Property Investment

What does a financial adviser actually do?

In this article, you’ll learn what a financial adviser does, what are the different specialties of the trade, and how they can help you on your investment journey.

Reviews

7 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

If you’ve ever been shopping for financial advice, it’s likely you’ve heard of enable.me.

These guys are pretty big names in the business. They’re lead by founder Hannah McQueen who (in our opinion) is one of the best financial advisers focusing on budgeting.

But are they the right financial adviser for you?

In this article, you’ll learn who enable.me is, what services they offer, and whether they’re the right fit for you.

And if you have a question, write your questions or thoughts in the comments section below.

enable.me is a financial advice business, specialising in budgeting.

Hannah McQueen has been growing the company for 15 years, which now includes 10 offices around New Zealand.

Our favourite part about enable.me, here at Opes Partners, is that they are arguably the best at helping you learn to budget. (We’ve got Hannah McQueen included in our top 10 financial advisers in NZ)

However, the business works a bit differently to some of the other financial advisers you may have used before.

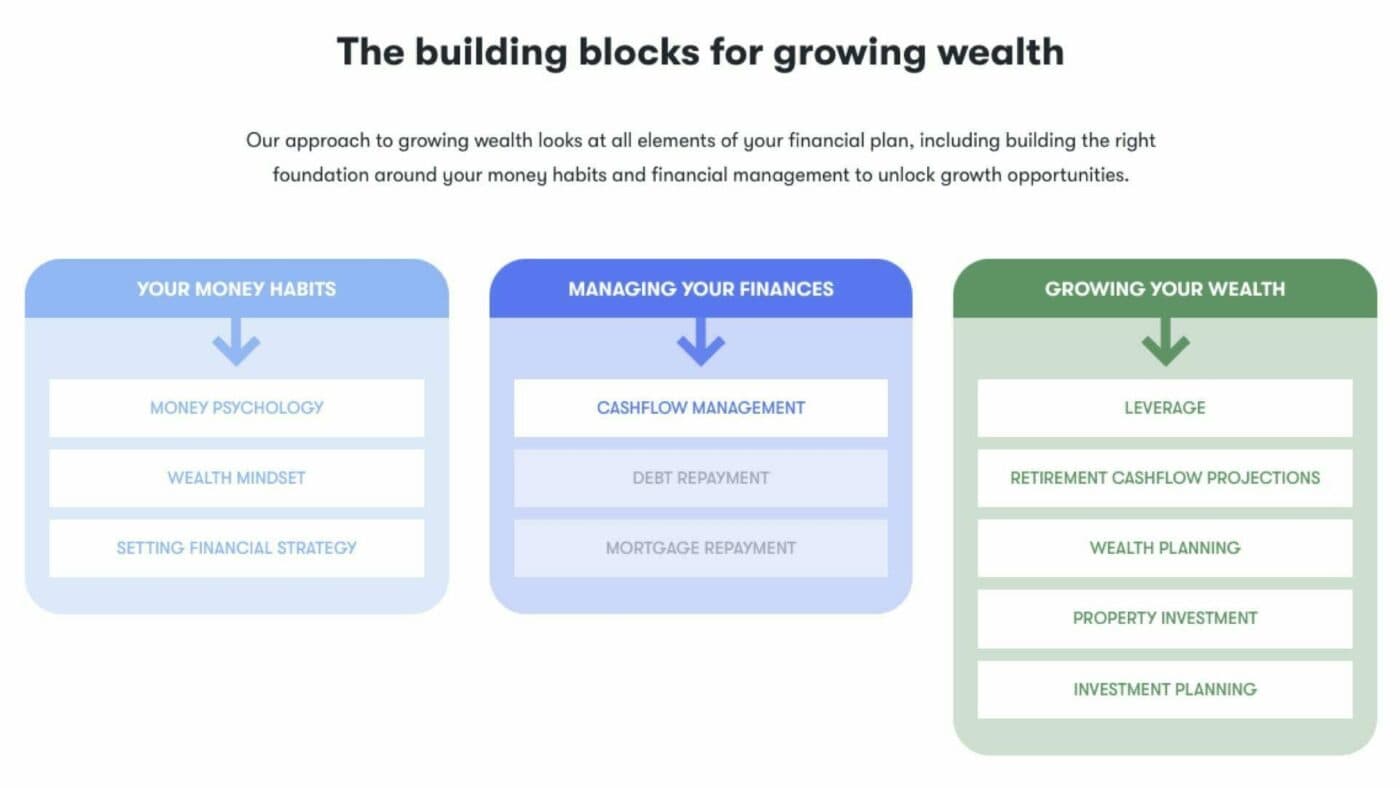

This is because enable.me’s core strategy is to:

Once you’ve got your money habits sorted (and your mortgage paid off) the team helps you grow your wealth.

This is different from some other financial advisers who:

Neither one is always right or always wrong. It comes down to what’s best for you.

Hannah McQueen is the founder of enable.me, and is the company’s current founding director.

Hannah started enable.me at 27, having skipped year 13 of high school to start university at 17. She achieved a Bachelor of Commerce first, then went on to graduate with a Masters in Taxation Law.

Hannah continued to work with the university to create and then patent a formula for paying off your mortgage faster.

But Hannah also figured out that the formula only works if you’ve got extra money to pay against your mortgage. So you need both the formula and the ability to manage your money that will help pay off your mortgage faster.

That’s why enable.me helps investors understand their spending habits and also gives them a financial coach. Together it makes investors accountable so they have the willpower to make better financial decisions.

On top of being a business owner Hannah is also a chartered accountant. She frequently appears on TV and radio, and has written 3 books.

Secure a comfortable retirement with 3 easy steps

Book your free sessionenable.me has 21 specialised coaches (offering online and in-person meetings). For example, they have advisers who specialise in:

After an initial consultation you’ll be hooked up with a coach to help you manage your money.

This person will help you gain good habits, so that you start spending less than you earn.

Once you’ve got your money habits down they’ll refer you to another adviser who can help grow your wealth.

enable.me offers two types of services – ‘programmes’ and ‘specialist services’.

enable.me offers 5 programmes, which are built around a particular theme and stage of life. They’re called:

For example “Mortgage killer” would be the right programme for an investor who has a mortgage and wants to pay it off faster.

In this programme an enable.me coach would use their own software (‘Nest Egg’) to analyse every single dollar you spend.

Together, you would go through every dollar and find where you can spend less money. You’ll then agree with them a budget on how much you can spend (and on what). Then it’s up to you to follow the plan.

In the first year you work with enable.me you might see your financial coach once every two months (depending on your programme). You’ll work with them to make sure you’re following the plan and make any adjustments.

Once you’re spending less than you earn (what they call stopping the “fritter”), you’ll have money left over when you get to your next pay day.

You and your coach will then decide what to do with this money. This will often be:

1. Pay off any consumer debts (e.g. credit cards or personal loans)

2. Pay down mortgage

3. Get the right insurance in place

The exact details of what you’ll do in each programme will change. But the core idea of analysing your spending, and then spending less, is the same.

enable.me also has (what it calls) specialist services. The two main ones are property investing and investing in managed funds.

For investing in property, enable.me refers clients to Momentum Realty (which is also owned primarily by Hannah McQueen).

This business focuses on finding New Build investment properties for enable.me clients.

Their other specialist service, enable.me investments, helps their clients invest in a range of assets.

enable.me programmes range from $3,000 to $12,000 in the first year, and $1,500 to $2,000 for every extra year.

The cost of each programme varies, depending on which one is right for you and different payment options.

The first step to becoming an enable.me client is to book a 90-minute consultation. This costs $400, but is often discounted to $250.

Here at Opes, our opinion is that enable.me is one of the best financial adviser at budgeting, with a focus very much on day-to-day money management.

We have also worked with many enable.me clients – helping them buy investment properties. And many of these investors say enable.me has helped them be better with money.

However, that doesn’t mean they are going to be the right financial adviser for every single person or investor.

Well, not everyone wants to be better at managing their money. And some aren’t interested in counting every dollar they spend.

There can also be situations where an investor will have multiple financial advisers, and those advisers may have different opinions on what is the best financial decision for you.

This is generally because of different specialties.

For instance, let’s say Bobby, an engineer in her late-20s, owns her own home. She engages enable.me to get budgeting advice.

As part of Hannah’s service, she would analyse what Bobby is spending money on and she might suggest Bobby spend less in order to pay down her mortgage more quickly.

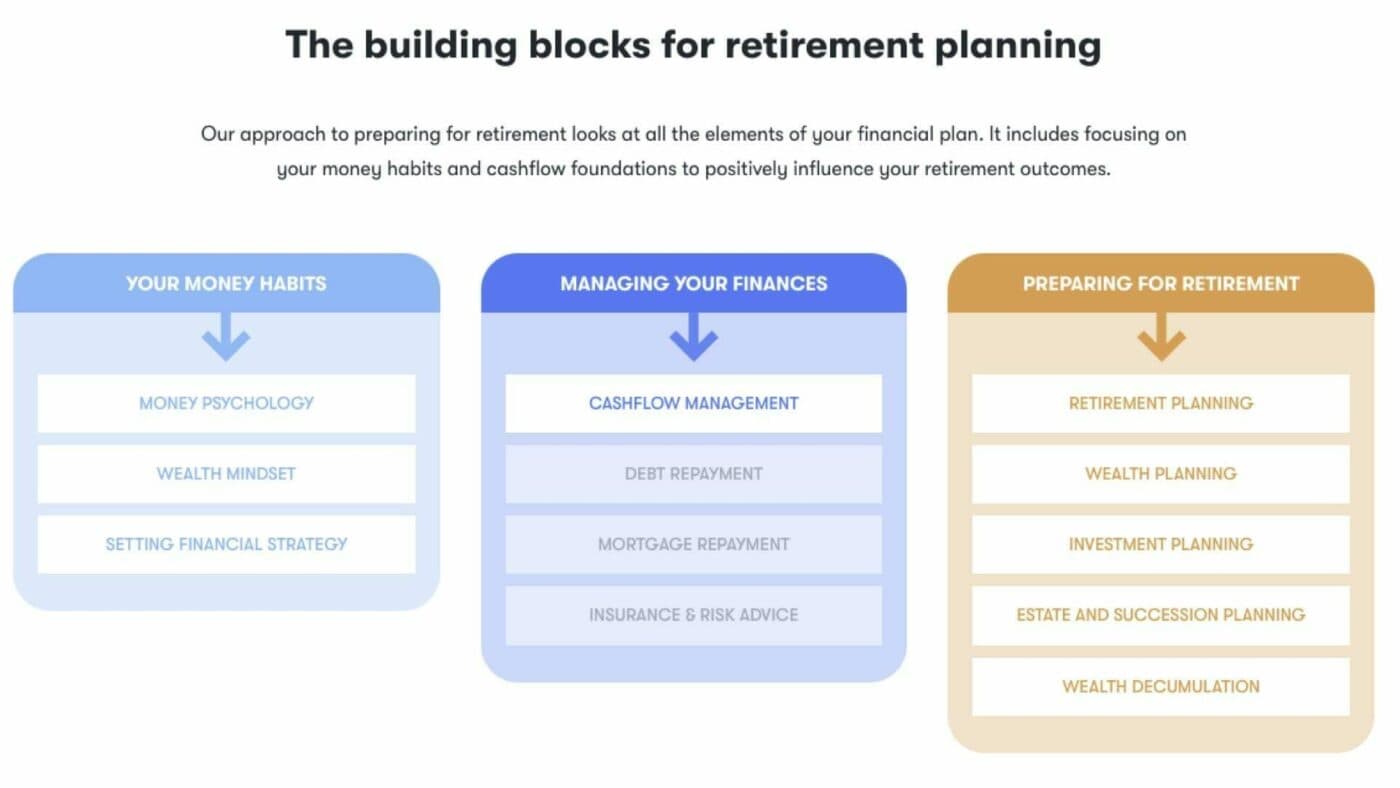

But now let’s say, after working with Hannah for a few years, Bobby is now interested in planning for her retirement, and she wants to stop working well before the age of 65.

So, Bobby books an appointment with Andrew Nicol, of Opes Partners (that’s us), who helps Bobby identify a 2-bedroom townhouse in Christchurch that she’d like to purchase as an investment.

It’s likely Bobby will have different advice from both financial advisers:

Hannah, from enable.me, would likely say: “Your goal is to pay off your mortgage first. We need to stick with that strategy and pay down debt.”

Andrew Nicol, from Opes, might say: “Your goal is to retire early, you need assets outside your main home so you can use them in retirement. It’s time to invest.”

Now, this doesn’t mean either financial adviser is wrong – it’s just differing strategies. Read our whole article on what to do if your financial advisers are saying different things.

The bottom line is enable.me is a good option for someone looking for financial advice who wants to be better at budgeting.

Ultimately - as much as you can get financial advice from lots of professionals - you (as the investor) still have to make a decision.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser