Property Investment

Property Investment

2 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Property investors constantly ask: “I’m thinking of buying an investment property … where’s the best place to invest in New Zealand?”

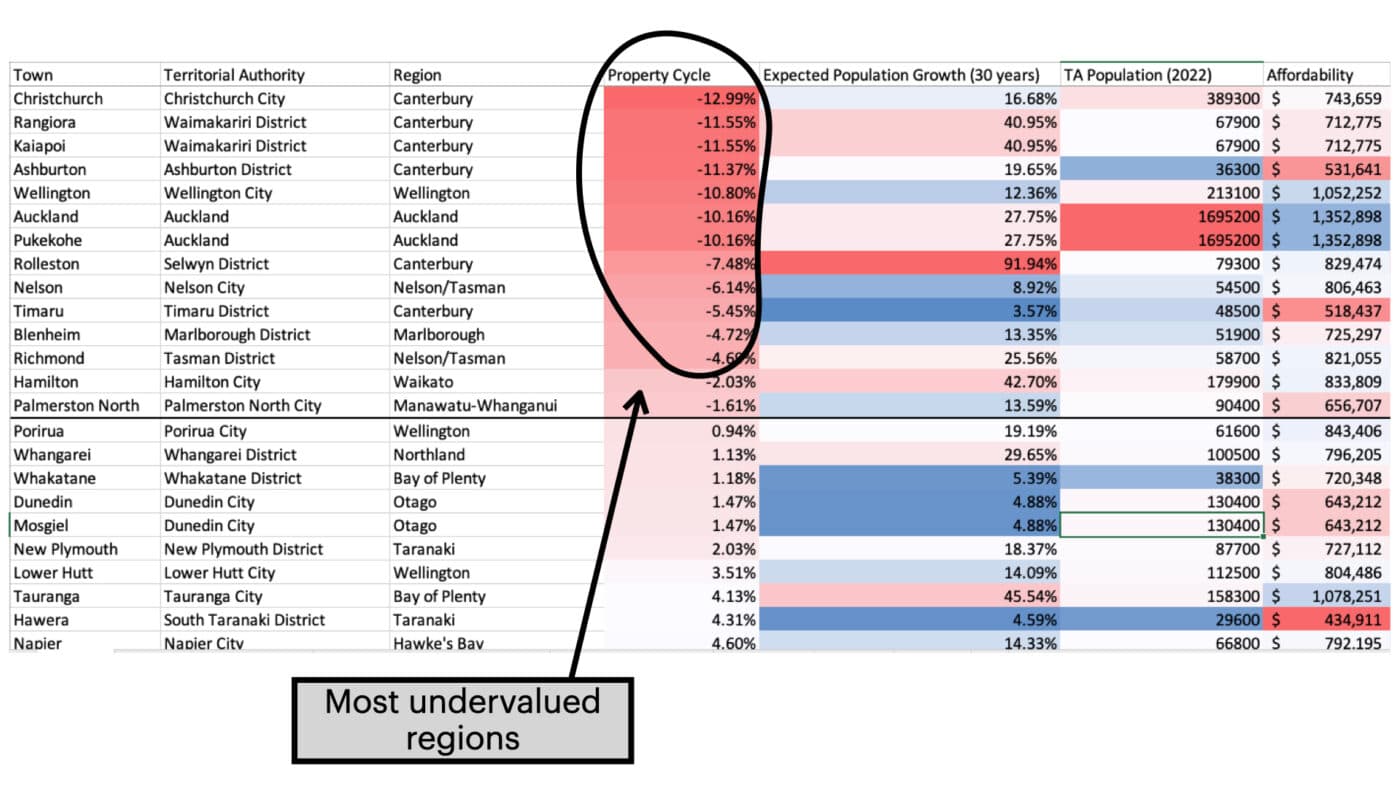

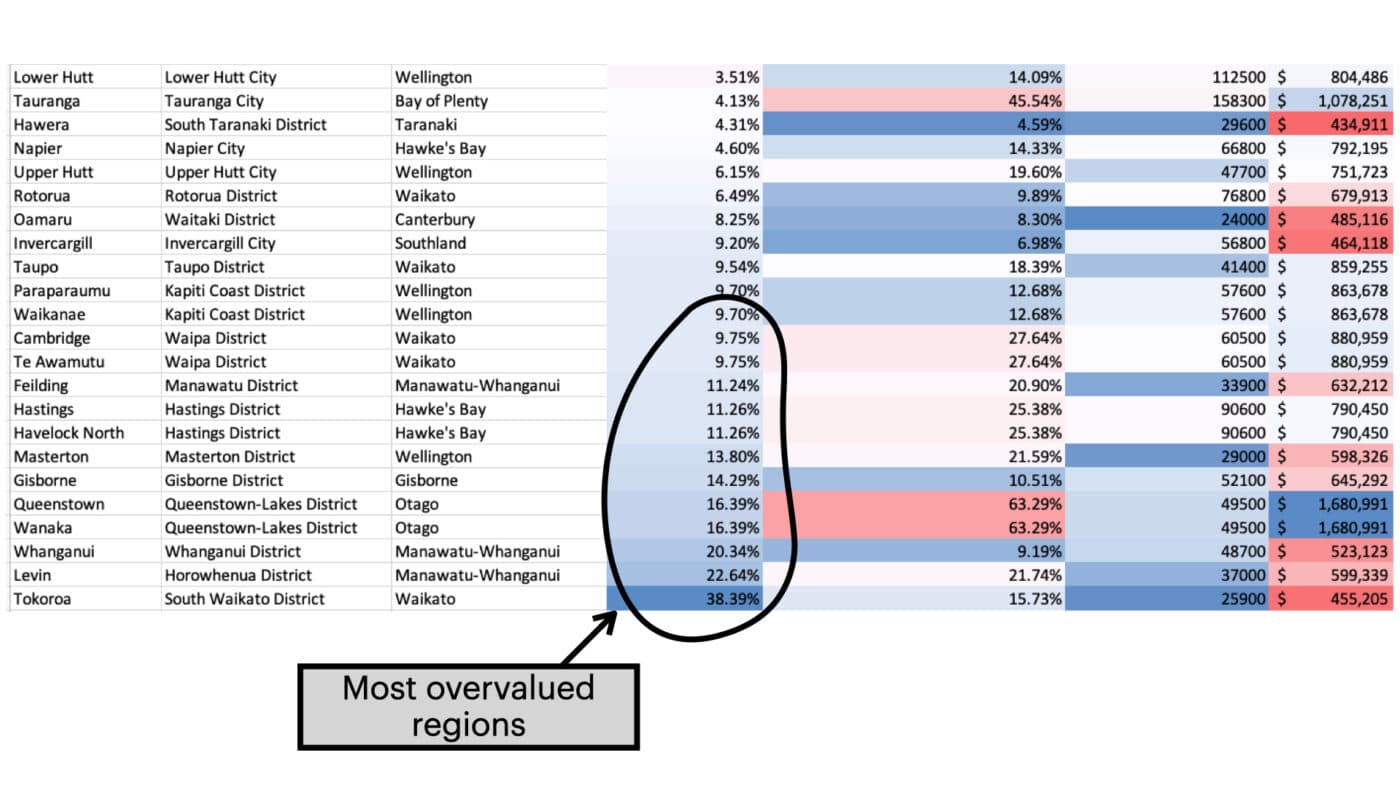

So, Ed (our economist) crunched the numbers for every town in the country. And in true data-nerd fashion, he’s created a spreadsheet.

Here’s what the data says.

Let’s cut to the chase. Looking at the data, the top 3 places to invest are:

#1 Christchurch

#2 Waimakariri District (Rangiora, Kaiapoi)

#3 Auckland

More details on each place and our process for picking them are below.

But these towns should also get honourable mentions. You might be able to pick up an investment here too:

You might think, “Andrew, how did you pick these places?”

Step 1 – In our book, Wealth Plan, we show the 3 factors investors should look for when choosing a place to invest. They are:

An undervalued area that expects considerable population growth (and already has a decent-sized population) … that’s a recipe for house price growth in the future.

Step 2 – But then we also need to consider factors like:

An undervalued area that expects significant population growth (and already has a decent population) is good.

But if that area also has cheap properties, people who earn decent incomes (to support higher house prices), and good rental returns … that’s ideal.

Step 3 – Finally, you combine these numbers to build an overall picture of each region.

There’s no point in creating a formula that says, “a good location is 42.5% property cycle and 12.9% population growth …”

No one has ever created a model to accurately predict future house price growth.

So instead, the spreadsheet uses “heat maps” to show how each area compares for each factor we’re considering. ‘Red’ = good, ‘blue’ = not good). The redder, the better.

The bluer, the worse.

Let’s look at our top 3 in more detail.

Christchurch is the most undervalued area in the country (13%).

Even though the expected population growth is below average (about 15% over the next 25 years, compared to 25% for the whole country), it’s still robust, and the existing population is large.

Waimakariri District is just north of Christchurch. It is also undervalued (11.5%). The population is projected to expand by 41% (above average) over the next 25 years.

And while the current population is average, property prices are relatively affordable, and people earn decent incomes.

Some readers will be surprised that Auckland made the top 3 list. Property prices there have fallen 21.4% since their peak in 2021.

That’s pushed the city into “undervalued” territory. House prices are 10% below where we’d expect them to be.

And the population growth and current population are massive. Property prices are high. But, there are pockets of the city where investors can buy well under the city’s average house price.

And if you want to dig into more detail. We’ve just released this video going through the data more thoroughly.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser