Property Management

How to work with a property manager during due diligence

In this article, you’ll learn exactly what you need to know about how to work with a property manager during the due diligence process.

Property Investment

9 min read

Author: Jess Knight

Business Development Manager with over 5 years of experience in Property Management in Auckland.

Reviewed by: Tiffany Bracey

Property Manager Team Leader at Opes Property Management Auckland.

This guide takes around 8-10 minutes to read. So you might think … “Do I really need to read it all?”

That’s a fair question.

Here’s the thing: you’re about to buy a New Build investment property. For this investment to succeed, you’re going to need a tenant who pays you rent.

So you probably have a ton of questions about when you’ll get a tenant, and what you need to do at each step.

So this guide helps you get the answers to all those important questions. That way you can feel comfortable knowing the process and what will happen.

There are several stages to renting out your New Build property.

Once you confirm your property (and go unconditional), your financial adviser will introduce you to one of our property managers.

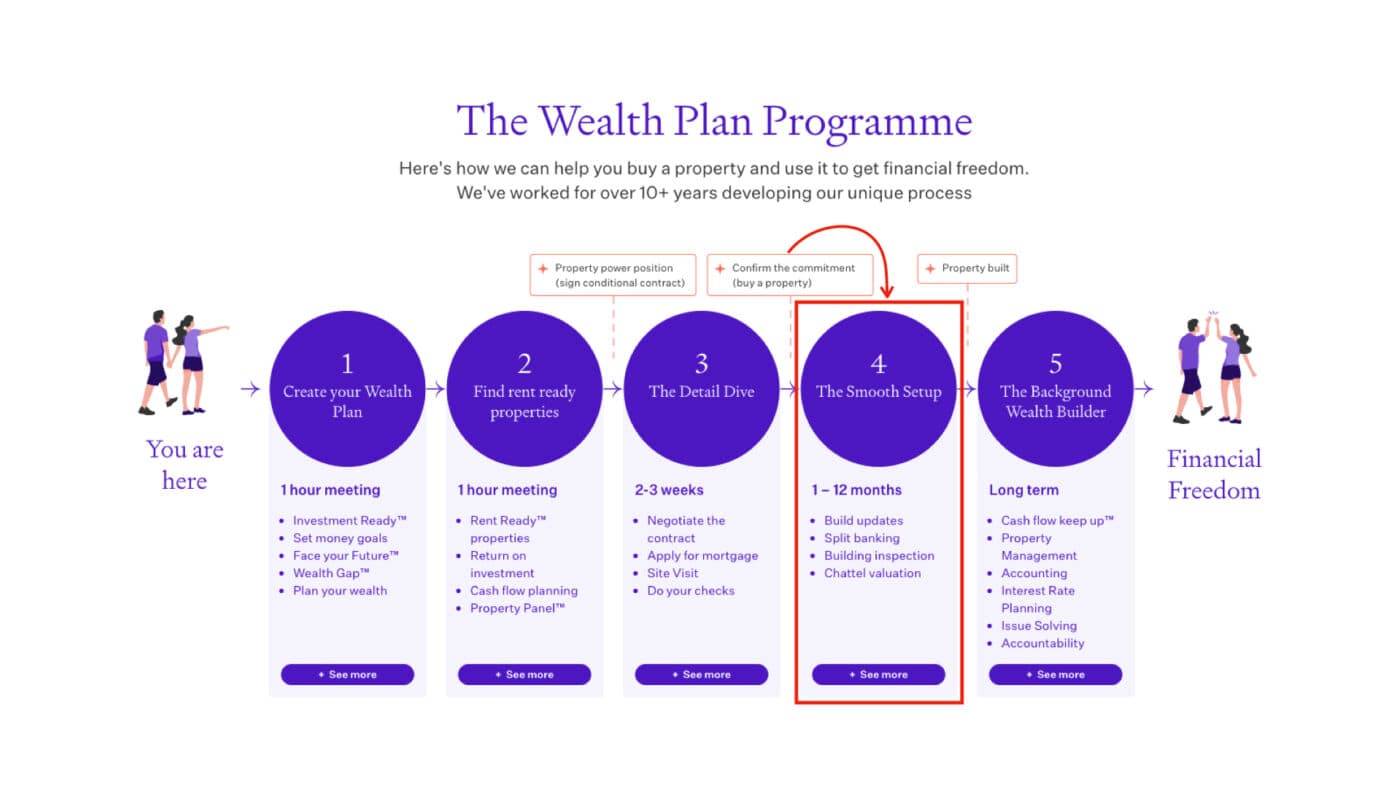

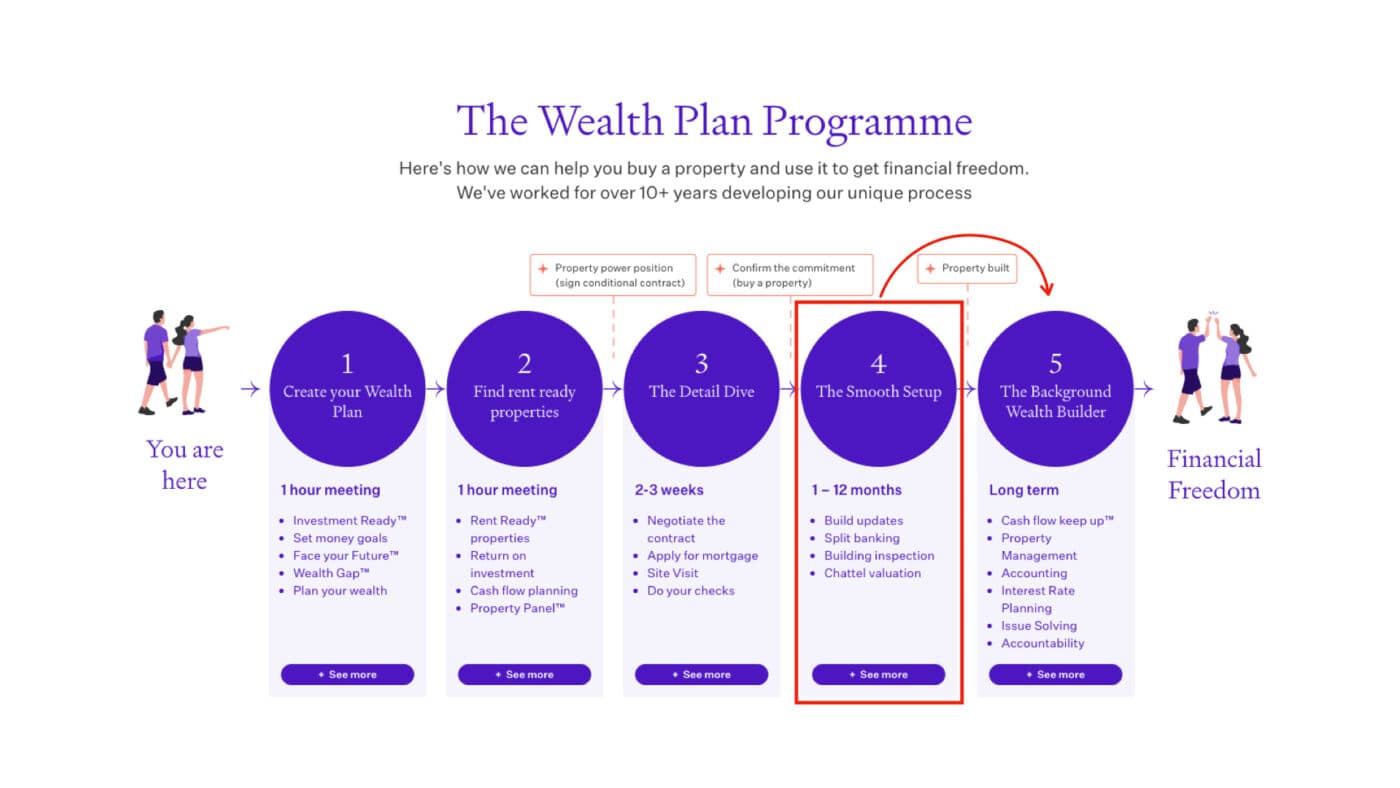

This is the point where you are transitioning out of “The Detail Dive” and into “The Smooth Setup”

In this initial meeting, we’ll recap what it’s like to work with us. This includes what you can expect from us and all costs (including the hidden ones).

If you decide to work with us, you’ll sign a property management agreement.

You don’t need to sign it immediately. But, we do need it before you settle and pay for the property. That’s to make sure it’s rented on time.

So, often investors like to get this out of the way early.

Investors can have some questions we can’t answer at this point, like:

We can give you our best guess on all these questions, but the exact answers can change based on how long the build takes.

And, keep in mind, we’re not building the property ourselves.

It’s also important to point out that if your property is nearly built, this meeting may happen about 10 days before you pay for the property (settlement).

A manager takes on the day-to-day responsibility of managing your rental property.

They’ll take care of:

Managing a property is a full-time job. Most investors don’t have the spare hours in the day to be fielding calls about the broken tap, missed rent, or a tenant’s personal issues.

Hiring a property manager comes at a cost, but many investors think it’s worth it.

Once the property is almost built, it’s time to get your property rented.

This is the point where you move from “The Smooth Setup” and into the “Background Wealth Builder”.

Around 2-4 weeks before you pay for the property, you’ll get the “key dates”. This is when the developer gives you a rough idea when you’ll get your keys.

But the 10-day settlement period is only triggered once the title and Code Compliance Certificate (CCC) are issued.

Once that happens, your exact settlement date gets locked in.

At this stage, it’s really important that you have signed your property management agreement with us. Otherwise, we can’t start the process of renting out your property.

Once that’s done, we’ll re-look at the market and let you know how the rental market is going. This includes:

The rental market might have changed since you first bought the property. Rents might have gone up, down or stayed the same.

We’ll also confirm:

Usually, when we get the key dates we get ready to advertise the property.

Remember, you don’t own the property until it settles.

Developers don’t have to give you access to the property before you pay for it.

But, because we have strong relationships with developers, we sometimes get early access to take photos and list your property online.

That doesn’t happen 100%, every single time. But, we often do get early access.

Once you know your settlement date one of two things could happen:

Best case: We get early access. One week before settlement, the developer lets us in. So we advertise the property and arrange viewings. If we find a tenant, they can move in soon after settlement.

Worst case: No early access. We’ll take photos on settlement and aim to start viewings 5 days after you pay for the property.

We aim to advertise 2-3 days before we can access the property for viewings.

Tenants get annoyed if we get the property online too early because then they want a viewing and we can’t show it to them. If we get it online too early properties can take longer to rent.

However, even when we get early access, a tenant can’t move in until you settle and pay for the property. So we try to balance it (always with the goal of getting a tenant as fast as possible).

There are two times when your property might have a vacancy:

You’ll usually have more vacancy when you find your first tenant. That’s because you often need to pay for your property before you can get in and show tenants around.

In Christchurch, almost 80% of our properties have 4 weeks vacancy or less (when finding the first tenant).

In Auckland, 76% of our properties have a tenant move in within 6 weeks of settlement.

So we often tell investors to expect 4 weeks vacancy in Christchurch and 6 in Auckland (just when finding a first tenant).

The type of tenant you get depends on where you’ve bought your property. So, to get an idea of who your tenant might be, you can use our Tenant Tool.

This shows the demographic details of people who are renting in your suburb.

Before we rent a property to a tenant, we will complete:

1. Reference checks

That means talking to property managers or landlords who have previously rented property to the tenants.

2. Background checks

That means checking whether those tenants have a criminal background. We’ll also check their credit history to see if they’ve been regularly behind on bills.

3. Rent affordability checks

That means making sure they have enough income to afford the property.

We’ll look at all applications then, once we find the most suitable tenant, we’ll send it to you for your final approval.

Yes, you can turn the tenant down … but you can’t discriminate based on the tenant’s age, race or family situation.

We also have to keep the Privacy Act in mind, so we can’t always share all the information with you. For instance, we might say: “The applicants are a full-time working couple with one child.”

Keep in mind we won’t present an application if we don’t think they’re a good applicant.

If someone doesn’t earn enough to afford the rent, we won’t present the application.

There are a couple of costs to get a tenant in. Firstly, we charge 1 week’s rent +GST to find the tenant.

But then there are a couple of other costs. You don’t pay us these,but it’s important to be aware of them because you often need to pay them:

Initial costs might include:

These are just sample costs to give you an idea. There can be other surprises, too. Things like paying for rubbish bins if your New Build doesn’t have one.

But this list should give you a good idea of all the times a property manager will charge you and what you get for it.

It’s important to emphasise these fees don’t all go to the property manager, but sometimes we’ll pay for these costs and then on-charge you, so it’s worth being ready for them.

Once your tenants are in, we will manage the relationship for you.

We’ll inspect the property every three months, and if the tenant’s lease comes to an end we’ll either renew it or look for new tenants.

At this point you are in the Background Wealth Builder:

Some people like to set up a bank account for each rental property; others like to have one account per entity (e.g. one account for a trust or company).

Once you have this account, let us know the details. We’ll collect the rent and pay you twice a month. This happens on the 1st and 16th of each month.

If that falls on a weekend or public holiday, we’ll pay you on the next working day.

You’ll get regular statements showing the money we’ve collected and paid to you.

You can also see any fees we’ve deducted, like our management fee (7.99% + GST).

Eventually your property will need some maintenance.

If you’ve bought a New Build, we’ll handle any maintenance issues with the developer during the first 12 months. That’s because the developer has to fix defects for the first year.

After that 12-month period, if it’s not urgent maintenance we’ll come to you to discuss paying for any fair wear and tear. We’ll often deduct these costs from the rent.

Often we sign tenants up for a 12-month fixed term. That gives you the confidence that you have rent coming in for a set time. And it also means the tenant feels comfortable they’ve got a place to stay for a while.

We then start talking to the tenant about their plans 60-90 days before their lease ends. That includes whether they want to renew their fixed term or if they want to move out.

If the tenant decides not to renew, we’ll relist the property four weeks before they move out.

It’s always worth having a few days’ vacancy between tenancies to fix any issues and make sure the place is clean and tidy.

Sometimes we’ll recommend fixing non-urgent maintenance when the property is empty (between tenancies). This is because we want to start the new tenancy off the right way.

If the tenant chooses to break the fixed term lease, they have to keep paying rent until we find a new tenant or until the fixed term tenancy ends.

In this case, we’ll relist the property ASAP.

Once a tenant moves out, we’ll inspect the property for any damage or cleaning that’s needed.

If everything is in order, we refund their bond. If there are issues, we’ll manage the repairs, and aim to cover those costs from their bond.

If there’s a dispute with the tenant, we’ll handle it through the Tenancy Tribunal.

Business Development Manager with over 5 years of experience in Property Management in Auckland.

Jess Knight is the Business Development Manager at Opes Property Management in Auckland. She has over five years of industry experience and is also an experienced property investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser