Property Investment

Private property issue #4 - predicting interest rates

Giving you exclusive insights into the NZ property market. Sign up to receive this newsletter and it will be delivered to your inbox every Thursday. Issue #4

Property Investment

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Some Kiwi investors are missing out on thousands of dollars because their properties aren’t renting fast enough.

This week, I’ve gone through TradeMe listings to show you the simple mistakes some property investors are making.

That way, when renting out your property, you can rent it as fast as possible.

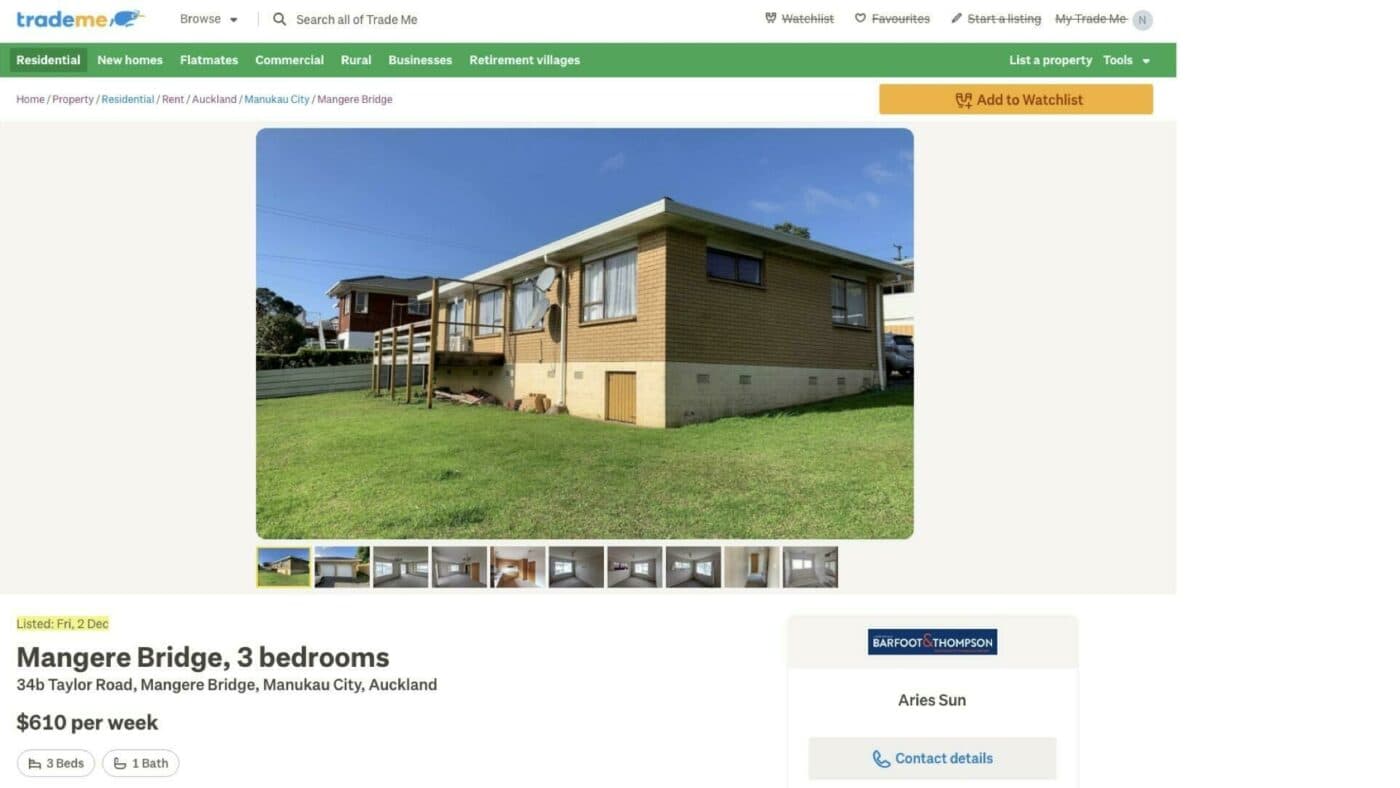

Here’s a 3-bedroom property in Mangere Bridge, South Auckland.

At $610 a week, it’s definitely one of the cheapest rentals in this area.

So….it should be a popular choice for tenants.

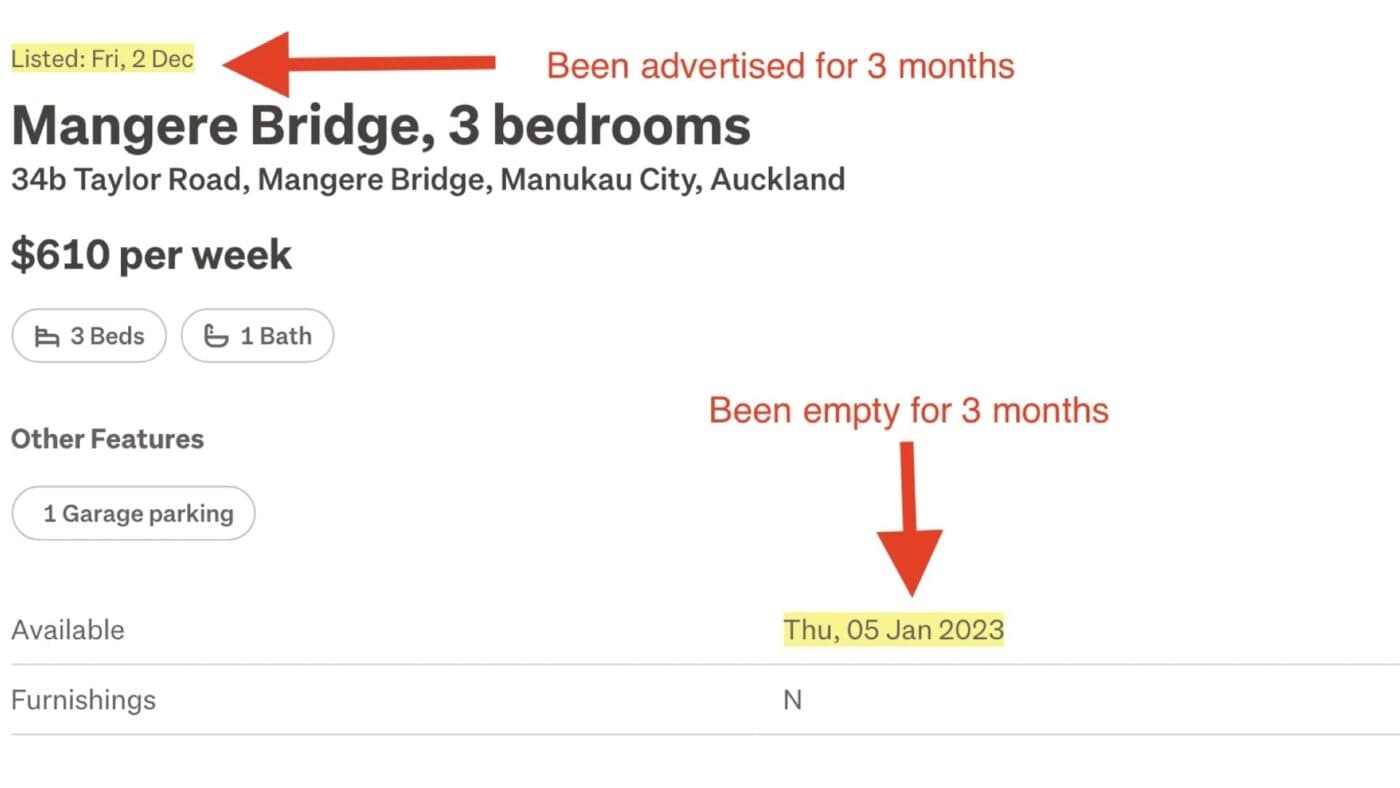

But it’s been advertised for the last 3 months and has been empty for about 2.

Why’s it not renting?

Here’s what’s sticking out to me:

This isn’t going to get tenants streaming through the door.

#1 – Turn the lights on when taking photos. This will make the home look much brighter and less dark. This will make a massive difference to the overall feel of the property.

#2 – Renovate the property cosmetically

This property has sat empty for about 8 weeks. So the investor has missed out on rent. At $610 a week, that’s $4880.

The investor would have been better off taking the $5k lost and renovating the property instead.

These are things like: stripping the wallpaper (or painting over it), replacing the curtains and updating the light fittings.

This would likely mean the property would rent more quickly, and the investor could charge more rent.

Here’s another 3-bedroom property, this time in Tai Tapu – a small town 23 mins south of Christchurch central.

It’s renting for $550 a week.

Like the Mangere Bridge property, it’s a wee bit older but isn’t as tired.

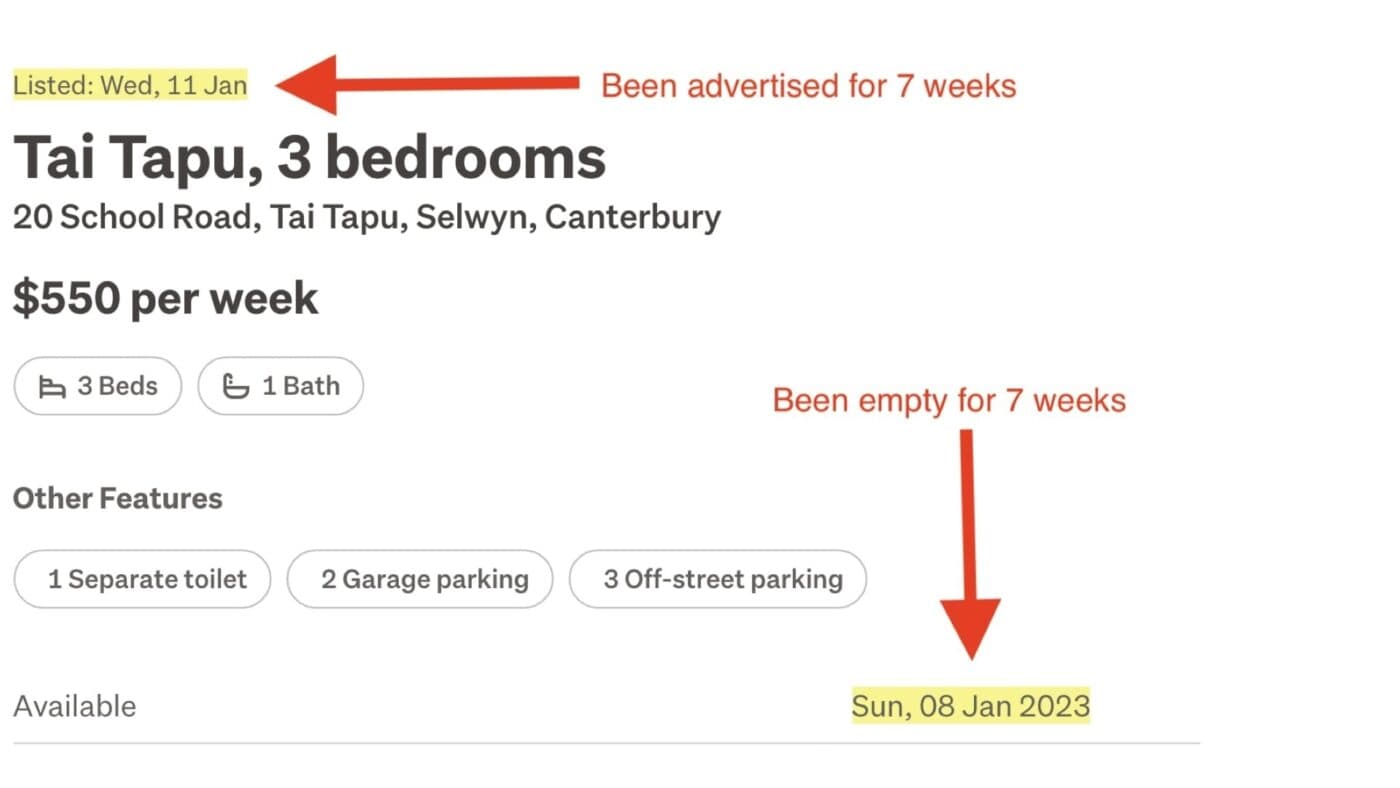

But, again, it’s been available for 2 months. Why?

The main problem is that the investor has bought a property in Tai Tapu. This is a small town of only 1,173 people.

And the town has a very high homeownership rate. Only 11.7% of households rent, and there are only 46 households that rent in the area.

There’s nothing wrong with the property. The issue is with the area. I don’t recommend investing in small towns, as there is often a limited tenant pool. So your property might sit empty, not earning any rent.

However, this investor already owns the property. So, what can they do to get the property rented faster?

#1 – List the property in multiple locations.

While there mightn’t be many people in Tai Tapu looking for a rental, 6km down the road is another town – Lincoln.

Lincoln has a population of around 6,000, and approximately 20% of people in the area rent.

So you’ve got more people and many more renters.

So this investor could create a second TradeMe listing, advertising the property as in Lincoln.

Since many properties in Lincoln are renting for over $100 a week more, many tenants would probably consider moving a 7-minute drive down the road for this property.

My key point is that if your property is sitting empty for weeks, there are often things you can do to get it rented faster.

And these are just 2 examples of the common mistakes property investors make.

If you want to hear about a few more – tune in to this coming Monday’s episode of the Property Academy Podcast: “TradeMe Takedown”.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser