Mortgages

How are interest rates changing right now? January 2026

See how interest rates are shifting, the lowest rates available, and how much you could negotiate right now.

Mortgages

2 min read

Here is your monthly interest rate report.

After months of falling mortgage rates, Westpac shocked everyone yesterday and increased its rates.

Here’s your quick, plain English update on why it happened and what it means for your mortgage.

Westpac has just increased its mortgage rates, raising all the longer-term terms: 2-year, 3-year, 4-year and 5-year.

They all went up 0.3%. For instance, the 2-year rate went from 4.45% to 4.75%.

But interestingly, the 1-year rate stayed the same. And the 6-month rate fell 0.2%.

So some rates are up, and some are down.

But, surprisingly, that doesn’t necessarily mean your mortgage just got more expensive. Here’s why

Remember, banks might advertise one rate.

But when you talk to your mortgage adviser or go into your bank app, they will sometimes offer a lower, discounted rate.

I just got word from Westpac (this morning) that while their advertised rate has gone up … their discounted rate has stayed the same.

This will change over time.

What this means today is: If you’re with Westpac and you go to refix your rate, it shouldn’t matter whether you fixed it today or two days ago, your interest rate should be the same.

The rates you see on their website have changed.

The rates you see in their app have stayed the same.

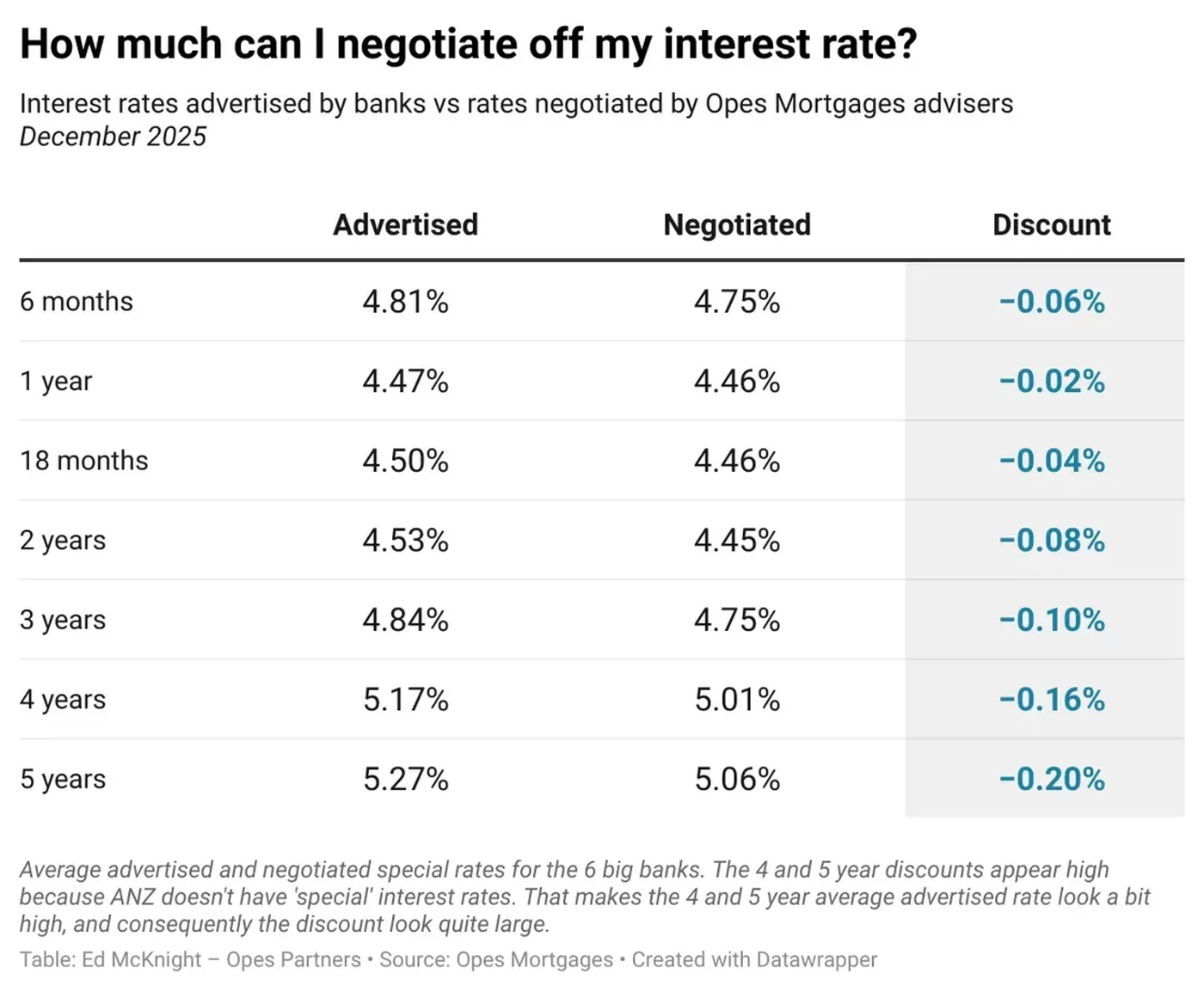

Because it’s hard to see these discounts, I like to show you the average rates my team at Opes Mortgages is getting from the banks right now:

You might have also heard that the banks are offering massive cashbacks to entice you to switch your mortgage to them.

Banks have offered these cashbacks for years. But usually they’ve hovered around 0.8% – 1%.

More recently, they’ve skyrocketed to 1.5%.

To put that into context, if you have a $500,000 mortgage and get a 1.5% cashback … that means that the bank will pay you $7,500 just to put your mortgage with them.

While it can feel like ‘free money’. It’s not.

Because there are some costs to switching banks, and it often comes with some conditions (like sticking with the bank for 2+years).

But many borrowers feel like it’s a good enough incentive to refinance to another bank.

Just keep in mind that these massive cashbacks will soon come to an end.

To get it at ANZ, you need your application in by Friday this week.

For ASB, it’s tomorrow.

So if you have been thinking about moving for one of these cashbacks, the window is almost closed.

My gut tells me that come next year, we’ll be seeing a more normal cashback around that 0.8% - 1% range again.

Mortgage broker for over 10 years, property investor and Managing Director at Opes Mortgages

Peter Norris, a certified mortgage adviser with 10+ years of experience, serves as the Managing Director at Opes Mortgages. Having facilitated over $1.2 billion in lending for 2000+ clients, Peter is a respected authority in property financing. He's a frequent writer for Informed Investor Magazine and Property Investor Magazine, while also being recognized as BNZ Mortgage Adviser of the Year in 2018 and listed among NZ Adviser's top advisers in 2022, showcasing his expertise.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser