Property Investment

When does Opes Property Management pay out landlords? (Exact payment dates revealed)

Find out exactly when Opes Property Management pays landlords, why payout dates shift, and how to plan your cash flow for the next 12 months.

Property Investment

4 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Tom Greene

Business Development Manager with 5 years Property Management industry experience. Property Investor in Christchurch

Before Opes Property Management there was Venture Management. That was our property management company at Opes.

But then a large part Venture Management sold to A1, another local Christchurch firm.

Over the last few years I often get asked:

These are great questions and important ones too.

So in this article you’ll learn exactly what happened, why it happened, and what to do if you’re thinking about switching to Opes Property Management?

Venture Management didn’t disappear — Opes intentionally reset the business to rebuild it properly.

Back in 2022, Venture Management was our property management business at Opes.

It had grown really fast. Much faster than I thought it would.

At that point we had:

On paper, this sounds great. But behind the scenes our systems and processes weren’t keeping up and I don’t think we were giving the best service to property investors.

So I had to make a tough call. I realised the only way to give a better service was to rebuild the company from the ground up.

So we sold most of Venture Management’s Christchurch property portfolio to A1 Property Management.

That’s not because I wanted out of property management, but because I thought A1 were good operators who could look after those clients.

It wasn’t a merger, but we didn’t sell our business and pack up shop either. It was a strategic reset to make sure we could do a better job at Opes.

In three years we’ve completed the reset and we’re now larger than we were before we did the deal with A1.

We now manage over 1500 properties between Auckland and Christchurch.

Our Auckland office has a team of 10; Christchurch has 13.

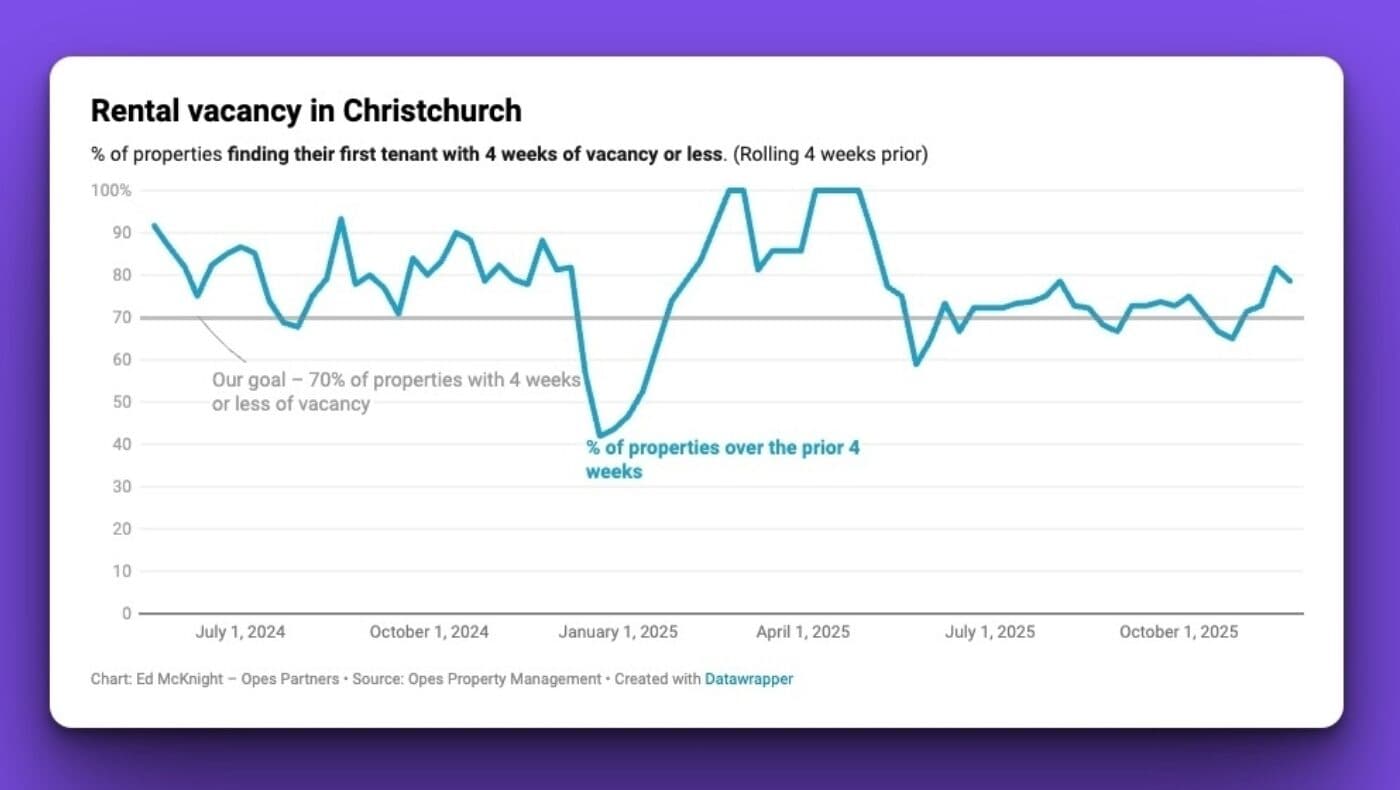

We’ve also focused a lot on service. We now release data that shows if we are delivering a good property management service.

These customer service stats are public and updated every week. You can see how we’re performing: when the data is good ... and when we’ve got work to do.

For example, here is a link to our live vacancy data.

We do this because (as part of our reset) we want to be the most transparent property management company in the country.

Here’s the honest answer: We can’t guarantee we will never sell in the future. No business can make that promise.

I’m lucky at Opes because so many of our clients are incredibly loyal. They want to have everything with Opes and some people were upset being moved to A1.

So you might be thinking: “If I decide to use Opes as my property manager, what confidence can you give me that you won’t sell again?”

Here’s the honest answer: We can’t guarantee we will never sell in the future. No business can make that promise.

But there are three actions we’ve taken that show we’ve got no intention of selling:

Firstly, we only slimmed down so we could build back better. We’ve done that, so I have no plans to slim down or sell again. My commitment is that Opes Property Management will stay part of Opes.

As part of that commitment we renamed the company. Rather than calling it Venture Management and having it as a “side thing” Opes Property Management now carries the “Opes” name.

We did that to show the commitment that I see all our companies as one group.

And finally, I’m investing a lot of money to include Opes Property Management with Opes+. Remember, Opes+ is our free app that helps you run cashflows on your investment properties.

As part of that you can now see all your property management information in Opes+, but only if you use Opes Property Management.

Building apps and software costs a lot and I wouldn’t be spending the money to do this unless I thought Opes Property Management would be around for the long term.

Some owners have decided to move from A1 back to Opes Property Management. Others are happy staying where they are. There’s no right or wrong.

But if you do want to switch back, here’s how it works depending on your contract:

If you never signed a new agreement with A1, then you are still on your original Venture Management agreement.

That means:

If you did sign a new A1 agreement, then you need to check if:

Once you give notice and serve out the notice period, you’re free to shift to any property management company you choose.

One of the main benefits of having your property managed by Opes is that you get upgraded access to Opes+ (our app).

You can then see your property management information (statements, inspection reports) all in one place.

On top of that you can also see:

So, you don’t just get property management … you get a complete view of your financial plan.

We slimmed down Venture Management so it could grow the right way.

Today, Opes Property Management is stronger, more integrated, and more transparent than ever before.

And we’re now in a position where we can welcome any investor who wants to use or return to Opes Property Management.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser