Property Investment

Property Investment

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Want to end up with 3x more wealth? This one simple habit can make it happen.

Imagine two groups of people.

They’ve all walked similar paths in life.

They have the same education, the same income.

But Group #1 ends up with 3-4x more wealth than Group #2.

And it comes down to one simple action that Group #1 took.

Did they take higher risks? Did they start a business and earn truckloads of money?

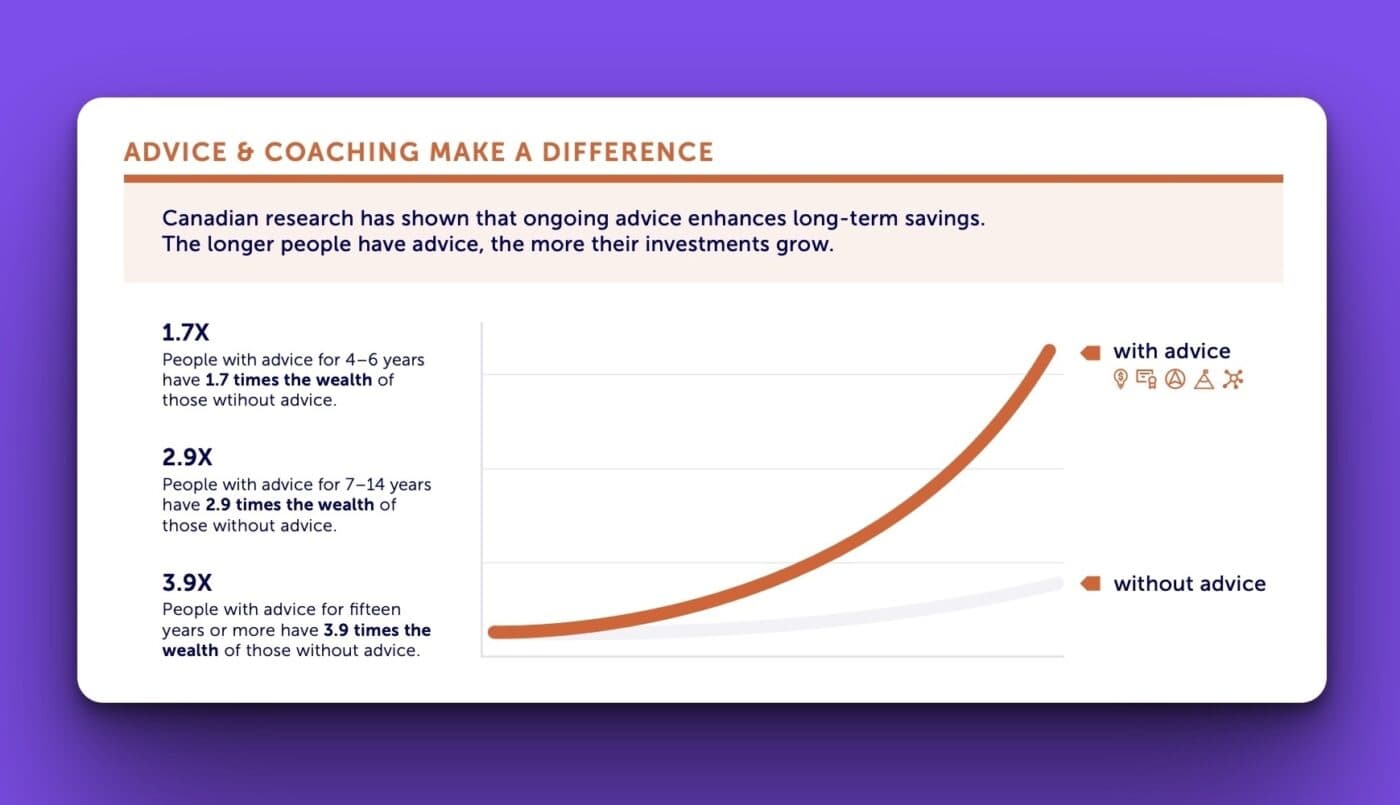

No, according to research out of Canada, they talked to a financial adviser.

The stats are crazy. Families who used a financial adviser ended up with:

That’s compared to the wealth they otherwise would have had.

How could this be the case? Why do people make so much more money if they have a financial adviser?

Well, let me tell you, it ain’t because financial advisers are geniuses. Or Warren Buffett in disguise.

Here are the 3 big reasons why advisers help you grow more wealth.

When property or share prices fall, what do most people think: “I need to sell, sell, sell.”

But, often it’s better to do nothing. And stick with your long-term strategy.

If you have a financial adviser you’ve got someone to talk you off a cliff.

After the GFC, this US study found that investors with a financial adviser were 1.5× more likely to stick with their long-term strategy.

So they ended up with more money compared to DIY investors who were more likely to sell.

I’ve shed 13kg since the start of the year. How? I got a Personal Trainer.

My PT didn’t reveal the long-lost secret to six-pack abs.

After all, the (not-so) secret is diet and exercise.

So I didn’t get fitter because my PT taught me something new.

Instead, he gives me structure and a programme. And most importantly, accountability.

If he says, “Andrew, haven’t seen you in a few days – time to hit the gym.” Then I haul myself there, even if I don’t always feel like it.

I already knew what to do (exercise more, eat better).

But knowing isn’t the same as doing.

The trainer got me to show up.

It’s the same with your money.

You end up investing more when you have a financial adviser cheering you on.

And finally, the biggest reason of all …

A man walked past a construction site and saw a builder layering bricks.

He watched for a few minutes, then said, “That looks simple. I could do that.”

The builder didn’t say much; he just smiled and nodded.

A few months later, the man decides to build a garden shed in his backyard. He didn’t hire anyone. After all, how hard could it be?

He bought the timber, laid the foundation, and started hammering.

He stepped back to look at his work … and the walls weren’t straight. The roof leaked. The door didn’t close properly.

After weeks of frustration, he gave up and called a builder.

When the builder arrived, he looked at the mess, scratched his head, and said,

“Mate, it’s a bit more complicated than it looks.”

That’s what financial advice is like.

From the outside, investing looks simple: “Just buy a property” or “Just put money in shares.”

But once you start doing it, you realise there are 1,000+ moving parts. Structures, taxes, timing, compliance, mistakes.

That’s where a financial adviser, comes in.

Not just to lay bricks for you, but to give you the blueprint.

Investing looks simple – until it leaks, tilts, and costs you thousands.

So, if you want to make more wealth, speak to a financial adviser.

Now you don’t have to use my team at Opes. We’re not the right fit for everyone.

But don’t leave your financial future to chance.

Right now, you’re either in:

Group #1 – the ones who build 3x more wealth.

Group #2 – The ones who don’t.

If you’re in the second one, don’t panic. Just change teams.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser