Reviews

Top 6 property developers in NZ

Discover the top 6 developers we work with here at Opes Partners and why they have made our list.

Property Investment

7 min read

Author: Maxine Clason Thomas

Financial Adviser at Opes Partners with over 10 years of experience in property investment and 4 years advising clients on building wealth through real estate.

Reviewed by: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Not all developers are angels in hard hats.

Some – whether by accident or design – use tactics that mislead, confuse, or even exploit property investors. All … just to sell a property.

These tricks aren’t always illegal … but they’re often shady. And if you’re a first-time investor, they can be easy to fall for.

Now, here at Opes Partners we see this all the time. We work with developers day in, day out. Many are top-notch – they build solid homes and play by the rules.

Some – are not so good.

So, in this article, we’re pulling back the curtain on the 7 dirtiest tactics developers use. You’ll learn how to spot them before they cost you thousands.

Some developers act like they’re giving you investment advice – when they’re legally not allowed to.

They might walk you through spreadsheets showing the investment side of the property. Or they might talk about how property can help you achieve your goals.

And that borders on illegal.

Because while you might think: “This is great financial advice.”

But unless they’re listed on the Financial Services Providers Register (FSPR), they’re not legally allowed to give personalised financial advice. That’s the law.

Here at Opes, all our financial advisers are licensed and must follow a strict Code of Conduct.

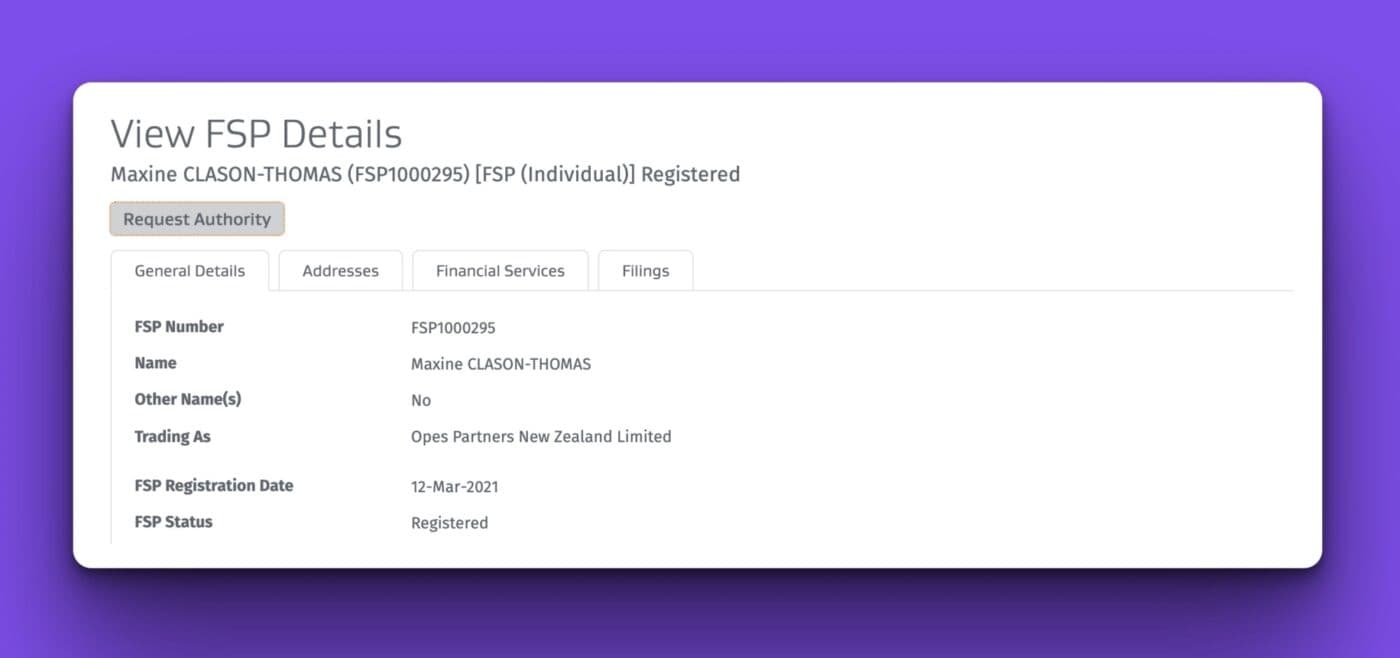

Here’s me registered on the FSPR:

So if you can’t find a developer on the FSPR register, they can not give you financial advice.

They haven’t got the qualifications or got the systems to give good financial advice.

If a New Build doesn’t suit your financial goals, I have to tell you that – by law.

But developers? They don’t have that obligation.

So they might give biased or poor ‘advice’. Not out of malice – they’re just not trained (or regulated) to help you build wealth.

Now to be fair … most developers won’t say “I’m a financial adviser” when they’re not.

But they’ve started doing the things that financial advisers do … and that’s illegal.

Heard of click-bait? Some developers use show homes as rental bait.

They might say: “Buy this show home from us. We’ll then rent it off you.” When you look at the numbers the rent often looks really good. Because the developer will pay an above market rate.

So you might think “It’s a great investment!”

This can give you a false impression of how that property might perform long-term.

Because after the 1 – 2 years the developer rents the property off you … you then have to rent the property out on the open market. And suddenly your rent drops. And you think: “that’s not what I signed up for”.

On top of that, show homes are usually decked out with premium fittings and furniture that standard homes in the development don’t have. This makes them more expensive. So they often have a lower yield when you rent them to a normal tenant.

That doesn’t mean that all show homes are bad. But, before you buy one, always check market rent from a third-party property manager.

Watch out for creative square metre counts.

Some developers include balconies in the advertised floor area.

Some even measure from the outside of the property, instead of just the interior. If you measure a property from the outside of the walls, it adds a few extra square metres since the walls are thick.

That can make a 70m² unit seem like 75m² on paper.

So, for the record, the floor plan should be measured form the inside wall. It should only include the garage (not the balcony or the garden).

If you're comparing properties, make sure you're looking at internal usable space – not just whatever number is on the brochure.

You see an ad on Facebook saying that properties are starting from just $400,000 and you think … “Wow. That’s cheap for a property.”

Then you find out that only one property has that cheap price. All the others are more expensive. The classic ‘bait and switch.’

To be fair lots of retailers do this. It’s not so much a problem though if we’re talking cushions at Farmers.

This tactic is used to draw people in with a low price point, even if most of the development is much more expensive.

Always ask what most homes are actually selling for. And don’t get too excited when you see a Facebook or Instagram ad showing a low, low property price.

Rental guarantees sound great on paper.

That’s where you buy a property off a developer. And if you don’t get the $600 a week (or so) that they said … they’ll top you up.

Sounds good. As long as rental guarantee ISN’T inflated.

Some developers use inflated rental guarantees. This is to make properties seem like better investments than they really are.

For example, Golden Homes advertised a property in 2023 for $869,500.

They guaranteed $820/week in rent. But the market rental appraisal was only $650–$675/week.

So the developer was able to say “it’s a good gross yield … 4.9%!”. But once the rental guarantee fades away after a year or two the real yield is more like 3.8%.

So you don’t want to make a 15-20 year investment decision based on an inflated rental guarantee that only lasts 2 years.

So if the numbers only work because of the guarantee, then they don’t really work at all.

Some developers promote Airbnb as a fast-track to higher cashflow. And yes, short-term rentals generally do mean higher returns and more cashflow.

But if you are comparing 2 properties … you need to run the numbers in a fair way.

Imagine you have two properties. One is a 7/10 property. One is a 9/10 property.

If you run the numbers with the 7/10 property as an Airbnb vs the 9/10 property as a long term rental … then the 7/10 property will probably look better on paper.

So you need to run the numbers in a consistent way. Either run both properties as Airbnbs … or run both properties as long term rentals.

That’s how you create a fair comparison.

Even if you do decide to Airbnb a property … you still need to look at the long term rental numbers.

Because local councils are changing the rules. In some areas you need council consent before you can legally Airbnb your property.

You should laso be careful with any financial modelling developers give you. Because developers are good at building properties. They’re not necessarily wizards with an Excel spreadsheet.

If a property only works as an Airbnb, it’s not a solid long-term investment. Airbnb income should be the bonus, not the foundation.

There are plenty of excellent developers out there. We work with many of them.

But as an investor, you need to look past the sales pitch and make decisions based on facts, not flash.

That’s especially important if you're buying off the plans or in a market you don’t know well.

At Opes Partners, we’ve built a business on sifting through the noise and helping investors make smart decisions based on real numbers.

So, next time you’re evaluating a deal, remember: A shiny brochure doesn’t guarantee a smart investment.

Financial Adviser at Opes Partners with over 10 years of experience in property investment and 4 years advising clients on building wealth through real estate.

Maxine Clason Thomas is a financial adviser at Opes Partners. She has over 10 years of experience in property investment and 4 years advising clients on building wealth through real estate.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser