Mortgages

Debt To Income Calculator

Find out how much you can borrow under the DTI rules for your next investment property

Mortgages

7 min read

Author: Ed McKnight

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Reviewed by: Peter Norris

Mortgage broker for over 10 years, property investor and Managing Director at Opes Mortgages

Debt-to-Income (DTI) restrictions were implemented in New Zealand on July 1, 2024. DTIs link your income and how much you can borrow.

This means you might not be able to borrow as much money to invest or buy a property.

Here are the new rules set by the Reserve Bank:

The number one question on everyone’s minds is: “How will DTIs affect my portfolio and the property market?”

Key points:

Here are the rules the Reserve Bank has set:

If you and your partner earn $100k a year combined, the maximum you can borrow is:

All your rent counts in the calculation. So, if you’re an investor earning $100k in salary and $30k in rent, your income is $130k in the calculation. That’s what you multiply by 7.

Your debt includes everything. That means mortgages, credit cards, personal loans and student loans.

The new rules only count if you are buying an existing property.

So, if you buy a New Build … forget the new rules. They don’t impact your mortgage application.

Use our DTI calculator to work out how much you can borrow with debt-to-income ratios in place.

Let’s go through a couple of examples to understand how DTIs work.

Let’s say Sally and Bob own their own home … but don’t own any investment properties.

They both earn $75,000 each, which is a combined income of $150,000. This is before tax (gross income).

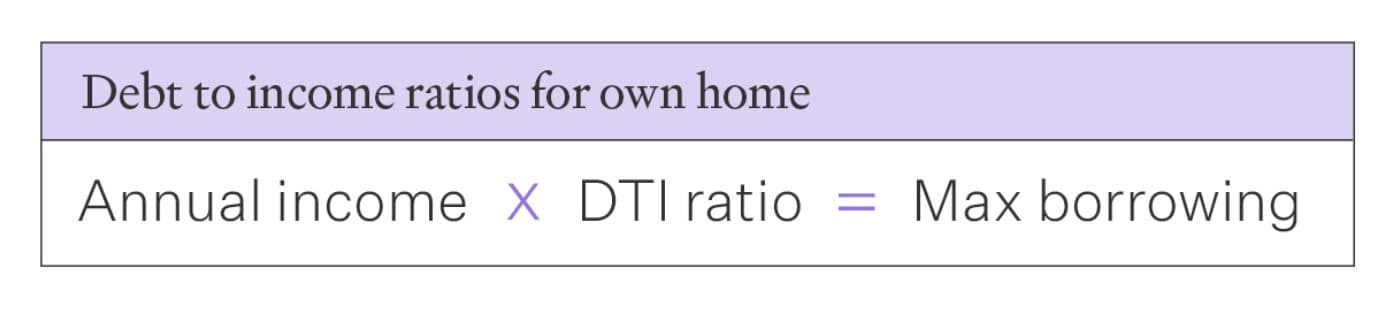

The DTI is set to 6 for owner-occupiers, and you multiply this by your household income.

6 x $150,000 = $900,000.That’s the maximum Sally and Bob can borrow.

But that doesn’t mean Sally and Bob can only afford a house worth $900,000. That’s just the lending. We also need to factor in their deposit.

Let’s say they have a 20% deposit.

The maximum price Sally and Bob can pay for a house is about $1,125,000. That’s broken down into $900,000 of lending and a $225,000 cash deposit.

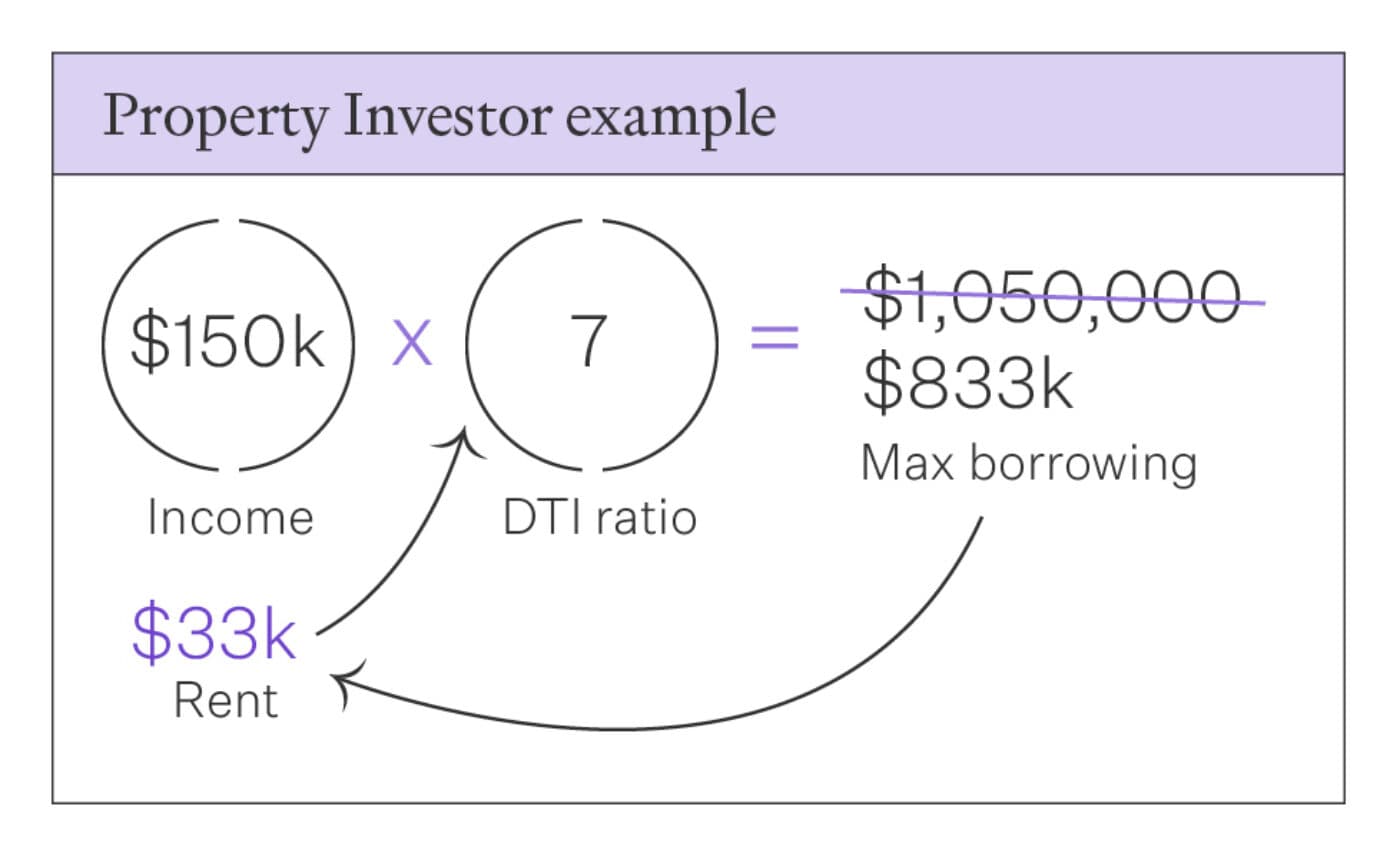

Sam and Murphy want to buy their first investment property. Their household income is also $150,000.

This couple has owned their property for a while and has paid down the mortgage to $450,000.

If we multiply their income by 7 (the DTI), the maximum they can borrow is $1,050,000.

But they are already borrowing $450,000.

That means they could potentially borrow an extra $600,000 for an investment property.

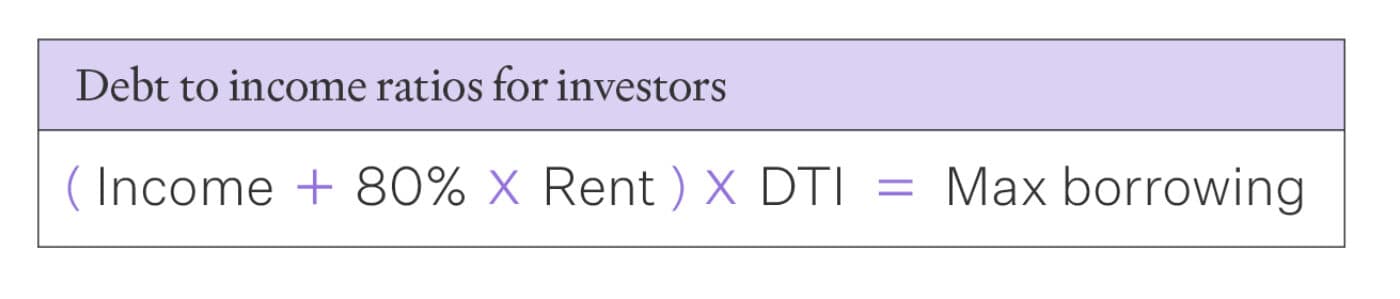

But we also need to factor in rental income.

Assuming they can buy a property with a 4% gross yield, they could borrow about $830,000 (with no cash deposit).

That’s because a $830,000 property would earn almost $33,000 in rent. That counts towards the DTI calculation.

So the calculation goes – $150,000 (their income) + $33,000 (applicable rental income) x 7.

That equals about $1,280,000 of debt.

The calculations for investors are a bit tricky, so it’s a good idea to work with a mortgage adviser to see how much you can borrow.

Until now, DTIs haven’t been a big factor. Interest rates were so high you could only borrow 5 – 5.5x your income anyway.

So, the DTIs didn’t stop you from borrowing.

But now that we are seeing rates drop away, DTIs will have more impact.

We won’t be able to borrow as much as we otherwise could.

What’s the impact? It depends on where you live.

In parts of New Zealand (Invercargill, Taranaki) house prices are low, and incomes are healthy.

The average person buying the average home has a DTI of less than 4. So the DTI rules will have less of an impact on those market.

In holiday hotspots (Queenstown, Coromandel), house prices are high compared to incomes. So, there is more scope for DTIs to slow the market down.

Here’s a map of the country, so you can see the estimated DTI in your area:

Property investors are more likely to be impacted by a debt-to-income ratio. As well as owner-occupiers who have big mortgages to their name.

These are the groups who tend to buy at high debt-to-income ratios.

However, New Builds are exempt from these new rules.

So, if you’re investing in a New Build you won’t have to worry about DTIs.

Because DTIs slow down lending, they can slow house price growth.

So many property investors will ask: “Will my property’s value still go up if DTIs come in?”

Let’s look at the stats.

Ireland introduced DTIs in 2015. Since then, Irish house prices have gone up 64%, or 6.4% a year.

Ireland is an interesting case, though. They had a massive property price boom between 1990 and 2007.

Then, house prices dropped by over 50%. So, some of that increase is recovery from the falls.

But it’s fair to say that DTIs didn’t stop Irish house prices from going up.

Eight years before that, Latvia brought DTIs in, too.

Since 2009, Latvian house prices have doubled (in just 13 years).

That’s 6.7% a year on average.

In Norway, house prices have gone up 4.4% a year since their rules came in (in 2015).

So, international evidence suggests house prices can still go up with DTIs …

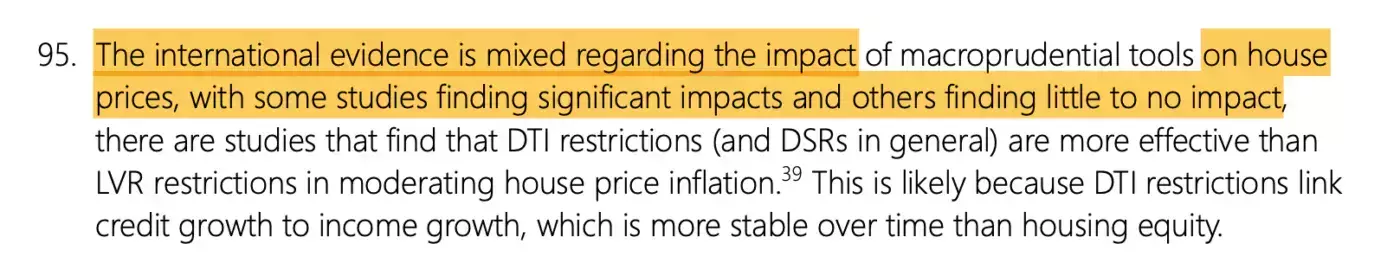

even the Reserve Bank agrees.

They say: “The international evidence is mixed … some studies find significant impacts [on house prices], and others find little to no impact.”

Of course, these countries have different circumstances. Norway is different from Latvia, and New Zealand is different from Ireland.

But it’s clear: house prices can still go up when DTIs come in.

Let’s pretend the whole country (hypothetically) has maxed out its borrowing ability.

If this happened, we can only borrow more money when our incomes increase.

Incomes go up by around 4% annually. So, that’s about how much extra the country could borrow.

That means house prices could still increase by about 4% a year, solely from a lending perspective.

But Kiwis have not maxed out their borrowing potential ... far from it.

We estimate that the average mortgage borrower in NZ has a DTI of 4.5x.

This means that the average Kiwi will still be able to borrow and spend on housing if they choose to.

Peter Norris, of Opes Mortgages, says that the DTIs won’t impact everyone the same way.

There will be some investors who won’t notice as much as others.

For example, if you have a large portfolio with low debt (or a big personal income), you won’t have to worry as much.

But, at the other end of the scale, who will it have a larger impact on? Investors at the start of their journeys and home buyers looking for their dream home.

If that’s you, talk to your mortgage broker to see how much you could be impacted. You may want to make a move in property before the DTIs start to bite.

Another option is to invest in New Build properties, which aren’t covered by the regulation.

To find the point where DTIs start to impact you. You can use our investment-ready spreadsheet to run your numbers.

Here’s how you do it.

Step #1 – Download the investment ready spreadsheet

Step #2 – Fill out your financial details

Step #3 – Go to the Assumptions tab and change the servicing test rate (usually putting it down).

Step #4 – Keep decreasing (or increasing) the rest rate until:

That’s how low the servicing test rates would have to go before DTIs kick in for you.

Resident Economist, with a GradDipEcon and over five years at Opes Partners, is a trusted contributor to NZ Property Investor, Informed Investor, Stuff, Business Desk, and OneRoof.

Ed, our Resident Economist, is equipped with a GradDipEcon, a GradCertStratMgmt, BMus, and over five years of experience as Opes Partners' economist. His expertise in economics has led him to contribute articles to reputable publications like NZ Property Investor, Informed Investor, OneRoof, Stuff, and Business Desk. You might have also seen him share his insights on television programs such as The Project and Breakfast.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser