Property Investment

Build a $100k passive income plan in 20 minutes

You might be investing… but are you on track for $100k a year? Here’s how to check 👇

Property Investment

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Mortgage interest rates are going to fall (again).

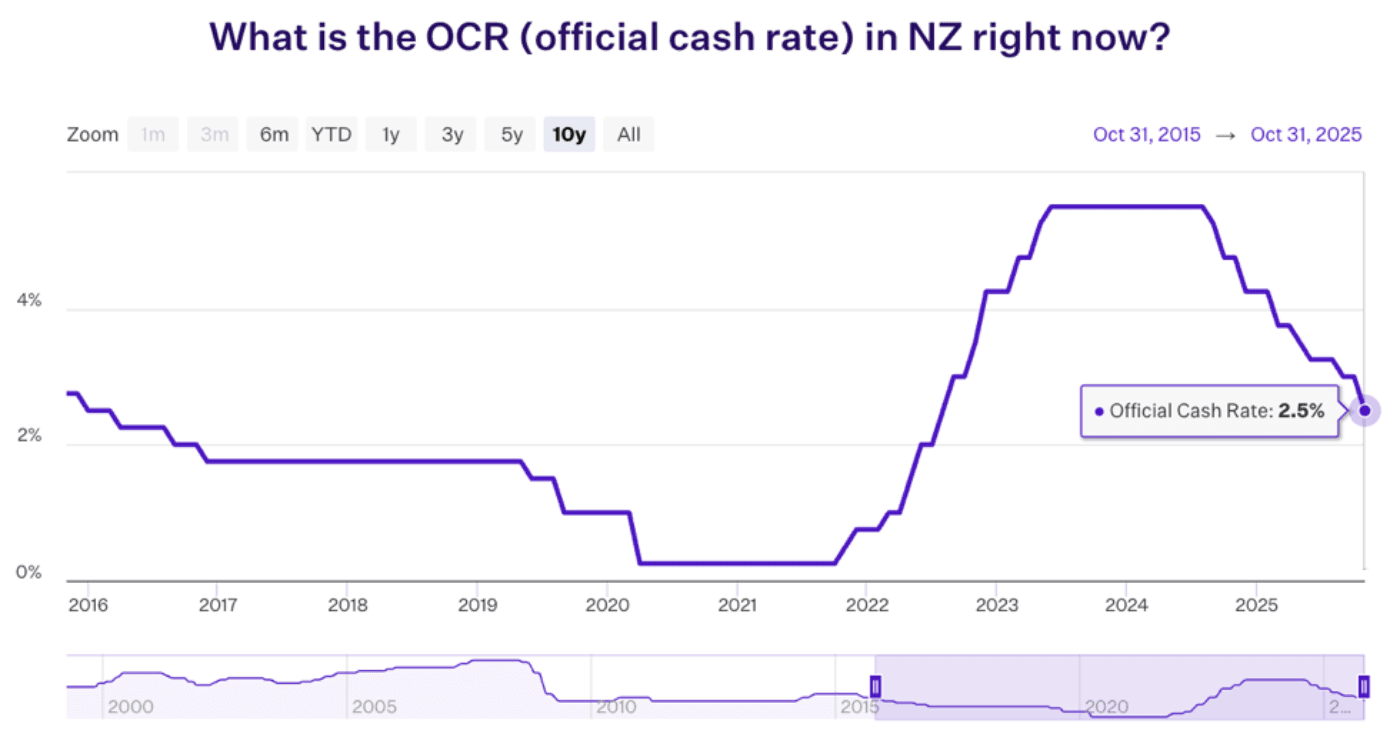

Yesterday, the Reserve Bank dropped the OCR by 0.5%. From 3% to 2.5%.

More than most economists thought they would.

So how low will interest rates go? And what’s coming next?

The Kiwi economy is not going well. The economy shrank 0.9% between April and June. Sure, the Reserve Bank thought GDP would fall. But only by 0.3%.

But it wasn’t that weak GDP alone that triggered the double-decker cut.

There’s a lot of “spare capacity” in the economy.

There are people who want to work. But, they can’t get jobs.

There are people who want to work more hours. But, they can’t get them.

There are businesses that could make more stuff. But, there are not enough buyers.

The Reserve Bank wants to kick the economy back into gear.

And that’s what lower interest rates do. It makes it cheaper to borrow and easier to spend.

And it lowers the return for leaving your money in the bank.

So as borrowers' mortgages roll over to lower rates, they’ll have more spare cash to spend.

And it makes it cheaper for businesses to borrow and invest in their companies.

The banks have already cut their floating rates. They’re mostly down the full 0.5%.

But the fixed rates always take longer to move.

They depend on the swap rates. Think of this as what it costs the bank to borrow money and lend cash out to you and me for our mortgages.

Because the double-decker cut took the market by surprise, those swap rates fell fast.

Within 38 minutes of the announcement, the one-year swap rate dropped about 0.12%.

ANZ’s 1-year interest rate already fell 0.26% last week (from 4.75% to 4.49%).

I expect it to drop another 0.1 – 0.15% over the next 1–2 weeks.

That’ll take the 1-year rate down to 4.35% (if I’m right).

A year ago today, ANZ was advertising 6.19% for its 1-year mortgage rate.

Today it’s 4.49%.

And if it gets down to 4.35% … that’s a 1.84% drop.

So your weekly payment could fall from $706 to $584 a week. That’s based on a $500k mortgage that you’re paying off over 30 years.

That’ll save you $122 a week.

But if you’ve got more debt, you could save even more.

My colleague, Ed has a $1.1 million mortgage that’s coming up for refix in December.

He’s currently paying 5.75%. If rates drop to 4.35%, that’s a 1.4% cut.

He’ll save $15,400 a year, or $296 a week.

It’s a lot of money!

Now, I get that not everyone has $1.1 million mortgage. But this is the kind of number-crunching the Reserve Bank want people to do.

They want people to reassess their household budgets so they spend more and stimulate the economy.

Lower interest rates should also help house prices rise.

Because lower interest rates often mean the bank will let you borrow more. And you can take out a bigger mortgage, while making the same repayment.

Now, house prices tend to get a boost in Spring and Summer anyway.

The REINZ House Price Index ticked up 0.3% in August. Cotality reported a modest increase in house prices in the 3-months to September.

It won’t be a full-blown property price boom. But, it could be a turning point.

Think of these lower rates as a tailwind rather than a take-off.

The Reserve Bank will be back in late November. That’s for their last OCR announcement for the year.

The central bank has said that: “The [Monetary Policy] Committee remains open to further reductions in the OCR”

That means the OCR will likely be cut another 0.25% in November.

There could even be another cut coming in February 2026.

That could take the 1-year rate within spitting distance of 4%.

That’d be good for borrowers, property investors and house prices.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser