Property Market

What's happening with NZ house prices right now?

Get the latest insights on New Zealand’s property markets, including trends, growth areas, and investment opportunities across regions.

Number Crunching

11 min read

Author: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Reviewed by: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

If you want to invest in property, knowing the current property value of your home suddenly becomes very important.

Why? Because you are probably going to tap into the equity within that house, to buy your next investment property.

Here at Opes, one thing we encourage people to do – if they are tight on equity – is to get a fair assessment done to find out what their property is worth.

This is called a valuation, and there are many different types available.

But not all valuations are all like the other.

Some are free and easy to get, others are more accurate – but you pay for it.

In this article, you’ll learn what sort of property valuations are available, when to use them, and how accurate each one is. Spoiler alert: they’re nowhere near as accurate as you might think.

Do you have a question or comment about how much your home is worth? Feel free to leave your thoughts in the comment section at the end of the page.

Let’s begin with the three different types of valuations you can get, ranked from least to most precise.

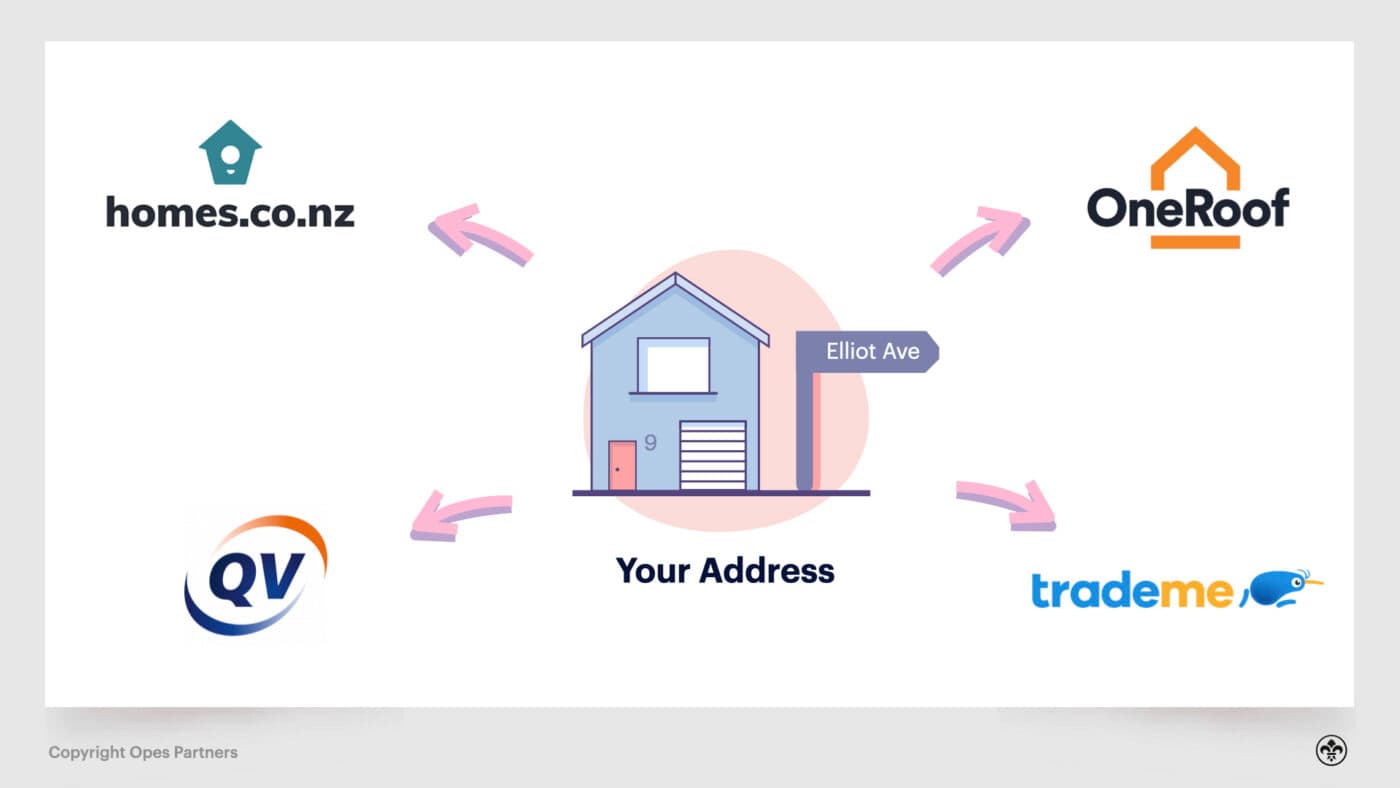

First up is: e-Valuations. This is the value that you can find on the internet. For this, you’ll enter your house details into a site like: Homes.co.nz, QV, TradeMe or Oneroof.

The website will then give you an immediate valuation, based on the algorithm it uses. And while it takes into consideration similar properties that have recently sold, it can’t tell how nice your house is, or whether you’ve just renovated your home.

It’s quick and easy, but it’s also the least accurate. More detail on why this below.

This is done through a real estate agent. It’s a step up from the e-Valuation because it’s informed by someone who’s looked at your house, and can assess how it will sell in the local market.

We would rank this as more accurate than e-valuations, but they can still vary widely.

This is because real estate agents are not always incentivised to tell you what a property will sell for. Sometimes they will tell you a high price to get you to list with them, and then look to bring the price down later.

For a registered valuation, a professional will come to your house and do an assessment.

It’s in-depth.

For instance, a valuer will come into your property and often use a laser pointer to measure the exact dimensions of each room. They will also measure the size of the property, and turn up with a list of similar properties for a comparison.

This is the best and most accurate option. But you pay for this accuracy.

Generally, a registered valuation will cost around $700. But it can go up to about $1000 or even $1200.

Estimating what your house is worth is a progressive process. Rather than picking just one of the 3 types of valuations, if you really want to get a sense of the property’s value, you’ll use them all.

Here are 5 steps you can work through:

There are four main websites that property owners use to get a sense of a home’s value in an instant.

You’ve probably heard of a few of them. Here are the top names in the country:

These websites work by using algorithms to generate an estimate based on:

These property valuations are simple and easy to use, and can be good for giving you a *wide ballpark estimate.

But they are just that – an estimate – generated by a computer.

The website hasn’t been to the property. It’s just an algorithm.

It won’t take into consideration any of the renovations you did to the kitchen last summer, and it won’t care if your property has a view or not.

Further on in this article we’ll discuss how accurate or inaccurate these websites are.

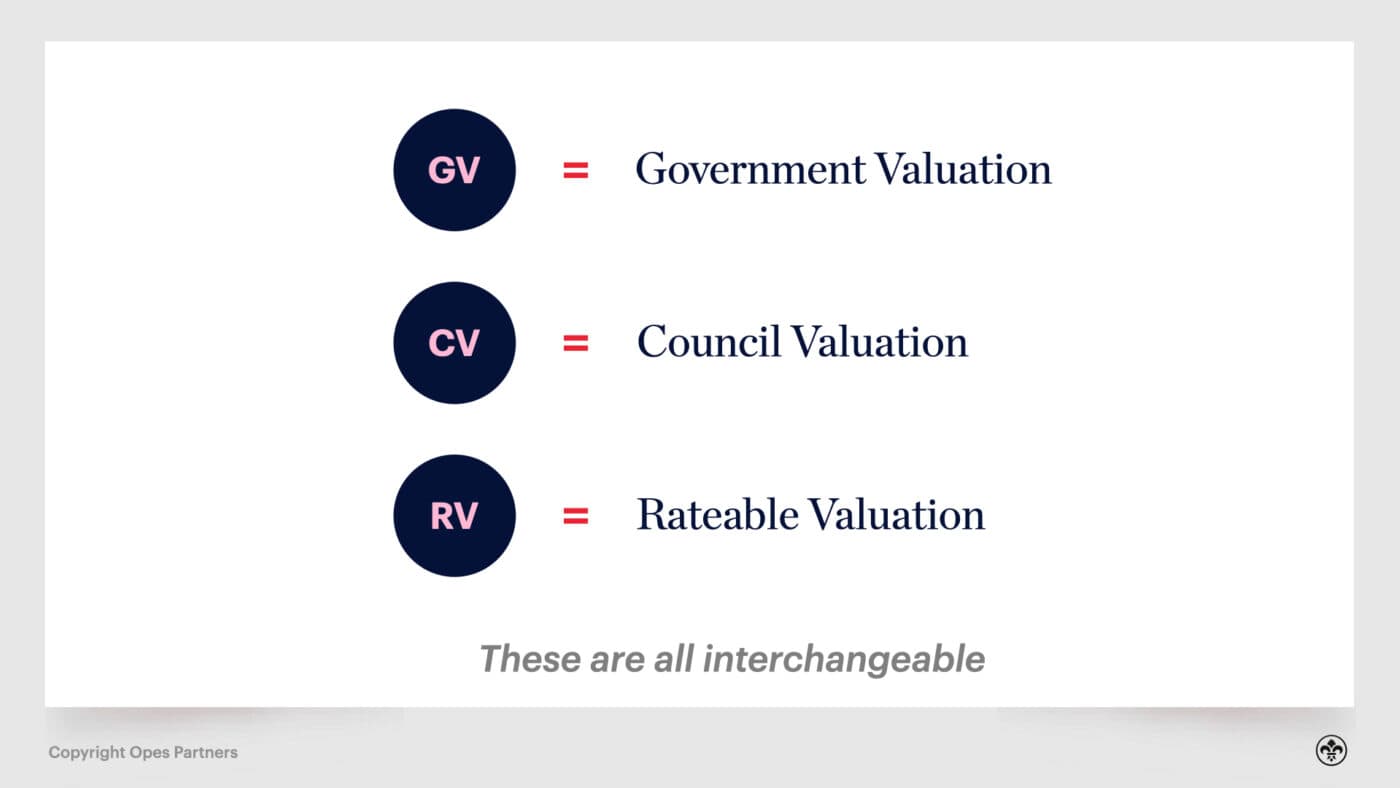

Local councils do a regular assessment of property values, as determined by house sale prices. These valuations are how council’s set rates for homeowners.

They’re often called different things like GV (government valuation), CV (council valuation), and RV (rateable valuation). But they are all interchangeable.

This information is searchable online by your specific address.

But, these figures are less accurate than what you will get from the likes of Homes.co.nz and QV. Why?

Because the councils use a similar algorithm to the websites mentioned above when determining a property’s value. However, they are only updated every 3 years or so.

For instance, Auckland Council says the last revaluation took place in June 2021.

This means, if you look up your address on the Auckland Council website, the figure you are seeing is a year out of date.

However, this is still useful to know, as some buyers use it as a blunt point of comparison, and will say things like “properties are selling for X% above CV.”

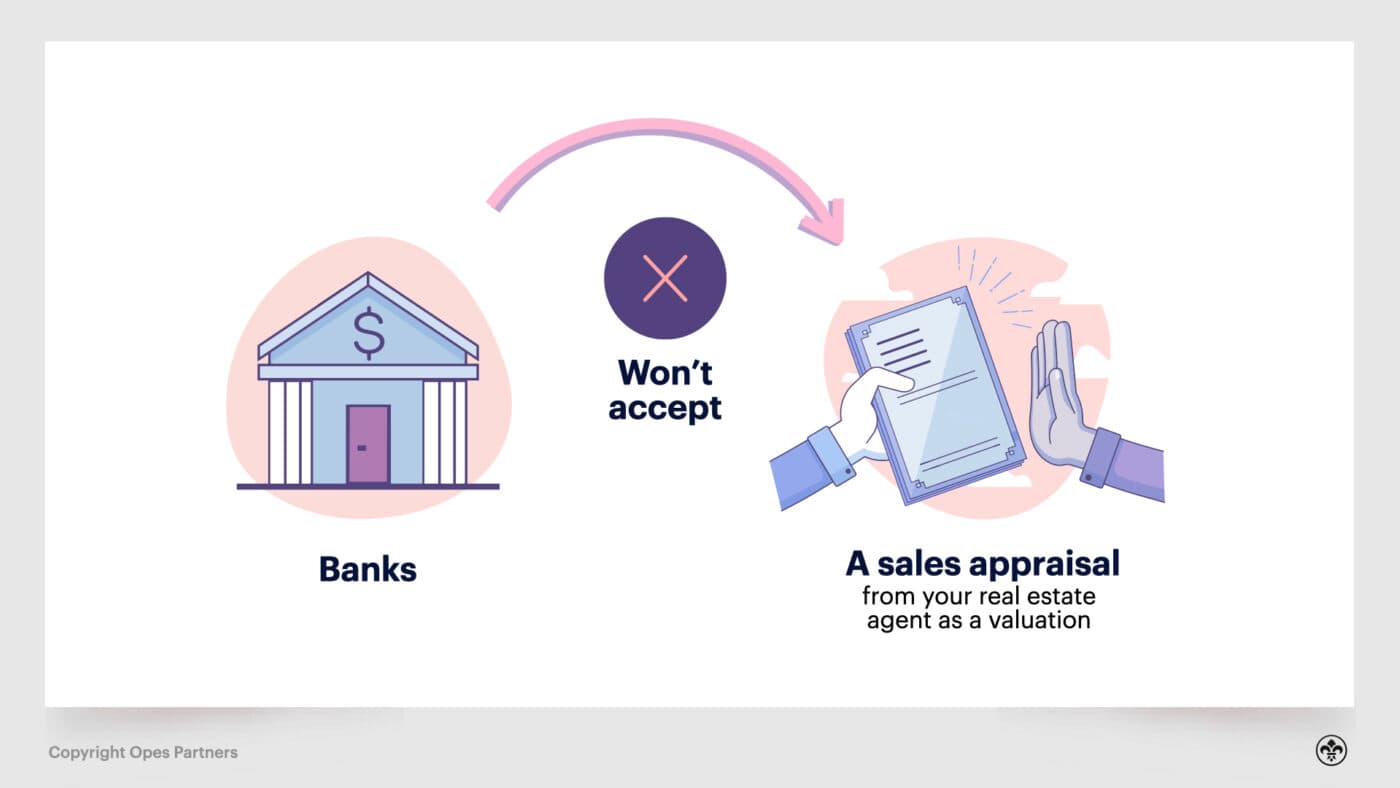

Real estate agents can offer a market appraisal.

If you ask a real estate agent, they are quite emphatic on making the distinction between an appraisal and a valuation.

Real estate agents are not registered valuers. So, a bank won’t accept a sales appraisal as a valuation of what your property is worth.

But it can be helpful in terms of giving you, the owner, a more accurate figure for what you can work with.

The appraisal is a two-fold process.

First, they will generally look at your property’s details on Property Guru, which is an online portal provided through CoreLogic.

This allows them to enter your address and see other similar properties that have recently sold. They can then select the ones that are most like your property. This gives them a sense of where the market sits today.

Second, they will go to your property and make an assessment, both based on the data and their on-the-ground knowledge of other properties they have been through.

Essentially, the final number is the result of these two processes – and the interpretation for what they think it will sell for in the current market.

REINZ (Real Estate Institute for New Zealand) releases a monthly-calculated House Price Index for councils.

They release this to the public in a bright PDF, full of colourful graphs that show house price trends, region by region.

So, if you want to understand how prices are generally trending in your area, this would be a great resource for you.

You can then get a sense of how the market has moved since you bought you current home, the the last time you spoke with a real estate agent, or the last time you had a valuation done.

For instance, let’s say you bought your house for $1 million a year ago and the market has appreciated by 10%. You can reasonably estimate that your home might be worth $1.1 million, assuming you didn’t over or under pay for that property.

However, these are broad trends of local markets – you won’t be able to get any information specific to your property. But, it helps you build an overall picture.

For the bona fide valuation on a home, you will need to hire a registered valuer to come to your property.

Registered valuers are professionals who have a university qualification in property and who are also registered members of the Valuers Registration Board.

When you hire a registered valuer, they will do a top-to-bottom assessment, and prepare a written report with their findings.

Some of the things they will be considering are:

It’s important to note, that while registered valuations are the most accurate, most people won’t pay the money to have one completed, unless the bank requires it to approve new lending.

If the bank does require you to have one done, then DO NOT organise the valuation yourself. Either your mortgage broker or the bank will arrange this for you.

This is because the banks do not want you to hire a friend to give you a favourable valuation and they want the valuer to send the report to them directly (at the same time you receive it).

When your mortgage broker organises this, you will be sent a link to put your credit card details in to pay the money, and this will usually be $700 – $1,200.

Don’t organise this yourself and send the bank the valuation you’ve had someone else do. They won’t accept it and you’ll have to pay all over again.

Homes.co.nz releases its own data about how inaccurate its valuations are. But you can probably assume this broadly applies to each of the other websites too.

On average, Homes.co.nz is 9.81% inaccurate (for the 3 months prior to June 2022).

They calculate this by comparing what properties actually sold for, with what their Homes.co.nz estimate was.

This is pretty big.

If your house appears to be worth $1 million on Homes.co.nz, it could actually sell for $98,100 more, or $98,100 less. And that’s only the average.

When we dive deeper, we see that only 50.73% of all homes across New Zealand sold within 10% (above or below) of their Homes.co.nz estimate.

Look at it this way: if Homes.co.nz says your property is worth a million dollars you only have a 1 in 2 chance that your home is going to sell within that $900,000 - 1.1 Million band.

The data also shows only 76% of property sales across New Zealand fell within 20% of their Homes.co.nz estimate.

So, in that same scenario you’ve got a 1 in 4 chance that your million dollar property will sell for less than $800K or more than $1.2 million.

However, you should also note that sometimes the online estimation tool is more accurate in some areas, and is less accurate in others.

As you can see from the above map, the website was least accurate in Opotiki District over the last 3 months. On average the Homes.co.nz estimate was out by 27.97%.

But, in Central Otago District, they were out by a margin of 4.97%, on average.

That’s why it’s important that when you use an online tool to value your property, at the bare minimum, you’ve got to do plus or minus 10%.

However, bare in mind that even then you’ve got a 1 in 2 chance that the money you are pocket is outside that band.

Ok, so we know that e-Valuations aren’t the most accurate, but of all the websites, which is the most accurate?

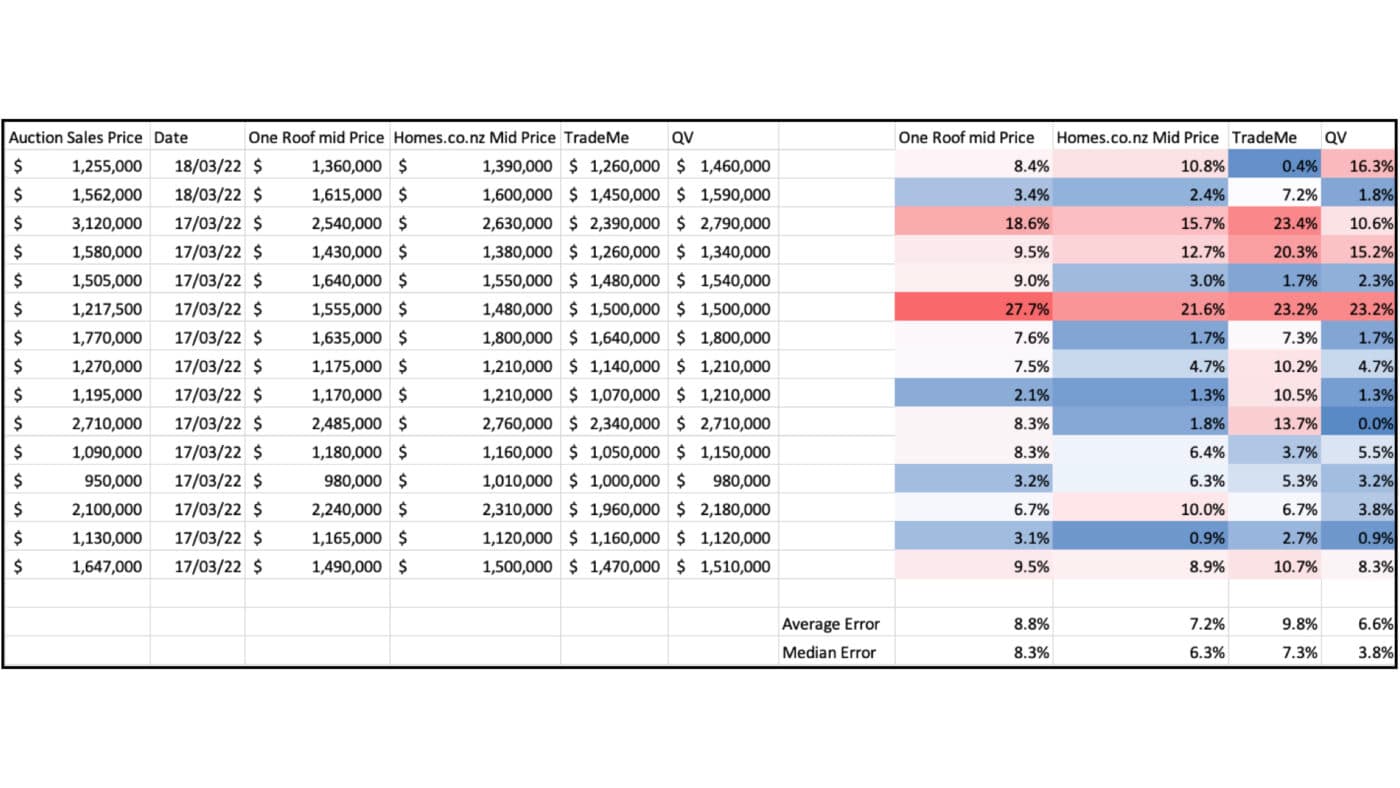

To figure this out, we sampled 15 different properties that had sold at auction only a few days before.

That meant that we could know the actual sale price, but that would not have been reflected in official data (so wouldn’t be counted in the websites’ algorithms just yet).

Then we compared the actual sales price to what each of these e-valuation websites thought they would sell for.

What we were looking for was the median error margin.

Said another way: How far off, above or below, were each of these e-valuations compared to the actual auction results?

Here’s how they compared.

As you can see, some were more accurate than others. For instance, on average, TradeMe was 7.3% off and One Roof was 8.3%.

From this sample, QV was the most accurate, followed by Homes.co.nz, TradeMe and then OneRoof.

Now, the conclusion most people will take away from this is that QV is the most accurate at predicting house prices.

Well…you can’t actually say that. Because we’ve only used a small sample, which isn’t statistically significant.

But, what you can take away is this: based on these 15 homes, QV had the least margin of error.

So, for us having done this exercise, if you were to ask us which one we would use– our choice would be QV.

All things considered, there are lots of options available for you if you want to get your home valued.

However, you will often find yourself pitting accuracy against cost.

Yes, online valuations are cheap and easy but their own data shows they are quite inaccurate.

From our comparisons, we’ve found QV to be the best. While it’s not statistically significant, that would be our place to go.

At the end of the day, nothing will give you an accurate figure like a registered valuation. It’s just up to you whether you want to spend the money to buy one.

Write your questions or thoughts in the comments section below.

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Ed, our Resident Economist, is equipped with a GradDipEcon, a GradCertStratMgmt, BMus, and over five years of experience as Opes Partners' economist. His expertise in economics has led him to contribute articles to reputable publications like NZ Property Investor, Informed Investor, OneRoof, Stuff, and Business Desk. You might have also seen him share his insights on television programs such as The Project and Breakfast.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser