Wealth

Property vs shares vs funds vs term deposits

In this article, you’ll learn which asset class earns the highest return based on the top-up you would usually put into your investment property.

Property Investment

14 min read

Author: Nefe Teare

Financial adviser at Opes. Formerly a senior adviser at one of NZ largest investment firms. Owned 3 properties by 30.

Reviewed by: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

There are many investment options in New Zealand for those who want to grow their wealth.

There is no “best” choice, as each option has pros and cons.

What option is right for you depends on your situation, how much risk you want to take and how much money you have.

In this article, you’ll learn about the Top 8 Best Investments in NZ. You’ll learn the pros and cons. That way you can make the right decision for you.

Before we get into it, you should know that here at Opes Partners we help investors buy New Build properties.

So you might think, “Nefe, you’re just going to be biased and tell me that property is the best!”

I’m not going to do that.

Before I came to Opes I worked as a financial adviser focusing on shares, KiwiSaver and managed funds, so I’ve seen both sides.

That’s why my approach in this article is simple: I’ll explain the pros and cons of each investment as honestly as possible. Then, I’ll take a step back so you can decide which is the best investment for you.

Let’s start with one of the most popular investments in New Zealand – KiwiSaver.

KiwiSaver is a voluntary retirement savings scheme for Kiwis, and any Kiwi with a job can sign up.

Once enrolled, you get to choose to contribute either 3%, 4%, 6%, 8% or 10% of your pay to KiwiSaver.

The best part of KiwiSaver is that your employer also has to contribute 3%—that’s if you put in at least 3% of your pay as well. This means your investment gets matched by your employer, effectively doubling your money. And then the government puts up to $521.43 a year in too, although there are some rules around this.

Some employers will even put in more money. For example, some government employers will match your investment up to 4.5% of your pay.

Another benefit is that you get to choose the type of fund your KiwiSaver money goes into, so you can decide how your money is invested.

The big pro for KiwiSaver is you don’t need any money upfront to invest, just a paycheck.

If you’re self-employed, there’s less benefit from going into KiwiSaver. After all, if you match your own contributions, it’s just your own money anyway, although some people will still put a little bit of money in to get the government’s contribution.

The downside of KiwiSaver is that your money is locked away until you’re 65, unless you're buying your first home. That means if you need money for an emergency, you can only access it in very rare circumstances, and you have to apply to get your money out.

Next up are managed funds. These work very similar to KiwiSaver.

Next up are managed funds. These work very similarly to KiwiSaver. A managed fund pools your money with other investors and spreads it across different investments.

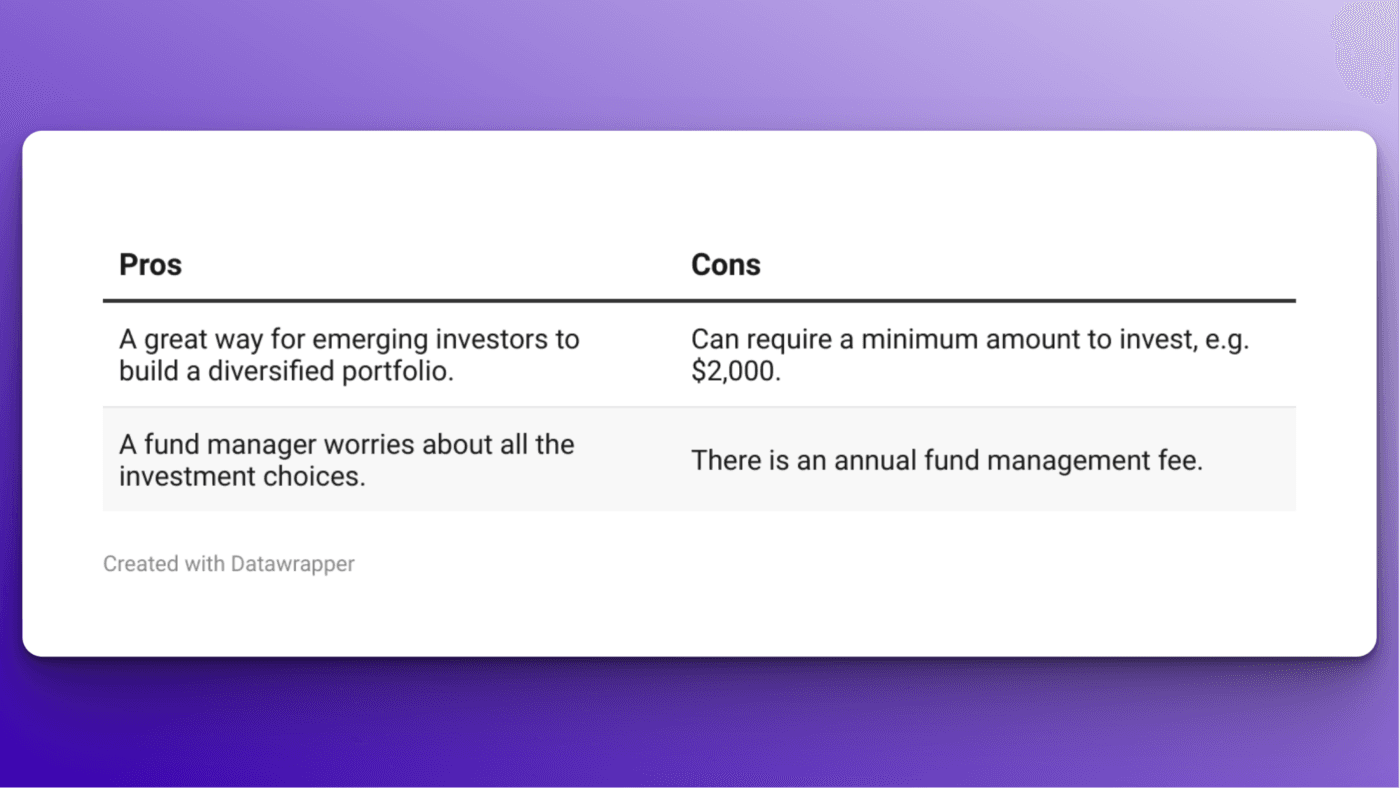

This makes them a great way for emerging investors to build a diversified portfolio without having to pick individual investments.

A fund manager chooses the investments, rather than you investing directly.

This means you don’t have to worry about selecting individual stocks, bonds, or property investments—the fund manager takes care of all the investment choices for you.

You can choose different types of funds, from conservative to high risk.

The conservative funds tend not to go up in value as fast, but their value is more stable. There aren’t as many big ups and downs.

Higher risk, aggressive funds, tend to have more ups and downs. But, over time, they tend to give you higher returns.

Conservative funds tend to be better if you need to use your money soon (for example, if you’re about to buy a house and have saved a deposit).

In that case, you’re more concerned with not losing money than you are worried about long-term returns.

On the other hand, higher-risk funds tend to be better if you don’t need your money for 8+ years. In that case, you’ve got time for your investments to recover if they go down in value.

Managed funds enable investors to buy into a diversified portfolio of assets. You can invest in everything all at once: shares, term deposits, and property.

However, one thing to consider is that many managed funds require a minimum investment to get started—often around $2,000. This can be a barrier for some investors who may not have that amount ready to go.

The downside is that there is an annual fund management fee, the same as any business. This fee is charged to cover the costs of managing the fund and is usually a percentage of your total investment.

For example, if you invest $10,000 in a fund that charges 1%, you’ll pay $100 per year to invest.

As your fund increases or as you invest more ... you pay more.

Also known as stocks or equities, when you buy shares you buy a percentage of ownership in a company or a financial asset.

You make money by collecting dividends, which is a share of the company’s profits. These are generally paid every quarter.

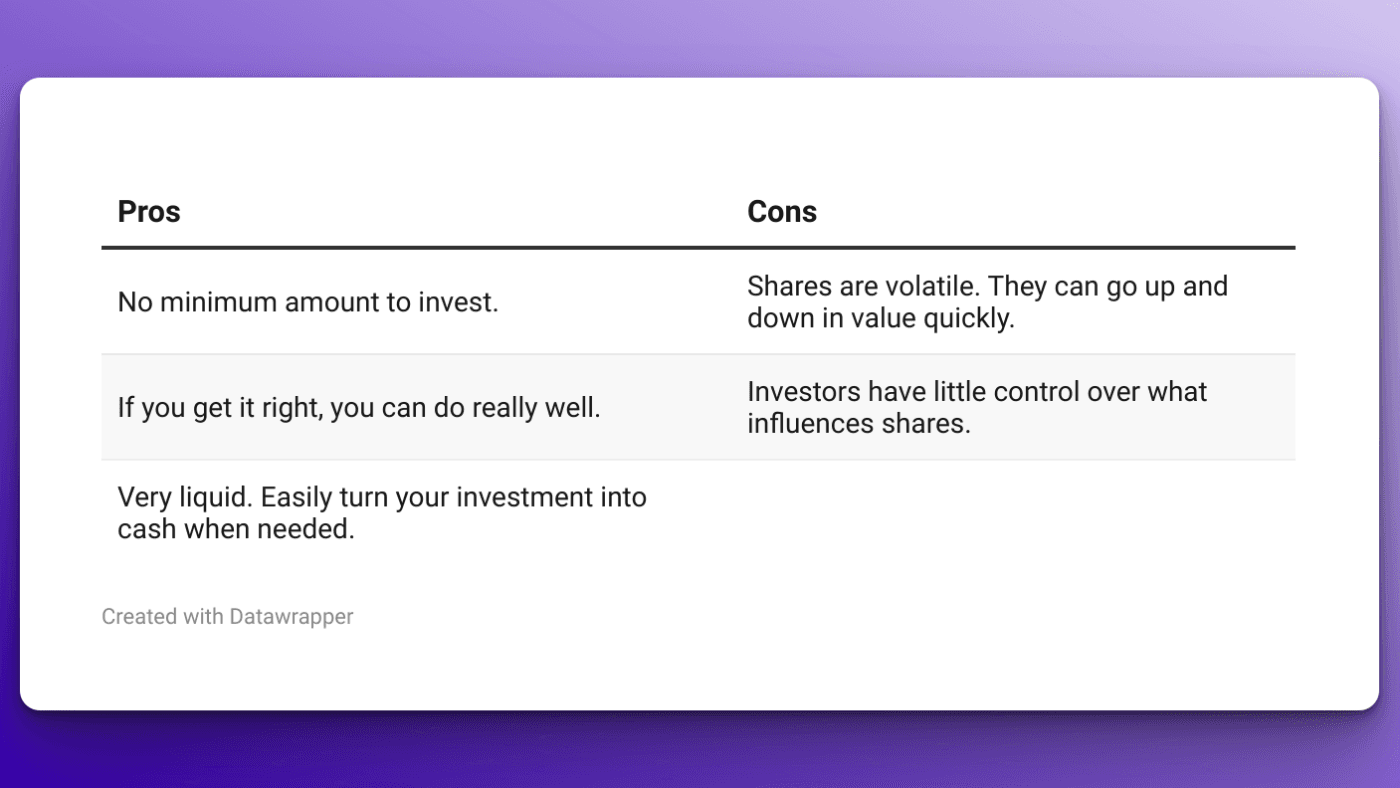

You also make money by the shares going up in value. And if you get it right, you can do really well. Some investors have made significant returns by picking the right shares at the right time.

For instance, some companies (growth stocks) often don’t pay dividends. However, they will reinvest funds to increase the value of the company and the shares.

Shares are a liquid asset. This means they’re very flexible—you can easily turn your investment into cash when needed. You can buy and sell as you please. All you need to do is sell.

But, if the value of your shares has just taken a hit, you might be reluctant to sell too quickly.

There are quite a few apps, like Sharesies, that have popularised the idea of investing in single shares like Apple, Tesla or Nvidia.

Think about it like this: if you had $100,000 to invest in shares—you can sell 5% of that at any time. There’s usually no minimum amount to get started, so you can start small and build up over time.

If you have bought a property with $100,000 (as a deposit), you can’t sell 5% of a house.

It's also easier to drip-feed small amounts of money into different shares.

If you had $100,000 to invest, you can’t drip-feed that amount into a whole bunch of properties.

Shares also have drawbacks. They are volatile, and prices can go up and down quickly. You as an individual investor often have no control over these. Investors have little control over what influences share prices—factors like the economy, interest rates, and company decisions can all play a part.

So, while shares are more liquid, they are often less stable.

Next up, let’s look at term deposits.

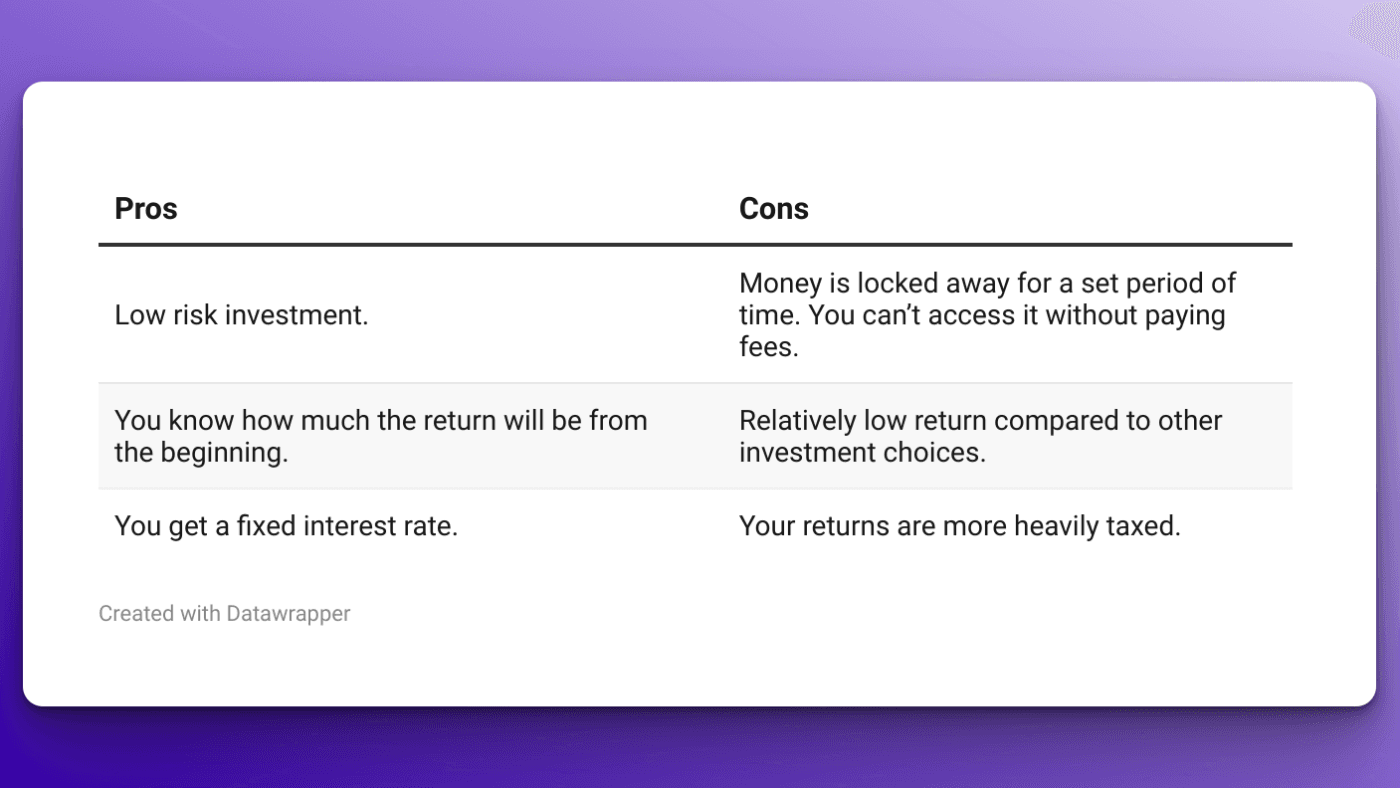

A term deposit is where you take a lump of money and lock it away in a bank account for an agreed length of time. In return, you get a fixed interest return on that money.

For example, I recently had $10,000 available, so I put it into a term deposit at 6% for a year. That means the bank will pay me a 6% return over the next year. That’s $600.

So at the end of the year, I get my $10k back, plus the $600 return (minus tax).

Term deposits can be a good way to generate income from your money if you don’t need that cash straight away.

Even better, you can choose to get that money paid out every quarter if you want (and sometimes monthly). So in my case, I could get paid $150 a quarter from that investment.

The interest rate you get depends on what term you choose and how much you can put away. The rate stays the same for the entire term.

Compared to alternatives (e.g. managed funds and shares) term deposits are pretty safe. You know what your return will be upfront. This makes them a good option for conservative investors looking for a low-risk investment.

The main benefit of this is that the cash is paid to you.

The downside is it’s taxable because it counts as income. If I get a 6% return on my investment, a third of that might go to tax.

So my after-tax return is 4%. At the moment inflation is 4%, so my inflation adjusted after-tax return is effectively 0%.

That means you can be investing your money in a term deposit and still be going backwards.

Another downside is they invest your money and can’t get it back … not without paying some hefty fees. Your money is locked away for a set period of time. You can’t access it without paying fees.

And while it’s safe, the return you get is relatively low compared to other investment choices.

Plus, your returns are often more heavily taxed than other types of investments.

We’re just over half-way through this list. So now, let’s think about property.

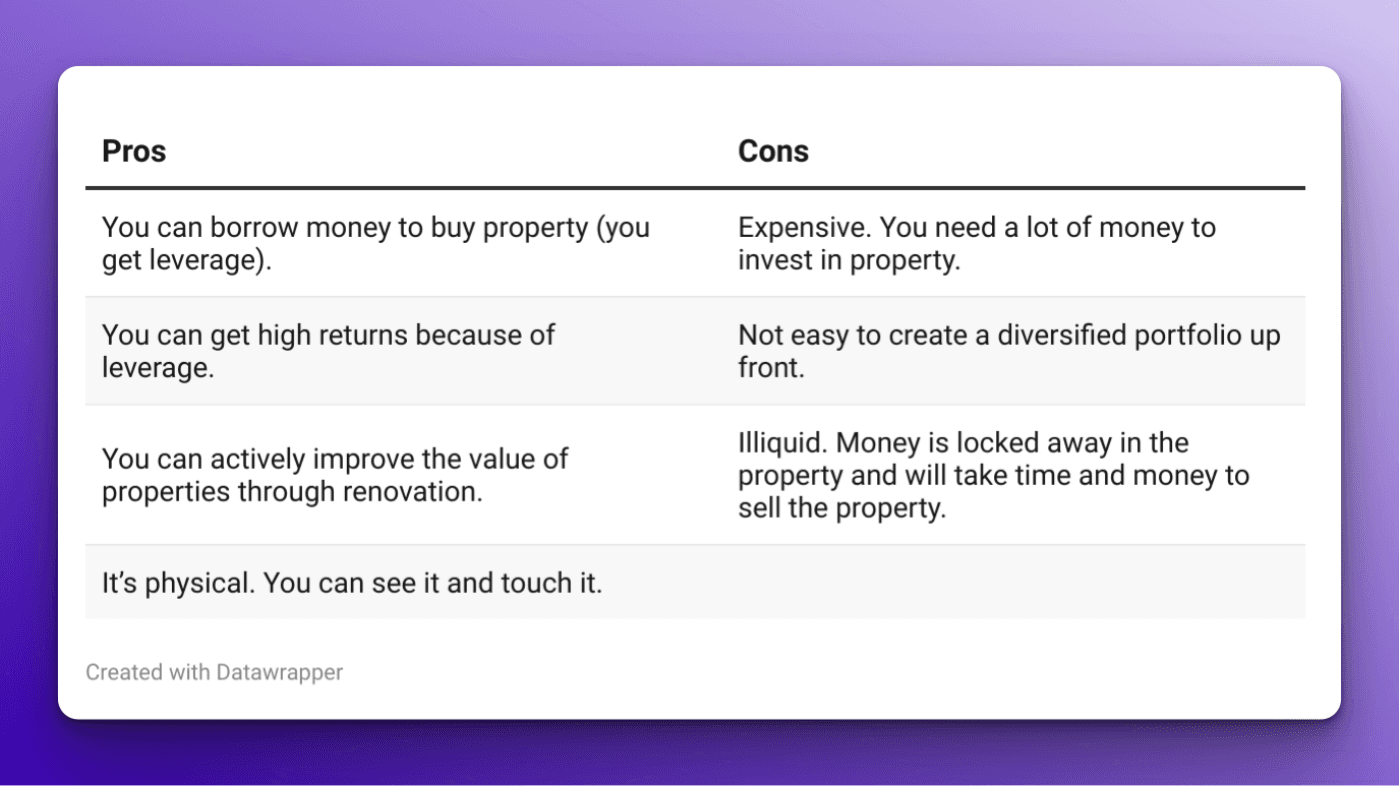

The thing property has, that others don’t, is you can borrow against property. You get leverage.

You can buy a high-priced asset and only front a portion of the money.

This can help generate substantial returns.

For instance, I might have $100k and use it to buy a $500k property – borrowing the rest of the money from a bank.

If the house goes up in value to $600k (a 20% increase), then I just made $100,000.

I doubled the value of my deposit, even though the property market only went up 20%.

So I used a lot of the bank’s money to buy the property, and then I get to keep all the capital gains.

That’s why leveraged property can earn much higher returns than some other types of investment. You can also actively improve the value of properties through renovation, which can increase your returns even further.

And unlike shares or managed funds, property is a physical asset—you can see it and touch it. Some investors find that reassuring.

But, while property can earn high returns, it is illiquid. You can’t access all that money in a hurry.

It’s going to cost you money (in fees and commissions) to get access to the money when you sell it. You’ll need to use a real estate agent and a lawyer.

This can also take time, whereas other asset classes can be sold down and turned into cash quickly.

Another downside to property is diversification. It’s hard to diversify your portfolio compared to other investments.

This is because many investors can’t go out and buy 10 properties all at once to build a diversified portfolio.

Instead, you might only be able to buy four over several years. That makes it harder to spread your risk. Whereas with shares, it’s not hard to buy a couple of shares in several different companies. It’s not easy to create a diversified portfolio upfront because of this.

Lack of diversification risks putting all your eggs in one basket or all your investment money in one or two houses.

Property is also expensive. To get started in property you need to have a 20% (for a new build) or a 30% for an existing one.

If the investment property you want to buy costs $1 million that’s $200k or $300k to get started. You can borrow that money against your own house. You don’t need it in cash.

But, that’s still a lot of money!

Take the quiz and get your results in 2 minutes

Find out if I can investNow let’s come to the next investment I often get asked about – Bonds.

A bond is a loan from an investor to entities like governments, local councils or businesses.

These entities are called bond issuers.

Like a share market, individual bonds can be traded on bond markets. Many managed fund providers also offer bond funds.

Bonds are issued for a set length of time, and are paid back in what’s called “coupons”.

It might sound a bit like a term deposit, but there are some important differences.

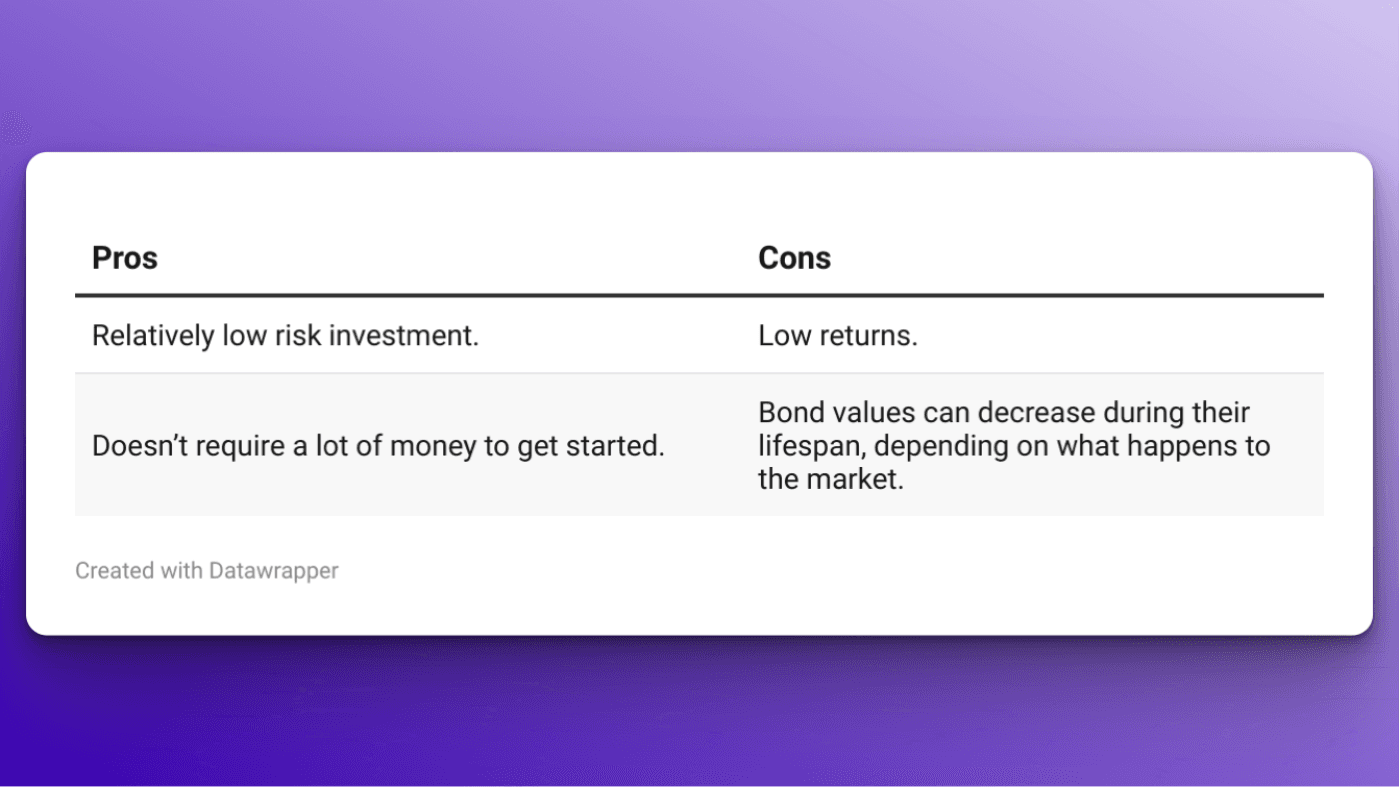

Firstly, because bonds can be traded, the value of them goes up and down.

For instance, if interest rates fall, then the value of existing bonds increase. That’s because those bonds were set when interest rates were higher.

Because of this, when interest rates rise the values of existing bonds generally fall. Bond values can decrease during their lifespan, depending on what happens to the market.

The return on investment at the maturity date is set at the beginning. If the investor holds the bond to maturity, they will get the same amount of money back.

Bonds are typically less risky because you’re lending to a government body rather than say lending to a company that could go under. A local government isn’t as likely to go bust. This makes bonds a relatively low-risk investment compared to other options.

But if their credit rating falls, this decreases the bond’s value.

This means government bonds usually have lower returns than corporate bonds because they are lower risk. In general, bonds have lower returns compared to other investment options like shares or property.

Many bonds issued have a $1,000 or $5,000 minimum investment. This means they don’t require a lot of money to get started, especially compared to property investments.

At No.7 on this list, let’s dig into peer-to-peer lending.

Peer-to-peer lending is when you lend and borrow money between people, rather than going to a bank.

So it’s similar to lending money to a friend, but now it’s grown into an industry.

Peer-to-peer lending happens online.

It can be a good option for borrowers to get money if they don’t meet the bank’s lending criteria. They also usually offer better interest rates, so it’s cheaper.

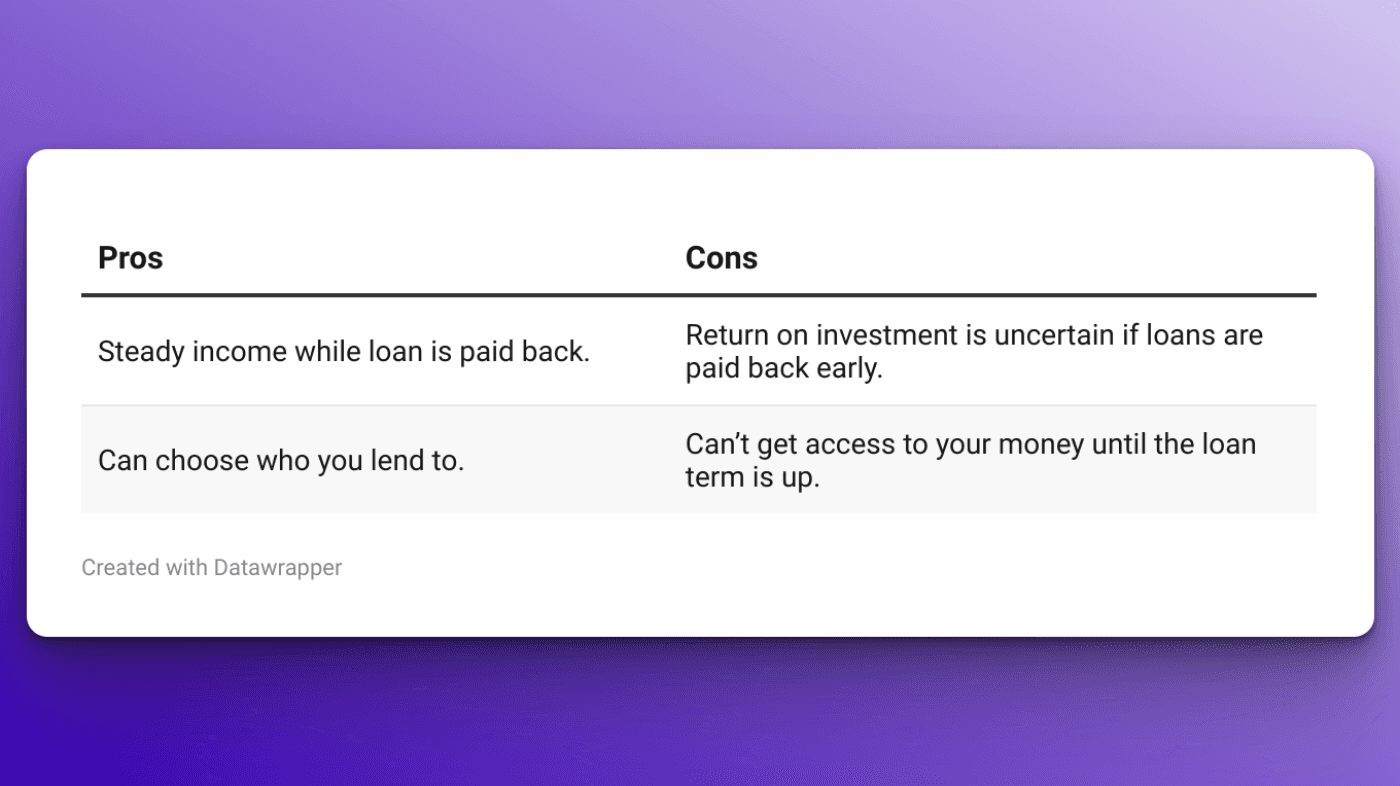

For investors, you get the benefit from a steady stream of income as your borrower makes the repayments every month.

You also get control over who you’re lending to.

So, if you’re a bit more risk averse you can demand a certain credit score from borrowers. It’s not like you’re just closing your eyes and rolling the dice on who you lend to.

But there are some downsides too because a borrower can repay the loan early, you might not get the full return you expected. This makes your return on investment a bit uncertain if loans are paid back ahead of schedule.

Also, your money isn’t just locked away, it’s given away. So you can’t get your investment back until the term is up unless the borrower repays it in full.

You can invest with Squirrel for peer-to-peer lending. The minimum amount is $500, all the way up to $2m.

Finally, let’s dig into cryptocurrencies.

Cryptocurrency is a digital currency.

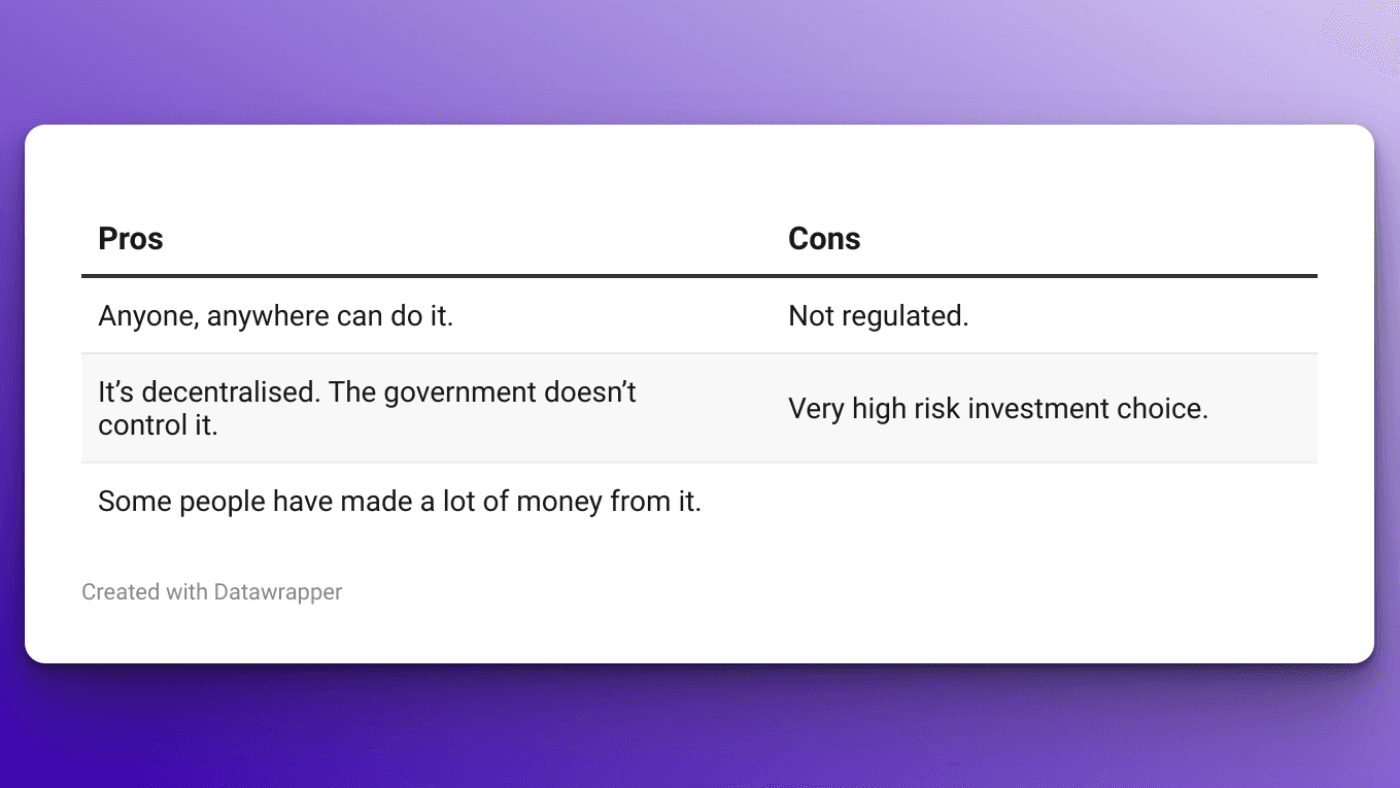

It operates on a “decentralised system”. This means all records and transactions are verified and recorded on what is called a “block chain”.

This sounds very complicated, and it’s hard to de-jargon.

But some people believe that in the future lots of people will use cryptocurrencies, rather than the money that’s created by central banks.

When most people think of cryptocurrency – Bitcoin often comes to mind.

Bitcoin was the first cryptocurrency, but certainly not the last.

Effectively, people make money in crypto by the currency going up in value. For instance, in 2010 the price of Bitcoin was $0.30 USD. Today it’s over $60,000 USD.

So some have done very well out of crypto, mainly because people believe it will go up in value and be used to facilitate transactions in the future.

There are a lot of people out there anti-crypto. It's a relatively new asset, and there is little regulation around it.

On top of that, lots of the increases in value come from speculation. Crypto isn’t often used to facilitate transactions. Lots of people just use it as an investment, thinking it will keep going up in value.

The right investment for you will depend on how much risk you want to take, how much money you have, and what your future goals are.

Again, while I help investors buy property, not everyone is in a position to invest in property right now. But that doesn’t mean you can’t invest.

Maybe you’ve got some cash locked away in a savings account that would work well as a term deposit or in a managed fund.

Maybe you want to up your KiwiSaver contributions and switch to a growth fund.

At the end of the day, the best investment for you will depend on your personal situation. But whether you’re investing in property, shares, or KiwiSaver, there are plenty of options available right here in NZ.

Financial adviser at Opes. Formerly a senior adviser at one of NZ largest investment firms. Owned 3 properties by 30.

Nefe is a Registered Financial Adviser at Opes Partners with 7 years’ experience in financial services. Before joining Opes, she was a senior adviser at one of New Zealand’s largest investment firms, managing $13 million in KiwiSaver and managed funds. She’s helped clients invest over $26 million in property and owned 3 properties before her 30th birthday.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser