Mortgages

How do I get a mortgage and pay it off?

This 9,500-word Epic Guide to Mortgages is the definitive article on how to get a mortgage and pay it off faster, today in 2026. The Ultimate Guide.

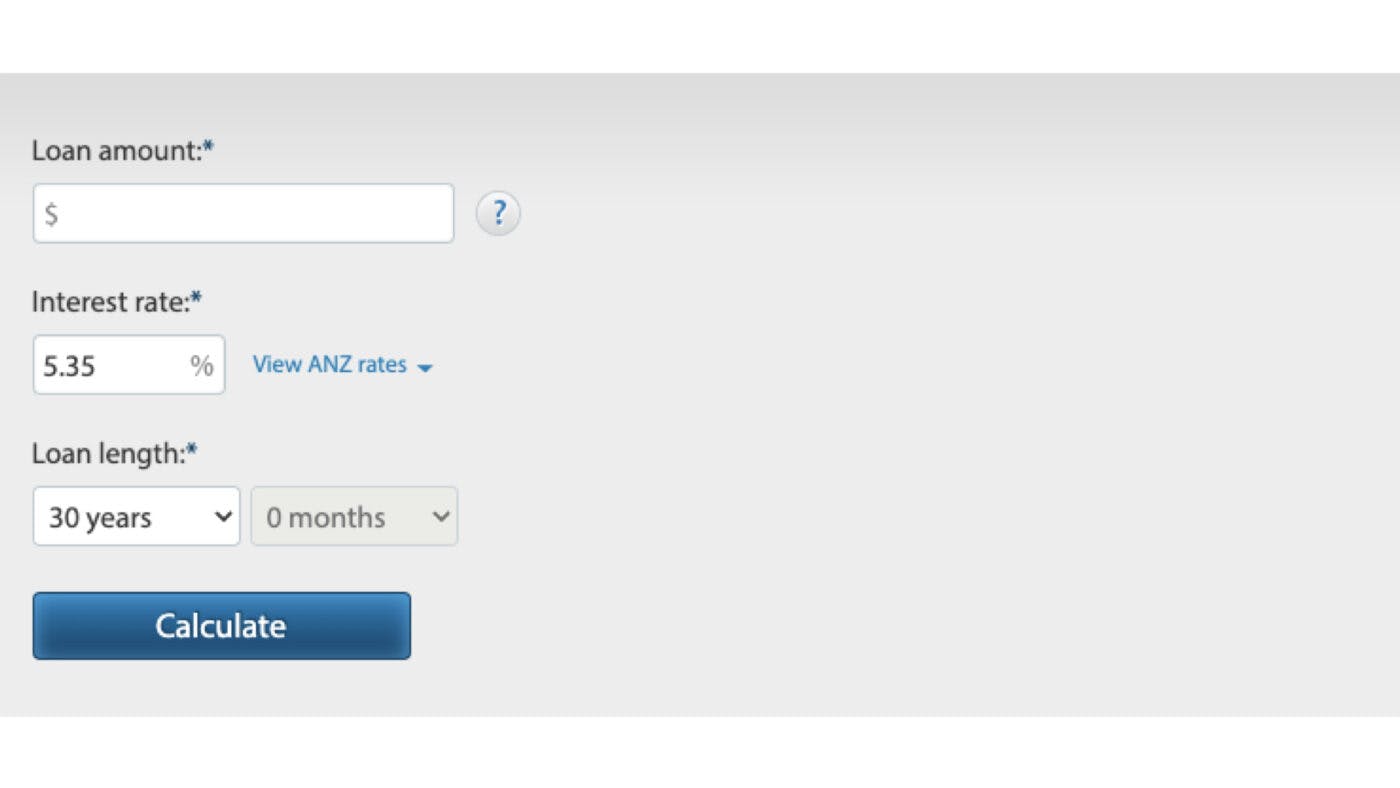

ANZ’s mortgage calculator is one of the most searched calculators in Google. By our count, 14,000 people search for it every month. But is it the best one? In this article you’ll learn how the ANZ calculator works, and get a sense of how it compares with other calculators.

Mortgage calculators are a popular (and fun) tool for would-be home owners.

Even if you're just toying with an idea of a house purchase, it can still give you a ballpark to work with. And they might just get you a little bit excited about your future home-owning prospects.

It seems every finance website comes with its own mortgage calculator (us too). Google “mortgage calculator” and you’ll see for yourself.

But they aren’t all the same – even though it seems like they are.

ANZ’s mortgage calculator is one of the most searched calculators in Google. By our count, 14,000 people search for it every month.

But is it the best one?

In this article you’ll learn how the ANZ calculator works, and get a sense of how it compares with other calculators.

Do you have a question or comment about the ANZ mortgage calculator? Feel free to leave your thoughts in the comment section at the end of the page.

We’ve tested all the main banks’ mortgage calculators.

ANZ’s mortgage calculator is the easiest to use out of all of them – and has a good mix of function and information.

For instance, you only have to fill in 3 fields to get going and it has the ability to see what you could save in interest if you made extra repayments.

It also pulls through current interest rates (instead of you having to search for them) and shows how much you’ll pay in interest over the life of the loan.

However, it is a bit basic.

It’s based on a standard table mortgage and doesn’t have the ability to calculate more advanced scenarios, for example if you are splitting your mortgage across multiple interest rates, which is surprisingly common for Kiwi borrowers.

Now, be warned, just because you use the calculator and think: “Oh yup, I can afford a mortgage” ... doesn’t mean the bank will agree with you.

A mortgage calculator can tell you what your repayments will be depending on the size of your mortgage and the interest rate you have put in.

But it falls short of considering all the other factors the bank will look at when renewing your application, or approving a new mortgage.

For example, they will use a higher interest rate when testing if you can afford your mortgage. This is called a servicing test rate.

Secure a comfortable retirement with 3 easy steps

Book your free sessionAnd they will also test your income differently, depending on how your employment is structured.

For example, ANZ will not currently take into account income earned from overtime, but Westpac will, so nurses applying for a mortgage are generally more suited to Westpac.

Similarly, BNZ currently has policies more favourable for women on maternity leave who are about to return to work.

These sort of nuances can’t possibly be factored into a calculator, and generally they are only things that a mortgage broker will readily know.

Sometimes subtle differences between calculators can mean that one is more user friendly than others.

So, because we went through them and had a play with each, here is our honest opinion on most of the main mortgage calculators in New Zealand.

This one we found to be the quickest to get started, but it has some issues you need to be aware of.

Like the ANZ calculator, this calculator is able to show you what you could save in interest if you made extra repayments and pulls through current interest rates.

And the results update automatically, which means you can instantly see the financial impact as you play around with the numbers. So we do think this one has one up on ANZ.

But again, the function is pretty basic. You can’t create a more complicated mortgage structure with different tranches or create different scenarios.

And you can’t create a more custom mortgage term; you can only set the mortgage term to 5-year increments for anything more than a 5-year term.

The Sorted.org.nz mortgage calculator has a nice design and is arguably the best looking.

On top of this you can create 3 different mortgage scenarios to compare.

However, there are a few issues with their default assumptions.

The default interest rate is set at 6%, which we argue is too high for the average user, given where current interest rates are.

The mortgage term is not capped at 30 years (the maximum term in New Zealand). This means a borrower who has never had a mortgage before might think they can extend the term out to 40 years or more to bring their mortgage repayments down.

That is unrealistic. So, it is well designed, but watch out for user error in this one.

The ASB Mortgage calculator is the best one for serious borrowers, especially those with more complex mortgage structures.

For instance, you can split your loan into 4 segments with different interest rates and terms. Across these segments you are also able to see the average interest rates and total repayments.

We like this feature because some investors and homeowners like to split out their loans into different tranches.

However, because it can offer more complex scenarios it runs the risk of getting complicated – fast. This can be a barrier for first home buyers or investors who are just getting started.

Westpac’s mortgage calculator is by far the best designed, but is the least user friendly.

By this we mean you can create 2 scenarios, but you are forced to put in a deposit of at least $1.

This is a problem for some investors who may not have a deposit, and are instead looking for 100% finance for an investment property.

There are also some issues with the assumptions. Like Sorted, it doesn’t cap out the loan term at 30 years. This can lead to uninformed borrowers getting the wrong idea about what’s realistic.

It also doesn’t have a weekly repayment amount. Yes, you can do the math yourself, but some investors might prefer to have that information readily available.

Here’s our calculator:

As you can see, it works off 4 fields of inputs:

This gives you an overview of what your repayments will be, how much the total interest paid will be, and how that breaks down into principal repayments.

Check out our interest-only mortgage calculator if you’re an investor wanting to jiggle some figures on what your repayments would be using an interest-only mortgage.

Most mortgage calculators work out your repayments as if it is a standard table mortgage.

This is where your entire home loan is on the same interest rate (which isn’t always the case).

It uses an amortisation table (hence why it’s called a table mortgage) to work out how much you have to repay each week, fortnight or month.

This is just a fancy way of saying “how much do I have to pay each week to completely pay off my mortgage in X years”.

And the key feature of a table mortgage is that you make the exact same payment for the length of the loan (as long as the interest rate doesn’t change).

Say you took out a $500,000 mortgage at 4% over 30 years and paid the mortgage weekly, you would pay $550.50 every single week for those 30 years.

It should be said that in actual fact your interest rate will move and your mortgage repayments will change every few years depending on how long you fix your interest rates for.

As your interest rates change, your repayments will be recalculated.

Interest rates fluctuate up and down, depending on the market and the bank you choose to go with.

At the time of writing (mid-July 2022), interest rates see ANZ, BNZ, Kiwibank, ASB and Westpac’s 1-year term hover around 5.19% – 5.35%.

To see what interest rates are by the main lenders in New Zealand visit: mortgages.co.nz.

And if you want to see where we predict interest rates are going, see our interest rate forecast here.

As well as calculating your mortgage repayments, if you’re making a property purchase you may also like to run a couple of other numbers.

Use our capital growth calculator to see what your capital gains might be.

To see the financial picture of your investment, you can use our property investment calculator.

You may also want to see whether the property will earn you money each week, or require additional investment to keep going. Use our rental yield calculator to run these numbers.

If you want to run the numbers using another method, Opes has a full range of other calculators you can find and use.

Write your questions or thoughts in the comments section below.

Mortgage broker for over 10 years, property investor and Managing Director at Opes Mortgages

Peter Norris, a certified mortgage adviser with 10+ years of experience, serves as the Managing Director at Opes Mortgages. Having facilitated over $1.2 billion in lending for 2000+ clients, Peter is a respected authority in property financing. He's a frequent writer for Informed Investor Magazine and Property Investor Magazine, while also being recognized as BNZ Mortgage Adviser of the Year in 2018 and listed among NZ Adviser's top advisers in 2022, showcasing his expertise.

This calculator is for general information only. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the calculator and its assumptions are reasonable and accurate. But calculators rely on estimates and inputs you provide, and the results won’t be right for everyone. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser.