Number Crunching

Useable equity calculator

Find out how much equity you have in your home

Mortgages

7 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Derry Brown

Financial Adviser in industry since 2007. Investor in Auckland & Christchurch. Previous COO of Global Brand

Many investors buy investment properties with $0 cash. How? They borrow the deposit against properties they already own.

I call this the “No-Cash-needed Method”. So, no, you don’t need $120,000+ in cash to buy an investment property.

Useable equity is the portion of your home’s value that you can borrow against to purchase another property. If your property has gone up in value or you’ve paid down your mortgage, you can use this equity to grow your investment portfolio without needing to save a large deposit.

In this article, you’ll learn how you can use equity to buy a second property with $0 cash.

If you’ve owned your own home for a while, two things are likely to have happened.

This creates wealth within your home. It’s worth more, and you’ve got less debt held against it.

And you can use some of this newly created equity as the deposit for an investment property. This is how to use equity to buy another house.

You take out a new loan secured against your own home. Then you use that money as the deposit to get another loan for your new property.

My friend, Ed, wanted to buy this property for $625k. The plan was to use it as a long-term investment.

TSB bank said they would lend him $500k to buy it, but that meant he still needed to come up with $125,000 for the deposit.

He didn’t have that sort of cash sitting in his bank account, but he did already own an apartment central Christchurch.

So, he went to Westpac (one of his other banks) and said: “Can I borrow $125k against this property? I want to add another rental property to my portfolio.”

And they said: “Sure thing”.

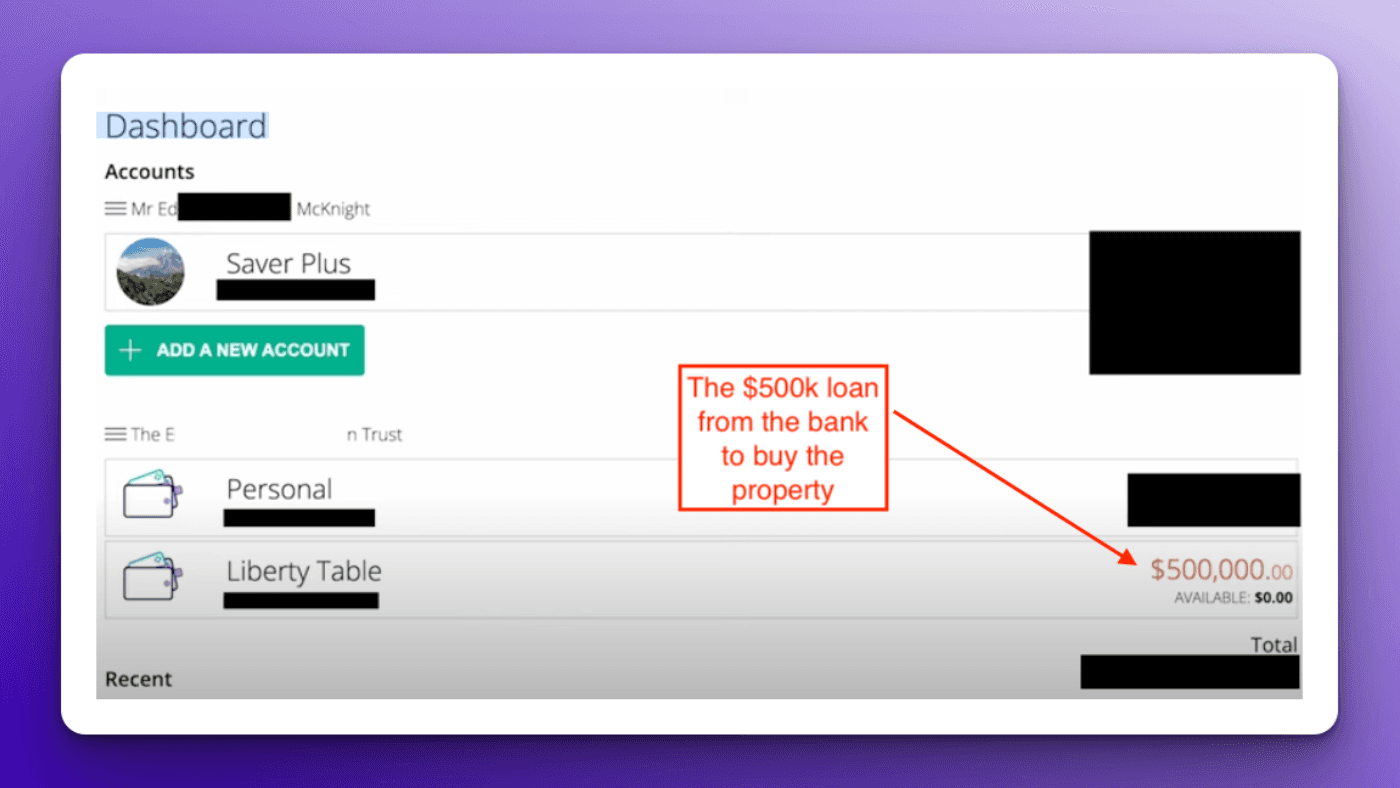

Here’s how it looks in his bank account:

Here’s the $500k loan from TSB:

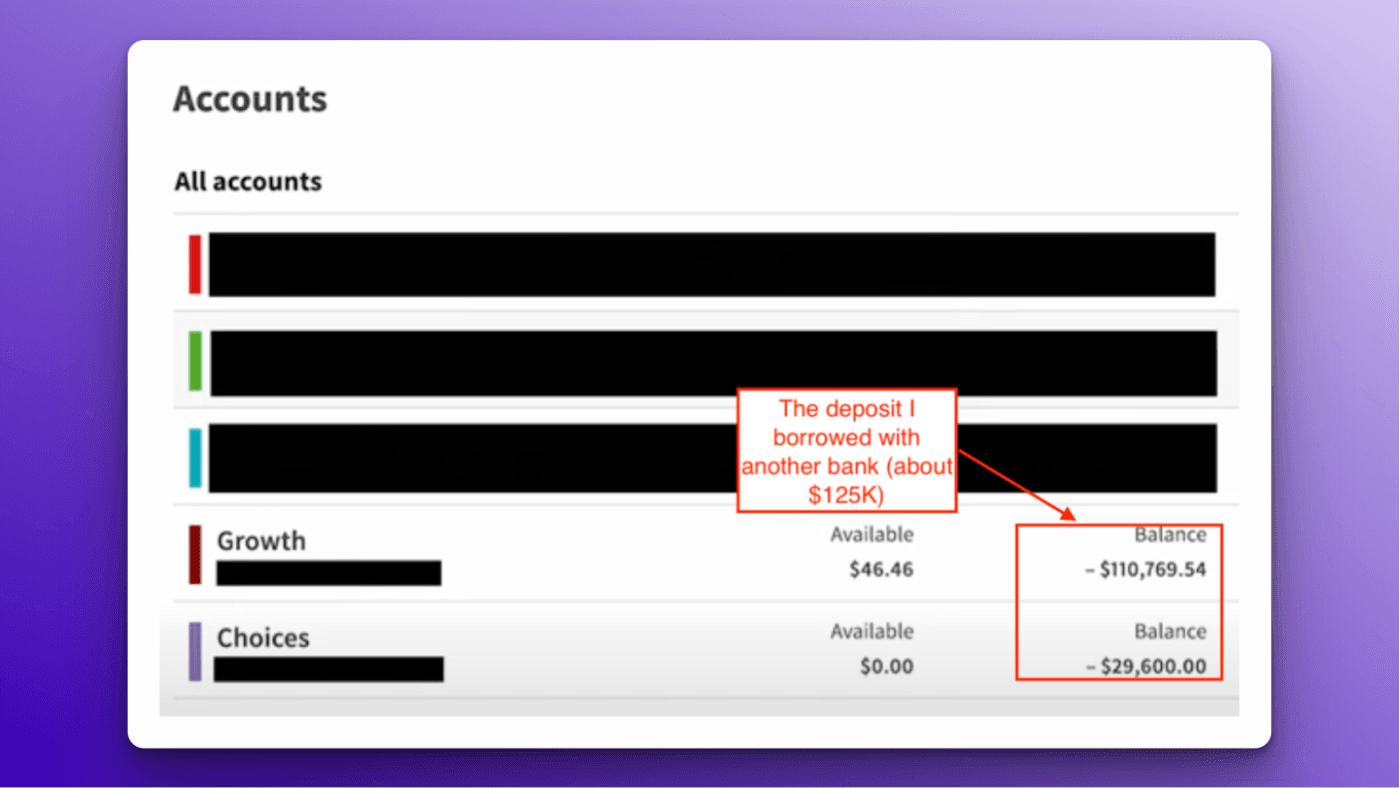

Then here’s the $125k (just over) from Westpac:

Put them together, and that’s how he paid $625,000 for a property (without putting in any cash to buy it).

It was entirely bought with other people’s money. That’s the No-Cash-Needed Method.

Let’s go through the pros and cons of buying a house with $0 cash.

Let’s be clear. The No-Cash-Needed method isn’t right for everyone.

If property prices go down (as they have), your mortgage may be higher than the house value.

That might mean you have to put off selling the property until the market recovers to avoid selling at a loss.

If you plan on owning your property for the long term this won’t matter all that much. But if you wanted to own it for only 2 years, this wouldn’t be the right fit for you.

You also need to have a property that you can borrow against, but there are definite pros to this method too.

Of course, the biggest benefit is you get to buy a house with $0 cash. There’s no having to save hundreds of thousands for a deposit.

Then, as the property goes up in value, you get to keep all the house price growth.

It also means you can grow your property investment portfolio faster than if you had to save the deposit.

Under the Loan to Value Ratio (LVR) restrictions, you can borrow up to 80% of your own home’s value.

If your owner-occupier home is worth $1,000,000, you will generally be able to borrow $800,000 against it.

But most Kiwis won’t be able to borrow all of that for investment. This is because they already have a personal mortgage secured against that property.

Here’s an example of using equity to buy an investment property in NZ:

One of our advisers at Opes Mortgages is currently working with Carol and Steve.

They own their own home worth $850,000, and they have a $400k mortgage.

Carol and Steve can borrow up to $680,000 against their home. ($800k x 80% = $680k).

But they already have a $400,000 mortgage. That means they have $280,000 of useable equity ($680k - $400k = $280k).

This useable equity is sometimes called dead-equity, or lazy money. Because if you don’t use it to invest, it doesn’t give you a return.

What could they do with that? They can spend up to $1.4 million buying investment properties.

They still need to pass the bank’s income tests, but it’s looking promising.

If you prefer a calculator, use the tool below to figure out the value of properties you can potentially buy.

The value of the investments you can buy with your deposit depends on the types of properties you decide to buy.

Under LVR restrictions, investors need:

Let’s continue with the example from above to illustrate the point.

You’ve got $280k in useable equity to use as a deposit. If you invest in existing properties, you can buy investments worth a maximum of $933k.

Take that same $280k and buy new properties, and you can now invest a maximum of $1,400,000.

Investing in brand-new properties means you can afford to buy more properties quickly.

There are two ways you can access your equity.

Option #1 is to go to the same bank that holds your existing personal mortgage.

This is the most straightforward way.

You submit a mortgage application. Then the bank will give you pre-approval to buy a property up to a specific value.

The benefit of going to your existing bank is that it’s simple. You get the approval and buy the investment property.

But this approach does have downsides. Your properties are generally less secure when you use one bank rather than two.

So Option #2 is to use split-banking. That’s where you use two banks rather than just one.

To do this, you need to turn the useable equity into cash to use it as a deposit.

The most common way to do this is by setting up a revolving credit against your owner-occupier.

In simple terms, this is a large overdraft that uses your home as security.

Once approved, you can move that money into a solicitor’s trust account as the deposit.

You can also access this equity by taking out a second mortgage against your home. However, that’s a less flexible way.

If you’d like to start investing, your next step is to determine whether you can afford to buy an investment property.

As a first step, check out this quiz. It will give you a “yes”, “no” or “maybe” answer on whether you’re ready to invest. It also gives you the value you could be able to afford up to.

Alternatively, you can get started by talking to a mortgage broker to get pre-approval with a bank.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser