Property Investment

Property Investment

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

The property market will go through 6 years of changes in the next 6 months.

Here are the 6 big changes going on. As you read through these, you’ll be surprised just how much is changing –

This week, the government said they’ll bring in a new rule to allow pet bonds.

Under the rules, you can charge up to two weeks of rent (as a bond) if your tenant wants a pet.

The rules will probably come in from early 2025.

And you’ll also get back 90-day “no-cause” terminations. That means some property investors can soon ask tenants to leave without giving a stated reason.

If you’ve got a tenant who is always late on their rent, you can ask them to leave. At the moment, you can only do that in very specific situations.

We’ve discussed interest deductibility and the bright line test a lot in this newsletter.

So we won’t go over all the rules again. But these two tax changes are HUGE. This is the biggest seen in the 20 years I’ve invested in property.

At Tuesday’s webinar, I shared this case study. There were 3 investors, all with identical properties.

But one is better off by $152 a week. Another isn’t any better off at all once the tax changes come in:

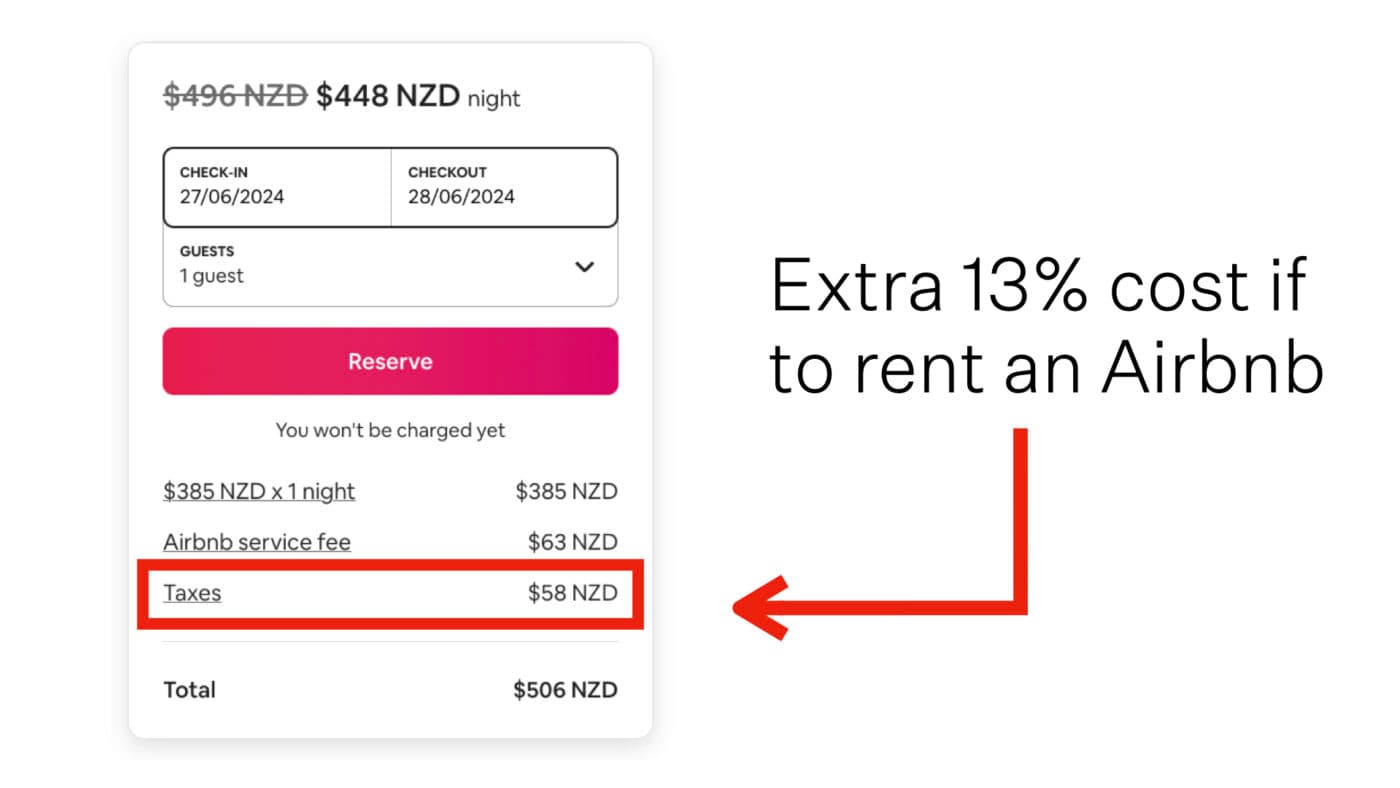

The government has also changed the GST rules. This makes renting Airbnbs more expensive.

Rather than forcing investors to swallow the cost, Airbnb updated its website.

The cost is now passed on to renters.

Because Airbnb is now more expensive, some people will stay in a hotel instead.

So, if you currently rent a property on Airbnb, you may need to accept less occupancy or lower your nightly rate.

Interest rates have gone from their lowest point ever to their highest point in 15 years. All that happened in the last 24 months.

Interest rates will likely go down over the next few years. The question is when.

New inflation data came out yesterday. Inflation dropped from 4.7% to 4%. It’s the lowest level in nearly 3 years.

That sounds like good news. And it is (in part).

But domestic inflation is really high.

Domestic inflation is usually higher than imported inflation.

The issue is that domestic inflation is being sticky.

So, it’s more likely that the Reserve Bank will cut the OCR in November rather than August.

Getting a mortgage will soon change, too.

The Reserve Bank will probably bring out new Debt-to-income restrictions (DTIs) mid-year. That will tighten some parts of the market up.

At the same time, they will let property investors buy properties with slightly lower deposits (LVR restrictions).

Then Andrew Bayley, the Commerce Minister, wants to loosen the lending rules. He plans to roll back parts of the CCCFA to get more lending going.

House prices are now in recovery mode. That comes after they fell by more than they ever have (since the data began in 1992).

But at the national level, the recovery stalled over the last 6 months.

That’s not the case everywhere, though. Property prices are bouncing back fast in some parts of New Zealand. Otago, for instance, has already made a full recovery.

The house price recovery will be uneven.

Some parts of the country (generally the main centres) will bounce back faster than others.

How do you keep up to date with all these changes?

Make sure you subscribe (and listen) to the Property Academy Podcast.

Every day, we release a new episode to keep you up to date with the New Zealand property market.

Subscribe here for free on Apple Podcasts, Spotify, or wherever you tune in to podcasts.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser