Property Investment

Property Investment

2 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Everyone wants the perfect investment property.

The one that:

Here’s the truth: you can have all of those things.

But not in a single property. And that’s because all investments have trade-offs.

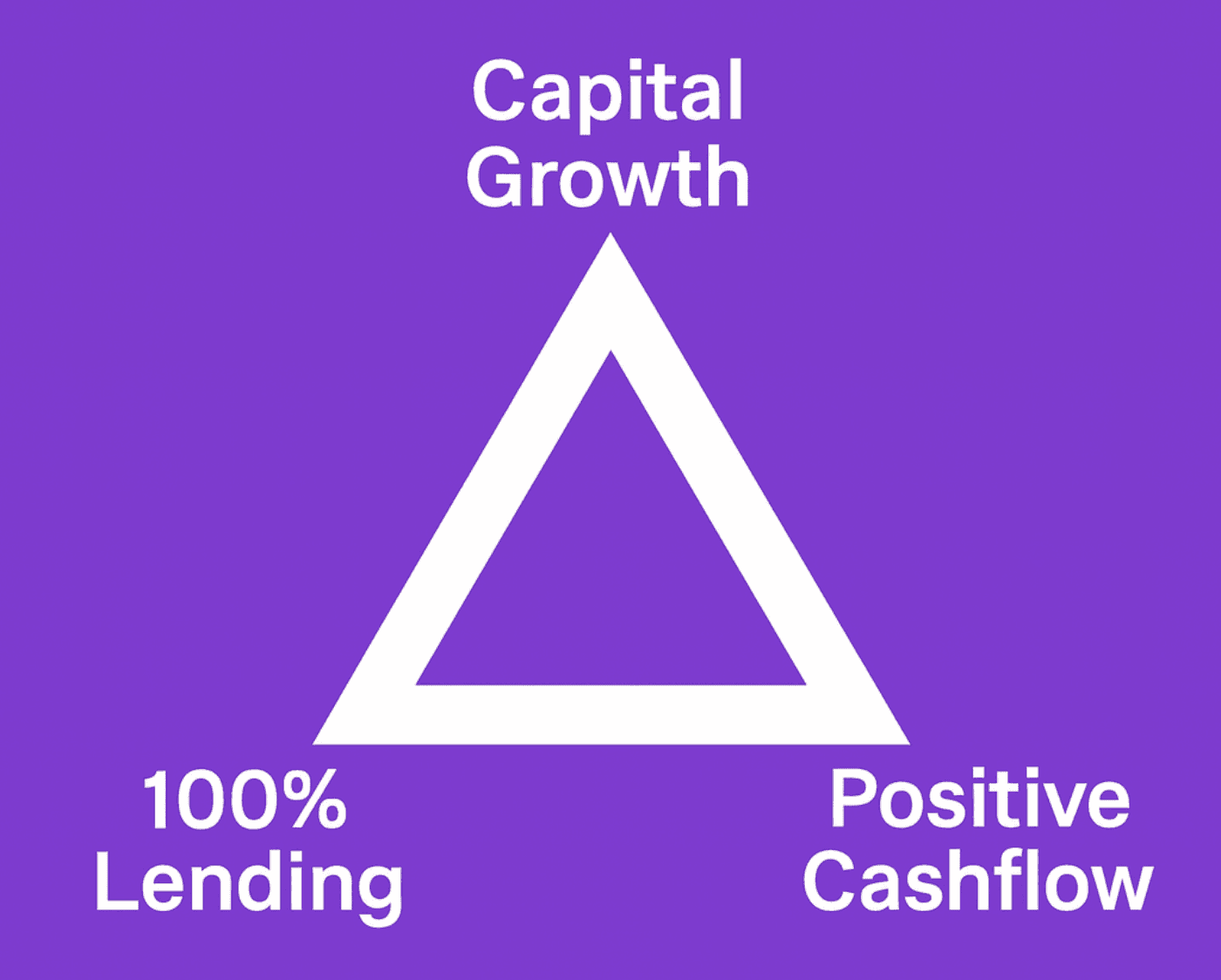

To show these trade-offs, I created the Property Triangle.

The idea is simple. You can choose 2 out of these 3 things:

You can say ‘yes’ to 2 of those. But the trade-off is that you have to say ‘no’ to the other one.

So what happens if you want a property to go up in value quickly and pay money each week?

You’ll often need to put in a cash deposit. That’s to get the mortgage lower.

What if you don’t have a cash deposit and you want the property to pay you money each week?

The property often won’t grow in value as fast. That’s because there is a trade-off between growth and yield properties.

Want the property to grow in value quickly and put in no cash deposit? The trade-off is that you’ll often need to top up the cashflow each week.

A property isn’t automatically:

It depends on how you buy it.

Let’s say you buy a $525k property renting for $500 a week. After all expenses, you might be topping up the mortgage by $150 a week.

But what if you put in a 40% cash deposit? Now you’re paying less interest to the bank, and suddenly the property becomes cashflow positive – making you $25 a week instead.

So, a property is not inherently cashflow positive or negative.

It comes down to:

When I show this diagram to first-time property investors, they often struggle to decide which two to choose.

Here’s what I recommend. Just pick one.

Pick the one that is the most important to you. Because then it becomes a choice between the other two.

Many first-time property investors don’t have a cash deposit.

So it doesn’t matter whether the property goes up in value faster or whether it’s cashflow positive.

What matters is that it must have 100% lending (no cash deposit).

Once you’ve got that sorted, you decide between the other two … faster capital growth or positive cashflow.

So start with the one that is most important. Because then it comes to a choice between the two alternatives. If you care most about:

All investments have trade-offs. This is what they are in property investment.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser