Property Investment

Self-employed and applying for a mortgage? Here’s how banks actually calculate your income

Learn how banks calculate your income, what counts as provable income, and how to boost your borrowing power when you're self-employed.

Mortgages

6 min read

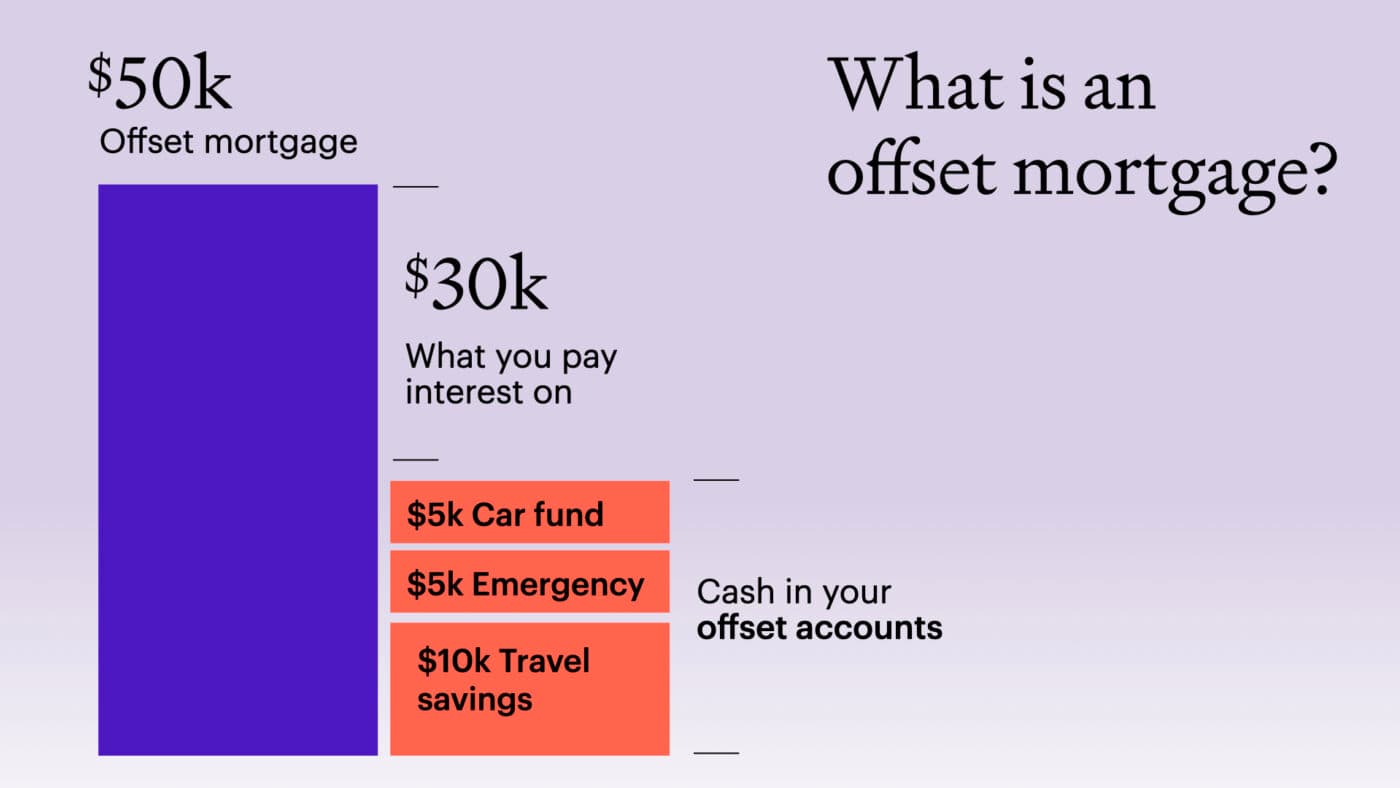

An offset mortgage uses the money you have in other accounts to pay less interest on your mortgage.

Let's say (in a perfect world) John has a $300k mortgage and also has $300k sitting in offset accounts.

His mortgage is fully offset. So, he pays zero interest on his mortgage. But he still has access to the cash.

Of course, not everyone has that much money sitting in savings. But you don’t need much money for an offset account to work for you.

I’ve been a mortgage adviser for over 12 years. One of the most common questions I get from clients is, “what is an offset mortgage? And how does it work?”

So, in this article, you'll learn how an offset mortgage works. That way, you can decide whether one is right for you.

An offset account is an account (or accounts) that are linked to your home loan.

If you put money in your offset account, you save on interest. It’s like paying off part of your mortgage, but you still have access to the money.

You can use your offset accounts as a regular transaction account. So put in money, take it out ... it's all good.

But all the money in your offset accounts gets added up, and that amount is offset (this ‘cancelled out’) on your mortgage. So you don't pay interest on that offset amount.

Let’s say Jill has a savings account with $20k in it. She’s saving up for a deposit on another property.

If she has a $500k mortgage, and links that $20k as an offset account, she’ll only pay interest $480,000.

She won’t earn interest on that $20k … but she’ll save a lot in mortgage interest.

As Jill adds to her savings account, she’ll pay even less interest on her mortgage.

But the day she takes all that money out and buys her car, she’ll be paying more interest.

You can have up to 50 accounts collectively working together to offset your mortgage.

But there are pros and cons (and a few things to look out for).

Offset accounts are very flexible.

If you take money and pay it off your mortgage, you can’t get it back straight away. You need to apply to get a bigger mortgage.

But, if you use an offset account, you can get the money back at any time.

You also can have lots of offset accounts. Some people like this. If you like to bucket your money into different accounts (one for emergencies, one for savings, etc.) then an offset account could be for you.

You can even share your offset with your family.

Let's say Jill’s parents recently sold their house and had that money in an account. They could set this account up as an offset for Jill.

That way, they can use their money, but Jill will save the interest on her mortgage.

Similarly, Jill saves money in her children's bank accounts. Those can link to offset her mortgage too.

The downside to an offset is it has to be on a floating rate, which tends to be much higher than a standard fixed rate.

But you only pay interest on the un-offset amount.

Jill has a $500k mortgage. She sets up $450k on a fixed 1-year interest rate. Then, she sets up the remaining $50k as an offset mortgage.

She then has $20k of cash in her bank accounts, so she only pays the floating rate on $30k of her mortgage.

This is why it’s a really good idea to offset as much as you can.

However, not many banks offer offset mortgages. Right now, Westpac, Kiwibank and BNZ are the only ones that do it.

If you use a different bank, you’ll need to use a revolving credit instead.

If you think an offset account is the right fit for you, speak to your mortgage broker.

They will tell you the pros and cons of your situation and be able to set it up for you.

There is no minimum or maximum balance to offset.

This means even $1 in savings will offset your mortgage costs.

If you don't want an offset account anymore you can switch it back to a standard fixed loan yourself. No questions asked.

An offset account is an alternative to a revolving credit. It has similar benefits, but it works a bit differently.

The big difference between them is that the revolving credit is just one account. It works like a big overdraft.

But it's an overdraft that's already maxed out, and you still have to pay it back.

For me, I prefer offsets to revolving credits.

Sure, a revolving credit is more straightforward – it's one big overdraft.

Whereas you can use up to 50 different accounts for your offset.

Offset accounts are a great fit for people who have some savings, or money they have access to.

Here’s a good example who it could work for.

Let’s say you want to buy a house and have more than a 20% deposit. Maybe you’ve got some inheritance, or you’ve recently sold a house.

In this instance, the homebuyer might get a big mortgage and then set up an offset account. They’ll save on interest and still have access to the money.

That being said, don’t be disheartened if you don’t have $100k sitting in the bank.

An offset account still can be beneficial if you’ve only got $10k or 20k.

A $10k offset on a $600k mortgage (7%) can save you just over $17k on a 25-year loan.

There’s no point paying the interest on $20k if you don't have to.

Mortgage broker for over 10 years, property investor and Managing Director at Opes Mortgages

Peter Norris, a certified mortgage adviser with 10+ years of experience, serves as the Managing Director at Opes Mortgages. Having facilitated over $1.2 billion in lending for 2000+ clients, Peter is a respected authority in property financing. He's a frequent writer for Informed Investor Magazine and Property Investor Magazine, while also being recognized as BNZ Mortgage Adviser of the Year in 2018 and listed among NZ Adviser's top advisers in 2022, showcasing his expertise.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser