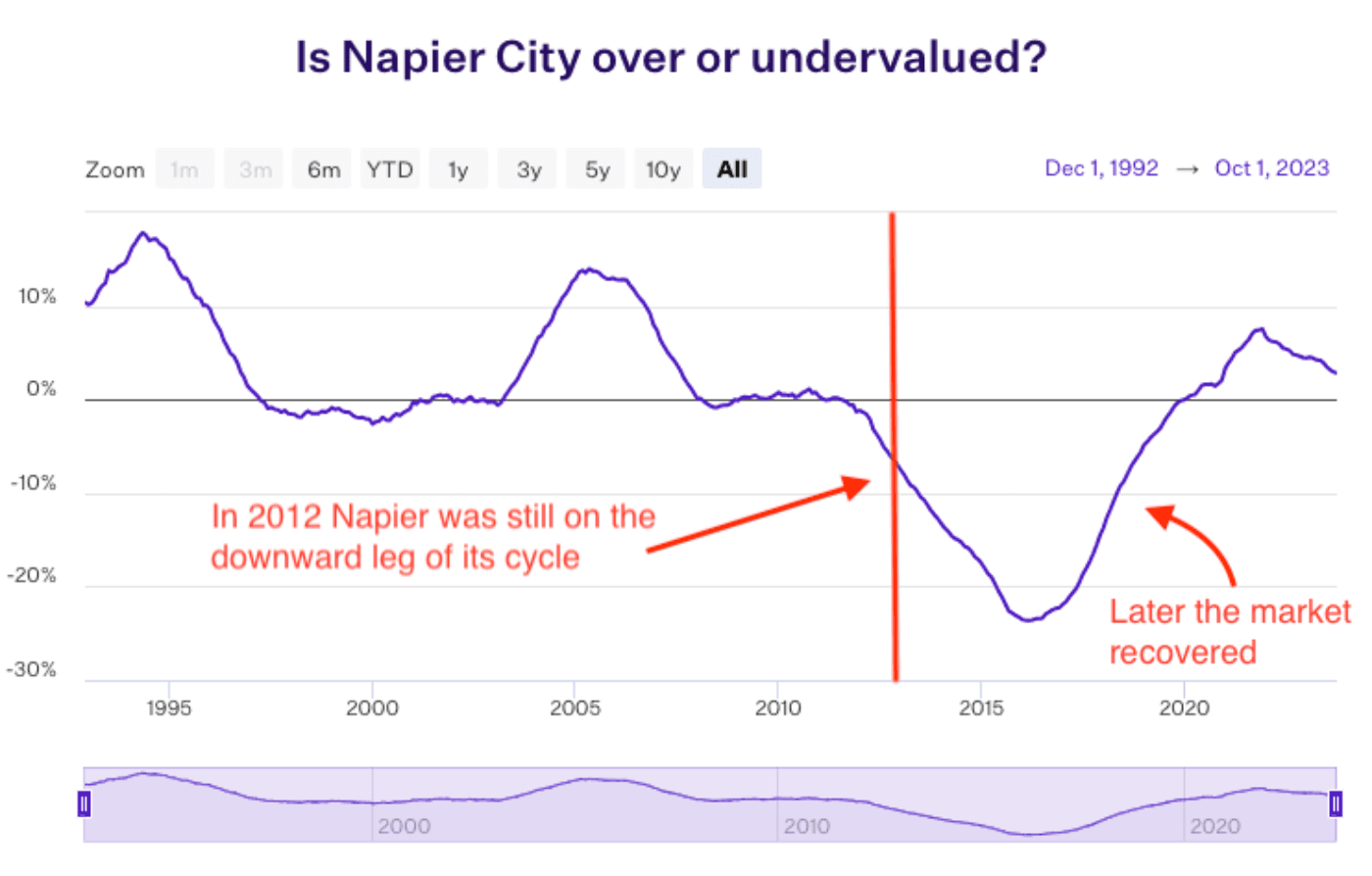

That’s the shortcoming of this model. It tells you if an area feels cheap. But it doesn’t tell you when the market will recover.

So, over a fixed 4-year period, this model doesn’t work 100% of the time.

Let’s continue to see what happens if you follow this model every 4 years.

Where were the best places to invest in 2016 and 2020?

In 2016, you would have invested in Whanganui (33% undervalued), spending about $150,000. Over the next 4 years, you would have made $145k.

That’s $106,000 more than if you bought the average property.

Then, in 2020, you would have bought in Christchurch (24% undervalued). You could buy a property for $525k back then.

3 years later, you would have made $174k. That compares to $67k for the average NZ property.

So, let’s add it up. Over 23 years, how much money did we make?

Can you make more money following this way of investing?

If you made the investments discussed in this newsletter, by 2023, you would have made:

- $3.1 million using the under/over model

- $2.1 million if you bought the average property