Number Crunching

LVR calculator – How to calculate LVR

Quickly calculate your loan-to-value ratio and find out how much you can borrow

Mortgages

12 min read

Most people think they know how much deposit they’ll need to buy a house.

But the deposit you need changes. It’s all because of the loan-to-value ratio (LVR) restrictions.

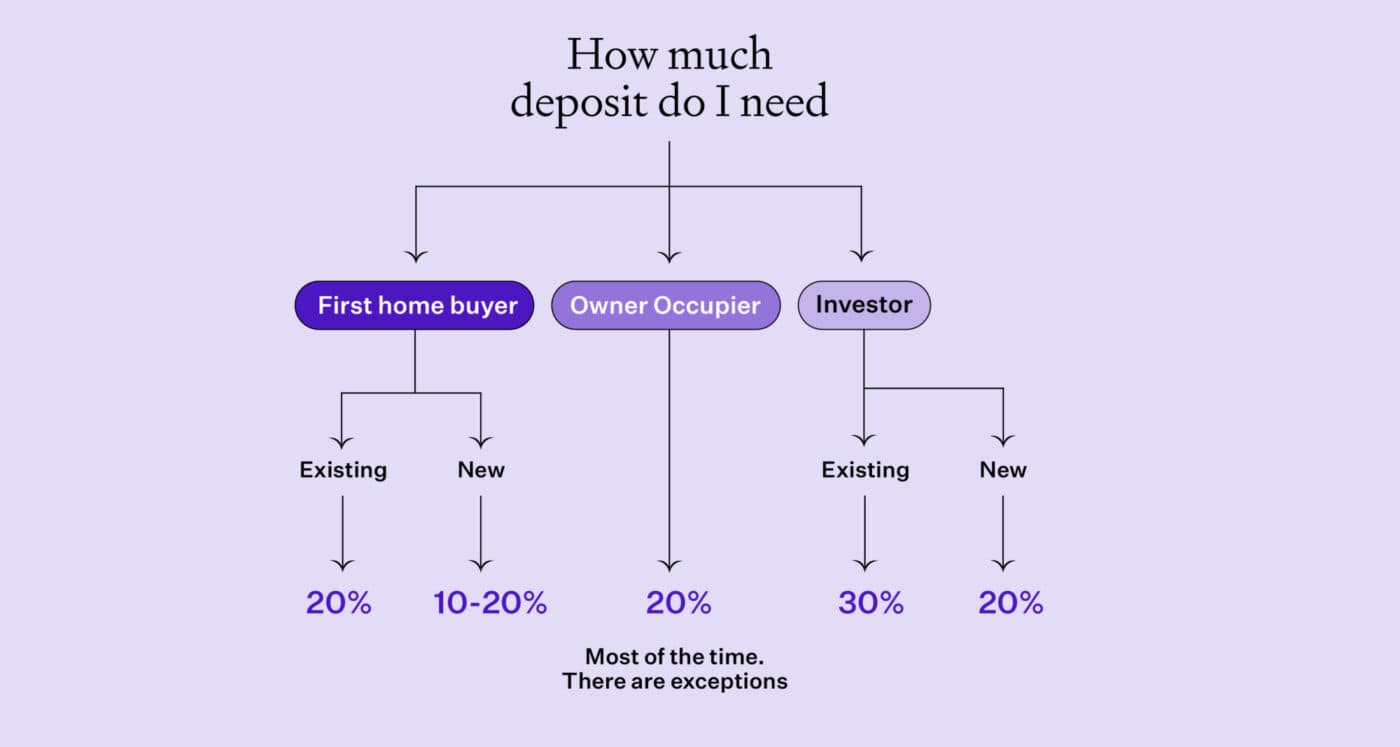

Under these rules, your deposit changes depending on:

The LVRs, or Loan-to-Value Ratio Restrictions, are rules set by the Reserve Bank to decide the minimum deposit you need to get a mortgage.

For example, property investors usually need a 30% deposit for existing homes and 20% for new builds.

Owner-occupiers generally need a 20% deposit.

These rules help keep the financial system stable and can change depending on your situation.

In this article, you’ll learn what LVRs are and what they means for you.

Here’s how much deposit you need based on the type of property buyer you are and what you buy.

The LVR restrictions changed in July 2024. This coincided with the introduction of Debt to Income ratios (DTIs).

Under the new rules, investors only need a 30% deposit to buy an existing property, whereas they previously needed a 35% deposit.

This means some property investors can buy when they couldn’t before.

However, for New Builds – everything stays the same. You still only need a 20% deposit.

Loan to Value Ratio restrictions (LVRs) are the rules that say how much a bank can lend you.

It’s the percentage of your mortgage compared to the value of your property.

For instance, let’s say you want to buy your own home. The bank can lend you up to 80% of the money. That means you need to put in the rest. That’s your 20% deposit.

Here are the current LVR restrictions:

| Deposit required % | Lending from bank % | ||

|---|---|---|---|

| Owner occupier* | Existing property | 20% | 80% |

| New Build | 20% | 80% | |

| Investor | Existing property | 30% | 70% |

| New Build | 20% | 80% |

* 10% of each bank's lending can be given out to borrowers with less than a 20% deposit. This is mainly used by First Home Buyers. Technically there is no LVR restriction for New Builds. But most banks will only lend up to 80%, unless the borrower is a First Home Buyer.

These rules are set by the Reserve Bank of New Zealand.

That’s the part of the government that makes the rules for all commercial banks. Banks like ASB, BNZ, ANZ and Westpac.

Let’s say you’re an owner-occupier. You’re eyeing up a house that’s $1 million.

The bank is only allowed to lend you up to 80% ($800,000). So the 20% left over ($200,000) is the deposit you have to front.

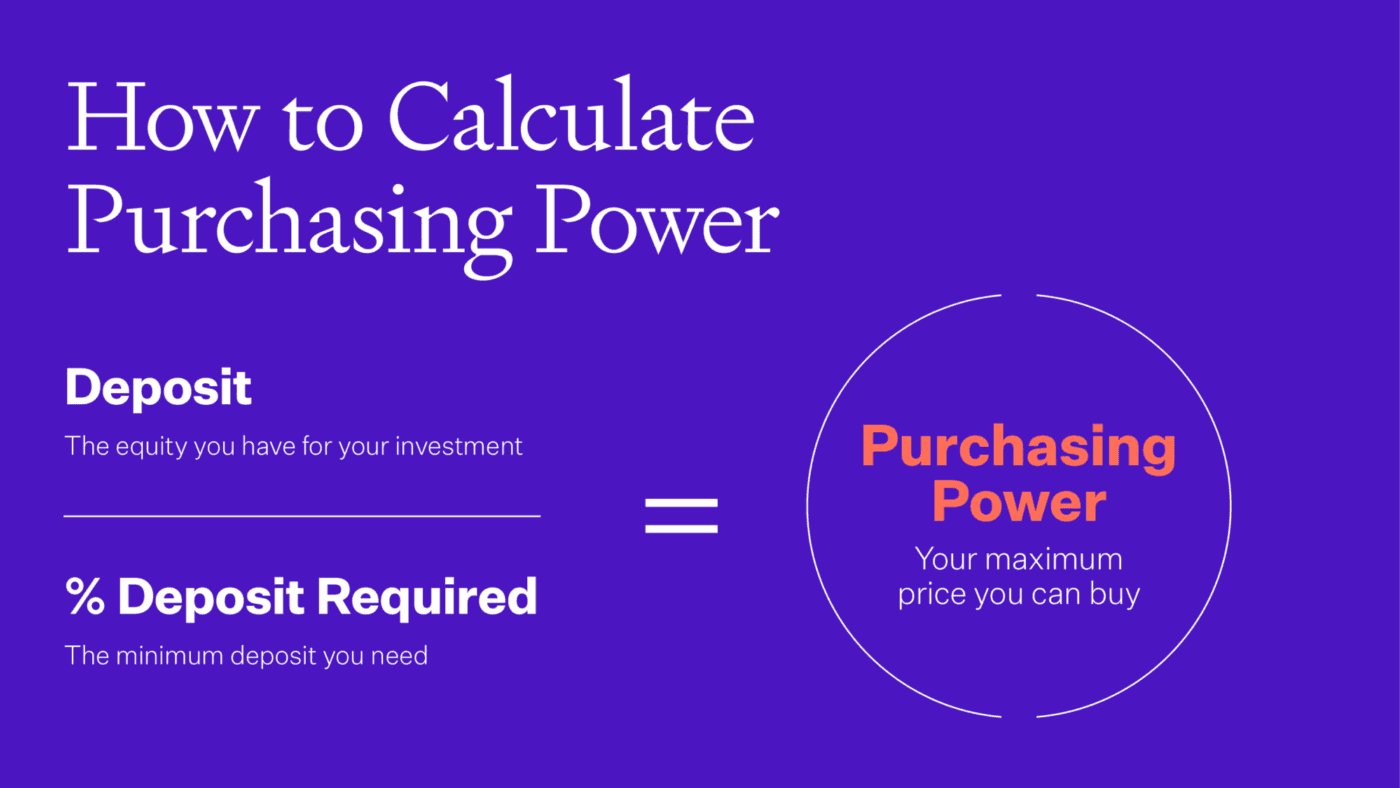

Let’s work backwards and figure out how much you can spend on a property under LVR restrictions.

Say you have a $200,000 deposit. How much could you borrow?

The formula is:

Your Deposit / Deposit Required = Maximum Purchasing Power

What if you’re an investor wanting to buy an existing property? You need a 30% deposit. So the formula is:

$200,000 / 0.30 = $666,667 of purchasing power.

You can spend up to $667k for an existing investment property.

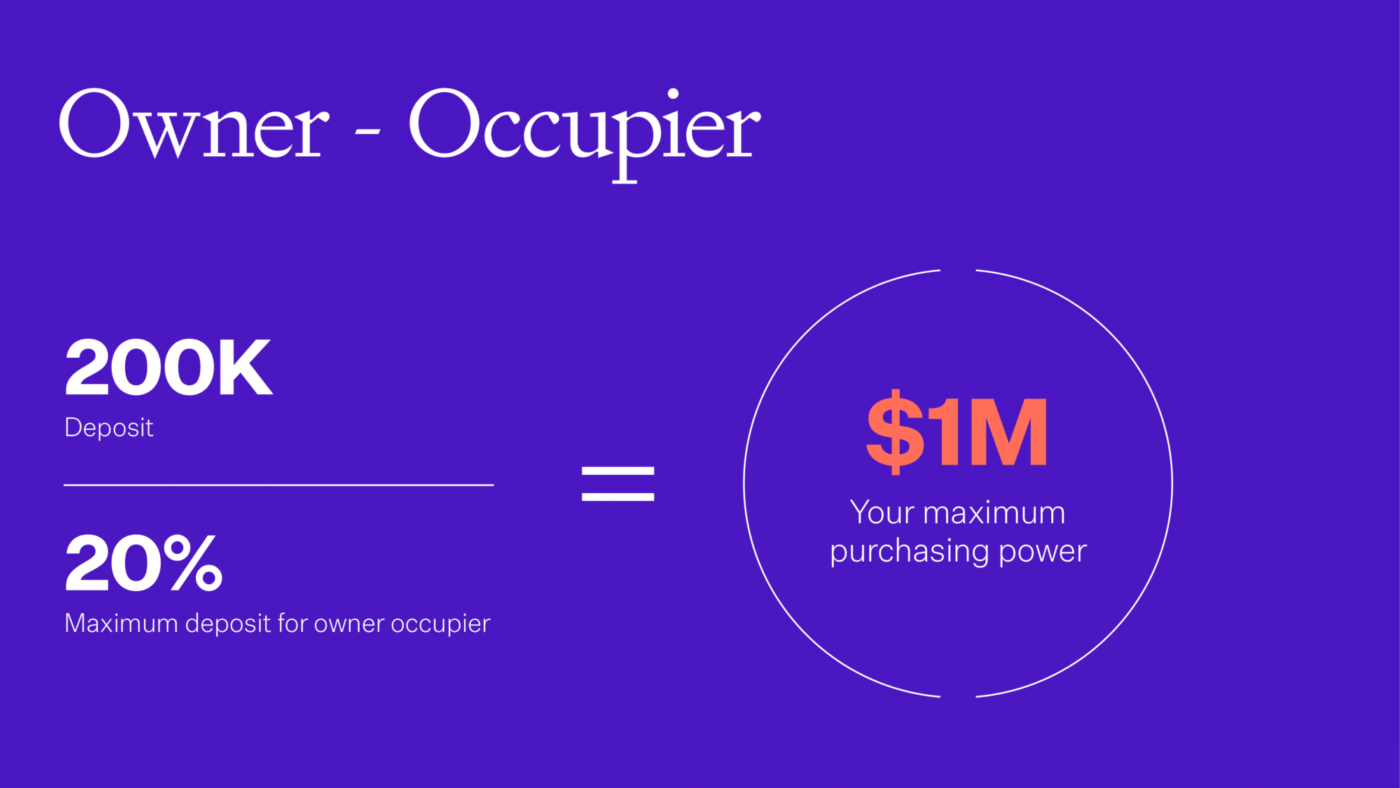

If you want to buy your own home, you need a 20% deposit. So, the formula is then:

$200,000 / 0.2 = $1,000,000 of purchasing power.

You can spend up to $1 million on a property.

That is made up of a $200,000 deposit and $800,000 worth of lending.

In this example, both the owner-occupier and the investor have the same $200,000 deposit.

But, the owner-occupier can borrow more than the investor.

That disadvantages investors compared to owner-occupiers. Some Kiwis would say that’s not a bad thing.

Use our LVR calculator to find out the LVR of your property:

You might think the LVR restrictions have a big impact on the property market.

That’s not really the case, especially when property prices are rising fast.

As property prices rise, borrower’s loans make up a smaller percentage of the property’s new (higher) value. So your LVR goes down.

So, as house prices rise, property owners can borrow more anyway.

That’s partly why when LVRs came back in (2021), they had little impact on house price inflation.

Even when the Reserve Bank increased the deposit investors needed from 20% to 40%, the Reserve Bank only expected LVRs to lower house price inflation 1-2%.

That doesn’t mean house prices go down 1-2%. It means that if house prices were going to go up 10% anyway, they now go up 8-9% instead.

Let’s look at some examples of how LVR restrictions can impact individual buyers.

Jenny is a first home buyer. She and her partner, Steve, saved a $70,000 deposit.

Without any LVR restriction, Jenny and Steve might secure a 10% deposit home loan.

That would mean the couple can buy a property worth $700,000.

That’s enough to buy a nice 3-bedroom home in their home city of Christchurch.

But, if Jenny and Steve have to follow the 20% LVR rule, they can only buy a property worth $350,000.

That’s not enough to buy a home that suits their needs or tastes. So, Jenny and Steve can’t buy.

Buyers who can still buy these sorts of properties now have less competition.

This softens housing demand, and house price inflation slows.

If Jenny and Steve want to enter the market, they will need:

Jeremy bought his first property 2 years ago in Wellington. It’s a tiny shoebox apartment in the central city. But, despite its limited market, the property has gone up in value gradually each year.

Now, Jeremy and his partner plan to adopt. So, the couple want a larger home to provide for their growing family.

He plans to sell his apartment and use the money as a deposit for his next home.

After selling the property and paying the real estate agent, he’ll be left with $150,000.

So he starts looking at properties in the $725,000 - $750,000 range.

Under the LVR restrictions, Jeremy’s $150,000 deposit will be enough to secure a mortgage of up to $600,000.

So Jeremy can spend up to $750,000 on a property.

While Jeremy can still afford a home in his price range, he is limited in how much he can compete with other buyers.

He can’t bid up the prices as much. This decreases competition, dampening house prices.

Lastly, let’s look at Barbara and Bruce. This couple “buy and flip” properties, doing them up to sell at a profit.

They’ve been in the game for a while and prefer to use a large deposit while renovating each property. This helps lower interest costs.

They’re looking in the same price range as Jeremy (from our last example), i.e. in the $725,000 - $750,000 range.

But, because they have a $300,000 deposit, they have no concerns about the LVR restrictions.

With a $300,000 deposit, Barbara and Bruce have a purchasing power of $1,000,000.

The couple don’t want to spend that much. But, if they have to pay $770,000 for a house that is “worth” $750,000, they’ll do it. They can easily outbid Jeremy.

The LVR restrictions do not impact Barbara and Bruce.

There are several exemptions to the LVR rules where low deposit loans are still possible:

The biggest exclusion is for New Builds. No LVR restrictions apply. It’s up to the banks how much they’ll lend to you.

This applies to homeowners and investors, but it matters more for investors.

In practice, you can buy an investment property using a 20% deposit rather than a 30% deposit.

Take the example of two $700,000 properties standing side by side. One is existing, and one is a New Build.

If an investor buys the existing property, they require $210,000 as a deposit. But, if they decide to purchase the brand new property, they’ll only need a $140,000 deposit.

This exemption makes New Build properties more attractive to investors. That encourages developers to build more houses.

Only some borrowers have to follow the LVR restrictions. The Reserve Bank has “speed limits”. This is where a small amount of each bank’s lending can be to people with smaller deposits.

In practice, banks allocate the bulk of these low-deposit loans to first-home buyers.

Less than 1 in 3 owner-occupiers (excluding first home buyers) buy with less than a 20% deposit.

Compare that to first home buyers. Between 20 – 40% of first home buyers buy with less than a 20% deposit.

If you buy a property not up to the current code, you can borrow above LVR limits to put the property right.

Let's pretend an investor bought an existing property with 70% lending.

But the property needed to meet the standards set under the Healthy Homes Act. The bank can then lend more funds to the investor to bring the property up to code.

This would push the investor’s lending on the property above the 70% limit. But the Reserve Bank would allow this to happen, so the quality of New Zealand’s housing stock isn’t harmed.

The government introduced First Home Loans a few years ago.

These loans allow first home buyers to buy property with as little as a 5% deposit.

To be eligible for a First Home Loan, the borrower must:

This means eligible first-home buyers can still borrow at lower deposit amounts.

Short-term bridging loans are also exempt. This is where a homeowner buys their next property before they sell their current home.

That’s because bridging finance is only temporary. So, it’s not a threat to a bank’s long-term financial stability.

If you refinance your mortgage (i.e. switch banks), you are also exempt from the LVR restrictions.

That’s as long as you don’t try to take out a bigger mortgage.

This means there is still competition between banks. You’re not stuck with the same bank just because of the Reserve Bank’s rules.

The LVR restrictions have been around for 12 years.

And they change constantly. In fact, they’ve changed 6 times since we first wrote this article back in 2020.

The first restrictions came in October 2013.

The Reserve Bank governor at the time, Graeme Wheeler, wanted to slow house price growth. He had a specific focus on slowing down house price increases in Auckland.

But it didn’t work. Auckland house prices kept going up for the next 3 years.

LVR restrictions were strengthened in 2016. You needed a 40% deposit to buy an existing investment property in Auckland.

For everywhere else it was just 30%. Over the next few years, the Reserve Bank kept tweaking the rules.

LVR restrictions were removed altogether in April 2020. This was part of the Reserve Bank’s response to Covid-19.

But house prices skyrocketed since the country came out of lockdown and through the rest of 2020.

In March 2021, they were brought back in, with investors requiring a 30% deposit.

This increased to 40% in May 2021.

In November 2021, the owner-occupier speed limit changed. Under the new rules, only 10% of each bank’s lending to owner-occupiers could be at less than a 20% deposit.

The Reserve Bank then reduced the deposit required for investors down to 35%. It's now back at 30%.

The point is that the Reserve Bank changes the deposit requirements all the time. These are the rules today, but over the next 2 years they will probably change again.

Mortgage broker for over 10 years, property investor and Managing Director at Opes Mortgages

Peter Norris, a certified mortgage adviser with 10+ years of experience, serves as the Managing Director at Opes Mortgages. Having facilitated over $1.2 billion in lending for 2000+ clients, Peter is a respected authority in property financing. He's a frequent writer for Informed Investor Magazine and Property Investor Magazine, while also being recognized as BNZ Mortgage Adviser of the Year in 2018 and listed among NZ Adviser's top advisers in 2022, showcasing his expertise.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser