Property Investment

Catch-up growth: The mistake property investors often make

Bay of Plenty house prices just overtook Auckland. Most investors see that as a red flag for Auckland. Here's what we see 👇

Property Investment

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Monday was the day everything changed.

3 big, huge, massive changes came in. Together, they will impact both property investors and home buyers.

Let’s talk about the:

Here’s what changed and what it means for the next 6 months in property.

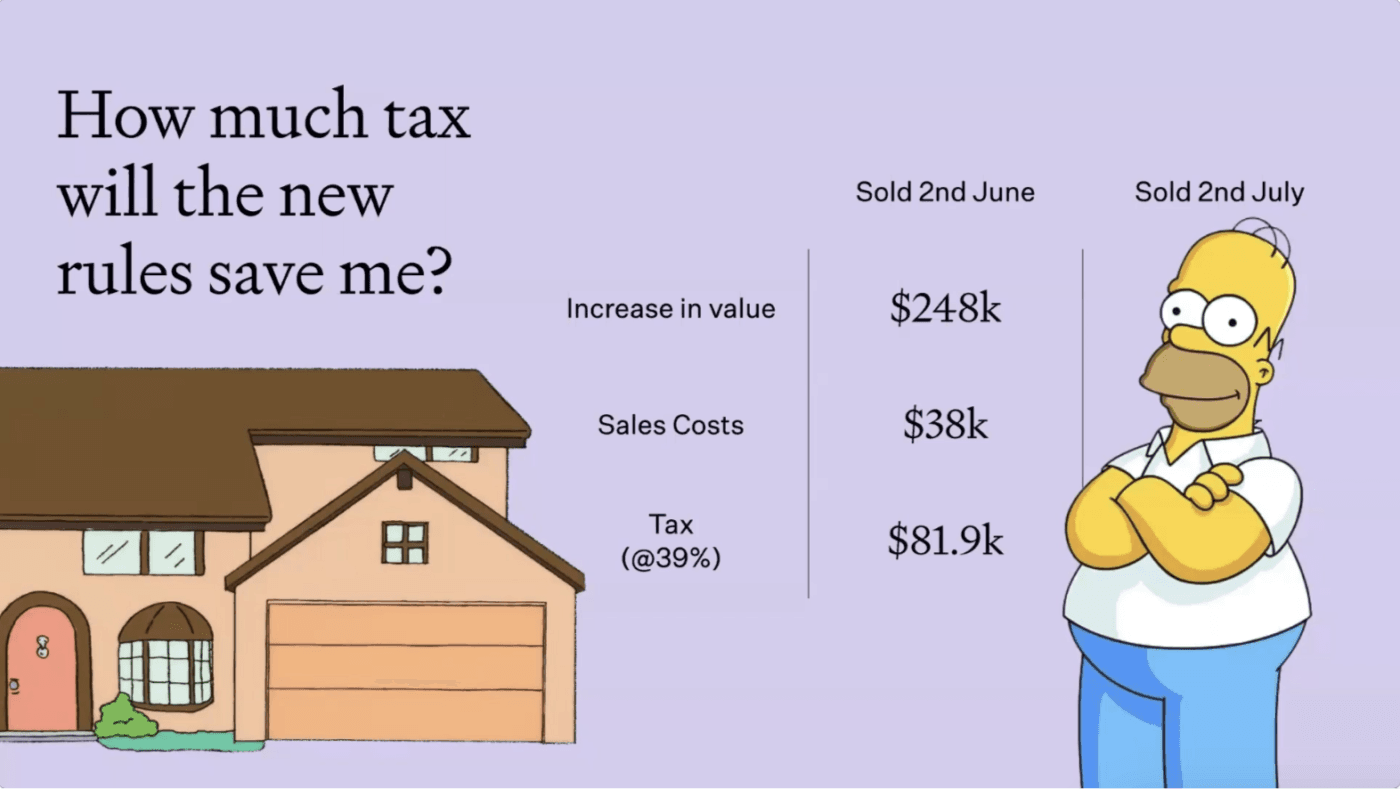

The bright line test makes investors pay tax on their capital gains (depending on when they sell).

But from Monday, you only pay tax if you sell within 2 years of buying a property.

No more 5-year rules for some people and 10-year rules for others.

So, if you bought before July 2022, you probably don’t have to worry about the bright line anymore.

This makes a big difference. If you bought the average Christchurch property in March 2020, you would have paid $514,000.

Today, the average house is worth $762k.

So you could sell and make $248k worth of gains.

But, if you sold on Sunday, you’d have to pay $81.9k to the IRD.

But if you sell today, you pay them nothing.

You save almost $82,000.

What’s the impact on the market? Some investors will sell their properties.

Some investors are struggling with high interest rates. But they were holding on because paying $80k+ to the IRD is even more painful.

But now the tax is gone. These investors will sell their homes tax-free.

CoreLogic reckons there are about 50-60,000 investors who could sell.

But, not everyone will bring their property to market.

There will be more listings on TradeMe. That creates opportunities for buyers.

That gives you more choice, less competition, and more opportunity to negotiate a deal.

Investors now only need a 30% deposit to buy an existing property.

That’s down from a 35% deposit.

It sounds small. But it can have a big impact.

Because you get a double-decker benefit.

Not only can you buy with a lower deposit. You can also borrow more against your current investment properties.

Let’s say you own a rental property worth $1,000,000 with a $550k mortgage.

Under the old rules, you could borrow $100k against this investment property.

Use that as the deposit for another existing property. You can buy a house worth $287k.

But under the new rules, you can:

So, this investor can buy a property worth 75% more.

This will push the property market. At the margin, a few more investors will be able to buy.

But wait. There’s more.

The debt-to-income ratios are now live.

These new rules link what you can borrow to your income.

For investors, the cap is 7x your pre-tax household income.

I’ve been talking about this for a while. So, to get a fresh take, I called up Kate Le Quesne. She’s the Head of Prudential Policy at the Reserve Bank.

That basically means that she sets the DTI rules.

She told me to think of the DTIs as a "guard rail". When house prices are going up really fast, it stops us from borrowing too much money.

But when the market is quieter, we’re nowhere near the guard rail. So, the DTIs don’t come into play.

Those DTIs don’t have much of an impact today. Mortgage brokers tell me that interest rates are so high that most banks will only lend 5 – 5.5x a borrower’s income.

So that 7x limit doesn’t stop us investors from borrowing. We’re already under the limit.

So, there is no immediate impact here.

The bright line test change will add supply to the market. The deposit changes will bring some investors to the market. That adds to demand.

But my gut says that the extra supply will likely outweigh the extra demand for a while.

This will help the buyer’s market continue for at least the next 6 months. So, buyers will continue to have the upper hand for at least the rest of 2024.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser