Mortgages

Interest rate report: December 2025

See how interest rates are shifting, the lowest rates available, and how much you could negotiate right now.

Mortgages

3 min read

Here is your monthly interest rate report.

This gives you a quick, plain English update on how much your mortgage costs.

TL;DR

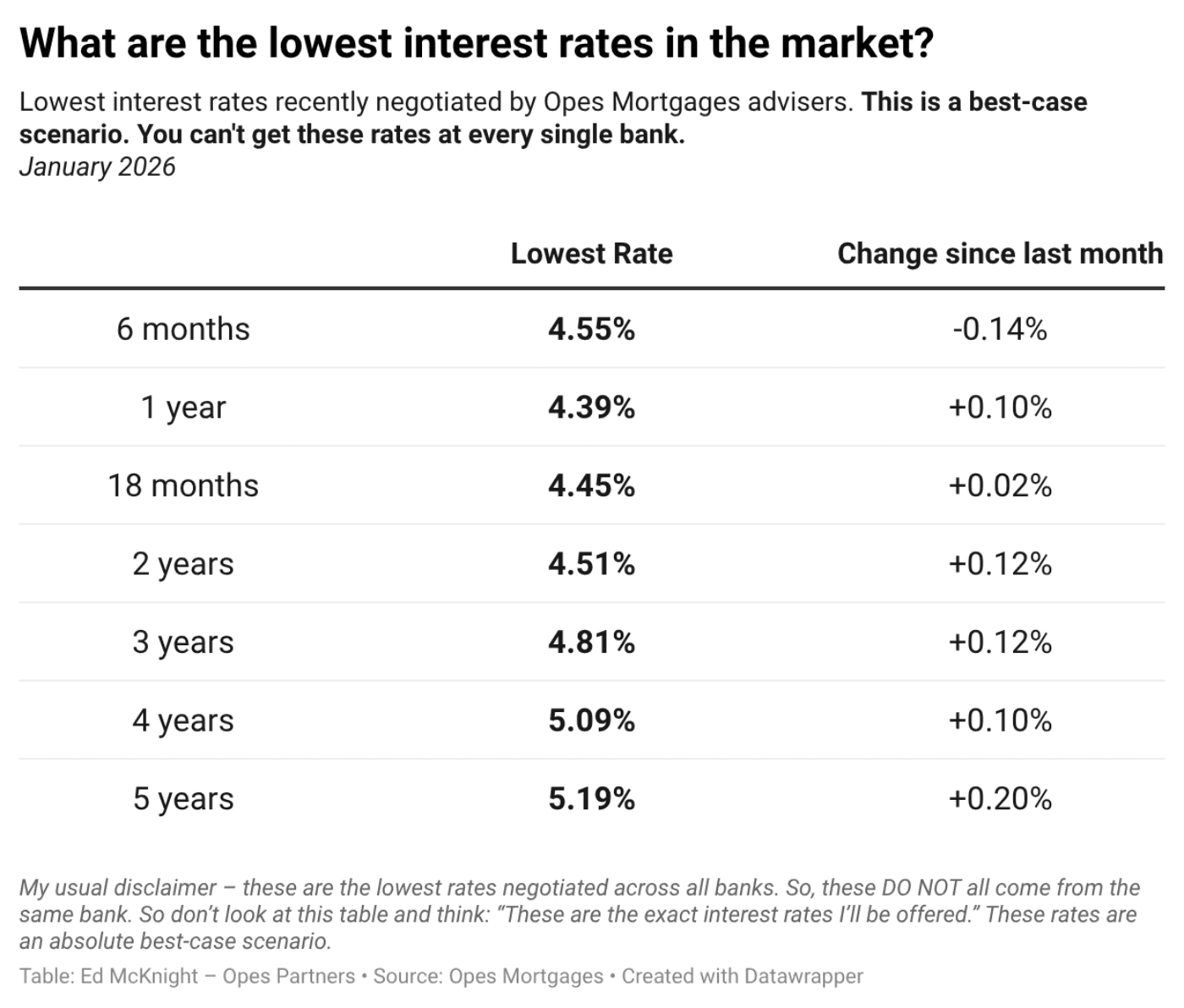

After falling for much of 2024 and 2025, some interest rates have started increasing.

The last time I wrote this report in December, many banks were offering a 5-year mortgage interest rate of 4.99%.

Not anymore.

The lowest 5-year rate on offer is now 5.19%. And many are sitting between 5.30% and 5.59%.

Not all mortgage interest rates have gone up that much. It’s mainly the 3-5 year rates. The 6-month to 2-year rates haven’t moved much, yet.

These moves make it clear. The bottom of the interest rate market is likely over.

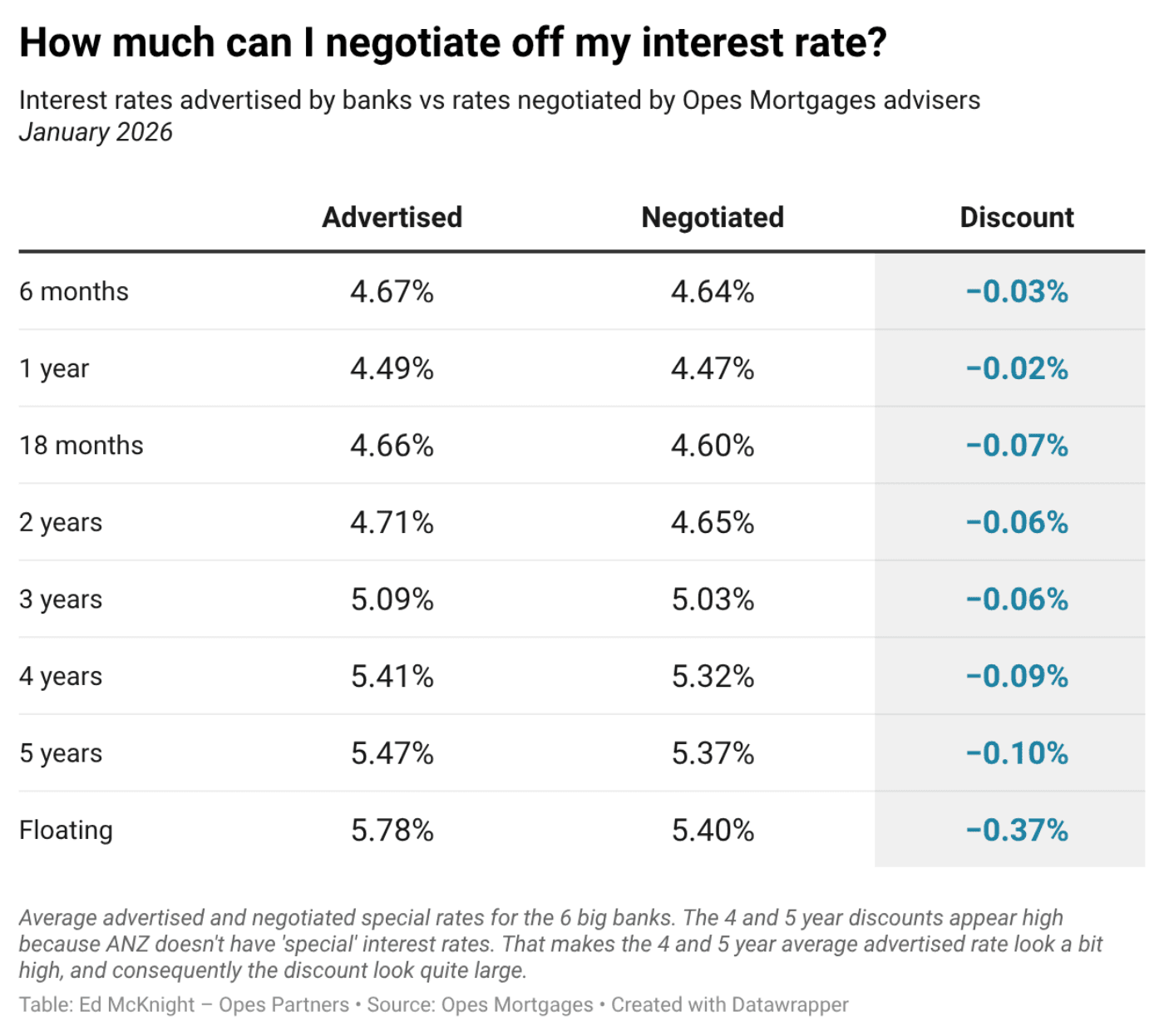

You know those "secret" bank discounts? Where the bank advertises one rate on a billboard (or TV ad) ... and then when you fix your rate in the bank app, there’s a discount?

They've pretty much disappeared.

Except for floating rates.

The average bank advertises a floating rate of 5.78%. But by the time you negotiate, they're discounting it by 0.37%, bringing it down to around 5.40%.

Remember, each bank has different discounts. Some offer more. Others offer less.

The point is: the floating rate is now where the discounts are.

That doesn't make it the most attractive deal. After all, floating rates are often higher. But it's good to know when you're thinking about your options.

It’s hard to see these secret discounts as a borrower. So here are the average discounts my team at Opes Mortgages has negotiated this week:

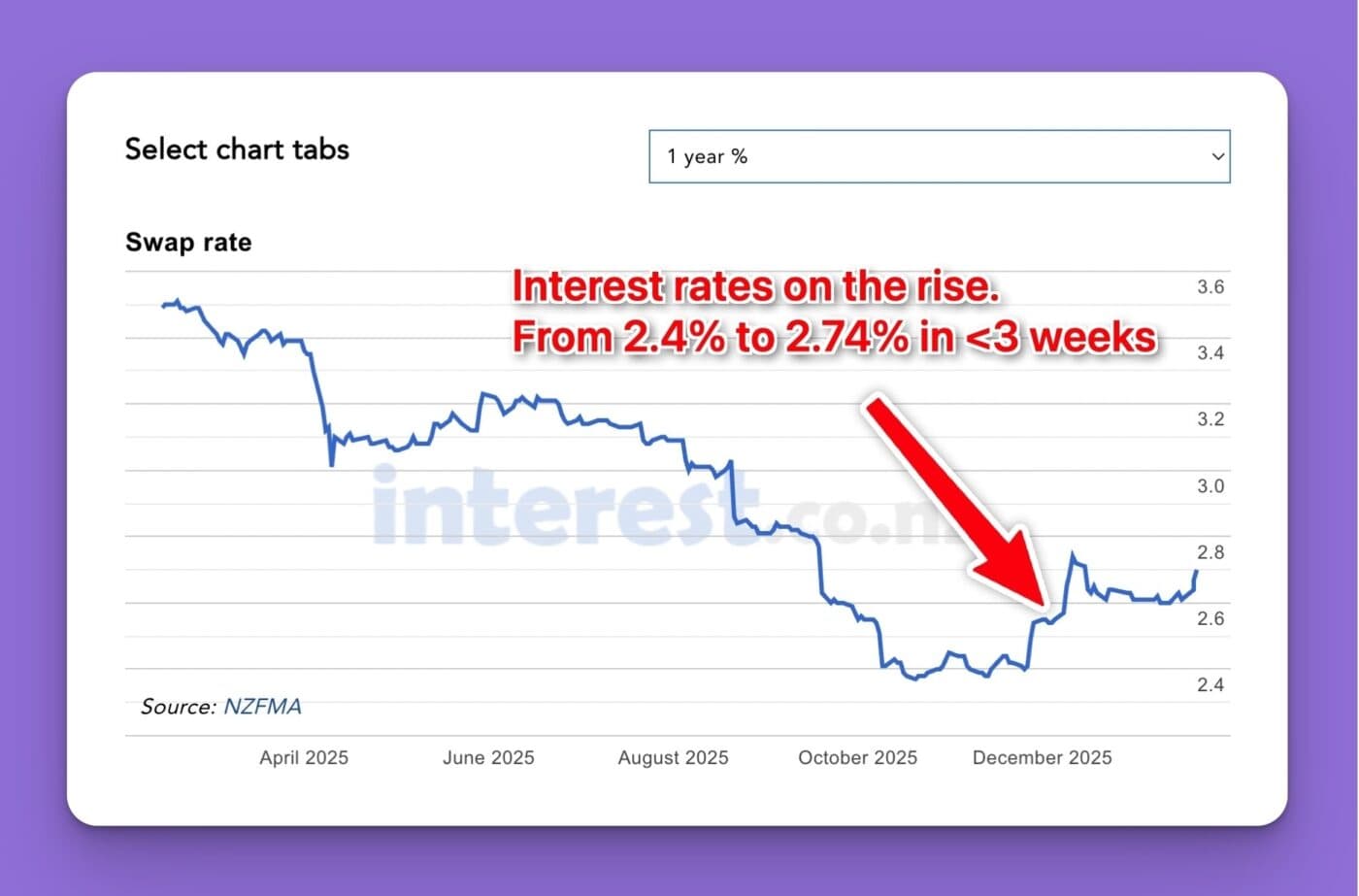

You might be wondering: "Why are interest rates going up when term deposit rates are flat?"

Good question.

Banks don't set their mortgage rates based on term deposit rates alone. They do it based on swap rates.

Think of swap rates as what it costs the bank to borrow money and lend it to you and me for our mortgages.

When swap rates go up, banks pass that cost on to borrowers.

And, those swap rates have been rising since November. Here’s why 👇

It all started when the Reserve Bank came out with its Monetary Policy Statement.

They appeared more hawkish about inflation than the market expected.

That means the Reserve Bank signalled it might raise the OCR sooner than many people anticipated.

The 1-year swap rate roughly averages what people expect the OCR to be over the next year. That’s why when the interest rate markets sensed that an OCR rise could be on the horizon, that rate jumped from 2.4% to 2.74% in just over 2 weeks.

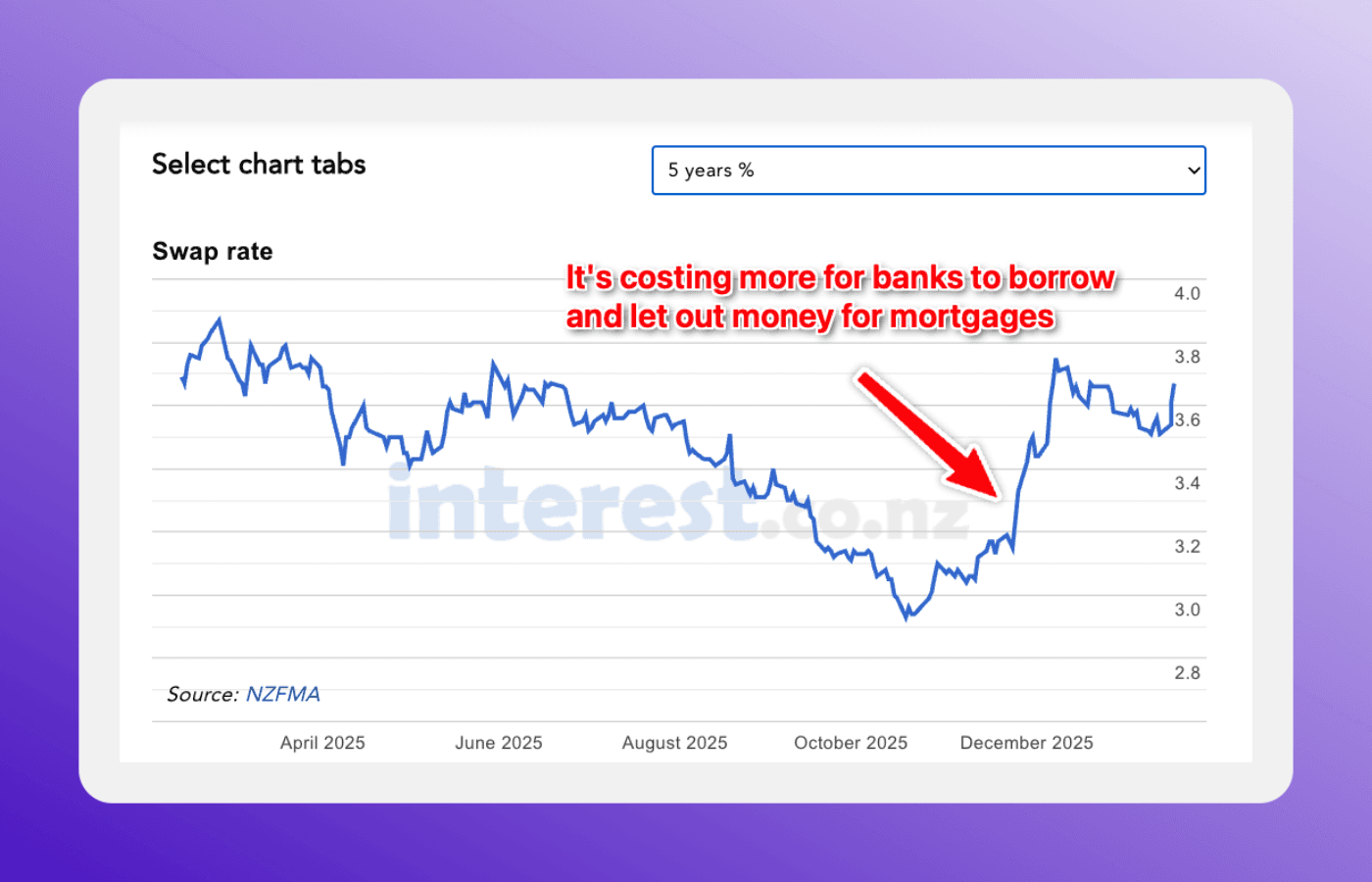

But that wasn't the biggest jump.

It was the 5-year swap rate that took off.

In late October, the 5-year swap rate was under 3%.

By mid-December? It was nudging 3.8%.

That is the real reason banks are raising interest rates. Especially on longer-term rates. It’s costing them more to borrow and lend to us for our mortgages.

This doesn't mean interest rates are going back to 7% or more.

Right now, the 5-year swap rate is where it was back in June 2025. And even back then, that rate felt pretty good.

But it does mean the low-interest-rate era of 2025 is coming to an end.

Property investors and borrowers should expect that interest rates (on the balance of probability) are more likely to go up than down.

The real test is in February. That’s when the Reserve Bank will reveal whether it’ll move the OCR and what its future plans could be.

If Dr Anna Breman, the Reserve Bank Governor, signals that rates could stay the same for longer … those swap rates could come down.

But if she’s worried that inflation could be back … expect those rates to rise.

I'll be back next month to tell you exactly how banks are responding and where interest rates could go next.

Mortgage broker for over 10 years, property investor and Managing Director at Opes Mortgages

Peter Norris, a certified mortgage adviser with 10+ years of experience, serves as the Managing Director at Opes Mortgages. Having facilitated over $1.2 billion in lending for 2000+ clients, Peter is a respected authority in property financing. He's a frequent writer for Informed Investor Magazine and Property Investor Magazine, while also being recognized as BNZ Mortgage Adviser of the Year in 2018 and listed among NZ Adviser's top advisers in 2022, showcasing his expertise.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser