Property Investment

What makes property go up in value?

Despite the fact that NZ’s median property price increased 3.7x over the last 20 years, some investors are still cynical of market-made capital gains.

Property Investment

17 min read

Author: Laine Moger

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

A financial adviser is your professional planning partner. Your financial wealth planner. Your investment “hype girl” (or guy).

They wear many hats, and can act as your financial educator, goal setter, and coach.

Whether you want to retire at 55, send your kids to university or help them onto the property ladder – you can enlist the skills of a professional (the financial adviser) to make those goals a reality.

All financial advisers can give broad advice on your entire financial situation.

But most will typically specialise in one specific area, such as property investment, investment, budgeting, mortgages or insurance.

In this article, you’ll learn what a financial adviser does, what are the different specialties of the trade, and how they can help you on your investment journey.

Do you have a question or comment about financial advisers? Feel free to leave your thoughts in the comment section at the end of the page.

A financial adviser is a professionally recognised expert, who is qualified and paid to give you advice on your personal financial situation.

Said another way, you sit down with a financial adviser and say:

So, just like you would hire a personal trainer to plan your fitness regime to meet your weight loss goals – you hire a financial adviser to create a plan for your finances.

A financial adviser will work with you to figure out:

Essentially, you are using their expertise to help reach your financial goals.

That doesn’t mean you need to know exactly what your financial goals are right now. Your adviser will also help you figure out what those goals are.

Advisers tend to specialise in a couple of different areas. These areas are:

This is where you use an adviser to plan your property portfolio, and find you properties as well.

This is what we do here at Opes Partners. We help investors plan their portfolios, then buy new build rental properties. But, we don’t give advice on other investments or budgeting. We’re focussed on property.

If you want to invest in property, you don’t have to use us. There are other companies too.

You also don’t have to invest in property. Another popular option is investing in shares and funds.

A share is when you buy a small part of a specific company. And a fund is where you put your money into a pot with other investors, and a professional invests on your behalf.

This tends to work well for people who already have cash to invest.

Some of the big names are: Milford (funds), Craigs Investment Partners (shares and funds), Fisher Funds (funds), NZ Funds (it’s in the name).

Like us at Opes Partners, these companies focus on what they’re good at. They don’t give advice on residential property. They focus on shares and funds.

It’s likely you’ve heard of EnableMe. These guys are the best financial advisers who focus on budgeting.

They help you manage your money both coming in and going out of your bank account. So, they help you get good habits, and grow wealth.

Once you’ve got your money habits down, that’s where they’ll refer you to another adviser who can help grow your wealth.

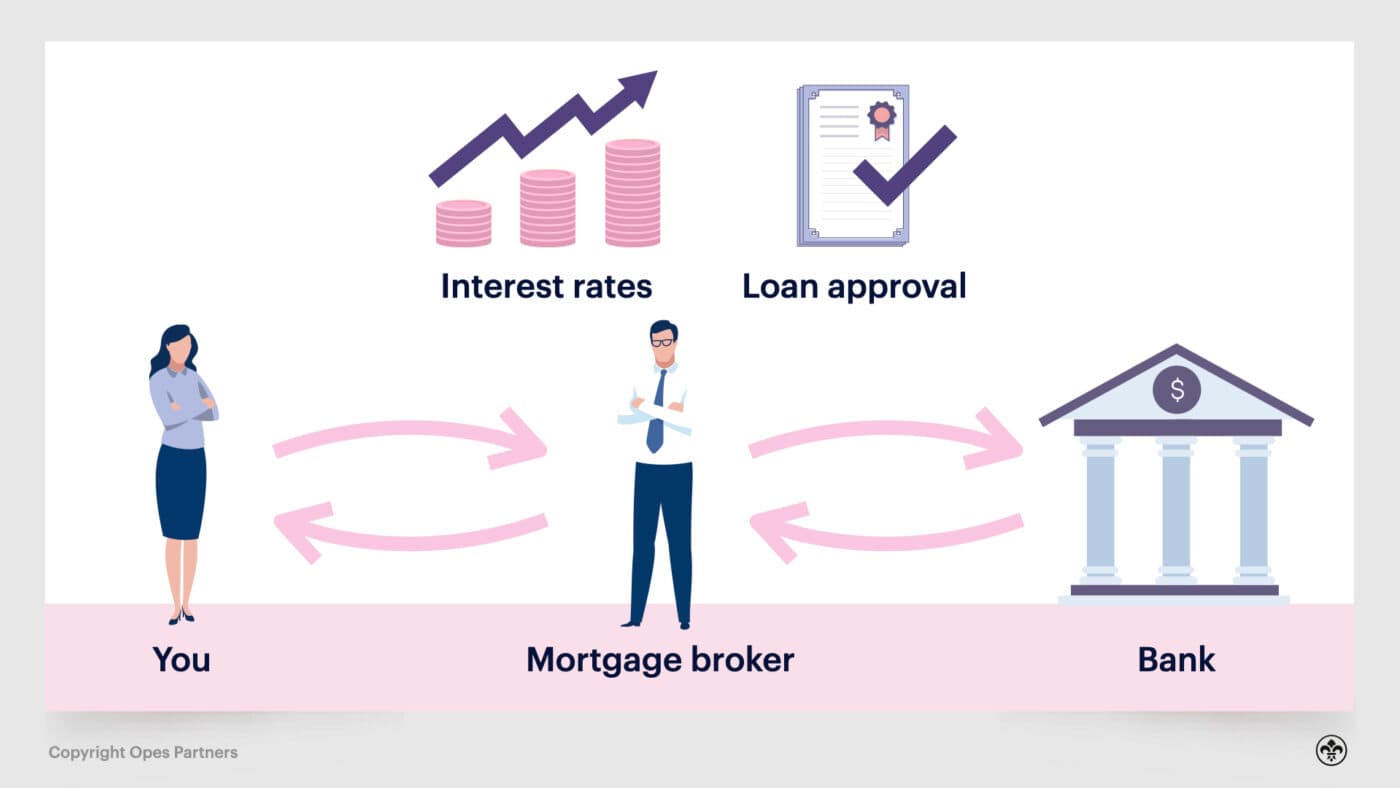

Next you’ve got mortgage advisers. These financial advisers are there to help get your mortgage approved, and then structured correctly.

They can give you advice on what interest rate to lock in, and how to pay off your mortgage faster.

Our colleagues at Catalyst Financial are a good example of advisers who specialise in mortgages.

Then you’ve got other big names like Squirrel, Loan Market and NZ Home Loans – all mortgage brokering firms that have financial advisers who specialise in mortgages.

And finally you’ve got insurance advisers. Think names like Axico and Apex. Many mortgage advice companies will also have insurance advisers.

For example at our sister-company, Catalyst Financial, we have mortgage and insurance advisers.

Yes, these insurance brokers are financial advisers too. This is where the line is drawn between insurance broker and a direct insurer – direct insurers don’t give advice

When most people think of a financial adviser, they think of an investment adviser. Someone who is going to help them buy more assets.

So for this section, we’re just going to focus on property investment and investment advisers.

What can they actually help you do?

Top of the list, most people use a financial adviser to help them plan for their retirement.

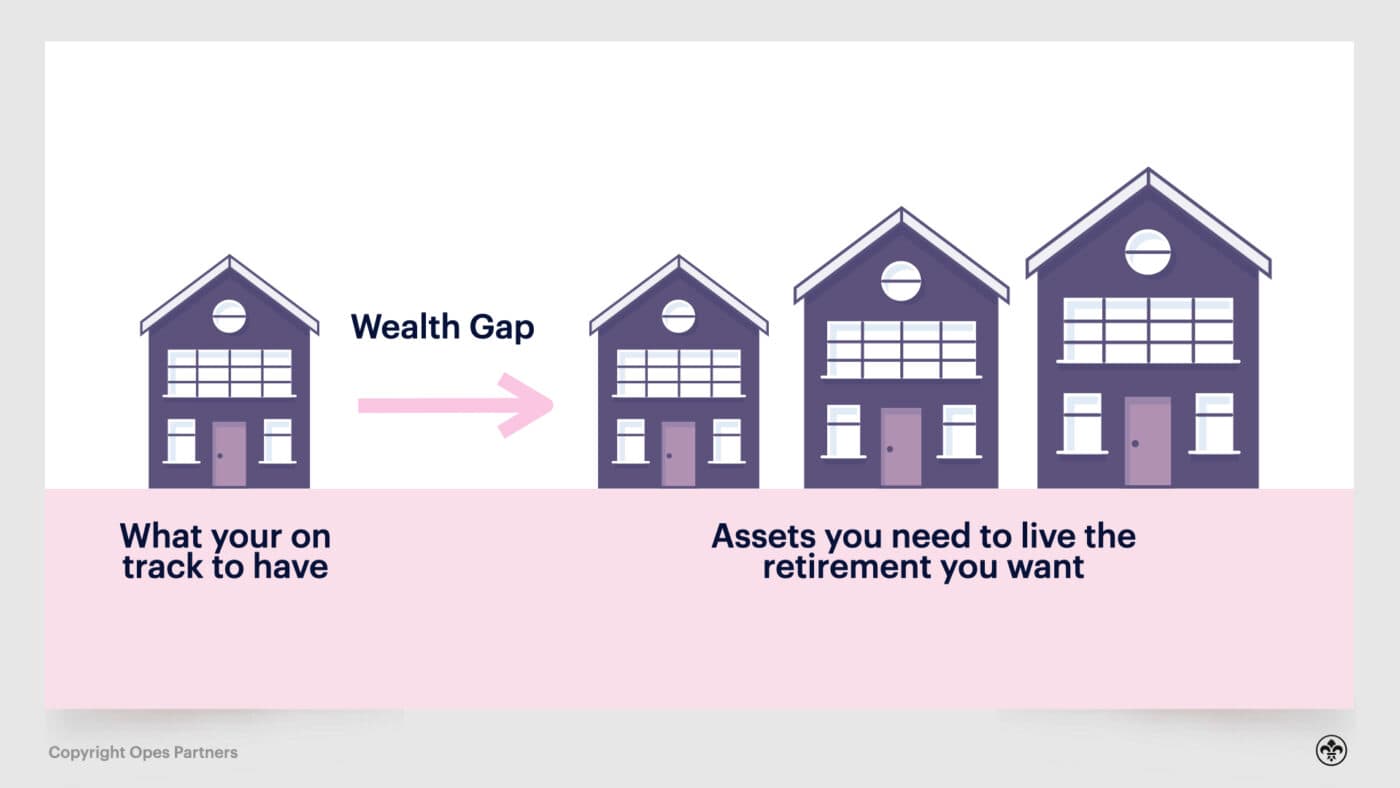

And that’s because most people have a “wealth gap.”

There is a difference between the assets you’re are on track to have, and the assets you’ll need to live the lifestyle you want to live in retirement.

And it’s important to note that according to the latest NZ Retirement Expenditure Guidelines report by Massey University, superannuation doesn’t cover what Kiwis are actually spending in retirement.

How do you close this wealth gap? You buy more assets. And your financial adviser will help you figure out hwo many assets you need.

This is exactly what we do here at Opes Partners.

You don’t have to just talk to your financial adviser about goals some 10 - 20 years in the future.

A financial adviser will also be able to help you plan for things like: renovating your home, planning a big holiday overseas, or future private schooling for your children, if that’s important to you.

A wee word of warning, that doesn’t mean it’s always achievable to do everything – i.e. Live a good retirement, go on lots of overseas trips, live in a newly renovated home and send little Sally and Jimmy to the best private schools.

But, your financial adviser will have a discussion about what your priorities are so you can make an informed decision about what’s realistic for you.

Financial advisers are also the best people to speak to if your financial situation has changed.

So, many Kiwis will seek out financial advice when they have:

Or if you’re just plain feeling like you're not getting ahead, and you really want to.

These are the sort of triggers that would make someone think “I need to go and see a professional and get some financial advice.”

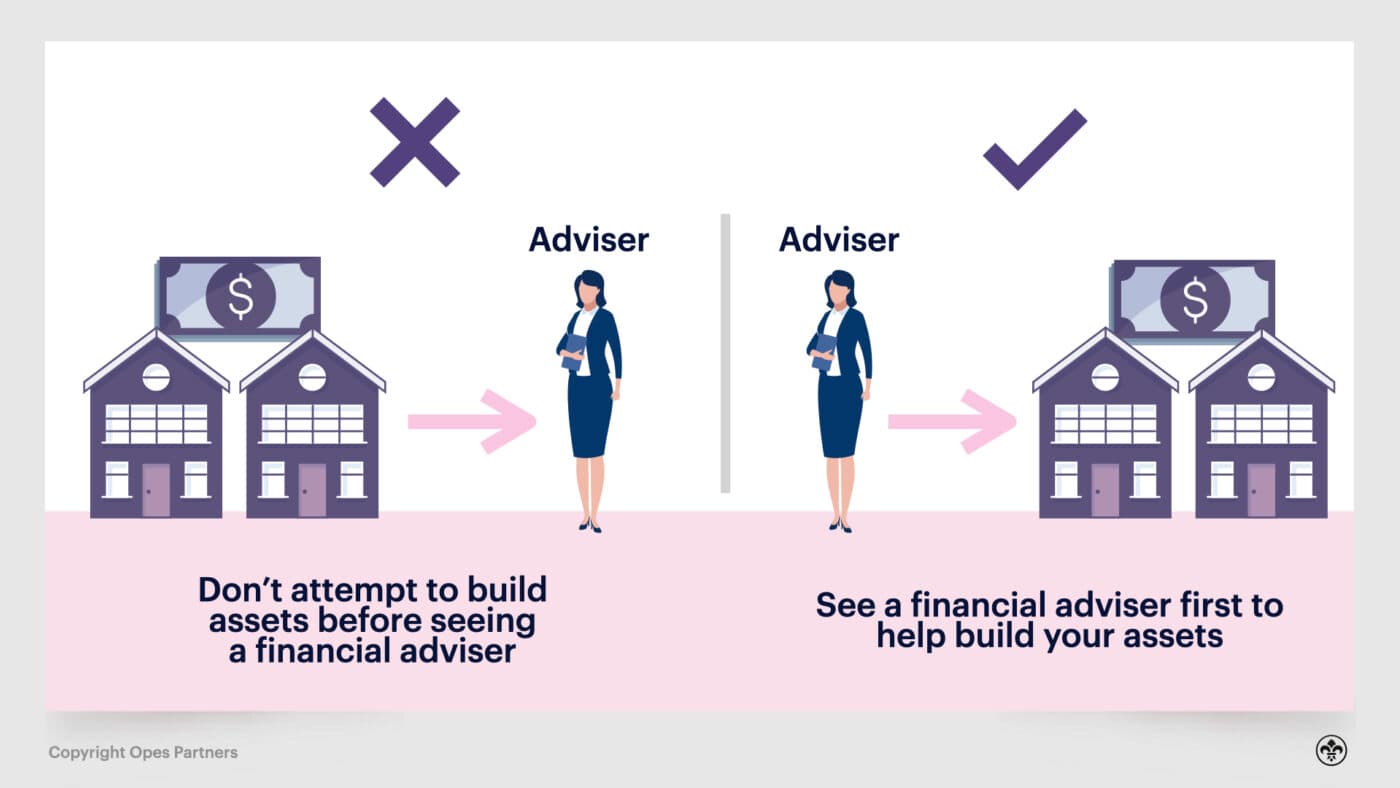

Some Kiwis hold off on using a financial adviser because they think they need more money before they use one.

One of our financial advisers, Toby Pascoe, says “I met with a couple who admitted they were scared of meeting me after I was a guest on the Property Academy Podcast.”

“They said they thought they needed more assets before they sat down to talk to a financial adviser.”

This is a bit like thinking you need to get fit before starting to use a personal trainer at the gym. Or that you need to clean your house before a professional cleaner comes over.

The way you build your assets is by using a financial adviser. You don’t attempt to build your assets first and then use a professional.

The main reason investors hold off is that they feel a bit embarrassed. They think they need more assets or should be doing better. So they don’t want to talk about their financial situation until they’ve sorted it.

Just know that financial advisers are there to help you improve your situation. And because they work with many, many Kiwi couples every year, they’ve seen every financial situation under the sun.

For example, another Opes Partners financial adviser, Stevie Waring, says “I’ve worked with couples who have lots of money and I’ve worked with couples with very little money. No matter who I work with, my goal is to help every investor get closer to their goals.”

There are two ways a financial adviser typically gets paid. Either through commission, or through a direct fee.

The company/financial adviser can get paid a commission from a “product provider” when they recommend an investment and you take it up.

What does that mean?

Let’s say you call up a stockbroker and they recommended a particular share to invest in. You probably won’t pay them a fee directly. Instead, they might get paid a fee if you take up that recommendation.

Or let’s say an adviser recommends you invest in a specific managed fund. That fund will charge you an annual fee for investment your money e.g. 1% of the money you’ve invested.

The adviser who recommended that fund will then earn a commission.

That doesn’t mean that you pay a higher management fee to the fund, e.g. 1.2% of the money you’ve invested. The commission is already baked into the fee.

Here at Opes – this is how we work – we have relationships with 58 different property developers around the country. We fund the new build properties that we think are a good investment, then we recommend them to investors.

If you agree that it’s a good investment and decide to buy a property, then we earn a fee from the developer. That way we don’t have to charge you a fee for the service.

The second way financial advisers make money is by charging you a fee directly.

This is more common if you’re not investing or taking out an insurance policy or mortgage … so, if you’re just receiving advice.

For instance, let’s say you are asking for help on a specific financial problem like: “should I sell this property and buy another one I’ve found?”

In this case it’s often charged by the hour, which is usually in the region of $350 an hour.

If we go back to EnableMe, they give budgeting advice. This costs between $3k - $12k a year for the advice given in one of their 5 programmes.

Darcy Ungaro, from Ungaro and Co. charges around $370 an hour for his financial planning services.

Some people think an adviser is there solely to choose the investments.

While it is true that a financial adviser will often help you decide what to invest in, that’s not all they bring to the table.

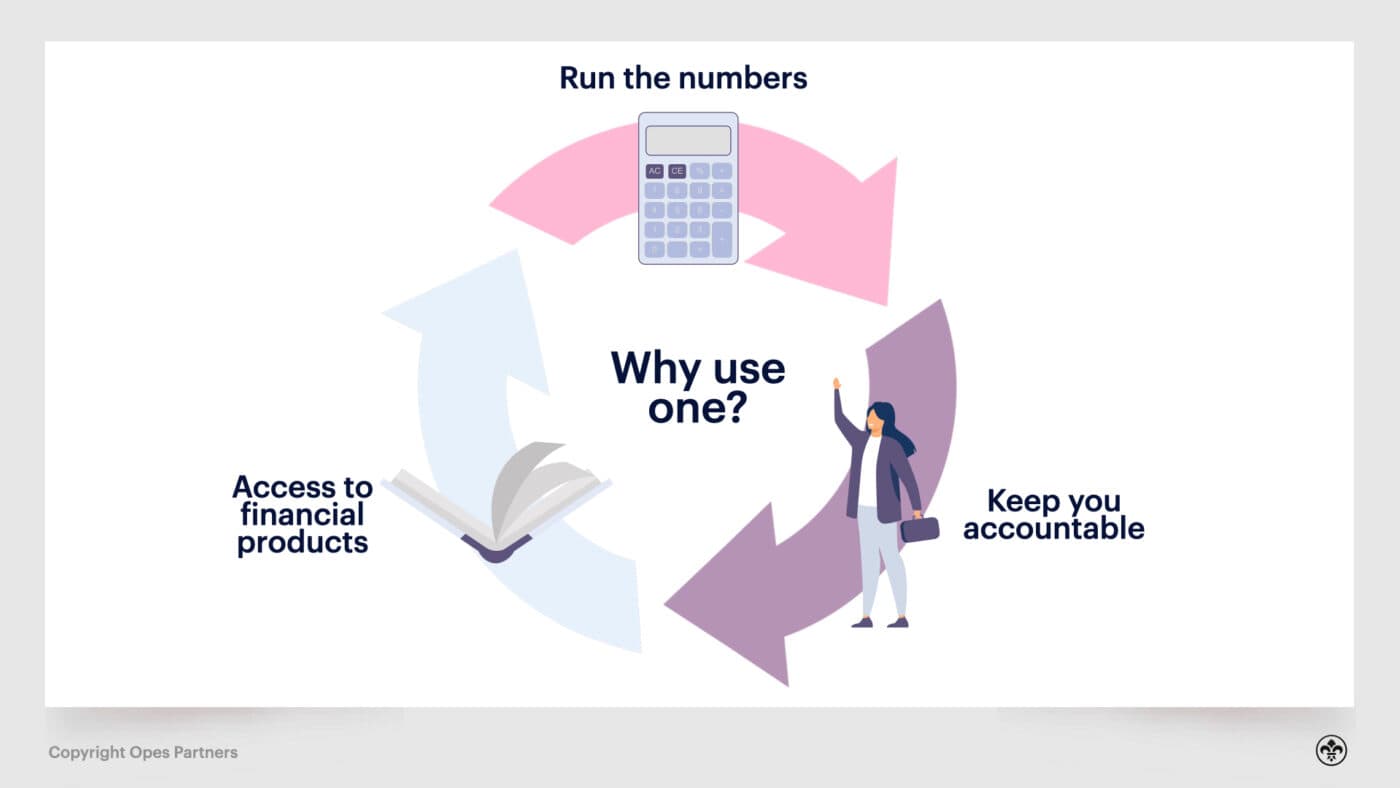

It’s more centred around deciding how to match your investments to your goals. There are three main reasons investors (and prospective investors) will use a financial adviser:

Reason #1 – You’ve got an expert who can run the investment numbers for you.

Let’s face it, we’re not all numbers people, and not everyone is handy with a spreadsheet. Your financial adviser will crunch the numbers for you.

Reason #2 – You’ve got someone keeping you accountable for your investment goals.

If you know you’ve got a personal trainer waiting for you at the gym, you turn up and do your workout. It’s the same with financial advice.

If you know someone if waiting on Zoom ready to talk about investing, you’re more likely to invest.

Reason #3 – You’ve got an expert giving you access to financial products.

And yes, just like how a personal trainer at the gym will have access to certain types of equipment you might not have at home, a financial adviser will have access to more investment options that can’t be openly accessed by everyone on the internet.

Not to mention, a financial adviser will also take into consideration your appetite for risk, the right type of investments for your portfolio, and the right amount of investment.

It’s a fair question. When discussing something as important as your finances (and your future) – you want to make sure they know what they’re doing.

But does your financial adviser need to be rich themselves? Do they need lots of assets?

It helps, but it’s not absolutely necessary. Don’t let it be a deal breaker for you.

It’s more important that your financial adviser has experience in putting together a plan and helping people achieve their goals.

For instance, someone young and keen might do an excellent job even though they don’t have lots of assets yet.

Remember, a financial adviser will work with investors day-in day-out. The experience they can get from working alongside lots of different investors is often the most important factor.

But at the bare minimum, your financial adviser needs to be “walking the talk”. Or said another way, they need to be following the habits they talk about.

Someone can’t call themselves a financial adviser unless they are legally entitled to.

That means they have to have a New Zealand Certificate in Financial Services (Level 5 Qualification), and be on the financial service provider register (and a few other things too).

If someone is not on the financial services register they cannot legally give you personalised financial advice.

For example, a financial adviser can tell you to buy or sell a specific asset. Your lawyer can’t.

If it were me, this is what I’d do.

On the Companies Office website you can search for any company and see who the directors and shareholders are.

You can then use this as the basis for step #2.

Definitely a Google search of both the company, the directors and the financial adviser — sometimes you’ll learn a lot from a media article.

For instance, there is a well known Auckland developer that hires property consultants to sell properties. Pretty normal.

But if you Google the name of one of their top consultants, you’d see that this person had stolen $89,000 from ANZ while an employee, to fund their gambling addiction.

Now of course, everyone makes mistakes and can redeem themselves. But, once you have the information, you can then ask yourself whether this person’s values align with yours.

If a Google search reveals no unsavoury news articles, then it’s a good idea to follow that up with a check of the disclosure statements on the company’s website.

Legally, every financial service needs a disclosure statement (here’s ours). This gives information about how the company gets paid and any companies that the business works with.

For example, a mortgage advice business will list every bank and non-bank they can help you borrow money from.

It’s not compulsory to work with a financial adviser. But, they are worth their while.

Financial advisers can help manage and choose your assets, and they can also work as a professional guide to make sure you reach the goals you want.

But more than that, they’re there to make sure you have a plan for your retirement and financial future. And investors often tell us this takes away their worries when thinking about their future.

They don’t need to worry because they’ve got a plan.

But one word of warning. Just because someone has met the legal requirements to be a financial adviser, that doesn’t automatically mean they give good advice..

This is why it can be a good idea to work from recommendations from other people.

Write your questions or thoughts in the comments section below.

Journalist and Property Educator, holds a Bachelor of Communication (Honours) from Massey University.

Laine Moger, a seasoned Journalist and Property Educator holds a Bachelor of Communications (Honours) from Massey University and a Diploma of Journalism from the London School of Journalism. She has been an integral part of the Opes team for four years, crafting content for our website, newsletter, and external columns, as well as contributing to Informed Investor and NZ Property Investor.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser