Property Investment

Catch-up growth: The mistake property investors often make

Bay of Plenty house prices just overtook Auckland. Most investors see that as a red flag for Auckland. Here's what we see 👇

Property Investment

2 min read

Author: Andrew Nicol

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

If you're going to use property to build wealth for retirement... you need to track your net worth.

It's how you know if you're actually getting wealthier — or just treading water.

This was a nightmare to track in the past. But I’ve got a new app to help you track it automatically 👇

At its simplest:

Your Net Worth = What you own – what you owe.

So that’s your properties, your shares, and any investments, minus your mortgage and other debts.

You need to track this so you can tell if you’re getting closer to your retirement goals (or not).

Of course, some years the market’s kind to you. Other years… not so much. But you can’t manage what you don’t measure.

Working out your net worth is technically simple: add everything up, subtract what you owe.

But in reality? It’s messy.

As a property investor, you might have:

That’s why some people have monster spreadsheets.

One of my clients checks Homes.co.nz every fortnight to manually track what he’s worth.

I admire the dedication. But that’s way too much admin for most of us.

The big issue hasn’t been understanding net worth; it’s been seeing everything in one place.

Sure, your bank app might show you the mortgage you have with them. But you can’t see your mortgages at other banks.

And some budgeting tools can pull your mortgages all in one place. But they don’t automatically pull through your property values.

So I set out to build a Net Worth Tracker inside Opes+.

Remember, Opes+ is the free app that helps you see if any property in NZ is a good investment (or not).

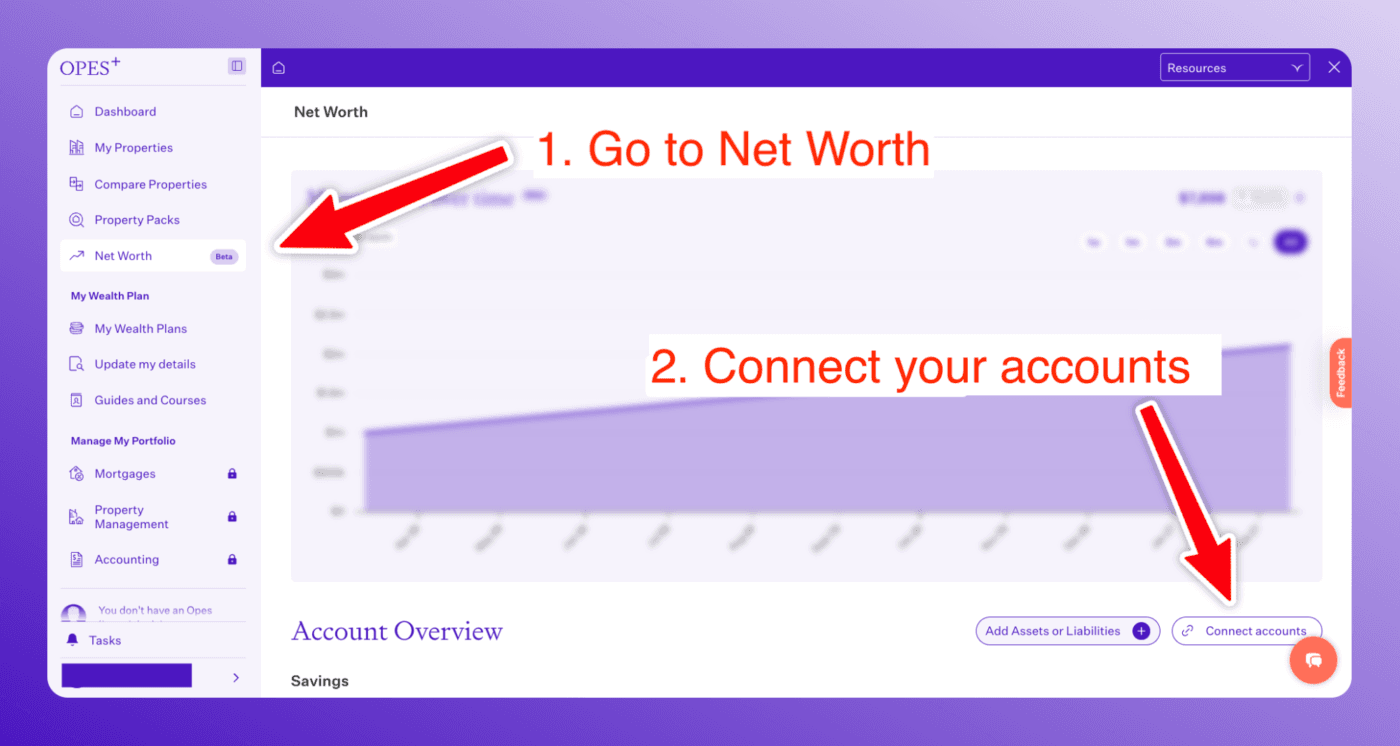

Head into your Opes+ account and go to the “Net Worth” section.

Any properties you already added will be there. And the property values will automatically update.

But now it’s time to connect your live mortgages with the banks.

Connect to your accounts using Akahu.

That’s the piece of tech that’s part-owned by Westpac. It lets you pull through data from any bank in NZ. Here’s how to know if it is safe.

You can even connect your Sharesies, Hatch or other investments.

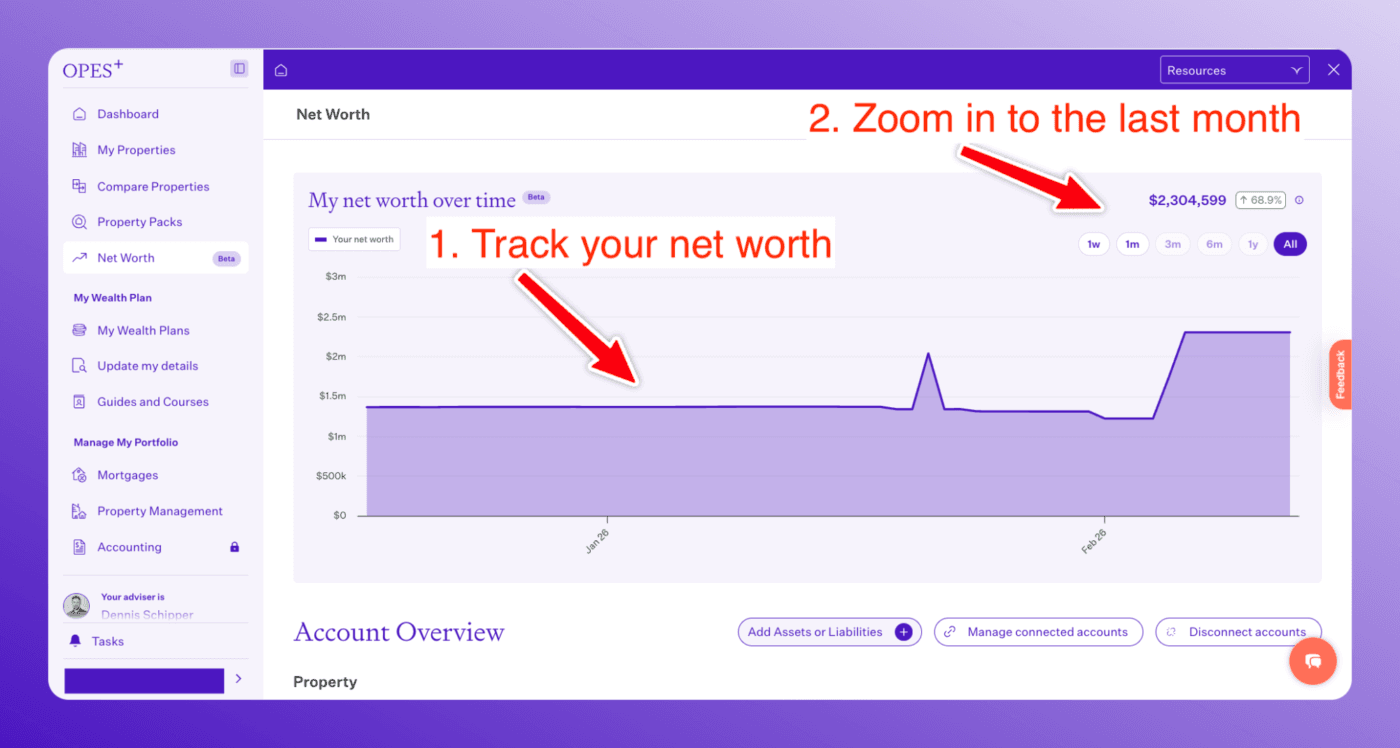

From there, Opes+ takes a daily snapshot of your net worth so you can see long-term progress and short-term changes.

That way, you’ll know if you’re moving forward, flat, or backwards

There are a few things to know:

But, I wanted to build a Net Worth Tracker into it because … my company helps people build wealth through property.

So I’ve got an obligation to help them see and track if it’s helping them build their wealth.

So sign into your Opes+ account and start tracking your net worth (for free).

Managing Director, 20+ Years' Experience Investing In Property, Author & Host

Andrew Nicol, Managing Director at Opes Partners, is a seasoned financial adviser and property investment expert with 20+ years of experience. With 40 investment properties, he hosts the Property Academy Podcast, co-authored 'Wealth Plan' with Ed Mcknight, and has helped 1,894 Kiwis achieve financial security through property investment.

This article is for your general information. It’s not financial advice. See here for details about our Financial Advice Provider Disclosure. So Opes isn’t telling you what to do with your own money.

We’ve made every effort to make sure the information is accurate. But we occasionally get the odd fact wrong. Make sure you do your own research or talk to a financial adviser before making any investment decisions.

You might like to use us or another financial adviser