Property Investment

What happens in due diligence for an investment property?

This article shows you exactly what you need to do as a property investor during due diligence. This includes costs and a step by step guide of what to do.

Due Diligence

6 min read

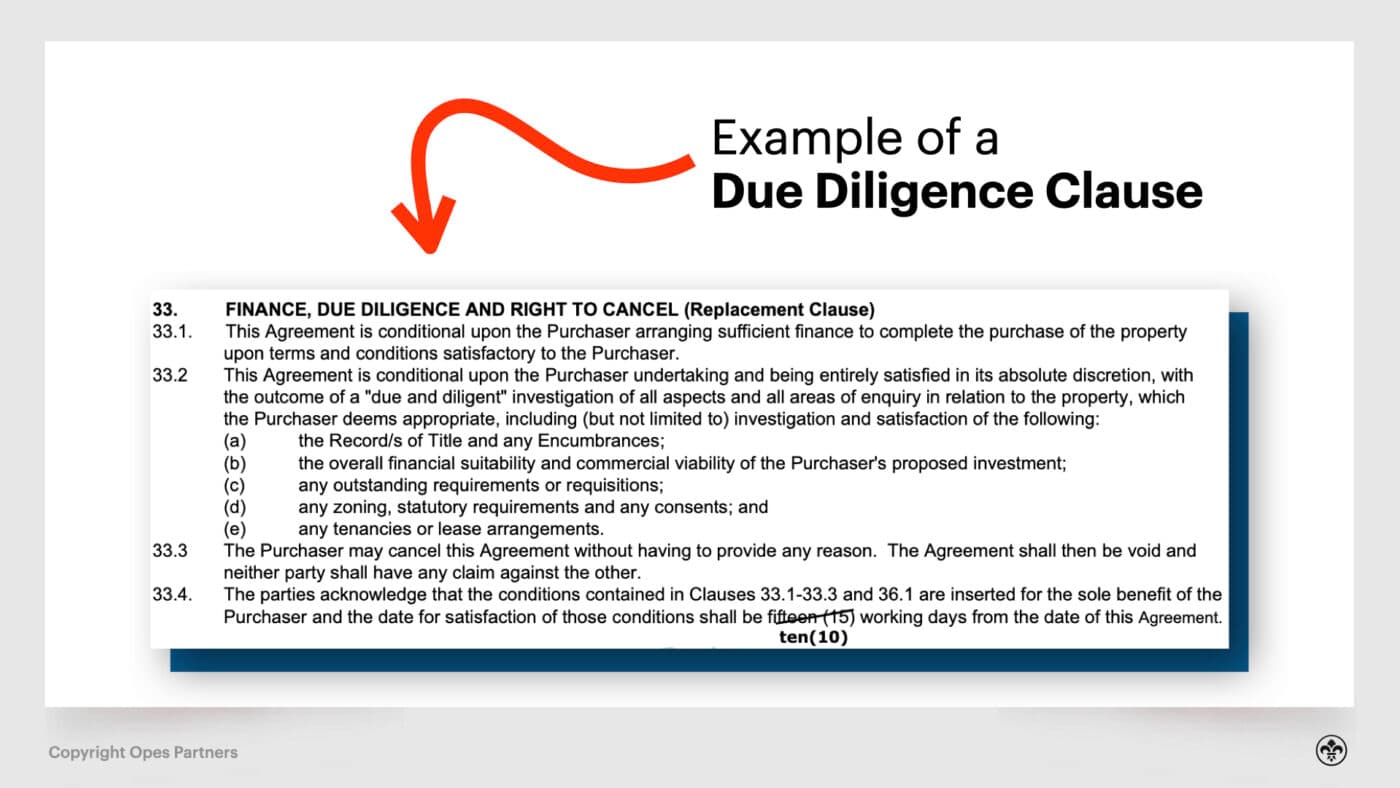

A Due Diligence clause lets you (a property buyer) cancel a contract for pretty much any reason.

You can use this clause whether you’re buying a property that is already built, or an off-the-plans build.

You can often find a Due Diligence clause in “Further Terms of Sale” in the contract.

In this article, you'll learn what a Due Diligence clause is, how to use it, and what it means for you.

The exact wording used in the clause will change based on who wrote the contract.

But, generally, it will read something like:

That can sound a bit legalese (and it is). So what does this mean for you as a property buyer?

Simply put, Due Diligence is when you want to buy a property, but you still need to do some checks first. That might be a building inspection, getting the mortgage sorted, or just thinking it over.

But, while you’re doing these checks … you don’t want someone else to buy the property.

So you sign the contract and go into “due diligence”. It’s a 10-day period where a property buyer can investigate the property.

This is to see if:

At the end of Due Diligence, you can either decide to buy the property, let it go, or ask to extend this period.

The big benefit of a Due Diligence clause is that you get control.

You sign the contract and no-one else can buy it. You’ve put it on hold.

You then have the time to decide whether you want to buy the property or not.

Register for Opes+ (the ultimate property investment app) where you can access the Ultimate Guide to Due diligence.

Remember, investigating a property costs money. You’ll spend money on a lawyer to look at the contract and you might have to pay to get documents from the council. Or, you might need a building inspection.

You don’t want to spend time and money on these checks only to discover someone else signed the contract before you did.

Then, if you decide the property isn’t right for you, you can cancel the contract.

You are only fully committed to the property once you go “unconditional”.

Due Diligence clauses are powerful. That’s why every property an investor buys from us at Opes has a due diligence clause in the contract.

If you’re working with a real estate agent, they will not typically have a Due Diligence clause in the contract. You need to ask for it.

Because Due Diligence clauses are so powerful, they will often discourage you from using them. Remember, they work for the seller. They don’t want you to sign a contract that you can easily cancel.

So here’s how a conversation with a real estate agent might go:

You: “I want a Due Diligence clause in the contract, please.”

Real estate agent: “What sort of things do you want to check before you buy the property?”

You: “I want my lawyer to check the contract and to get a building inspector through.”

Real estate agent: “OK, let’s put in a solicitor’s approval clause and building inspector clause.”

You: “No, I want a Due Diligence clause.”

Sometimes you need to be firm to get what you want.

It’s also important to mention that Due Diligence clauses are easier to get in a cold market than a hot market.

If you put a Due Diligence clause into a contract, the sale is less certain, so sellers usually don’t like them.

When there aren’t many buyers, sellers might have to accept this clause. But, when the market is hot, you might not be able to negotiate one in.

The Due Diligence clause is your safety net.

So, if you have a property under contract and want to cancel it just email your lawyer saying that you want to cancel the contract using the Due Diligence clause.

You can then get out of the contract, no questions asked.

Licensee (Eligible Officer) and Team Leader for Opes Property

Brittany graduated from the University of Auckland with a Bachelor of Property and later became a qualified financial adviser. She's now the licensee (eligible officer) and team leader for Opes Property.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser