Developers

The developers Opes recommends (and the ones we don't)

Who are all the developers you work with? Well, we counted them. In total there are 123 developers that we have had a relationship with over the last 3 years.

Property Investment

6 min read

Author: Stevie Waring

Financial Adviser with 7 years of experience. Property investor in Wellington and Christchurch

Reviewed by: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

A lot of Kiwis want to buy a holiday home.

When they start thinking about it, many ask, “Is it a good investment?”

Because as well as using the holiday home yourself, you might rent it out to get some extra income.

So, let’s go through the pros and cons of buying a holiday home. That way, you can make the right decision.

Before we get started, it’s important to note that I’m a financial adviser at Opes Partners. So, I help investors buy investment properties every day.

That does mean there is an incentive for me to be biased and say, “Don’t buy a holiday home. Buy an investment property instead.”

I'm not going to say that. I own my own holiday home and invest in properties at the same time.

Let’s dive into the pros and cons.

The #1 thing I love about my holiday home is it’s a place to relax and make memories with my children.

It’s close to Lake Taupo, and it’s in a beautiful part of the country. When I go down there from Auckland, I feel the world's stresses melt away.

I could just go and rent Airbnbs around the country. But I love the sense of belonging to a familiar place that I keep coming back to.

I can bring my pets along, too. Not all Airbnbs allow pets.

Often, families like returning to the same place again and again. It’s part of the appeal.

In fact, before I bought my holiday home, I rented it all the time. We made many happy memories with our family.

Now that my kids are grown, I still want to continue making memories there.

Today, my husband and I stay there for longer periods. Our work is more flexible. So we often get out of the city and stay there for weeks on end.

You probably won’t live in your holiday home full-time.

That’s why many bach-owners rent their properties to other travellers.

That means you can earn rental income to help you pay some of the costs of owning your holiday home.

When you go on holiday, you often need a lot of stuff. It might be your boat, your fishing rods, your dirt bike, your paddleboard or your skis.

It’s often annoying when you cart your stuff all around the country. So having one place to store it makes things easier.

That way, you don’t have to clog up the back seat of the car on a long road trip.

Of course, you can rent all of those things when you go on holiday. Places like Coronet Peak in Queenstown rent ski equipment right off the mountain. This saves the hassle of lugging equipment up to the slopes. But that costs money.

Now that we’ve gone through all of the pros let’s go through the cons.

Often, people think that they’ll buy a holiday home and that it’ll also be a good investment property.

That’s often impossible. Because the factors that make a house a good holiday home aren’t the same factors that make a good investment.

We often talk about the difference between home-buyer mindset and investor mindset.

Home buyer mindset is when you buy a house that suits your lifestyle.

Investor mindset is where you look at the numbers and make your decision.

How do most people buy a holiday home? Often, you start by looking at the areas you want to come back to again and again.

So you’re making a decision based on the lifestyle you want. You’re not thinking about whether that area is a good place to invest.

My holiday home is in Turangi, one of 18 suburbs in the Taupo district.

While Turangi is the most affordable suburb in the district, property prices don’t go up very fast in this area. It has the slowest growth rate in the district.

So, buying a holiday home was a good lifestyle decision. But it wasn’t a good investment decision.

Holiday rentals have less stable income than traditional investment properties.

Often, you’ll let them out on Airbnb rather than getting a long-term tenant.

But for the best rental return, you need to rent out your holiday home during the peak seasons. Those tend to be during school holidays, Easter, and Christmas.

I don't go down to my holiday home as often as I’d like. That’s because I have work and other family commitments.

I could try to make more money by going there even less. But I bought the property to go on holiday. So I accept that I’m not going to get the maximum amount of rent.

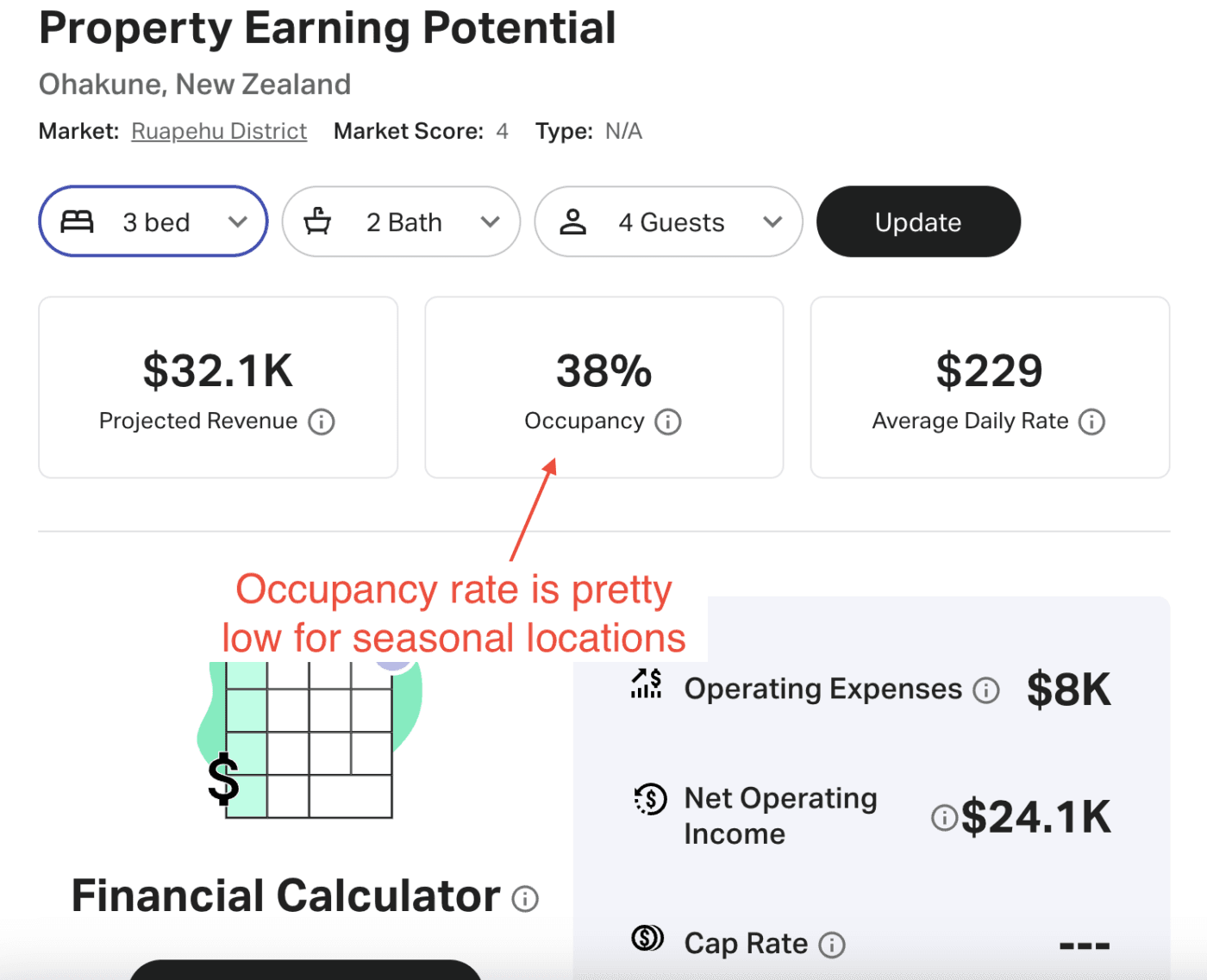

I once worked with one investor – Bob. He was a keen skier and wanted a holiday home in Ohakune, near Mt Ruapehu.

He thought he could buy a 3-bedroom property there for between $470k – $670k.

He reckons he could rent this out for $229 a night. But, the estimated occupancy is around 38%.

So, yes, Bob's place is going to be popular in winter and potentially earn some money. But that assumes he’s willing to rent it out during the peak ski season when he wants to be there.

Unlike an investment property, banks don't look at the rental income of a holiday home.

This means you need to show you can afford the mortgage using just your income.

I once worked with an Auckland couple – Tim and Mila. They went to the bank and asked for a mortgage. The bank said that they’d lend them:

So they could borrow almost $270k more if they bought an investment property.

It’s not only the mortgage you have to think about when you buy a holiday home.

You'll also need to furnish the house and keep it stocked up between guests. Things like hand soap, dishwashing liquid and laundry powder.

I live in Auckland, so I’m not the one changing the sheets. So I have to pay someone to do that.

There are also cleaning fees between guests, lawn mowing, and listing fees.

You could be looking at commercial rates, and if things get broken by rowdy guests ... you will likely foot some or all the replacement cost

All these jobs can add up.

Generally, I say it costs an extra $6-7k a year to keep your holiday home going. This is before you pay your mortgage.

Essentially, the pros of a holiday home tend to be emotional. However, the arguments against them are more logical.

It is a battle between your head and your heart.

And the decision often comes down to where you are in your investment journey.

I bought my family’s bach at a time when I already owned 4 investment properties. I already had assets for my long term future. So I felt it was ok to buy a bach for myself.

But if I didn’t have any investment properties, I wouldn’t have bought the bach.

Most people need to sort their retirement first before they buy the bach.

Financial Adviser with 7 years of experience. Property investor in Wellington and Christchurch

Stevie Waring is a Financial Adviser with over 7 years of experience in property investment and a successful investor herself. Stevie has successfully guided over 200 Kiwis in their property investments, helping them move closer to achieving their financial goals.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser