Property Investment

10 ways to manage your investment top-up

In this article, you’ll learn 7 strategies to improve your cashflow over the short term in 2026

Property Investment

5 min read

Author: Nefe Teare

Financial adviser at Opes. Formerly a senior adviser at one of NZ largest investment firms. Owned 3 properties by 30.

Reviewed by: Ben King

Ben has 14 years of experience as a mortgage advisor and background as an investment adviser.

A property’s rent might not cover all the costs. That’s especially the case if you take out a big mortgage or use the No Cash Needed Method.

That’s when an investor might need to top-up the cashflow by around $200-$350 a week.

But if you’re a first time investor how do you know if you really can afford that top-up.

That’s where you need to learn about the “Can I Invest Test?”

In this article, you’ll learn what the Can I Invest Test is and how the tools you can use to track your spending. That way you can see whether an investment property fits your budget.

The best way to know if you can afford an investment property top-up is to test it first by setting the money aside and seeing how your budget holds up.

Let’s say you want to buy an investment property. The rent doesn’t cover all the costs. So you need to top it up by $200 a week.

Before you commit to buying it … test yourself.

Put that $200 aside every week, as if you already bought the property.

Here’s how to set up the test in 4 minutes:

If you get paid fortnightly, just do one fortnightly payment ($400 in this case). It doesn’t have to be weekly.

Same deal if you get paid monthly. But it must be automatic.

And it can often be useful if you set it up to automatically transfer the day after you get paid.

That way, the money’s already moved before you even think about spending it.

After 2-3 months, check in:

If you’ve managed to put the money aside without touching it … Congrats! You’ve passed the test.

If not, that’s when you can use an app to start tracking your money better.

Most people I meet don’t know where all their money goes each month. If that’s you, you might decide to use a budgeting app.

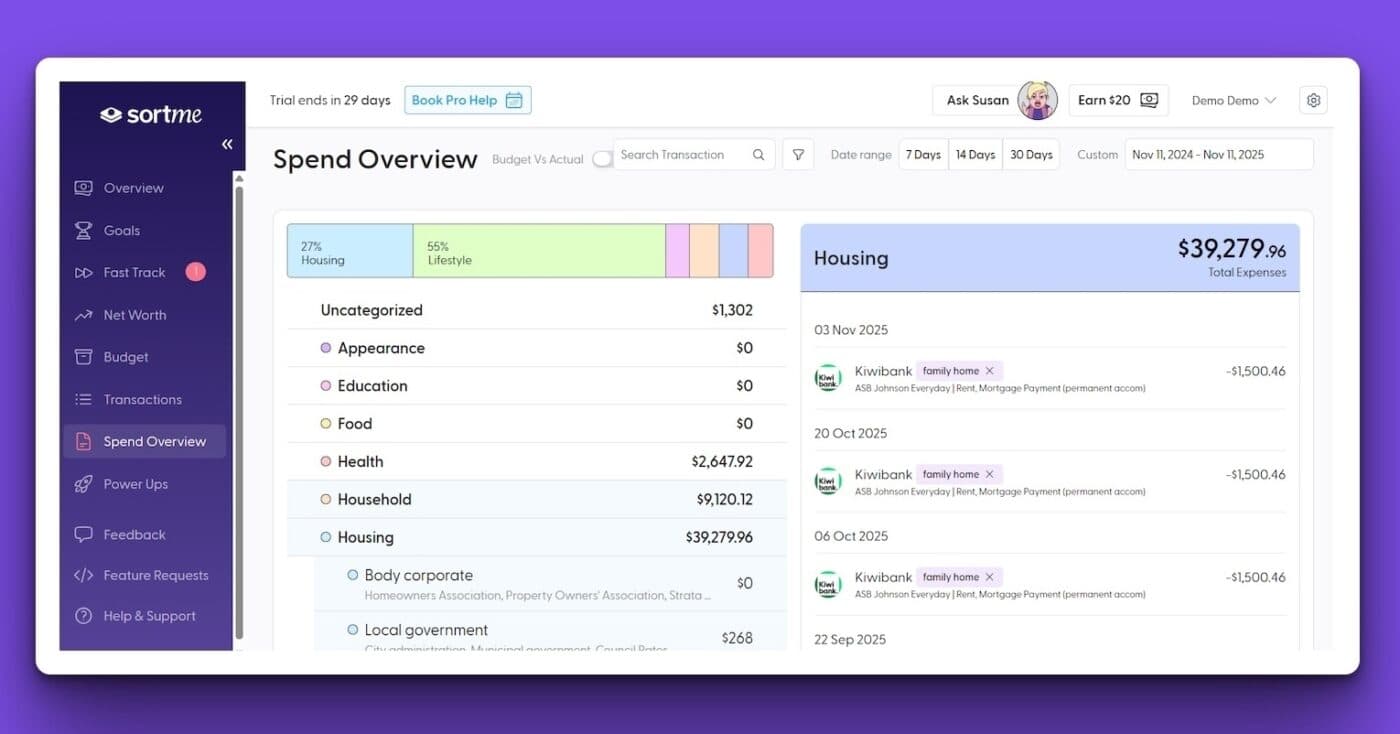

After testing all the different apps on the market, SortMe has become my favourite. It’s a Kiwi-made app that plugs in to your bank accounts.

It can automatically categorise your transactions. That way you know how much you spend on:

That way you can calculate how much might be available to top-up an investment property.

Here are the steps to use SortMe to calculate if you can afford an investment property top-up:

Create your SortMe account and link your bank accounts. The app uses Akahu to securely connect to your bank and import your transactions.

Next, click on Transaction in the left-hand panel. This will tell you over the last 7 - 30 days if you are in surplus. In other words if you are spending more than you are earning and how much is left over.

Just keep in mind that if you are saving money and transferring it between accounts, that can look like both income and an expense.

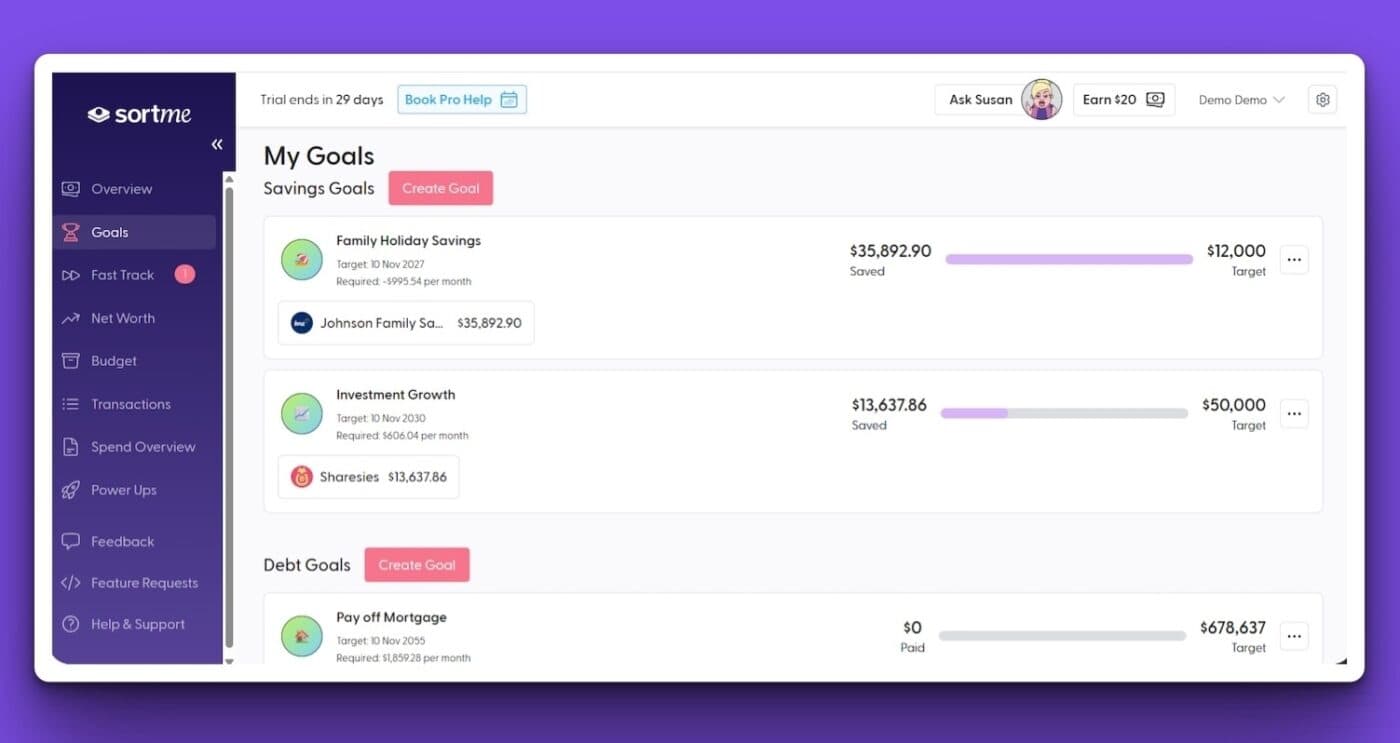

Once you’ve found your surplus, you can set a goal within the app. This is you Can I Invest Test.

You might aim to automatically transfer $200 a week into a separate account. Then connect that account to SortMe and create that goal.

Now as you transfer money into that account you can see how you are making progress towards that goal.

Some investors find that there is fat within their budget. There might be subscriptions they didn’t realise they’re paying.

Most people can create a surplus by trimming small, routine expenses.

That’s where you might use a feature like SortMe’s Fast Track to find money that you could potentially save.

The app highlights your recurring expenses, whether that’s a subscription to Netflix or your dialy coffee. You can decide what to keep and what to cancel.

Top-ups are different because no two properties (or mortgages) are the same.

Your weekly top-up depends on how much your property rents for … and all the expenses for your specific property.

But those aren’t the only reasons. All these factors affect the size of your top-up:

If the costs are higher, or you have a big mortgage, the expenses are higher, so the top-up is larger.

If you’re getting $600 a week in rent, but your mortgage, rates and other costs tally up to $850 a week ... you’ll need to top up by $250 a week.

That’s why top-ups are more common for investors who use the No Cash Needed method and borrow all the money to invest.

If you put in a deposit and take out a smaller mortgage, the top-up is usually lower because you’ve got a lower mortgage repayment.

But remember, your holding costs can still change. If interest rates rise your top-up amount can rise too. This is because your mortgage is now more expensive.

And because of this it’s a good idea to stress test the numbers.

To get ahead and invest, you often need to have a cashflow surplus.

After getting paid and paying your expenses, is there money left over? You can then use that money to pay down debt, save, or invest.

The issue is that investors sometimes don’t really know whether they have a cashflow surplus or not. So by using the Can I Invest Test, or a budgeting app, you can figure out if you have a surplus or not.

Ultimately, that helps you answer whether you can afford an investment property or not.

Financial adviser at Opes. Formerly a senior adviser at one of NZ largest investment firms. Owned 3 properties by 30.

Nefe is a Registered Financial Adviser at Opes Partners with 7 years’ experience in financial services. Before joining Opes, she was a senior adviser at one of New Zealand’s largest investment firms, managing $13 million in KiwiSaver and managed funds. She’s helped clients invest over $26 million in property and owned 3 properties before her 30th birthday.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser