Property Investment

How to know if you can really afford an investment property top-up

Not sure if you can afford a $200-$350 weekly top-up on an investment property? Learn how to test your budget before you buy.

Property Investment

5 min read

Author: Louis Fraysse

Louis is a registered financial adviser with an MBA from Massey University.

Reviewed by: Grace Gibson

Financial adviser at Opes. Over 10 years experience in financial services.

Have you ever used a budgeting app or an online financial tool and seen that you can connect your bank accounts?

There’s a good chance it’s using Akahu to connect your bank with the app.

But what is Akahu? And when most of us are extremely cautious about sharing financial information ... can you trust it?

In this article, you’ll learn what Akahu is, how it works, if it’s safe and whether you actually need to use it.

Akahu sits between your bank and financial tools, keeping your data flowing automatically so you don’t have to keep updating figures.

Akahu is a “middle man” between your bank accounts and your financial apps.

For instance, let’s say you use Opes+ to analyse your investment properties. Akahu is the connector that pulls your bank information into the app.

It sits in the background and is an independent, separate company. Its job is to share your financial data securely with other apps.

This works really well for app developers because they don’t have to build their own complicated bank connections.

And because financial data must be secure, Akahu has spent a lot of time and money making sure their cyber security is sorted.

It also benefits users (the people connecting their bank accounts) because Akahu then gives you one place to decide who gets your information. You may have even used Akahu without realising it.

New Zealand Home Loans, Public Trust and even Westpac all use Akahu. It’s also what we use here at Opes for our free online tool, Opes+.

For any financial apps to be useful they need some of your money data. Often that might be how much your investments are worth.

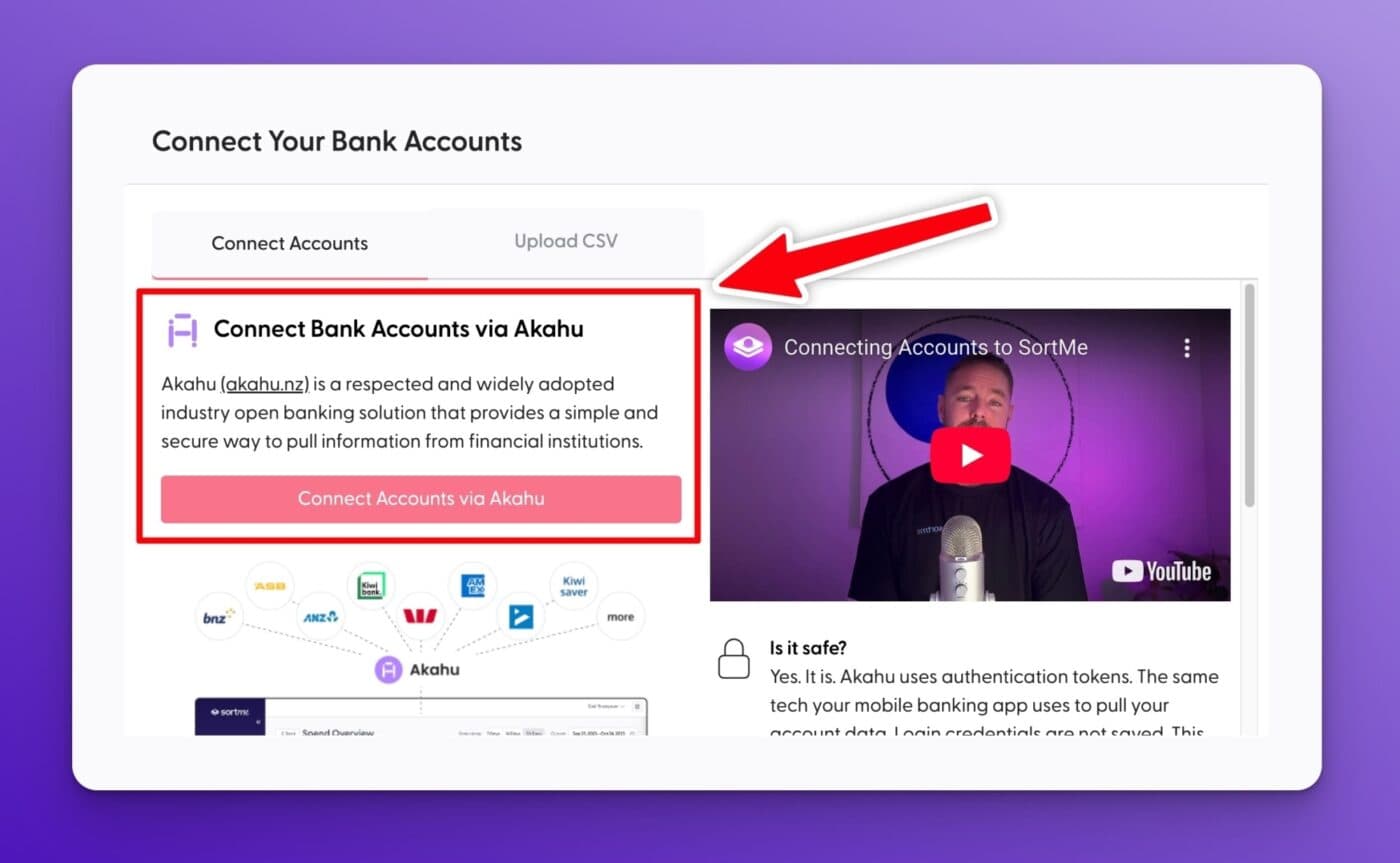

But instead of giving your bank account details directly to the app or website you’re using ... you go through Akahu.

Let’s say you’re logging into Opes+ and you want to track your net worth on a daily basis. You can:

But it’s important to mention:

We don’t receive your bank password and we don’t want to receive it. That should remain between you and the bank.

Akahu acts as the secure middle layer so your login information stays between you and your bank.

You don’t have to use Akahu, but if you don’t connect the process of using the app will be more manual.

For instance, you might need to manually put your mortgage in for a property and then update it regularly, whereas if you connect your bank accounts we can always keep that information up to date.

Or, let’s say you want to track your net worth. If you don’t want to connect your bank accounts you can always update your balances manually, but it’s simpler if you use Akahu.

No website is 100% unhackable (not even your bank).

But you can minimise risk by choosing tools that take security seriously. Akahu does that.

Here are some things that might reassure you:

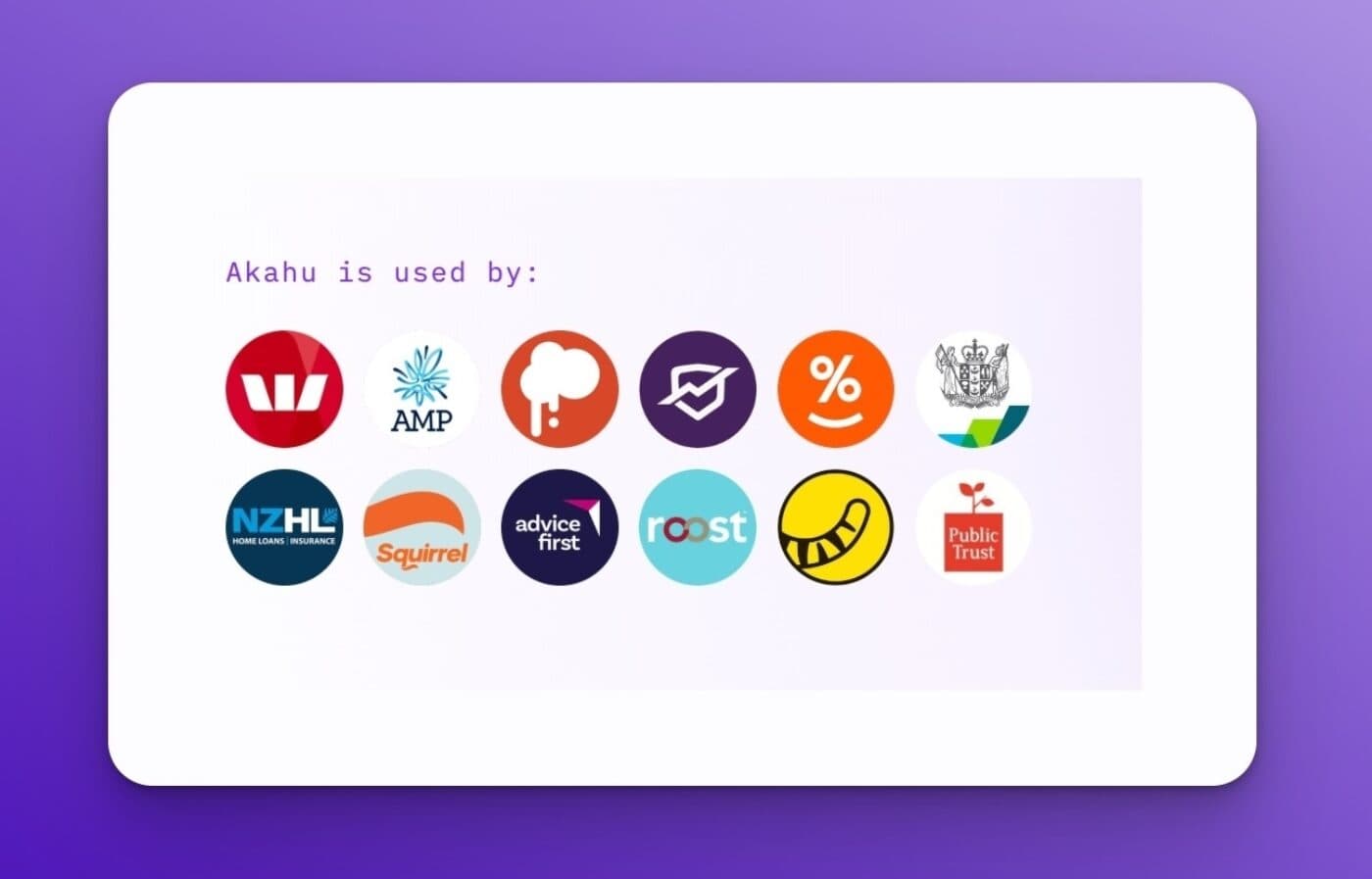

Here are some of the big names that use Akahu:

Akahu also says they work with New Zealand government agencies, although they don’t publicly list which ones.

It might comfort you to know that Westpac’s investment arm invested in Akuhu a couple of years ago.

Banks do their due diligence before they invest, so I personally read this as a vote of confidence in Akahu’s security.

CyberCX is one of Australasia’s leading cybersecurity firms. They test, audit, and attempt to break systems to ensure they’re robust.

Akahu and Opes+ use Cyber CX to test our cyber security.

In December 2025, Opes received a letter from CyberCX about how risky our application is. This is what they said:

“Comparing the target of the review to others that CyberCX has reviewed in the past, based on the age, size and complexity of the application, the overall technical risk appraisal of the Opes+ web application was low risk, with no significant security issues outstanding.”

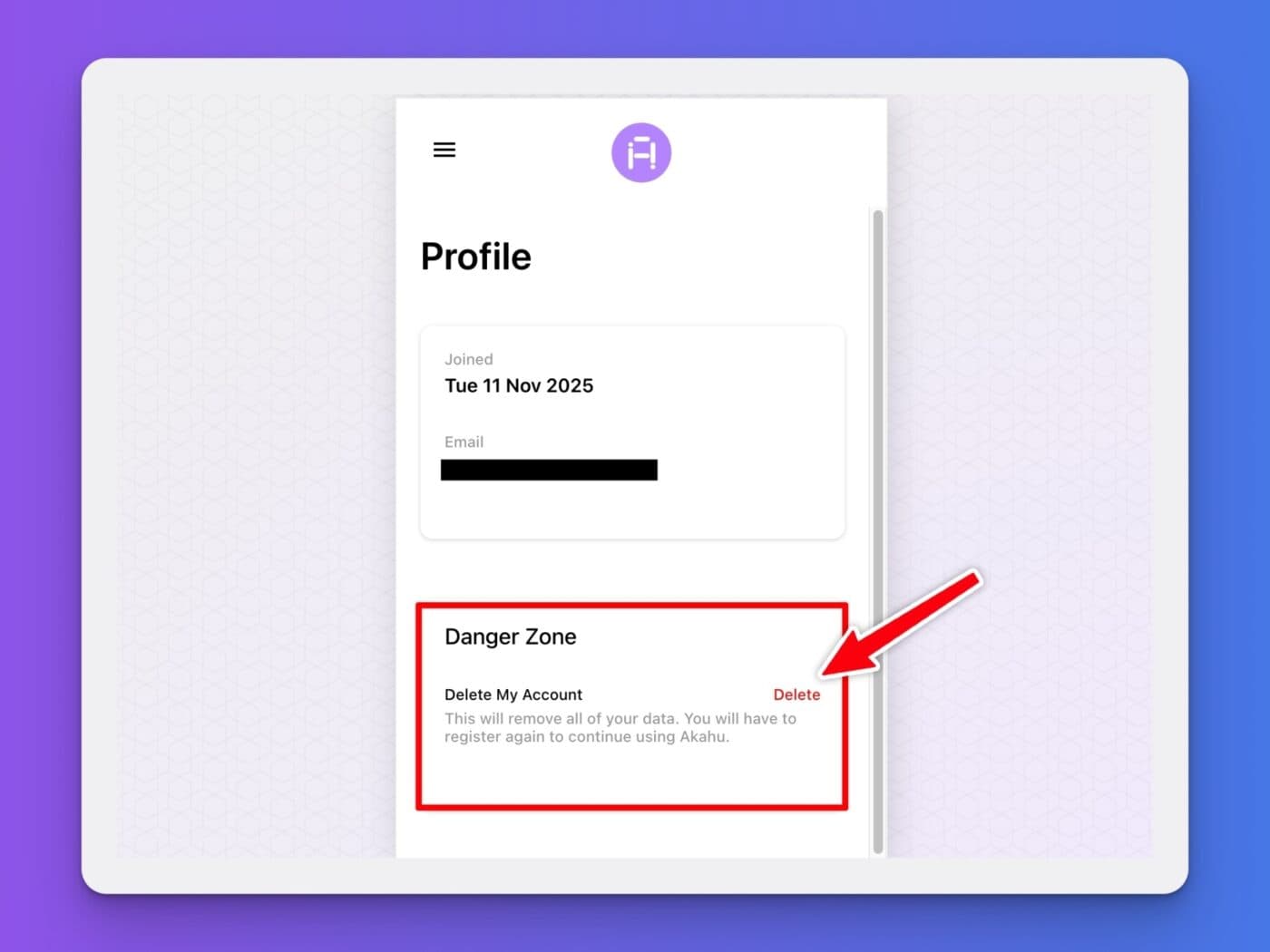

You can log into Akahu at any time and see exactly which apps have access to which accounts.

You can also remove access from any app immediately. You don’t even need to log into each and every app.

So, if you connect your bank accounts to Opes+ you could then log into Akahu and remove that access at any time.

Akahu’s great for most people, but it’s not for everyone.

Let’s say you’re someone who really, really doesn’t like sharing financial info online even with all the safety checks in place. In that case Akahu probably isn’t going to feel right for you.

And that’s totally fine. You can still use your apps, but you’ll just be doing a bit more manual updating.

It’s also not worth bothering with if you hardly use financial tools or if you’re happy typing in your balances yourself. Some people love their spreadsheets.

And if you don’t fully trust the app you’re connecting to, don’t do it. Akahu can be secure, but the app you link to also needs to be one you’re comfortable with.

Basically, if it doesn’t feel right, you don’t need it. Akahu’s helpful, but completely optional.

While no app is totally risk-free, Akahu is widely seen as the gold standard for connecting bank accounts in New Zealand.

It’s trusted by major financial organisations. Westpac uses it.

Most importantly, you stay in control. Your data is only shared with your consent, and you can switch off access at any time with a single click.

Louis is a registered financial adviser with an MBA from Massey University.

Louis is a registered financial adviser with an MBA from Massey University. He's also a property investor and a father. So he understand firsthand what it's like to balance family, investments, and long-term financial goals. Louis is based in Auckland.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser