Property Investment

Property Investment

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

If you’re not thinking like this, you’ll never be wealthy. No matter how much you earn.

After analysing thousands of investors, I’ve found one mindset that separates the wealthy from everyone else.

And you can steal it in just 90 seconds ... with this one simple change.

Most people think about money in terms of days.

Wealthy people think about money in decades.

So if you’re financially stressed, you’re only thinking about the next payday. How to pay the bills this week.

Thinking about money in days = Survival Mode.

If you’re better off, you think about money in months. You’re saving for your next holiday. Or, you want to buy a different car at the start of next year.

Thinking about money in months = Comfort Zone.

But if you’re wealthy, you usually think about money in decades. You have a written financial plan. You’re building wealth for the next 2-4 decades.

Thinking about money in decades = Wealth Mode.

And this type of thinking can cost you hundreds of thousands of dollars (even if you don’t earn much money).

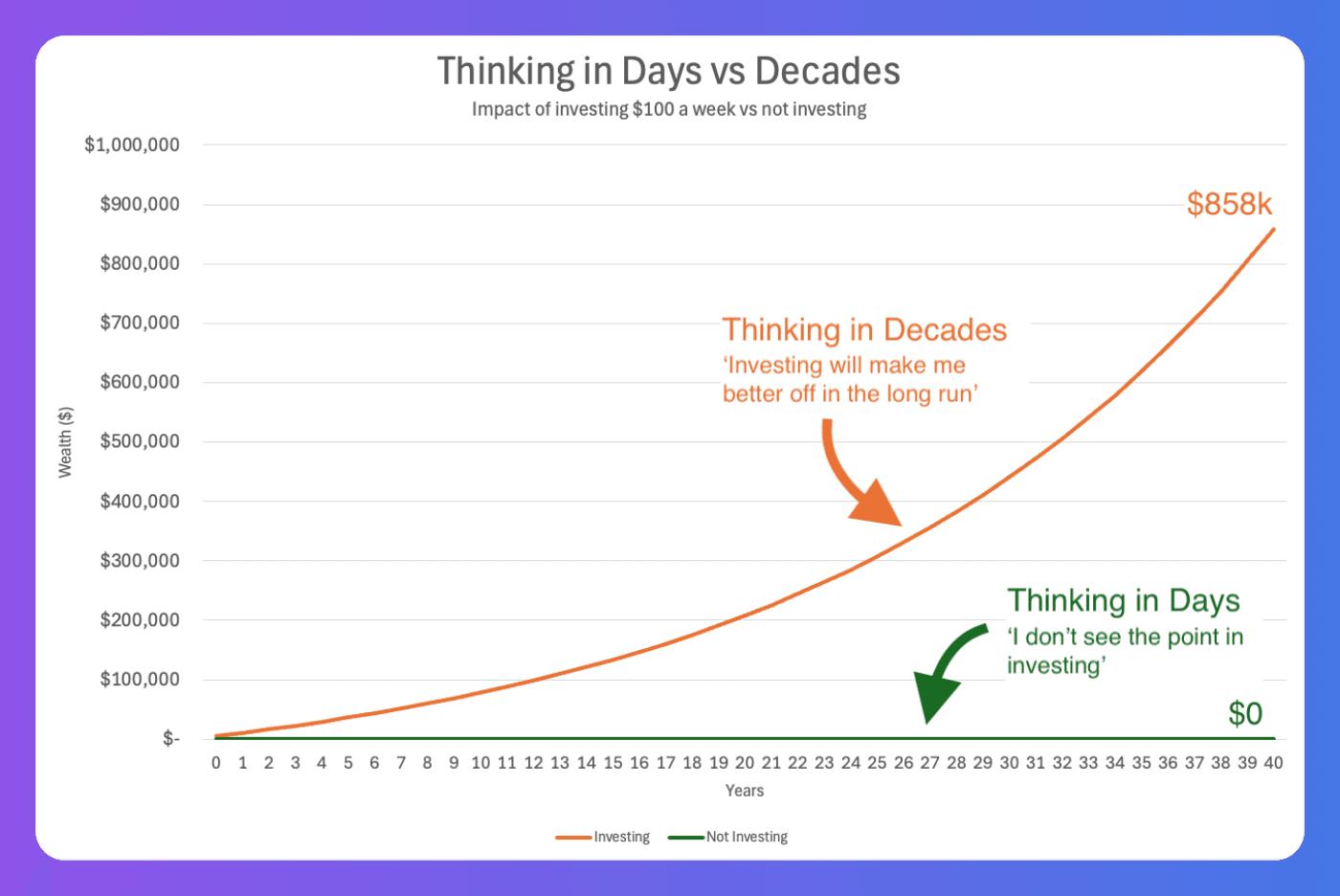

Take two 20-year-olds earning the same $60k salary.

One lives week-to-week. They think about money in days.

The future is far away, so they don’t see the point in investing.

The second invests $100 every payday into a managed fund. They want to get ahead with money.

40 years later, the person thinking in decades has over $858,000 in wealth and assets. (Based on a 6% return).

The other has $0. No wealth. No assets.

Thinking in days costs you.

That’s why some people I meet earn six figures, but still live paycheck to paycheck.

They’ve got the nice car and a fancy house. But they’re still broke.

They’re thinking about what they can buy next Friday instead of what they could build in 20 years.

So, ask yourself.

Right now, are you thinking about your money in days, weeks, months, or decades?

If you’re not … here’s how you can change it in just 90 seconds 👇

It sounds morbid – but experiments show that when people think about their own death, they sometimes make better financial decisions.

That might sound dark. But facing your ‘timeline’ forces you to think long-term.

And that’s why my team just built this calculator. It helps you think in decades by showing you your life.

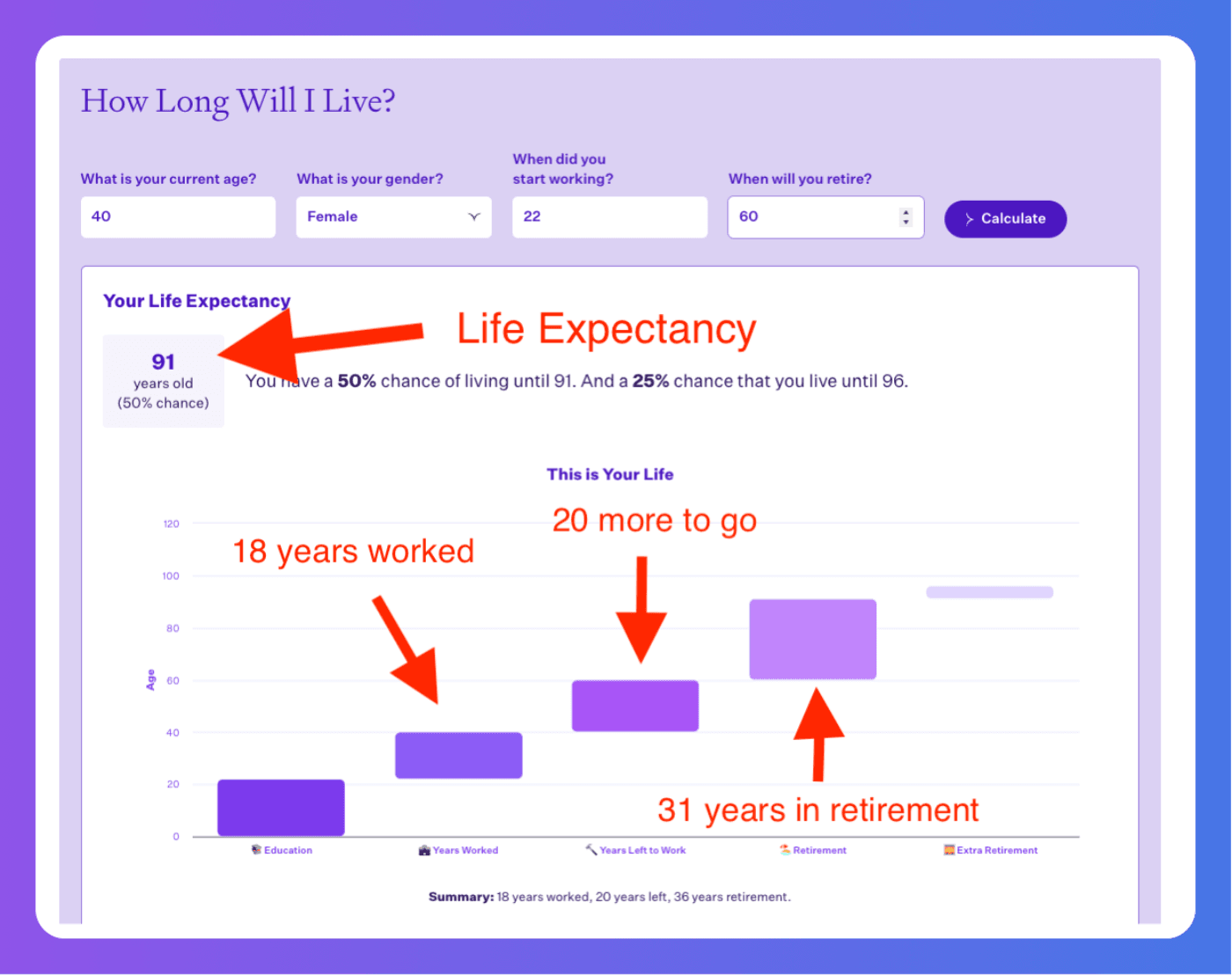

I showed this to one of my investors. She’s 40. She started work at 22 and wants to retire early.

She’ll quit work for good at 60.

The good news is … her life expectancy is 91 (great news).

But that also means that she’s worked for the last 18 years.

She’s got 20 left. And she needs to make enough money so she can retire for 31 years.

Now when she saw those numbers … do you think she was thinking about her latest bill?

Nope. She started thinking about what she needs to do for the next 2 decades so she can pay for the next 3.

Seeing her future laid out like that suddenly got her thinking in decades. Not days.

So try this calculator yourself. Because then you can get your number. And start thinking in decades.

I talk to hundreds of investors every year — and almost all say the same thing:

“The future feels far away.”

Especially when they’re juggling a career, a mortgage, and a family. It’s easy to focus on what feels urgent.

But once you start thinking in decades, you realise the future isn’t that far away.

Try the calculator yourself. It takes 90 seconds to change how you see the next 30+ years.

Most people think in days and stay stuck.

The wealthy think in decades. That’s why they win.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser