Property Investment

How to think like a millionaire (in just 90 seconds)

Do you think about your money in days, months, or decades? Here’s why the wealthy always think further ahead 👇

Retirement

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Could you live spending just $127 on food per week?

What about $8 on alcohol per week?

That’s what some retirees are spending, according to the latest numbers from Massey University.

So, how much will you need to spend for a comfy retirement?

Let’s go through the numbers. And then I’ve got a calculator where you can figure out your own number.

Every year, Massey Uni puts out the Retirement Expenditure Guidelines.

Most Kiwis struggle to figure out what they’ll need in retirement. So, this gives you a ballpark of what you might need to spend.

Retirees living the ‘No Frills’ lifestyle spend $910 a week ($47,320 a year). That’s for a couple living in a big city.

The same couple living the Choices lifestyle spend $1,740 a week ($90,480).

Here’s the scary part … NZ Super for a couple is $803 a week. It doesn’t cover either lifestyle.

So retirees need other money to top them up – even for the No Frills lifestyle.

Here’s what the average household spends on these lifestyles:

It’s worth asking yourself if you could survive spending $127 a week on groceries.

Some people do.

But, every time I go to the supermarket – even a small basket costs $100+

People often ask: “how does Massey calculate them numbers?”

Here’s what Massey Uni does. They go to Stats NZ and get data about what retirees actually spend each year.

The No Frills lifestyle represents retired people who spend below average.

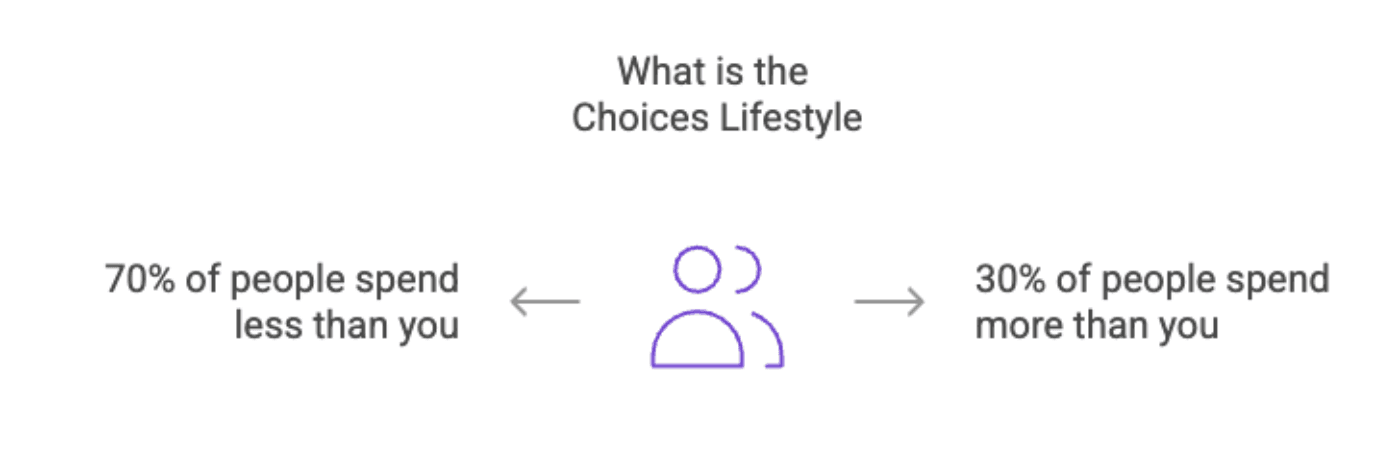

Imagine a lineup of 100 people. The lowest spenders are on the left, and the highest spenders are on the right.

People on the No Frills lifestyle would be about position 30.

So, 30% of people spend less than the No Frills lifestyle. And about 70% of people spend more than the No Frills lifestyle.

The Choices lifestyle is the exact opposite. It’s an above-average lifestyle.

In that same lineup, the Choices lifestyle would be in position 70 out of 100 people.

So, 70% of retirees spend less than the Choices lifestyle, and about 30% of people spend more than the Choices lifestyle.

There’s a bit more number crunching than that. But that’s the easiest way to think about it.

I got an email last week from Paula, asking, “Aren’t these numbers a bit low?”

She showed me her retirement budget. She reckons she’ll need $170k a year to maintain her current lifestyle.

This brings up an important point. The No Frills and Choices lifestyles aren’t what you SHOULD spend.

They aren’t example budgets showing what you ‘could’ spend in retirement either.

Massey aren’t going to the shops to decide what’s essential (or not) for retirees.

Instead, these numbers show what some people DO spend.

Paula’s income is high. She’s in the top 5-10% of households when it comes to income.

That’s because she and her husband both work white-collar jobs in the city.

They have more money, so they spend more. Nothing wrong with that.

So, it makes sense that the Choices lifestyle seems a bit low to her. Because the Choices lifestyle is a ‘top 30%’ of retirees' lifestyles.

Meanwhile, Paula and her husband are among the top 5 – 10% of earners.

That’s not to say that Paula should spend less. It’s just that the Retirement Expenditure Guidelines are, well, guidelines.

Think of it as a ballpark rather than a budget.

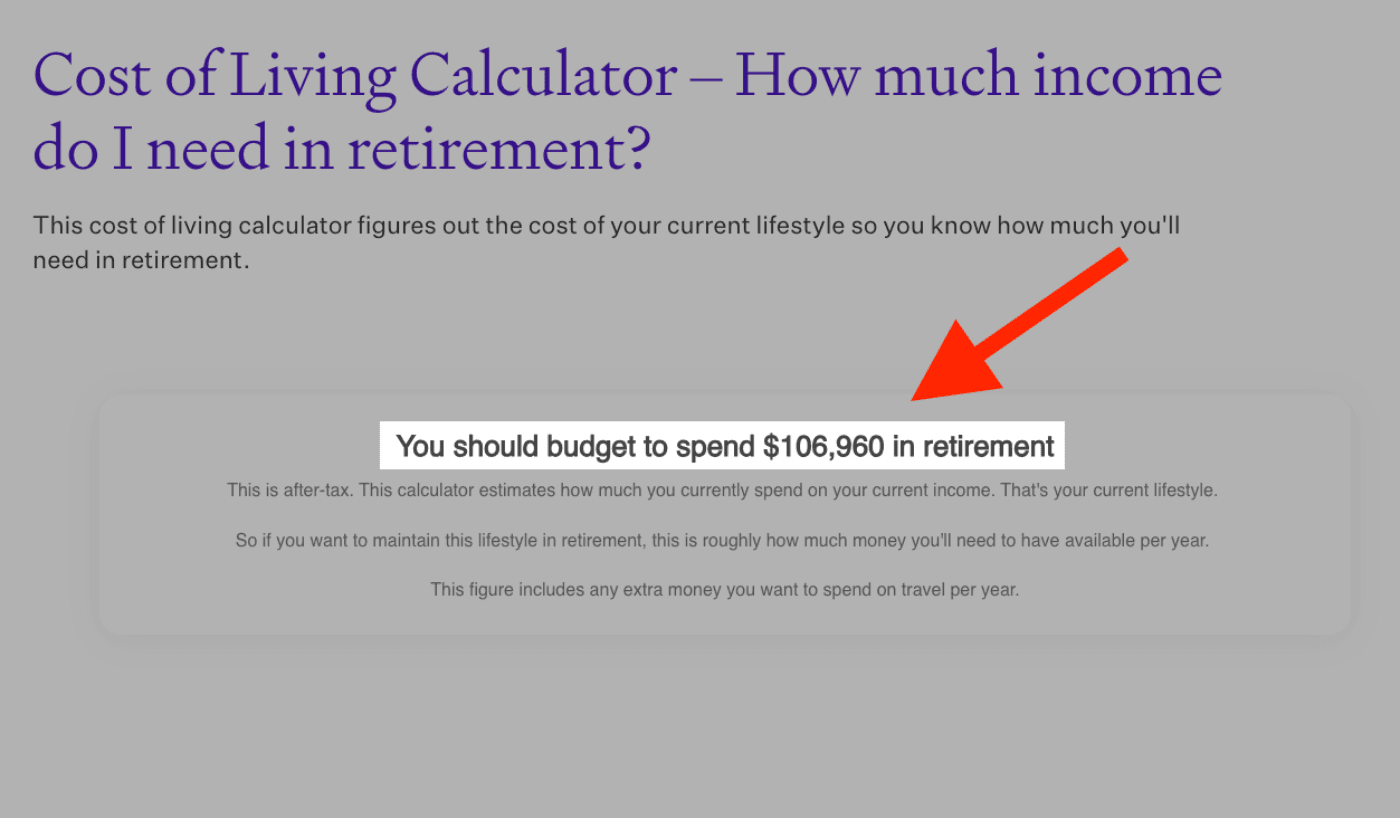

It’s hard for people to figure out what they’ll spend in retirement. So I built this calculator.

It figures out how much you currently spend each year.

It takes out the things you won’t spend on in retirement (like saving, childcare and your mortgage) and adds on things like travel.

That way, you can create your own ‘retirement expenditure guideline’ for the money you might need.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser