Property Investment

What does a financial adviser actually do?

In this article, you’ll learn what a financial adviser does, what are the different specialties of the trade, and how they can help you on your investment journey.

Property Investment

6 min read

Author: Ben King

Ben has 14 years of experience as a mortgage advisor and background as an investment adviser.

Reviewed by: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

If you're interested in money and investment you'll probably read and listen to a bunch of content. This means you'll often hear people talk about "financial advice".

For instance, if you've listened to the Property Academy Podcast you've heard Ed and Andrew say: “This podcast is not financial advice.”

(Even though they clearly talk about financial things).

Ok, so, what is financial advice, really?

I’ve been a financial adviser for over 14 years, both as a mortgage and investment adviser.

So, in this article, I’ll outline what financial advice actually is, what it includes, and what is and isn’t financial advice.

Financial advice is when a financial adviser looks at your situation and says:

“I've considered all the factors in your situation, and I recommend you do this ….”

That’s personalised financial advice.

And not everyone can dish it out. You need to be licensed

But here’s what isn’t personalised financial advice:

Thousands of people will read and listen to articles and podcasts. So this content can’t tell you what you should do, or take into account your personal circumstances.

That’s not to put Frances, Mary, Ed or Andrew down. They all produce great content. And they will make clear “this isn’t financial advice.”

So even when you read/listen to a person talking about money, and you think, “Wow, that’s good financial advice.”

That’s not what finance people mean when they use the term ‘financial advice’.

The information you read or listen to online is often called general or class advice.

But those terms aren’t widely understood. So, let’s stick with “general advice.”

There’s general advice and there’s personalised financial advice. It’s important to understand the difference.

Only, and we mean only, a licensed financial adviser can give personalised financial advice.

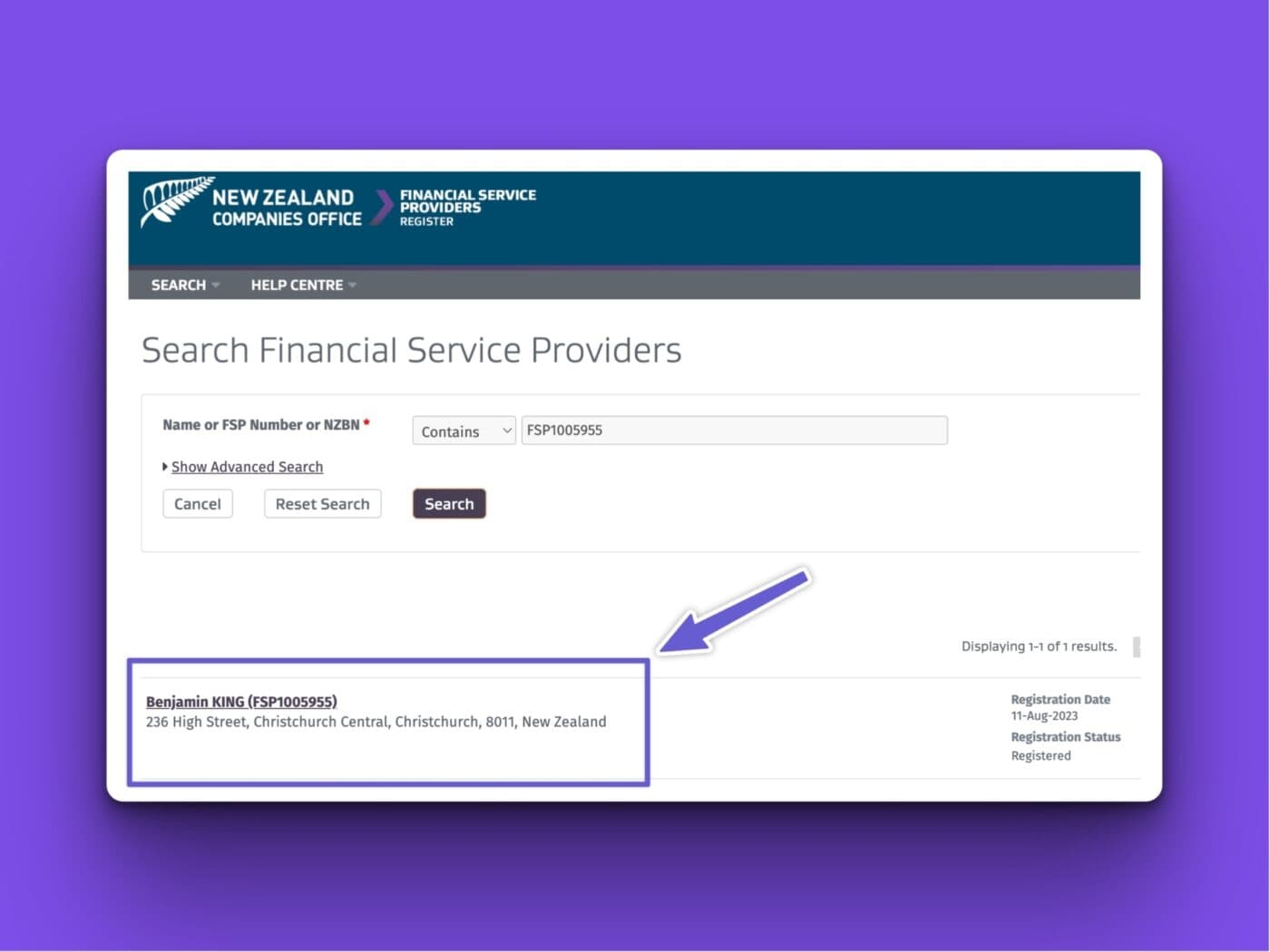

You’re a financial adviser when you’re listed on the Financial Service Providers Register (FSPR).

Here’s me:

If you’re not on this register, you cannot legally give financial advice.

That’s not to put anyone down. For instance, take Ed (our economist), for example. You’ve probably heard him on the Property Academy Podcast.

He talks about money and property. So you might think “I should go get some financial advice off him!”

But Ed’s not a financial adviser. And doesn’t want to be. He’s much happier with his spreadsheets.

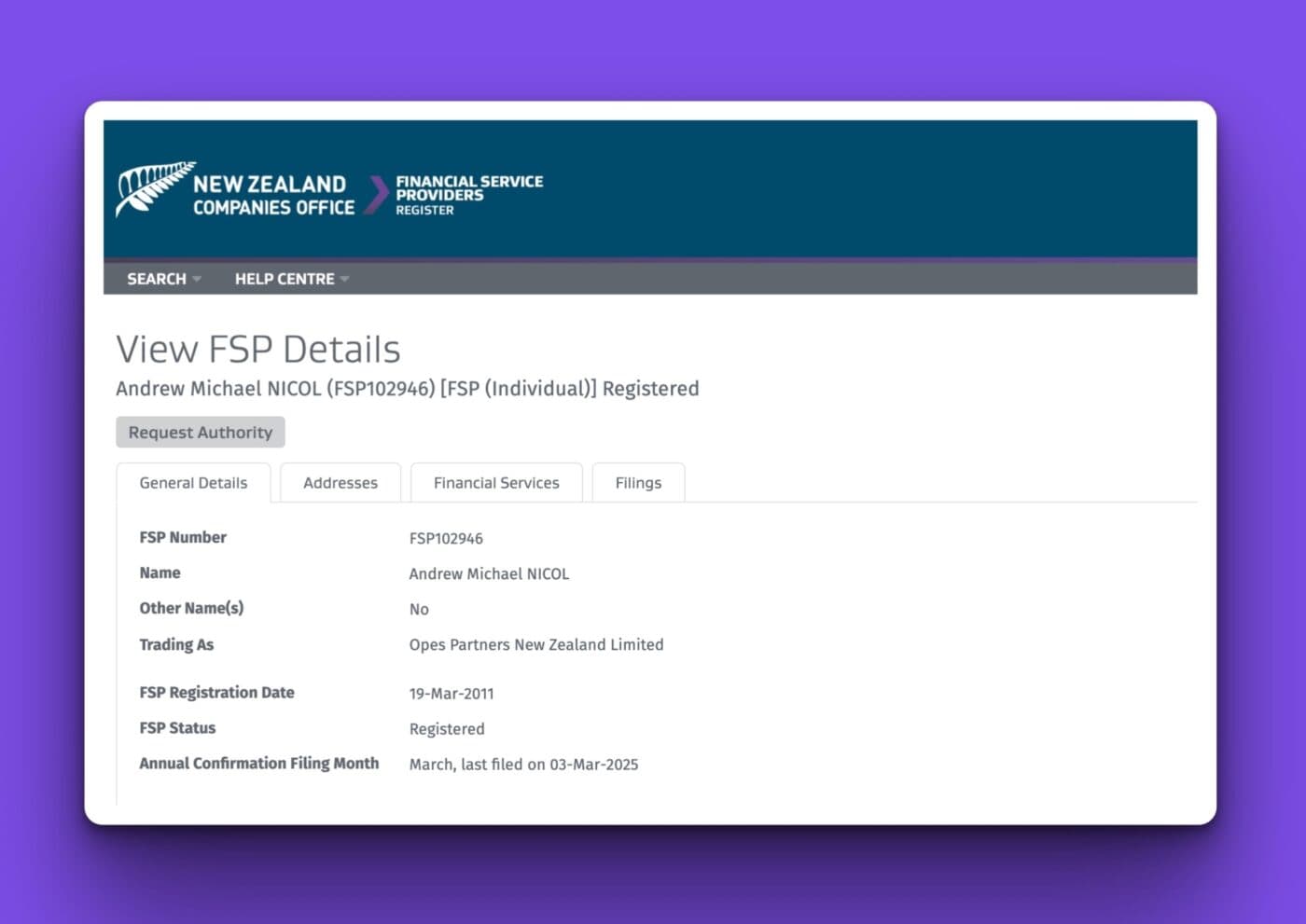

Andrew, on the other hand, is a financial adviser.

Here he is on the FSPR:

So, Andrew could (and does!) sit down with clients and give them personalised financial advice.

At Opes Partners all our financial advisers are registered.

That sets us apart from others who might appear to do similar things.

Take Property Factory – another Kiwi-based property investment company.

Like us, they specialise in New Build properties. But they’re a licensed real estate agency, not a financial advice firm.

So they can help you buy a property, but they can’t give you a financial plan.

Same goes for developers.

If a developer talks you through a spreadsheet about returns on a property, and starts saying things like: “This is what I’d recommend based on your goals,” ... that’s veering into financial advice territory.

And they’re not allowed to do that. It’s against the law. Because they’re not registered financial advisers.

Here’s why it matters. Financial advisers must follow a Code of Professional Conduct. They must act ethically and in your (the investor’s) best interest.

So even though our advisers here at Opes work for Opes and focus on New Builds ... if that’s not the right investment strategy for you, we have to tell you.

A developer isn’t held to the same standard. They might (unintentionally) give biased or poor advice. Not because they’re bad people, but because they’re not bound by the same rules.

You also get added protections when you get financial advice.

If you work with a financial adviser, they must be part of a Disputes Resolution Scheme.

This means that if a financial adviser has done you wrong, there is a set way to complain.

Think of it like this. If you complain about a bad burger at McDonald's, you’re probably talking to the manager. They work for McDonalds and decide what happens next.

With financial advisers, you can escalate your complain to an external “manager” who oversees complaints and decides what to do.

So if you think: “Goodness, Ben gave me terrible financial advice and I lost out”, you can make a complaint.

That goes to the bosses at Opes first. And if you aren’t happy with their resolution you can escalate it to the Dispute Resolution Team.

That team can make us take action. And if they think it's necessary, they can fine me.

So it’s a built-in layer of protection for you. You don’t get these protections if you decide to work with someone who isn’t a real Financial Adviser.

It depends. Financial advisers are usually paid in one of two ways: either a direct fee, or a commission.

So, some financial advisers are free for you to use.

Mortgage advice is usually free, because brokers are paid by the bank.

That’s also how it works here at Opes. We don’t charge a fee for financial advice because if you buy a property through us, we get paid by the developer.

But most of the time, if you go seeking personalised financial advice, you will be charged.

Here are some examples:

All financial advisers can give broad advice on your entire financial situation.

But most will typically specialise in one specific area.

Common areas of expertise include:

So you'll find financial advisers working everywhere.

At mortgage firms, insurance companies, wealth platforms, and even banks. But ‘Financial Adviser’ is an umbrella term for lots of different jobs.

Someone can’t legally call themselves a financial adviser unless they:

Without that, they can’t give you personalised financial advice.

For example, a financial adviser can tell you to buy or sell a specific asset. Your lawyer can’t.

Some advisers go further and earn more advanced qualifications, like becoming a CFA (a Chartered Financial Analyst).

That’s globally recognised and involves a rigorous level of study and exams.

It’s not compulsory. You don’t have to get financial advice. But it can be well worth it.

A financial adviser can help you:

And more importantly, they take the stress out of managing it all.

Many investors tell us that working with a financial adviser gives them peace of mind. Because then they have a plan.

One final thought: some people delay working with a financial adviser because they think they don’t have enough money yet.

But that’s like saying you need to get fit before hiring a personal trainer. Or clean your house before the cleaner comes.

The way you build your assets is by using a financial adviser – not the other way around.

Ben has 14 years of experience as a mortgage advisor and background as an investment adviser.

Ben brings a wealth of experience to the table with his 14 years as a mortgage advisor and background as an investment adviser. His dedication to helping clients reach their financial goals is central to his work.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser