Property Investment

The 6 best places to invest in 2026

Investors keep asking where the best opportunities are right now. Here are my top picks for 2026👇

Property Investment

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Is the media rigged against landlords?

Every week, Kiwis email me asking: “Andrew, did you see this headline? …. What does it mean?!”

This one hit my inbox 11 times last week 👇

Let’s find out the real story.

News headlines aren’t written to tell the whole story.

They’re written to make you click.

And our brains fall for it. Every. Single. Time.

Here’s why.

Imagine it’s 10,000 years ago.

You’re out hunting. It’s 8pm. Dark.

You hear a rustle in the grass.

You start to panic: “Is it a lion?!”

Now most of the time … it’s just wind in the grass.

But your brain thinks it’s a threat. A beast is coming to get you!

And there’s a very logical reason for that.

If you assume it’s a lion and it’s really the wind … no harm done. You just got a little scared.

If you assume it’s just the wind and it’s really a lion … you’re dead.

That’s why we evolved to pay more attention to danger than good news.

And the media use that to get us clicking.

So how do you outsmart your cave (wo)man brain?

You wouldn’t believe how many people email me saying, “What do you think about this headline?”

So I:

Remember: the headline is not a summary of the article.

It’s the scariest part taken out of context.

So your first step is to read the whole article. (And I really mean that).

“This isn’t a housing market meltdown, it’s a full-blown crash.”

When you read that headline, what do you think the article says?

Probably that house prices have started falling off a cliff again.

But you could fact-check that by using:

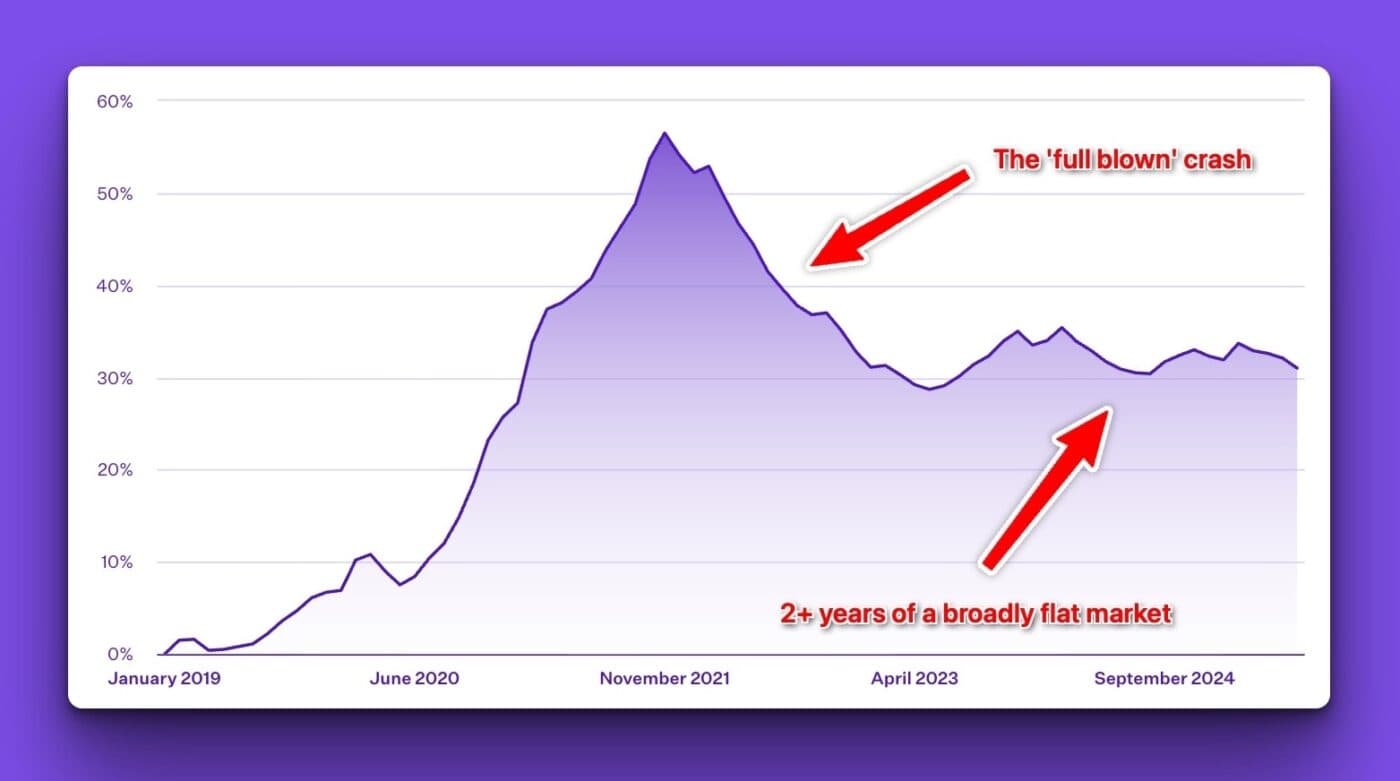

And if you did that, here’s what you’d have seen:

House prices did crash.

But that was over 2 years ago. Since May 2023, house prices have been broadly flat.

This isn’t yesterday’s news.

It’s not even last year’s news.

It’s the year before last year’s news.

The last step is to separate fact and from opinion.

This article from RNZ is a case in point. Check out this headline:

The headline is presented as a fact.

It seems that house prices will be lower in the 2030s than they were at the start of the 2020s.

I thought that too … until I saw the last word in the headline… ‘forecast’.

So:

And actually, it’s worse.

The fact isn’t that house prices will be lower. It’s that inflation-adjusted prices will be lower than the peak of the market.

I see this as a way of fudging the numbers. And to prove it … do a little test with me.

Let’s say that the price of butter is $8. And the price goes up to $8.40 (up 5%).

Now, let’s say inflation is also 5%.

When you stand in the supermarket and look at the price of butter, what do you think:

If you look at that experiment and think like the first person, congrats, you are a normal person.

If you stand in the supermarket and think like the second, you are an economist who doesn’t think like a normal person.

So given that most people think like person #1 (above), what did the article actually say?

That house prices would go up 3.1% a year for the next 5 years (on average).

+3.1% for 5 years = +16.5%.

If you buy a $600,000 house and it goes up by 16.5% over 5 years, that’s the same as saying:

“Investors could make $99,000 over the next 5 years”.

It’s the same data. Just different headlines.

But look at those 2 headlines:

Which one will your cave (wo)man brain click on?

The first one. That’s why the media went with that one.

Not exactly.

It’s your brain that’s rigged against you.

The media just serves up what you’re going to click on.

But you can use these 3 steps to outsmart both the media … and your own brain.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser