Property Investment

Property Investment

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Property developers can say their properties are good investments and market them to investors.

This should be illegal.

Here's why.

I recorded a YouTube video 2 years ago walking through a developer's spreadsheet. They were trying to sell their properties as Airbnbs.

My calculations showed the projections were misleading and unrealistic.

They said it was a 12.5% gross yield (it was closer to 7%)

They'd miscalculated the GST (costing you $19k+)

They had $0 for maintenance expenses (for an Airbnb, that's SO unrealistic).

And much more.

Developers aren't bad people. They don't intend to mislead. It's just that they're out of their depth when it comes to investments.

You don't go to a plumber to fix your electricity.

You don't go to the electrician to fix your toilet.

You've got to use the right person for the right job.

Developers are skilled at building houses.

I know them. They're not skilled at creating financial projections for property investors.

So, I worry they are putting financial projections out there that people are relying on to make an informed decision.

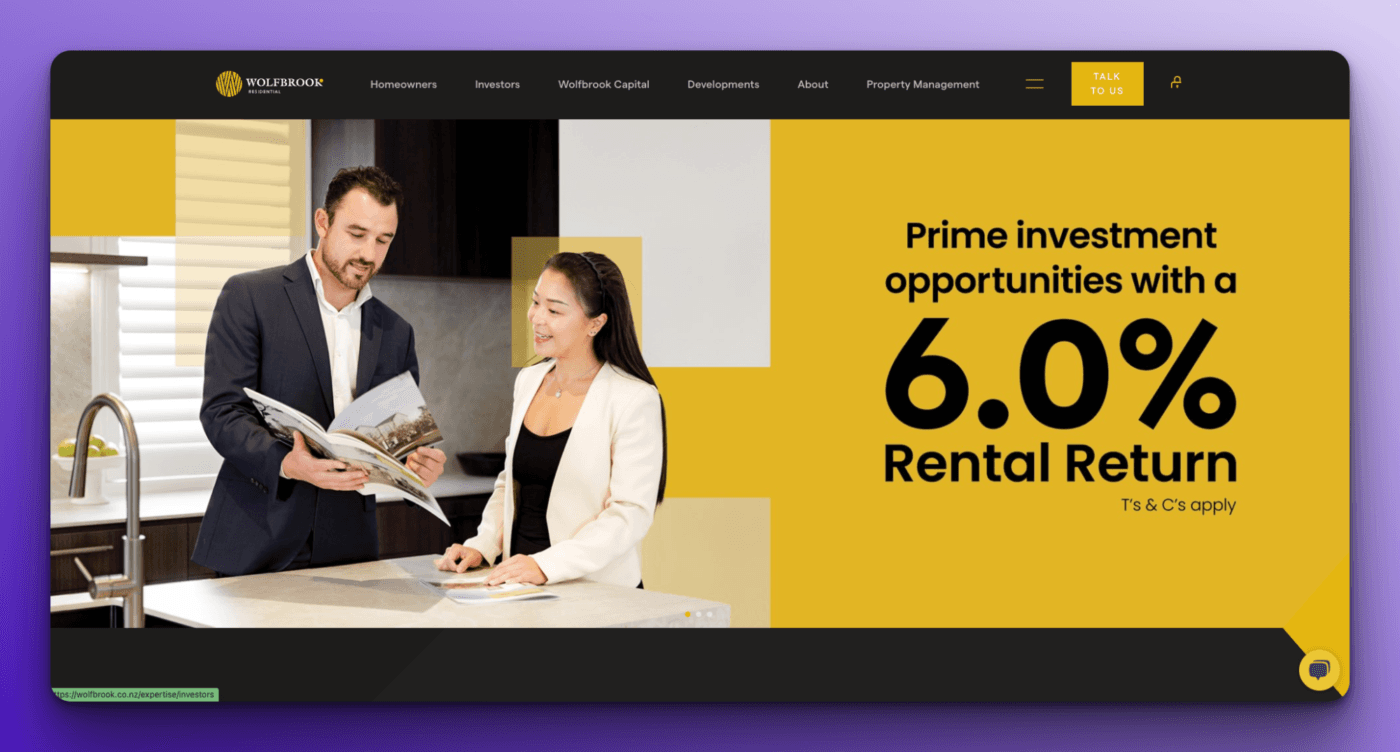

Yesterday, an investor asked me about Wolfbrook's current promotion.

"Prime opportunities with a 6% rental return."

What do you expect when you read that?

The properties should have a gross yield of 6%!

That's a good yield. And it could be a very good investment.

However, the properties don't have a 6% yield.

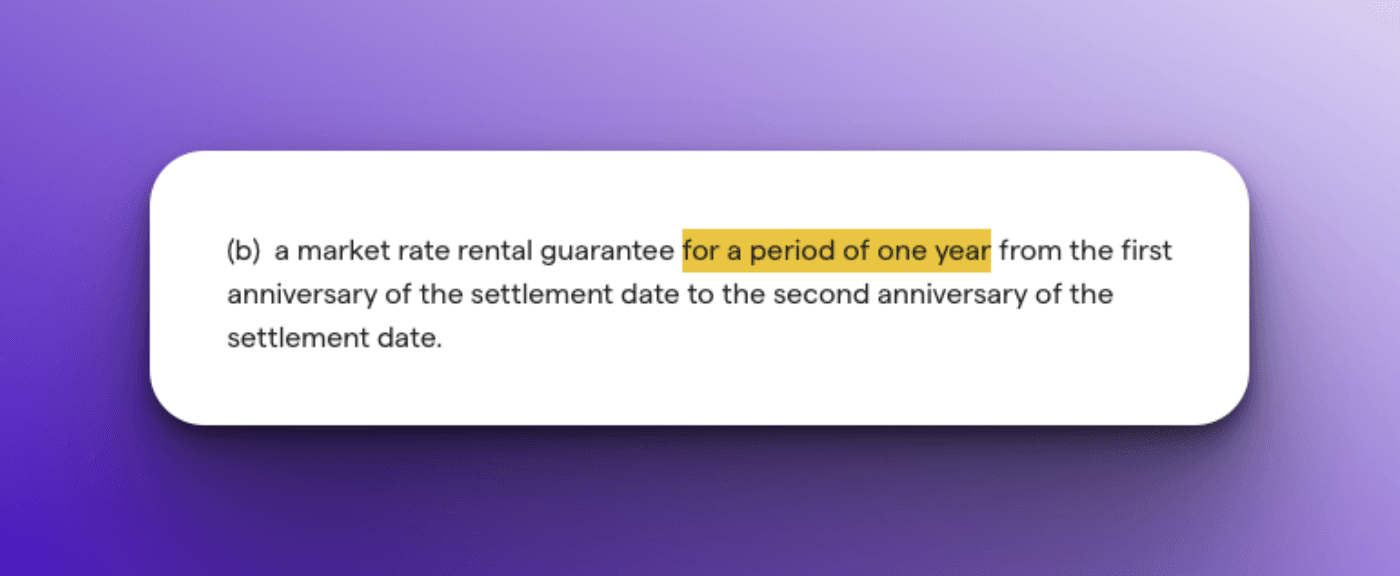

Instead, the company provides a 1-year rental guarantee. They'll top up the rent, so the property appears to have a 6% yield.

But that only lasts a year. After that, you get whatever the market rent is.

What I would expect to see in the marketing, is a rental appraisal to back up the 6% yield.

In my view, this is misleading and can result in poor decision making.

The issue here is that you might think: "Great, this has a high gross yield."

And yes it is great for the first year. But it's horrible for the next 15+ that you own the property.

Now, I've worked with Wolfbrook in the past. Some of my clients have bought their properties through me and Opes.

But let's call this promotion what it is — lipstick on a pig.

And that comes to the third issue.

If you go and get investment advice from a financial adviser, they:

Part of that code is that they MUST put your interest first. Always.

Developers don't have to do that. That is a massive conflict of interest. Because their number one priority is to sell their stock. Your interests ... are not.

If you rely on a developer’s projections and they turn out to be wrong, your options are limited.

You’ll either have to take legal action based on the sale agreement (which can be costly), or try to claim under the Fair Trading Act — and the burden of proof is on you.

But if you get advice from a licensed financial adviser, there’s a clear complaints process.

You can take it to a free disputes service, and the adviser usually has to follow the outcome.

And I know I am coming on really strong here. But I have seen the negative consequences. And I've seen what can go wrong.

I'm not saying you can't buy directly.

What I'm saying is that developers should NOT be allowed to market their properties as investments.

It should be illegal for them to provide financial projections.

UNLESS they are registered financial advice providers.

Only then have they proven they have the skills and the standards to put you first.

That way they can prove that their properties are suitable investments for your needs. And they are accountable to the government authority.

Now, I do get how it sounds. Of course, I run a property investment business. I make money if you buy through me and don't go to a developer directly.

The purpose of this newsletter isn't to say "use Opes".

Because other companies do things similar to ours ... and you could use them too.

But only get investment advice from people and companies who are on the Financial Service Providers Register.

That shows they have the skills (and accountability) to help you make a good financial decision.

And they've signed a code of conduct to put you first.

If they're NOT on the register? Be very, very careful. Because if things go wrong … you may find yourself on your own.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser