Mortgages

How to use the equity in your own home to buy another property (No-Cash-Needed-method)

This shows you exactly how to use equity to buy another house in NZ without any cash.

Mortgages

7 min read

Author: Nefe Teare

Financial adviser at Opes. Formerly a senior adviser at one of NZ largest investment firms. Owned 3 properties by 30.

Reviewed by: Stevie Waring

Financial Adviser with 7 years of experience. Property investor in Wellington and Christchurch

You might want to make enough to live out your big, bold dreams. Or, you might just want to set yourself up for a comfortable retirement.

Either way, once you’ve decided to invest, the next question is: “What should I invest in?”

The truth is, there are so many different ways you could invest and grow your money ... from shares to term deposits, crypto to collectibles.

Here at Opes Partners, we focus on one strategy: property investment. That’s in part because you can use other people’s money to invest.

In this article, you’ll learn the 3 different ways you can use other people’s money to invest.

That way, you can decide if this is the right way to grow your wealth.

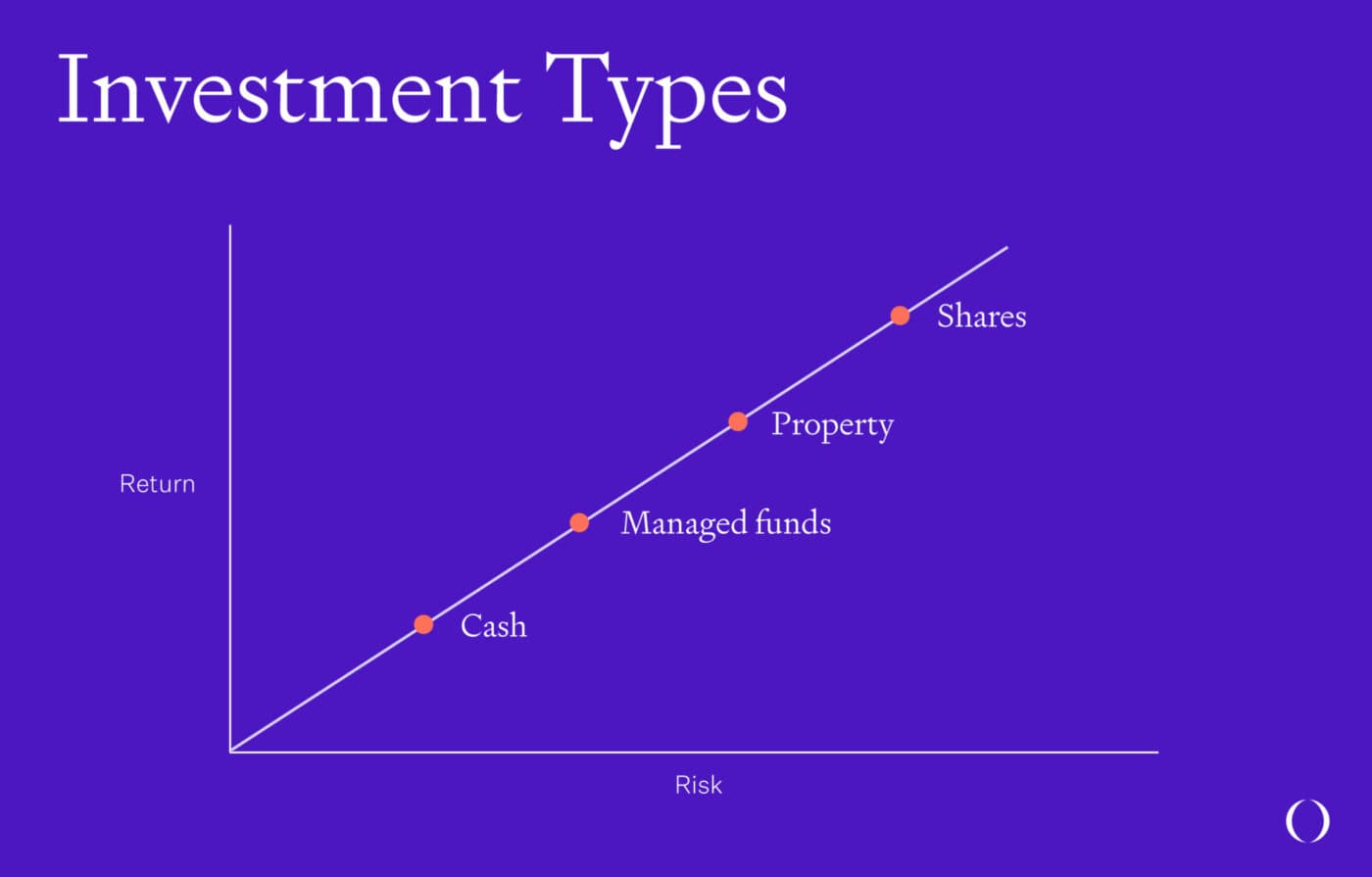

If you’ve ever been to an investing seminar, or read investing seminar notes, you’ll have seen a chart like this:

There are four different asset types you can usually invest in:

Investing your money in 'cash' like term deposits is the lowest risk. It also attracts the lowest return on investment.

At the moment, most 12-month rate sits between 3.8% – 4.3%.

Given that inflation is currently 2.5%, these returns are positive – but modest.

Bonds are also relatively low-risk. That’s when you loan your money to the government. Then they promise to pay you back later with interest.

Often, bonds aren’t that accessible for everyday (‘mum and dad’) investors. Unless you go through a managed fund (like KiwiSaver).

Typically, you might get around a 4% return per year. That’s a touch higher return than term deposits with slightly more (but still low) risk.

Shares tend to get a 8-10% return over time. It depends on which data you look at.

But they come with a lot more risk. Their prices go up and down a lot. And they might stay flat for a while.

But, they do provide a higher return.

A managed fund that’s heavily invested in shares might return 6–10% annually, depending on how aggressive it is.

For example, the S&P 500 has returned around 15% annually over the past few years, though that’s a high-growth, high-volatility index.

Then you've got property. Property isn't the highest-returning way to invest.

Property prices often go up by 5-7% per year. Again, depending on how you crunch the data.

In this case, you’ve got a little more risk (ups and downs) with property than you do in cash or bonds, but not as much as shares.

But it comes with one big advantage – you can use other people’s money to invest. In property we call this leverage.

Even if shares earn more on paper, property can often grow your wealth faster.

You do this by using leverage (other people’s money).

Let's walk through the 3 types of leverage.

Let’s say you buy a $500,000 New Build investment property. You don’t need to save up $500k in cash.

You just need the 20% deposit ($100,000), and the bank covers the rest.

Now, let’s say that property goes up in value by 5%. That’s 5% on the full $500,000, not just the $100k you put in.

So the property is now worth $525,000. $25k more than when you bought it.

That’s a 25% return on the $100k deposit you put in.

Compare that to:

Even though property doesn’t go up in value as fast as shares, using leverage / other people's money you can get a larger overall return.

Though this does come with extra risks. Which we’ll come back to in a moment. But, first let’s discuss the second type of leverage.

In the above example, we assumed you had $100k to invest. But what if you don’t have a cool $100,000 in the bank?

Most Kiwis don't.

So how do you start investing in property?

This is where the second type of leverage comes in. That's using the equity in your own home to fund the deposit for your investment property.

Over the last 5 years, the median house sale price in New Zealand increased from $628,000 to $780,000 (Dec 2019 – Dec 2024). That’s a rise of $152,000.

Let’s say you bought a home in 2019 for $628k and it’s now worth $780k. That’s an extra $152k of wealth (equity) you have in your home.

You can often borrow against some of that equity and use that as your investment deposit. For example:

Let’s say your house is worth $780k and you have a $500k mortgage, you could borrow up to $124,000 as the deposit for an investment property.

That’s because you can borrow up to 80% against the value of your own home. So:

$780k x 80% - mortgage = your useable equity.

If you used all of that, you could potentially buy a New Build worth $620,000.

So with the first two-types of leverage (other people’s money) … you can potentially buy a house without any cash.

But, then you have a big mortgage, which brings us to the final form of leverage.

And finally, you’ll rent out your investment property.

You then use your tenant’s rent to pay most of the mortgage, rates, insurance, maintenance, property manager, and more.

But sometimes the rent doesn’t cover all of the costs. Especially when interest rates are high.

So, sometimes you’ll need to “top up” the property each week. This often happens if you’re using all 3 types of other people’s money.

In this case you might contribute $150–$200 a week.

Say you buy a $750,000 property that you top up by $150 a week, because you’ve bought it using the second type of leverage.

If your property increases 5%, that’s a gain of $37,500.

Over the course of the year, you’ve contributed $150 × 52 = $7,800 in top-ups.

So, you’ve made $37,500 in capital gains from just $7,800 of your own money — that’s a return of 481% on the cash you put in.

In other words, while you put in $150 a week, capital growth gave you back the equivalent of $721 a week.

This is why property can be an efficient way to build your wealth:

Other assets don’t have these same types of leverage. That’s what makes property so unique.

Using other people’s money acts like a magnifying glass.

It makes the upside bigger. But it also makes any losses bigger too.

In above example, I talked about what happens if you put in a $100k deposit to buy a $500k property.

If the property goes up in value by 5%, the property is worth $525k. You made $25k – a 25% return on your initial deposit.

So the market went up by 5% and you got a 25% return.

But what if the market goes down by 5%?

Now you’re $500k property is worth $475k. And your equity in the property has gone from $100k to $75k.

You lost $25k that year. So the market went down by 5% and you got a -25% return.

So using leverage can supercharge your returns if you can hold on for the long term. But it makes both the ups and the downs bigger.

There are lots of ways to grow wealth – shares, bonds, term deposits, even crypto.

But property lets you leverage your money in ways those other asset classes can’t:

That’s the power of leverage. It’s not just about higher returns — it’s about amplifying your money using other people’s.

Just keep in mind that it also amplifies the downsides too. Keep that in mind before you rush off and blindly invest.

Financial adviser at Opes. Formerly a senior adviser at one of NZ largest investment firms. Owned 3 properties by 30.

Nefe is a Registered Financial Adviser at Opes Partners with 7 years’ experience in financial services. Before joining Opes, she was a senior adviser at one of New Zealand’s largest investment firms, managing $13 million in KiwiSaver and managed funds. She’s helped clients invest over $26 million in property and owned 3 properties before her 30th birthday.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser