Mortgages

Top Auckland mortgage brokers

Since we work with property investors and first home buyers every day here at Opes Partners, we’ve got a good sense of who the best mortgage brokers are. So here is our top 5 list in no particular order.

Mortgages

10 min read

Author: Peter Norris

Mortgage broker for over 10 years, property investor and Managing Director at Opes Mortgages

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

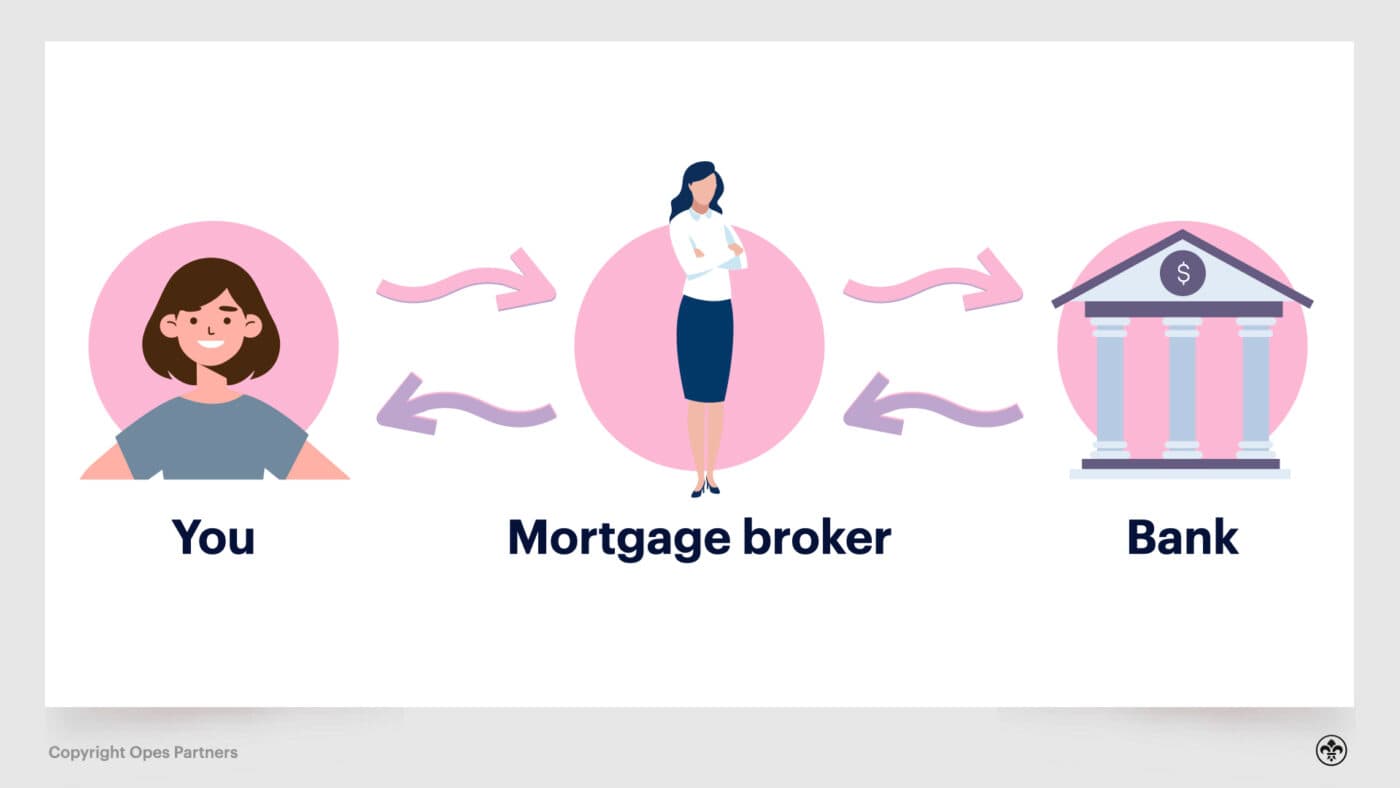

A mortgage broker is your link to the bank. They are the person who is going to take all of your documents (e.g. your pay slips, bank statements) and present your mortgage application in the best possible light to give you the greatest chance of obtaining a loan.

Could you submit your application to the bank yourself? Sure, you could.

But often you might be able to borrow more if you use a mortgage broker. Why?

Because a mortgage broker will pick up any holes in your application before it gets sent off to the bank. They also might be able to offer a few insider secrets for you to capitalise on or take advantage of.

For instance, a mortgage broker might take one look at your application and ...

All of these tactics require an experienced eye to figure out whether they will actually make a difference to your mortgage application and ability to get credit.

In addition, when applying for a mortgage, speed is of the essence. Often first-time mortgage applicants will send in incomplete details. This means time wasted going backwards and forwards to the bank.

Sounds simple, but it often happens. This can mean missing out on a property if you don’t get your finance approved on time.

A mortgage broker pre-empts this by requiring all your documents up front. For instance, they’ll often require:

Collecting this all up front means the bank can make their assessment earlier in the process – rather than having to chase you up later on.

A broker will also be able to help you make decisions on how to structure your mortgage (e.g. how long to fix your loan for, and whether you should use an interest-only mortgage).

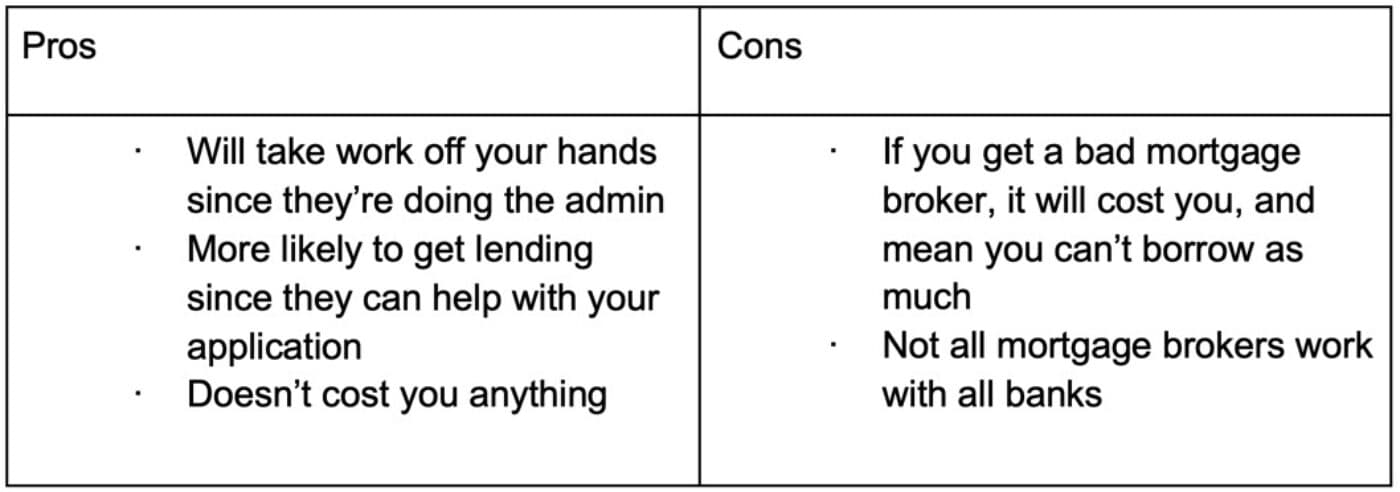

Yes. Provided, of course, you have a good one.

Why do we say this?

Well, for starters they are often free for the borrower to use, so you pay nothing for the expertise. They get paid a commission by the banks once you take out a loan.

They’ll also have expertise and knowledge of complex banking policies that can make the difference in getting your mortgage approved.

This sort of knowledge you can’t really Google.

For example, every bank has different lending policies and criteria. It’s completely normal for one bank to approve your lending, while another will not.

ANZ will not take into account income earned from overtime, but Westpac will. So nurses applying for a mortgage are generally more suited to Westpac.

That’s not to say that every nurse needs to work with Westpac, but it is worth accessing this kind of insider knowledge through a mortgage broker.

If your application is tight, and you're on the cusp of being approved or rejected, then a broker may be able to rejig your application to give it a better shot.

After you’ve found a mortgage broker you think you want to work with, what are the next steps.

Usually, your mortgage broker will conduct an initial assessment of you via a Zoom meeting or a telephone call on first contact.

It’s a bit like a meet and greet, except you will be telling them all about the type of property you want to buy and how much money you have.

In some instances, the mortgage broker will be able to give you a “ballpark” on what the bank is likely to lend you given your current situation. If anything this is just to give you an idea from the outset.

The next step is to hand over all documents the bank requires.

This can be laborious. Most of the time this will be done online, sometimes through a portal.

As we’ve listed earlier, a mortgage application requires:

(Positively, there is a new application that allows complete and immediate access to your bank account and takes a few seconds to make a username – should you feel comfortable doing so).

Armed with all of this information, the mortgage broker can now run your numbers properly through bank servicing spreadsheets to decide where you’re most likely to get lending approved.

This is entirely situation-dependent, and the mortgage will often make the call.

For instance, if one partner is pregnant, then BNZ often has more lenient policies. They’ll often factor in income, if that partner is about to go back to work, whereas other banks won’t.

In this case, BNZ will sometimes accept a letter from your employer stating that by the time the loan is approved you’ll be back at work at your normal salary (or whatever it happens to be).

So, if you’ve recently had a bundle of joy come into your life, your broker may decide this is the best bank to approach first.

The mortgage broker will be your go-between and advocate between you and the bank. If there are any additional questions, or pushback, they will push your case on your behalf.

After they get a decision they will come back to you with the final answer, called an approval.

If you already have a property, the bank will give you an approval. But if you don’t already have a property they’ll give you a pre-approval.

For you, mortgage brokers are often free to use. Generally, they get paid by the bank.

You are probably wondering: how much does a mortgage broker earn?

Upfront commissions on mortgages can be up to 0.85% –sometimes more – of the loan value. On a $500,000 mortgage, that’s $4,250.

You might think “gosh that’s a lot of money” – but just remember:

And also remember – the reason mortgage brokers can earn a solid income is because they provide a professional service.

Although you may not be paying them directly, they are working for you and on your behalf. So you should expect to receive a professional service.

They’re not doing you any special favours just because they don’t charge.

On the odd occasion, some mortgage brokers will charge you fees, but most are free.

One extra thing to note is sometimes a bank will approve lending dependent on a registered valuation on the property.

A mortgage broker will usually pick this up before sending your documents off and will give you a heads up. For instance, if there is an “as is” clause in your property documents.

A valuation typically costs $700-$800 and is organised through the bank.

If this is the case, your mortgage broker will send you a link to the bank’s system.

Just the same as any other transaction, simply put in your credit/debit card details to pay the fee.

Make sure you keep a receipt because the costs are tax deductible once your property starts earning rent.

At this point, some investors may be thinking: would it not be easier to cut out the middle man and go straight to the bank?

Our answer is often “no”.

The reason we like mortgage brokers is that there is often a better level of advice given.

However, if you have a business you may already have a personal banker or someone in the commercial team at the bank that you work with.

Business owners often have more complex situations and so working with the same banker you use day-to-day can be beneficial.

If your situation is more simple – you earn a salary or wage – we usually recommend going down the broker route.

Often the best way to find a good broker is to get a recommendation and then talk to a few.

Check out our top 10 mortgage broker list, but then if you interview 2-3 you probably need to figure out which one to use.

Of course you can get a gut feel to see who you click with … but that doesn’t necessarily mean the person you ‘click with’ will do the best job.

So, here are a few questions you might want to ask your potential mortgage broker to get a feel for if they are the right fit for you:

There are very few ‘no-brainers’ in buying property … but for us, using a mortgage broker is one of them for most people.

Not only is your lending more likely to be approved, since you’ve prepped the mortgage application properly, but the service is often offered at no cost. And the broker will take on the donkey work of getting your mortgage application pushed through.

For lazy people – like the writer of this article – passing the legwork off to someone else is reason enough to use a broker.

Mortgage broker for over 10 years, property investor and Managing Director at Opes Mortgages

Peter Norris, a certified mortgage adviser with 10+ years of experience, serves as the Managing Director at Opes Mortgages. Having facilitated over $1.2 billion in lending for 2000+ clients, Peter is a respected authority in property financing. He's a frequent writer for Informed Investor Magazine and Property Investor Magazine, while also being recognized as BNZ Mortgage Adviser of the Year in 2018 and listed among NZ Adviser's top advisers in 2022, showcasing his expertise.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser