Number Crunching

How much do rents increase in NZ? (Rental inflation)

Find out how fast rents have increased in New Zealand so you can decide what to use when forecasting your investment properties.

Property Investment

3 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Buyer beware. Pay close attention when developers give you investment information.

Here’s a good example of why.

A few weeks ago, an email from Golden Homes popped into my inbox: “Investor insider”.

One property, in particular, caught my eye.

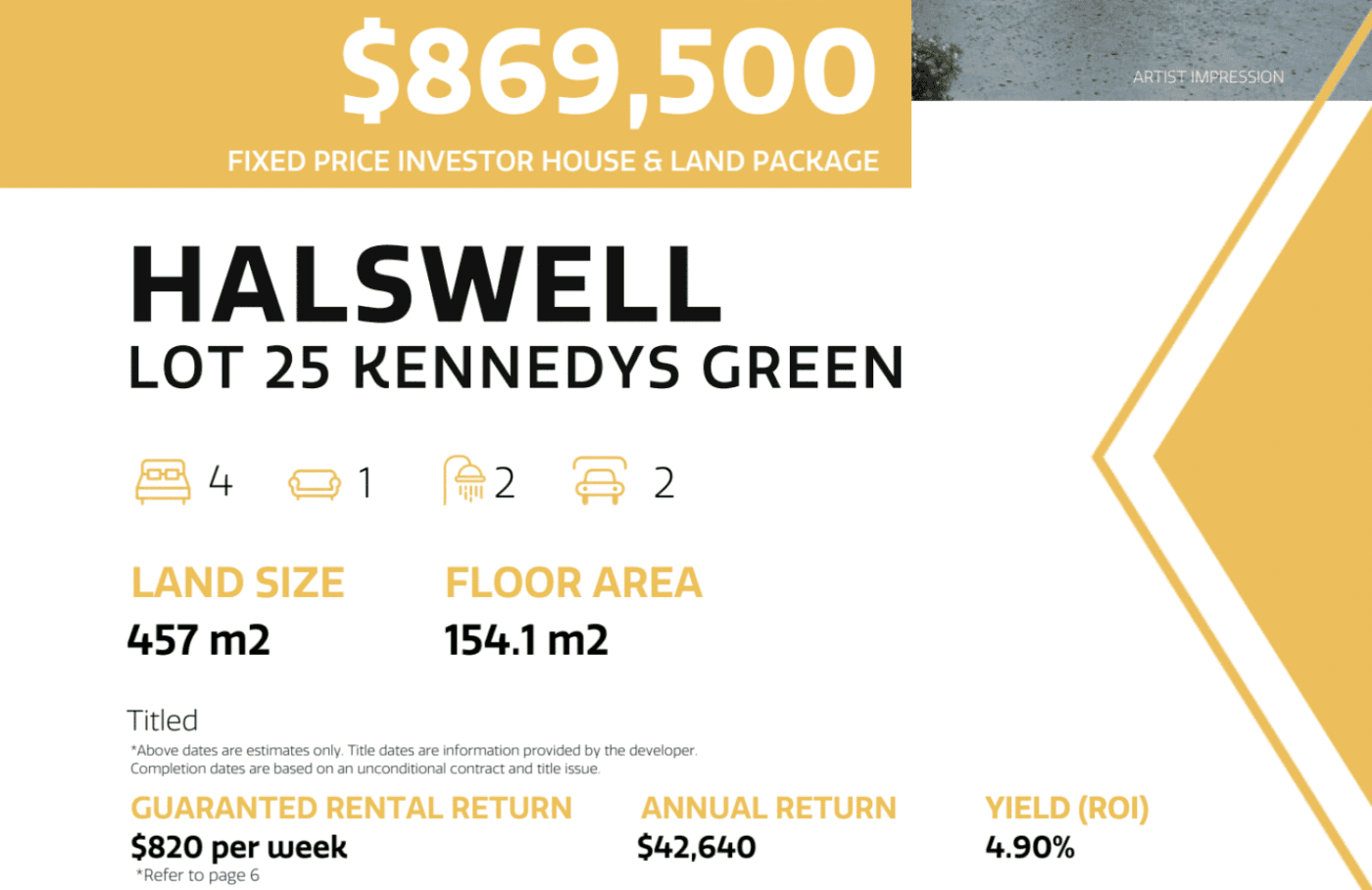

A 4-bed, 2-bath property priced at $869,500. This is good value for Halswell in Christchurch.

But wait, there’s more.

The email said:

I thought: “Those are good numbers for this sort of property.”

So I jumped into the detail – because I’m always on the hunt for new build properties for Opes investors.

Here’s what I found.

If an investor buys this property, there could be about $42,000 of hidden costs.

Why?

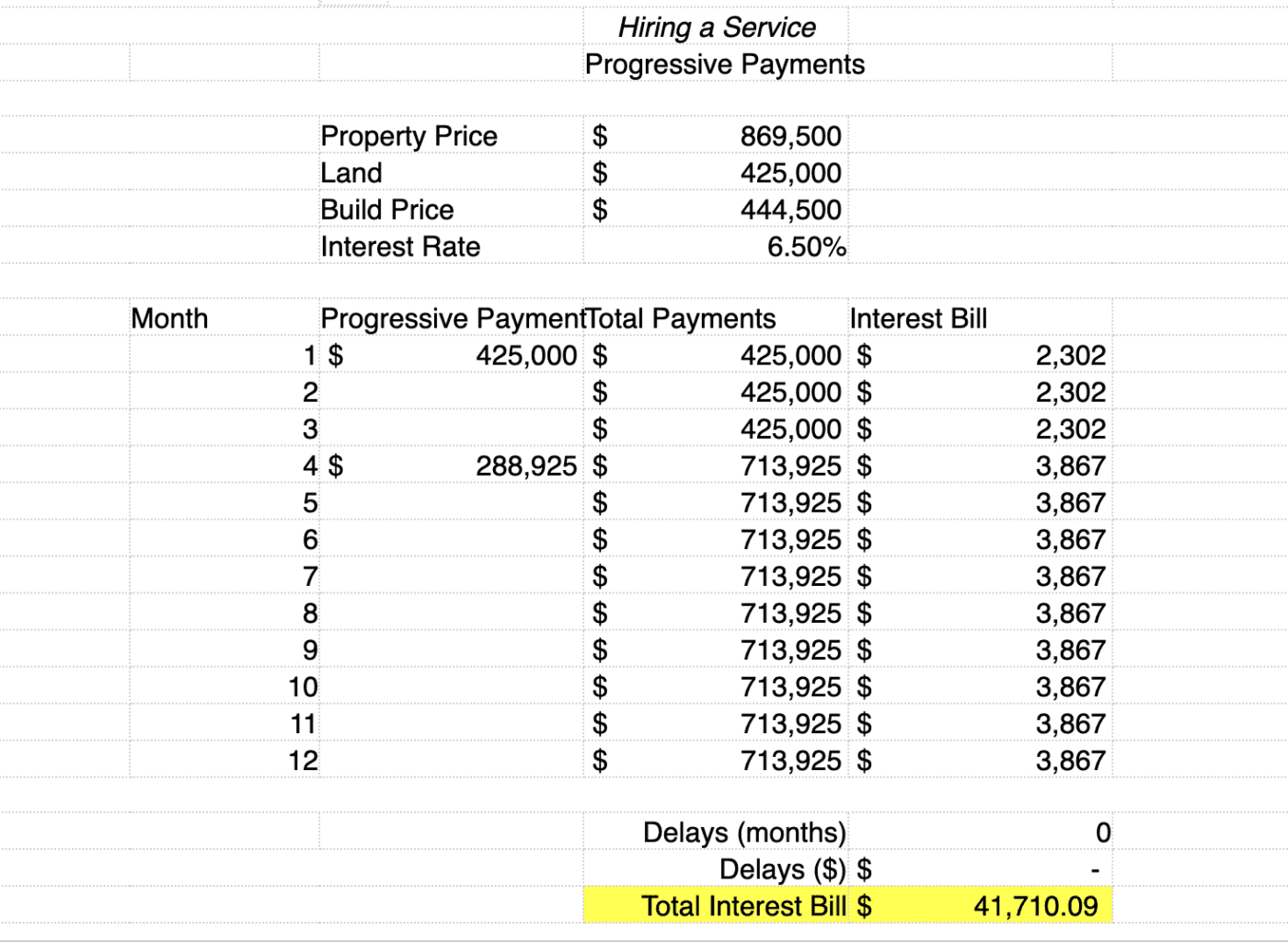

This type of property is a progressive payments build.

That means you pay for the property as it’s being built.

For most investors, that means borrowing lots of money from the bank.

So you’ve got to pay interest on that loan, even though you don’t have a tenant paying you rent.

You’ve got to cover all the costs.

If you borrow all the money, that can quickly add up to about $42,000 of bank interest.

So, the cost to own the property goes from $869,000 to $911,000.

That means the gross yield drops to 4.7%.

Even so, that’s still a good gross yield.

Sometimes, developers will give you incentives to buy their properties.

In this case, Golden Homes is offering a rental guarantee of $820 a week.

If you can only find a tenant that will pay $720 in rent, Golden Homes will top that up to $820. At least for the first two years.

But there can be a dark side to these incentives.

Developers sometimes use them to make their properties look better than they are. At least from an investment perspective.

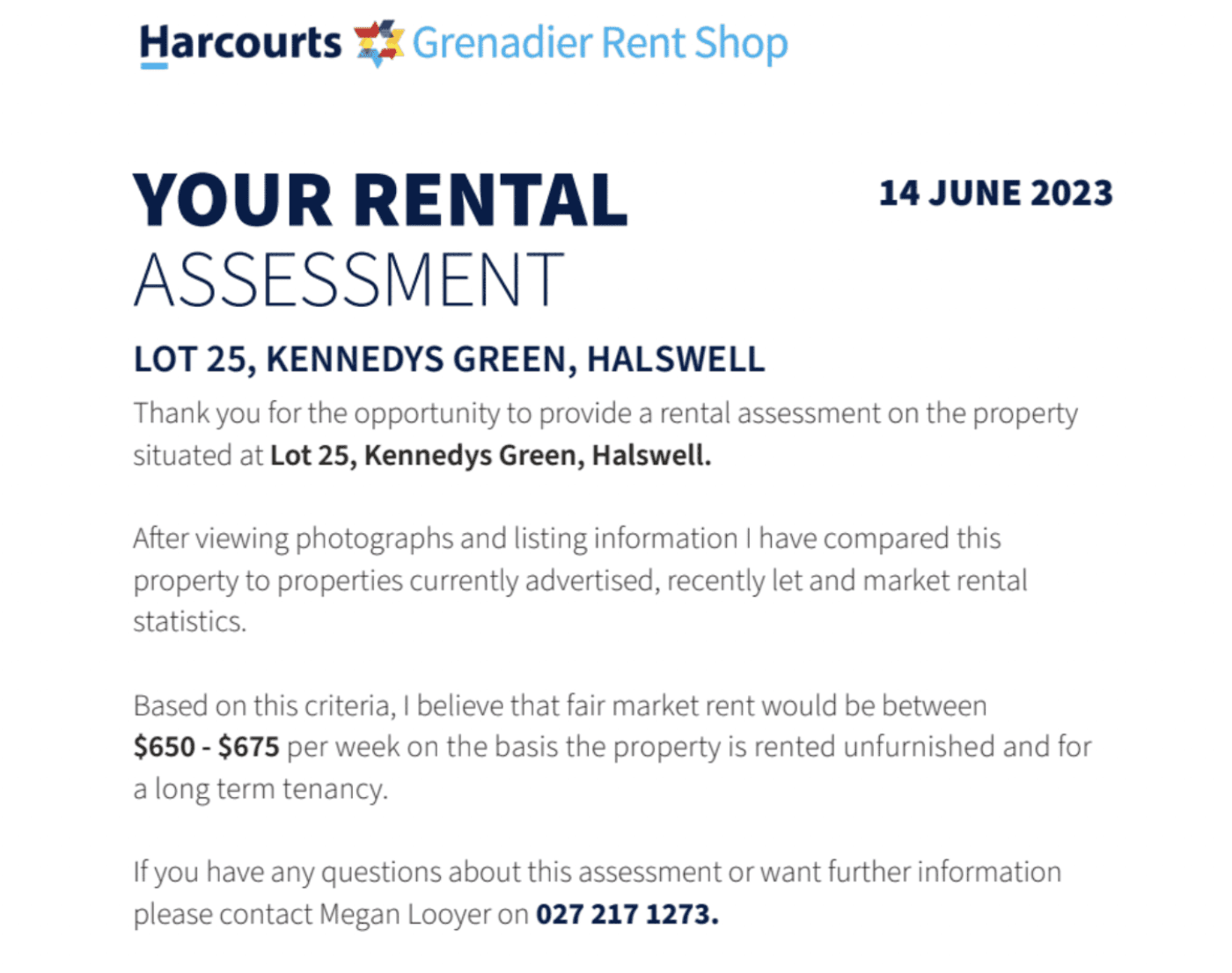

The property will actually rent for $650 – $675. That's according to a Harcourts rental appraisal supplied by Golden Homes.

That means Golden Homes calculated the gross yield on an inflated level of rent.

The actual gross yield isn’t 4.9%. It’s closer to 3.8%.

This matters because the rental guarantee lasts for 2 years. But most investors would hold this property for 10+ years.

So, there’s a risk that an investor will buy this property based on misleading numbers.

Then, after 2 years, the rent falls by $155 a week.

Developers specialise in building houses. That’s what they are good at.

Developers are not investment experts. That's why they make mistakes when talking about their properties as investments.

Golden Homes isn't the first and won't be the last.

It’s not that they’re bad people.

It’s just that well-meaning marketers write this type of investment information.

But, since they’re operating outside their area of expertise, they make mistakes.

This causes damage and harm to investors who think they’re getting investment advice.

This is why you should do 1 of 2 things.

Either use a property investment company. These businesses specialise in finding new builds as investments. So their information is more credible.

Yes, Opes Partners is one of these companies. But, there are others too. They are just a Google search away.

Your other alternative is to go through all the developer’s information yourself. In detail. This is to make sure you fully understand what you’re getting into.

Want to learn more about how to spot the difference between a good and bad investment property? Watch my most recent webinar.

It takes you through how to spot the difference between a good and bad investment.

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser