Property Investment

What properties are Opes recommending right now?

Curious what properties Opes Partners recommends? See real examples, prices, and locations of the investment properties we're recommending right now—updated weekly.

Property Investment

3 min read

Here’s your monthly plain English property report.

Just yesterday, an investor asked me … “Are we really at the bottom of the property market?”

I showed them this graph 👇. It shows how NZ house prices are changing month to month (once you take out the seasonal ups and downs).

It’s clear. We’re in a new phase of the property cycle.

We had the big boom of 2021, followed by the downturn of 2022/23.

The market had an early recovery, then prices took a little tumble again.

The property market has found a new phase over the last 8 months. And there’s only one word to describe it.

Flat.

Prices aren’t going up much. But they’ve stopped falling too.

Are we at the bottom of the market? Well, the true bottom of the market was 2 years ago (May 2023). That’s when house prices were at their lowest.

But today, we’re only 3% above that.

And that’s about as close to the bottom of the market as most of us are likely to get.

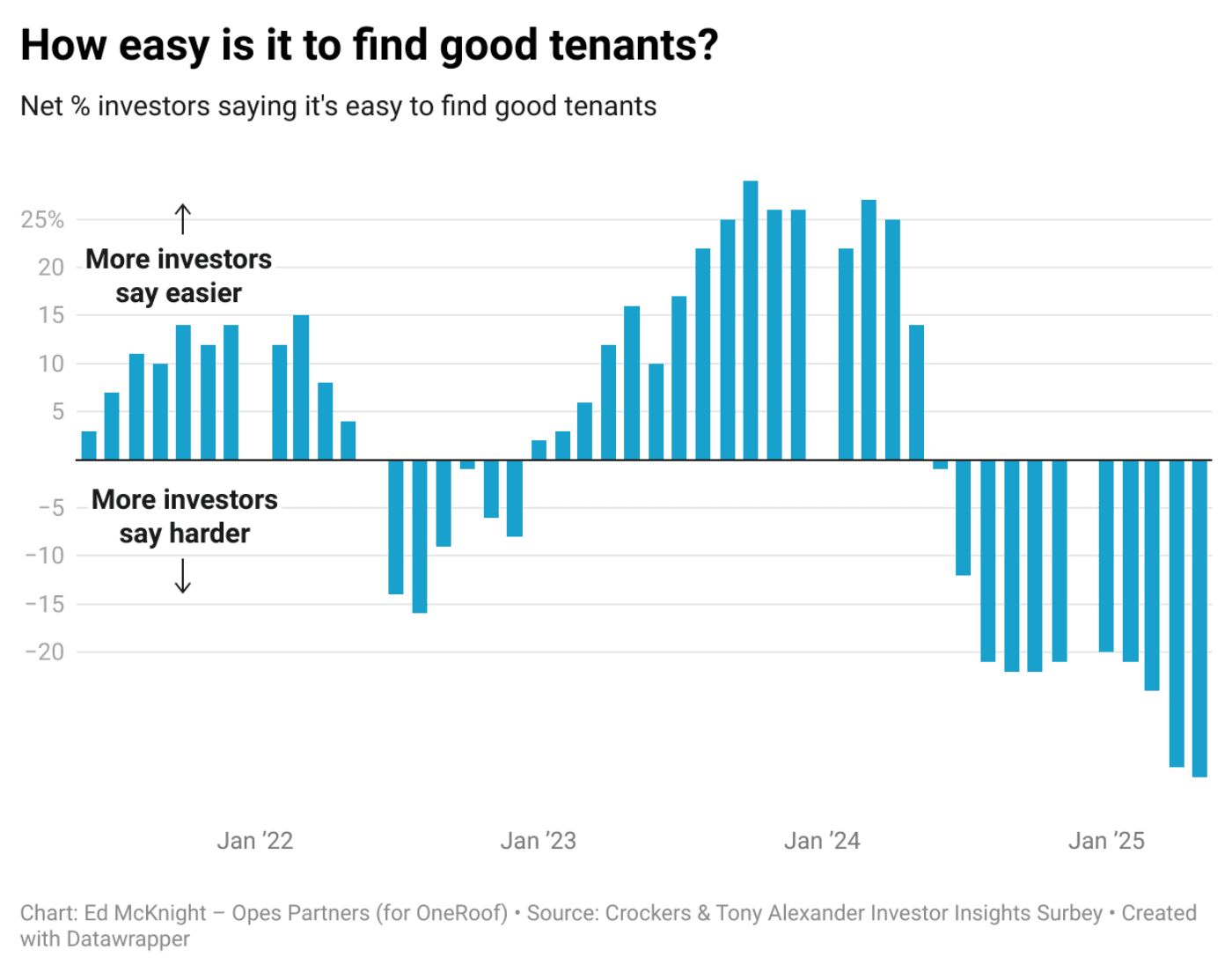

The other big news story for property investors is how fast you can get a tenant.

Independent economist, Tony Alexander has the best data about how landlords feel.

Each month, he asks investors if it’s getting harder or easier to find a tenant. Today, a net 33% of landlords say it is harder to find a tenant.

A year ago, a net 14% of landlords said it was easy. So this is a BIG change.

So what’s happening?

Trade Me’s data shows that roughly the same number of people are searching for rentals (at least compared to last year).

But the number of properties listed for rent is way up.

There were 23% more properties listed for rent in April 2025 vs 2024. That’s according to Realestate.co.nz.

But there’s an important piece of context missing here.

There were actually more rental listings per person in 2016 compared to today.

So, yes, it is tougher to find a tenant than a year ago.

But we’ve been here before. And when it comes to rental listings per 1,000 Kiwis we’re not that far above the 10-year average.

Over the last 12 months New Zealand property prices are down 0.3%. That includes that 0.3% decrease in April.

In April it took 42 days to sell a property (on average). The same as 2024.

Currently there are 32,566 properties on the market. That is up 6.5% compared to last April.

In terms of sales, April was much stronger than the previous year. 6,427 properties sold last month. That's 10.2% up on the prior year.

But rents remain flat at $600 a week.

But, once you scratch the surface, rents are actually going down slightly. The average rent for a:

The number of rental searches on Trade Me was down 2% last month compared to the same time last year. So rental demand is slightly down.

The number of listings on the other hand, were up 8% compared to the same time last year. So rental supply is up.

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Ed, our Resident Economist, is equipped with a GradDipEcon, a GradCertStratMgmt, BMus, and over five years of experience as Opes Partners' economist. His expertise in economics has led him to contribute articles to reputable publications like NZ Property Investor, Informed Investor, OneRoof, Stuff, and Business Desk. You might have also seen him share his insights on television programs such as The Project and Breakfast.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser