Property Investment

How long does it take to get a mortgage approved?

Learn the 30–60 day timeline, key steps, bank turnaround times and how to speed up your application.

Property Investment

3 min read

Author: Scott Collings

Qualified builder. 6 years’ experience building + 6 years project managing residential developments.

Sometimes great developers build bad investments.

And this is something many investors struggle to get their heads around.

You might see a shiny new property from a top-tier developer – and it might be a good property, but that doesn’t make it a good investment.

Let us take you through an example. Here’s a developer we often recommend to investors, but a property that didn’t stack as an investment.

That’s because some properties are designed for homeowners, not investors … and that’s totally fine.

But if you’re investing to grow your wealth, there are specific financial targets your property should meet.

In this example, I’m using Tuakiri Property. They’re an Auckland-based developer that primarily builds 2–3 bedroom townhouses.

At Opes Partners, we rate their work. At the time of writing, we’ve recommended 12 of their developments to investors.

But they also build properties more suited to owner-occupiers. That’s fine. They don’t try to say that every property they build is a good investment.

But the risk we often see is that because we here at Opes Partners try to be transparent, we release a list of our top property developers.

Tuakiri is one of them.

So some investors think: “Well I’ll just go to Tuakiri directly … because surely all their properties are good investments.”

Not so fast. That’s not the case.

That’s why it might be a surprise to you that our team at Opes said “no” to their latest project.

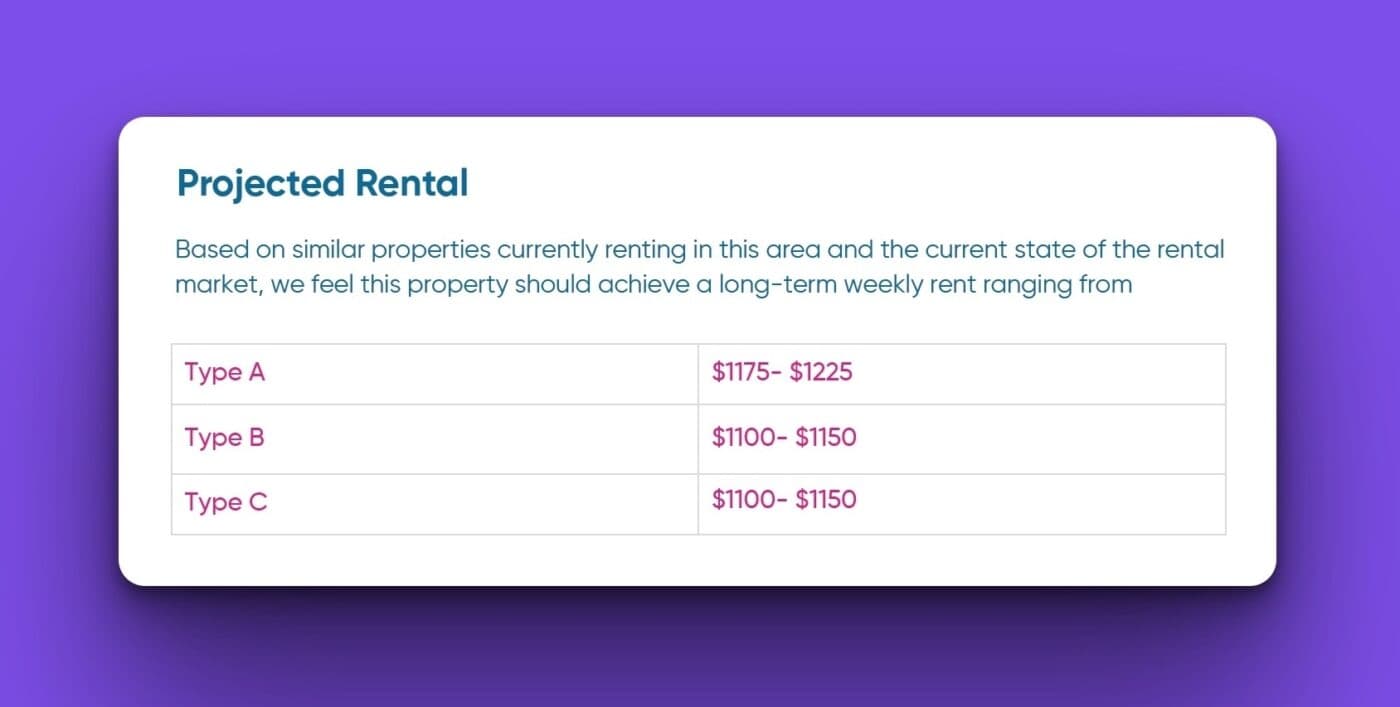

Let’s look at the numbers for one of the smaller units (Type C – 203m²). It’s on sale for $3 million.

That’s well below our target of 4.0% – 4.5%.

So, while we love Tuakiri’s build quality, and Milford is undoubtedly a blue-chip suburb, this property does not stack up as a good rental investment. The yield is just too low.

Again – we don’t want the message to be: “https://tuakiriproperty.co.nzTuakiri is bad. They’re doing the wrong thing”. They’re not marketing these premium properties as premium investments.

Just because we’ve backed a developer before doesn’t mean every one of their properties gets the Opes tick. But some investors don’t realise that – until it’s too late.

So, we’re grateful Tuakiri are letting us use this property as an example.

Here’s an example of a project we did recommend. This one is on Cleland Place in Blockhouse Bay (also in Auckland).

It’s the same developer, but a different deal.

These are also 3-bedroom townhouses. This is a suburb in central Auckland we frequently recommend and we think it has strong investment potential.

Let’s run the numbers on Unit 3 (a middle unit).

That’s above our target 4 – 4.5% gross yield range. A solid result.

Here are the two properties side-by-side so you can compare them:

| 98 Kitchener Rd (Milford) | Cleland Place (Blockhouse Bay) | |

|---|---|---|

| Developer | Tuakiri | Tuakiri |

| Bedrooms | 3 | 3 |

| Price | $3,000,000 | $849,000 |

| Rent (weekly est.) | $1,125 | $745 |

| Gross Yield | 1.95% | 4.56% |

| Investment-worthy? | ❌ | ✅ |

Both of these homes are built by the same developer – one we trust and recommend.

But only one is a good investment.

To be clear: we’re not saying 98 Kitchener Road is a bad property. It looks like a beautiful home, and Tuakiri has a strong track record of quality builds.

But when you’re investing, it’s the numbers that matter – and the yield on this property doesn’t stack up. Good for owner-occupiers; bad for investors.

A good developer doesn’t guarantee a good investment. You need the right builder and the right property.

We’ve lost count of how many investors bought the wrong property from the right developer. Our previous recommendation is not a blanket endorsement.

Qualified builder. 6 years’ experience building + 6 years project managing residential developments.

Scott has a background in construction. He progressed from a qualified builder to roles in project, construction, and finally development management. He brings this experience to his role as Opes' Property Development Liaison Manager, making sure investors can access high-quality properties.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser